Bjorn Bakstad

Elevator Pitch

I continue to appoint a Buy score to Salesforce, Inc. ( NYSE: CRM) stock. With my earlier article released on June 7, 2022, I examined CRM’s monetary outcomes for the very first quarter of financial 2023 (YE January 31).

In the existing upgrade, I detail my favorable view of Salesforce’s just recently revealed rate walkings, which supports my Buy score for CRM. The rollout of brand-new AI options have actually been a significant consider triggering CRM to increase its item rates, and I anticipate Salesforce to make use of rates as an essential lever for margin growth moving forward.

Rate Walkings

Salesforce will “raise sticker price approximately 9% throughout Sales Cloud, Service Cloud, Marketing Cloud, Industries and Tableau” starting in August 2023 as reported by Looking For Alpha News on July 11, 2023. It is affordable to presume that financiers have a beneficial view of CRM’s proposed rate walkings, as Salesforce’s share rate increased by +3.9% and +2.8% on July 11 and July 12, respectively.

There are 2 things that deserve keeping in mind about the boost in Salesforce’s sticker price.

First of all, AI played a substantial function in offering assistance for CRM’s just recently revealed rate walkings. In Looking For Alpha News’ July 11, 2023 short article described above, it was highlighted that “current generative AI developments” was among the essential elements that validated Salesforce’s rate boosts.

Second of all, Salesforce’s CFO Amy Weaver had actually formerly kept in mind at UBS ( UBS) Females in Tech Top on June 13, 2023 that “rates and product packaging, bundling” are the significant levers that the business can pull to “power our margin distinction (growth) for the upcoming years.”

In the subsequent areas, I will go over how CRM’s brand-new AI offerings have actually assisted to supply assistance for the business’s rate walkings, and overview Salesforce’s success enhancement objectives which will be improved by the boost in sticker price.

Generative AI

In current months, CRM has actually presented a variety of brand-new AI options, which have actually enhanced the case for the business’s item rate boosts.

Salesforce provided a media release in early March that it had actually introduced Einstein GPT, that it described as “the world’s very first generative AI CRM (Client Relationship Management) innovation, which provides AI-created material.” In late June, CRM revealed that it will be bringing Sales GPT and Service GPT to the marketplace, which the business referred to as applications using “generative AI abilities for Sales Cloud and Service Cloud”, respectively.

The Secret Includes Of Sales GPT

Salesforce’s June 29, 2023 News Release

Service GPT’s Main Characteristics

Salesforce’s June 29, 2023 News Release

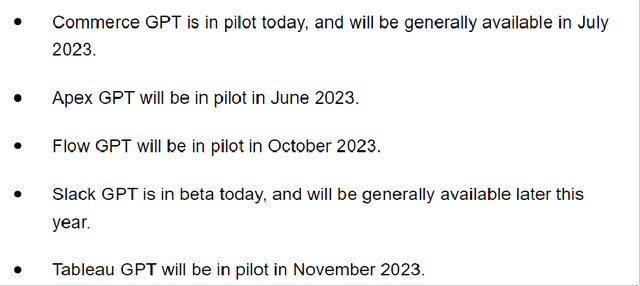

Looking forward, CRM has strategies to present generative AI abilities for its other items such as Slack and Tableau in the months ahead as in-depth listed below.

Salesforce’s Timeline For Rolling Out Other New GPTs

Salesforce’s June 12, 2023 Media Release

The Possible Advantages Of Using The Commerce, Slack And Tableau GPTs

CRM’s AI Products Site

At the Jefferies ( JEF) Software Application Conference on June 1, 2023, COO Brian Millham stressed that he has “this belief that if the (generative AI) innovation is driving worth for our clients, we must have the ability to monetize it.”

Thinking About that Salesforce has actually just recently developed brand-new AI options that benefit its clients, it is unsurprising that the business has actually chosen to raise rates now.

Future Success

Salesforce assisted for a +5.5 portion points growth in the business’s stabilized operating revenue margin from 22.5% for FY 2023 to 28.0% in FY 2024, when it revealed its Q1 FY 2024 outcomes at the end of Might. Wall Street experts anticipate CRM’s non-GAAP adjusted operating margin to additional enhance to 30.8%, 32.8%, and 34.4% for FY 2025, FY 2026, and FY 2027, respectively based on S&P Capital IQ’s agreement information.

As a contrast, CRM was formerly just targeting to attain a fairly lower stabilized running margin of 25% by FY 2026 based on disclosures at its Financier Day in September in 2015. It is clear that Salesforce’s success outlook has actually ended up being a lot more beneficial, thanks to the business’s new-found rates power driven by the increase of generative AI.

CRM highlighted at the UBS Females in Tech Top in the middle of last month that the business’s changed operating margin might possibly increase from 28.0% for full-year FY 2024 to 30.0% in Q1 FY 2025. Particularly, Salesforce’s CFO Amy Weaver kept in mind that expense optimization procedures had actually improved the business’s success in previous quarters, however she worried that “how do we go to market” (for which rates is an essential element) will be the essential element that identifies CRM’s future success enhancement capacity.

As such, Salesforce’s just recently exposed rate boosts are a lot more substantial than what they appear on the surface area. The intro of brand-new AI offerings has actually offered CRM the power to start rate walkings, and this might raise the ceiling for Salesforce’s long-lasting operating revenue margin.

Closing Ideas

My bullish view of Salesforce stays the same, taking into consideration the business’s capacity for margin growth. With the increase of generative AI, CRM has great deals of chances to release associated offerings to support future rate walkings (or other rate optimization procedures like bundling), which will play an essential part in driving its revenue margins greater in time to come.