GizemBDR/iStock through Getty Images

Intro

Viridian Rehabs ( NASDAQ: VRDN) is a biopharmaceutical company devoted to producing best-in-class medications for unusual and severe health problems, particularly where existing treatments fail. The business’s lead program, VRDN-001, a monoclonal antibody that hinders insulin-like development factor-1 receptor (IGF-1R), targets thyroid eye illness [TED] and has actually revealed motivating scientific proof-of-concept. Viridian is likewise establishing subcutaneous variations of its drugs for hassle-free self-administration. With continuous Stage 3 trials and collaborations for drug shipment, the business goes for market distinction and boosted client results.

Current Advancements: Viridian’s stock dropped 20% after stage 1/2 information on VRDN-001 revealed combined outcomes; business modified future trial style.

The following post examines Viridian’s monetary health, continuous trials, and market capacity. It information combined outcomes for its lead drug, VRDN-001, and recommends offering the stock due to high threats.

Q2 Revenues Report

Looking at Viridian’s latest revenues report, money and equivalents reduced to $334.3 M from $373.9 M in the previous quarter, forecasted to last up until the 2nd half of 2025. R&D costs almost doubled to $40.1 M, driven by production and scientific trials, to name a few. G&An expenditures likewise increased to $19.3 M, generally due to workers and expert costs. These increasing costs added to a bottom line of $55.1 M, up from in 2015’s $29.5 M.

Money Runway & & Liquidity

Relying on Viridian’s balance sheet, since June 30, 2023, the business has money and money equivalents of $87.1 M, short-term financial investments of $247.2 M, amounting to $334.3 M in extremely liquid possessions. In regards to month-to-month money burn, the “Net money utilized in running activities” for the 6 months ended June 30, 2023, was $107.2 M. This relates to a month-to-month money burn of roughly $17.9 M. Offered the unfavorable operating money burn, the business’s money runway can be approximated to be around 18 months ($ 334.3 M/ $17.9 M). It deserves keeping in mind that these worths and quotes are based upon previous information and might not be a sign of future efficiency.

The business’s liquidity status appears steady for the short-term, although the month-to-month money burn is a point of issue. Viridian brings long-lasting financial obligation of $4.7 M, which is very little in contrast to their liquid possessions. Based upon these numbers, it’s sensible to hypothesize that the business remains in a position to protect extra funding, if essential, either through financial obligation or equity channels. These are my individual observations, and other experts may translate the information in a different way.

Capital Structure, Development, & & Momentum

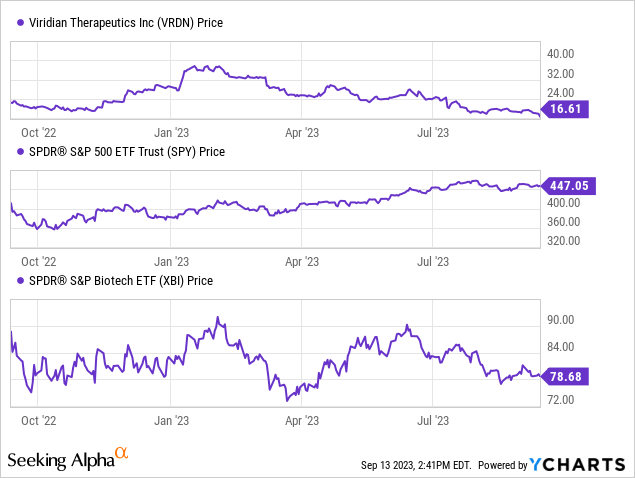

According to Looking for Alpha information, Viridian shows a fairly robust capital structure with considerable money holdings and very little financial obligation, showing a business worth of $582.70 M. Experts job earnings development in 2025, signifying high capacity for future revenues, particularly with continuous Stage 3 trials for its lead program, VRDN-001. Nevertheless, stock momentum is bad, considerably underperforming the S&P 500 throughout all determined timelines.

Viridian’s Mixed Lead to Persistent TED Trial

The Stage 1/2 trial for Viridian’s drug VRDN-001 in persistent TED revealed that the drug is usually well-tolerated and resulted in some decrease in eye protrusion and scientific activity ratings. Nevertheless, it didn’t enhance diplopia (double vision) – a crucial function of TED. Future Stage 3 trials are prepared, and outcomes are expected by the end of 2024. Viridian is likewise advancing subcutaneous variations of the drug, with preliminary information anticipated later on this year.

The marketplace’s lukewarm reaction to Stage 1/2 information might be due to a couple of factors. Initially, the drug’s failure to deal with diplopia may narrow its scientific energy. Second, the enhancements in eye protrusion and activity ratings, while appealing, do not, in my view, appear dramatically much better than what’s currently offered.

Relating to the subcutaneous programs, there’s a sense of mindful optimism. While Viridian has actually finished solution work, this does not ensure scientific success or scalability. Moving from intravenous to subcutaneous shipment might likewise produce brand-new security issues and/or moistened effectiveness, which might be adding to market suspicion about the business’s enthusiastic timelines.

My Analysis & & Suggestion

In summary, Viridian provides a dilemma for financiers. On one hand, there’s guarantee in VRDN-001 and its applicability in dealing with TED. On the other, the current combined information and the high money burn rate raise warnings. Financiers ought to keep an eager eye on the business’s upcoming Stage 3 trial outcomes, anticipated by the end of 2024, along with any interim information on subcutaneous drug variations.

Here’s what’s vital in the near term: the marketplace has actually priced in the combined outcomes of VRDN-001, making the stock possibly underestimated if the Stage 3 trial is successful. Nevertheless, the roadway to that success is filled with difficulties such as conference scientific endpoints and handling security issues, especially with the switch to subcutaneous administration. With the money runway approximated at 18 months, any misstep in trials or hold-ups in protecting extra financing might spell problem.

Thinking about all these elements, my financial investment suggestion is “Offer.” The present level of threat, in my viewpoint, exceeds the capacity for brief- or medium-term gains. While Viridian has good liquidity, its scientific pipeline still requires to show itself. Unloading now might alleviate prospective drawback threat, particularly offered the current 20% stock drop. Much better to avoid unpredictability up until Viridian shows more engaging scientific effectiveness and a clear course to market.

Threats to Thesis

In my examination of Viridian, I might have ignored the capacity for tactical collaborations or buyouts that might verify Viridian’s innovation and increase stock worth. I may likewise have actually undervalued the effect of the company’s robust capital structure, which might draw in institutional financiers. Favorable Stage 3 outcomes, due by end of 2024, might dramatically re-rate the stock, making a “Offer” call early. The company’s money runway, although minimal, may be adequate to reach vital value-driving turning points. Undervaluing the unmet medical requirement for TED and the prospective market size might be a predisposition. Offered the business’s concentrate on separated drug shipment, they might have a special worth proposal that I have actually underestimated.