georgeclerk

A Quick Handle Birkenstock Holding Limited

Birkenstock Holding Limited ( BIRK) has actually submitted to raise $100 million in an IPO of its regular Shares, according to an SEC F-1 registration declaration

The firm styles and offers premium shoes items worldwide.

Birkenstock Holding Limited’s leading line profits development has actually decreased in the most current reporting duration.

I’ll supply an upgrade when we discover more IPO details from management.

Birkenstock Introduction

London, UK-based Birkenstock Holding Limited was established in 1774 in Germany to supply comfy and natural shoes to customers.

Management is headed by Ceo Mr. Oliver Reichert, who has actually been with the company because 2009 and was formerly at “Deutsches Sportfernsehen (presently Sport1), consisting of as a press reporter and after that as Ceo in between 2006 and 2009.”

The business has more than 700 “shapes” of various shoes, however its leading 5 shapes created 76% of the company’s profits in financial 2022.

Since March 31, 2023, Birkenstock has actually reserved reasonable market price financial investment of $2.1 billion in equity from financiers, consisting of personal equity company L Catterton.

Birkenstock Client Acquisition

The company runs with a multi-channel “crafted circulation’ design, designating its minimal supply to wholesalers and its growing direct-to-consumer [DTC] channel.

The business has actually grown profits at a CAGR of 20% from financial 2014 through financial 2022.

Offering and Circulation expenditures as a portion of overall profits have actually trended greater as profits have actually increased, as the figures listed below suggest:

|

Offering And Circulation |

Costs vs. Income |

|

Duration |

Portion |

|

6 Mos. Ended March 31, 2023 |

26.8% |

|

FYE September 30, 2022 |

27.9% |

|

FYE September 30, 2021 |

24.5% |

( Source – SEC.)

The Offering and Circulation performance numerous, specified as the number of dollars of extra brand-new profits are created by each dollar of Offering and Circulation expenditure, was up to 0.6 x in the most current reporting duration, showing decreased performance in this regard, as displayed in the table listed below:

|

Offering And Circulation |

Effectiveness Rate |

|

Duration |

Several |

|

6 Mos. Ended March 31, 2023 |

0.6 |

|

FYE September 30, 2022 |

0.8 |

( Source – SEC.)

Birkenstock’s Market & & Competitors

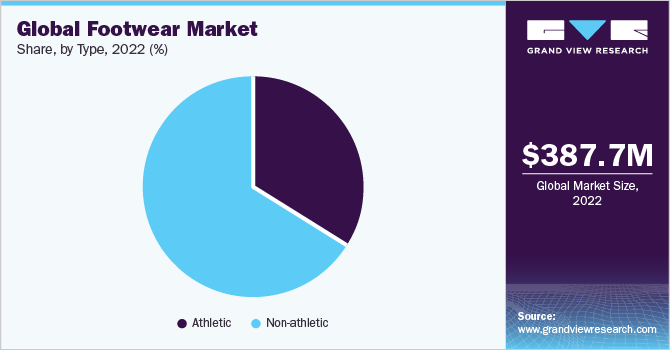

According to a 2023 market research study report by Grand View Research study, the worldwide market for shoes of all types was an approximated $388 billion in 2022 and is anticipated to reach $543 billion by 2030.

This represents a projection CAGR of 4.3% from 2023 to 2030.

The primary chauffeurs for this anticipated development are increasing need for athletic-oriented shoes and growing sales allowed by e-commerce channels.

Likewise, the chart listed below suggests that since 2022, a strong bulk of shoes was of the “non-athletic” type:

Worldwide Shoes Market ( Grand View Research Study)

Significant competitive or other market individuals consist of the following:

-

Teva

-

Crocs

-

Chaco

-

Naot

-

Studio Moulded

-

Mad Love

-

Will’s Vegan Shop

-

Others.

Birkenstock Holding Limited Financial Efficiency

The business’s current monetary outcomes can be summed up as follows:

-

Slowing leading line profits development

-

Somewhat increasing gross earnings

-

Steady gross margin

-

Minimized operating earnings

-

Greatly lower capital from operations.

Below matter monetary outcomes originated from the company’s registration declaration:

|

Overall Income |

||

|

Duration |

Overall Income |

% Variation vs. Previous |

|

6 Mos. Ended March 31, 2023 |

$ 695,706,840 |

18.7% |

|

FYE September 30, 2022 |

$ 1,342,259,640 |

29.2% |

|

FYE September 30, 2021 |

$ 1,038,971,880 |

|

|

Gross Earnings (Loss) |

||

|

Duration |

Gross Earnings (Loss) |

% Variation vs. Previous |

|

6 Mos. Ended March 31, 2023 |

$ 419,871,600 |

27.0% |

|

FYE September 30, 2022 |

$ 809,786,160 |

71.5% |

|

FYE September 30, 2021 |

$ 472,090,680 |

|

|

Gross Margin |

||

|

Duration |

Gross Margin |

% Variation vs. Previous |

|

6 Mos. Ended March 31, 2023 |

60.35% |

3.9% |

|

FYE September 30, 2022 |

60.33% |

32.8% |

|

FYE September 30, 2021 |

45.44% |

|

|

Operating Earnings (Loss) |

||

|

Duration |

Operating Earnings (Loss) |

Operating Margin |

|

6 Mos. Ended March 31, 2023 |

$ 126,975,600 |

18.3% |

|

FYE September 30, 2022 |

$ 392,069,160 |

29.2% |

|

FYE September 30, 2021 |

$ 147,584,160 |

14.2% |

|

Detailed Earnings (Loss) |

||

|

Duration |

Detailed Earnings (Loss) |

Net Margin |

|

6 Mos. Ended March 31, 2023 |

$ (64,216,800) |

-9.2% |

|

FYE September 30, 2022 |

$ 316,857,960 |

23.6% |

|

FYE September 30, 2021 |

$ 122,703,120 |

11.8% |

|

Capital From Operations |

||

|

Duration |

Capital From Operations |

|

|

6 Mos. Ended March 31, 2023 |

$ 4,406,400 |

|

|

FYE September 30, 2022 |

$ 252,866,880 |

|

|

FYE September 30, 2021 |

$ 190,914,840 |

|

( Source – SEC.)

Since March 31, 2023, Birkenstock had $185.4 million in money and $2.5 billion in overall liabilities.

Totally free capital throughout the twelve months ending March 31, 2023, was $169.1 million.

Birkenstock Holding Limited IPO Particulars

Birkenstock means to raise $100 million in gross earnings from an IPO of its regular Shares, although the last figure might be as high as $750 million.

No existing investors have actually shown an interest in acquiring shares at the IPO cost.

The company means to utilize the IPO continues to pay back specific insolvency and for basic working capital requirements.

Management’s discussion of the business roadshow is not readily available.

Relating to exceptional legal procedures, the company states it is not the topic of any legal claims that would have a product unfavorable impact on its monetary condition or operations.

The noted bookrunners of the IPO are Goldman Sachs, J.P. Morgan, Morgan Stanley and other financial investment banks.

Commentary About Birkenstock’s IPO

BIRK is looking for U.S. public capital market financial investment to pay for financial obligation and for basic working capital.

The business’s financials have actually created decreased topline profits development, greater gross earnings, flat gross margin, lower operating earnings and greatly decreased capital from operations.

Totally free capital for the twelve months ending March 31, 2023, was $169.1 million.

Offering and Circulation expenditures as a portion of overall profits have actually increased as profits has actually grown; its Selling and Circulation performance multiple was up to 0.6 x in the most current reporting duration.

The company presently prepares to pay no dividends and to keep any future profits for its operating capital requirements.

BIRK’s current capital costs history suggests it has actually invested substantially on capital investment as a portion of its operating capital.

The marketplace chance for shoes is big and anticipated to grow at a low rate of development in the coming years.

Company runs the risk of to the business’s outlook as a public business consist of magnifying competitors from comparable shoes business by means of online market channels.

When we discover more about the IPO’s prices and assessment presumptions, I’ll supply a last viewpoint.

Anticipated IPO Rates Date: To be revealed.