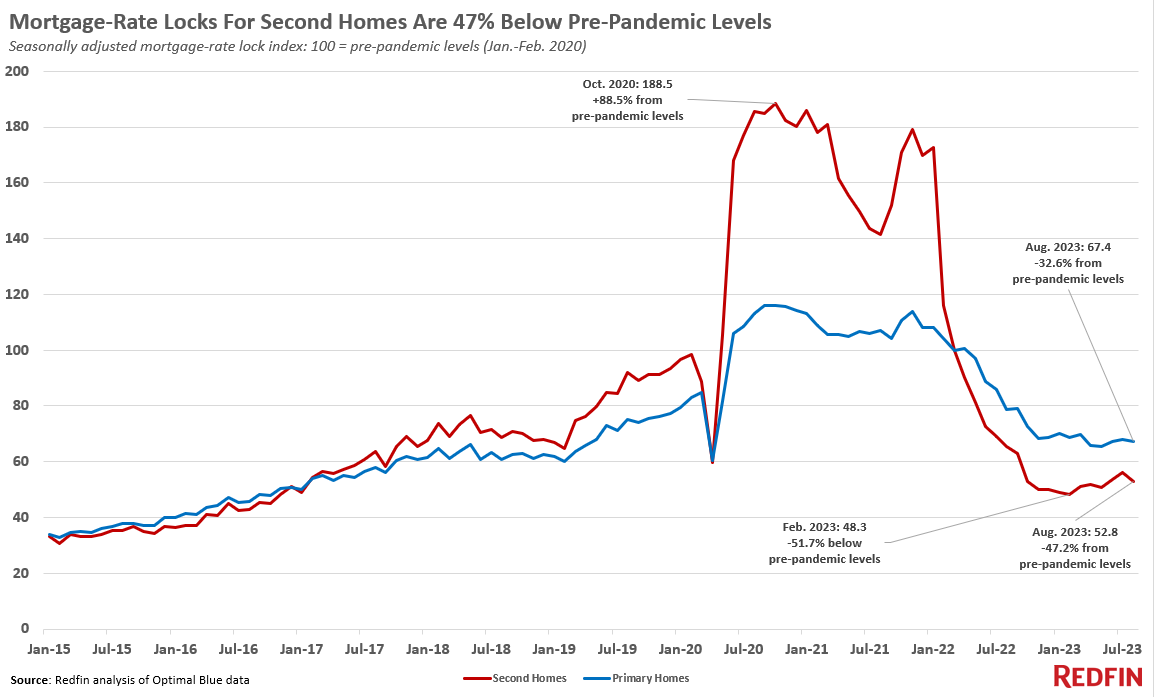

Home loan rate locks for 2nd houses are down almost 50% from pre-pandemic levels, compared to a 33% drop for main houses.

Mortgage-rate locks for 2nd houses were down 47% from pre-pandemic levels on a seasonally changed basis in August, compared to a 33% decrease for main houses. August marks the 14th-straight month that second-home need has actually hovered a minimum of 30% listed below pre-pandemic levels, as high real estate expenses and minimal stock prevent potential purchasers. Rate locks for 2nd houses struck a seven-year low in February, dropping to 52% listed below pre-pandemic levels.

That’s according to a Redfin analysis of Optimum Blue information. A mortgage-rate lock is an arrangement in between a property buyer and a lending institution that enables the property buyer to secure a rate of interest on a home loan for a particular amount of time; approximately 80% of rate locks lead to purchases. See completion of this report for more information on method.

Need for 2nd houses is likewise below a year earlier. Mortgage-rate locks for 2nd houses is down 19% year over year, larger than the 14% decrease for main houses.

The plunge in home mortgage locks for villa follows they increased throughout the pandemic, striking a peak of 88.5% above pre-pandemic levels in October 2020. Upscale Americans leapt at the possibility to purchase 2nd houses with record-low home mortgage rates throughout a time when much of them might work from another location from getaway towns. Need for main houses leapt throughout that time, too, however the boost was a lot more modest, reaching a peak of 16% above pre-pandemic levels in late 2020.

High rates and loan costs, plus lessening appeal of rental residential or commercial properties, prevent second-home purchasers

Home loan rates increased to a two-decade high in August, keeping need low for both main houses and 2nd houses. Still-high house rates, the raised expense of other products and services, the unpredictable economy, and an absence of brand-new listings are likewise keeping back purchasers of both house types.

However the drop in need for villa is larger, due to a range of aspects:

-

- It’s more costly to purchase a 2nd house. The common house in a seasonal town– where numerous 2nd houses lie– costs $564,000, up 5% from a year previously. That’s compared to $421,000 for houses in non-seasonal towns, likewise up 5%. Home loan rates for 2nd houses are likewise normally greater. Lastly, the federal government increased loan costs for 2nd houses in 2022, frequently including 10s of countless dollars to the expense of acquiring a house.

- Lots of employees are going back to the workplace. The appeal of 2nd houses has actually decreased as numerous business– consisting of huge ones like Amazon, Apple, Disney and JPMorgan— call employees back to the workplace, a minimum of part of the time.

- Short-term leasings are less appealing. Purchasing a villa to lease it out on a short-term rental website like Airbnb might be less appealing than it as soon as was. City governments consisting of New York City City are setting up brand-new short-term rental policies, fresh taxes and rigorous allowing, that cut into revenues and make business harder.

- The long-lasting rental market is cooling. Purchasing a villa to lease it out long term is less appealing, too. The rental market has cooled from its pandemic peak; although asking leas are still high, numerous property managers are being required to use concessions to bring in occupants. Plus, there’s an increasing variety of jobs for property managers to fill, with numerous brand-new systems set to strike the market quickly

Need for 2nd houses is up a little from the bottom it struck in the start of the year. That’s most likely due to the fact that house rates have actually boiled down in some second-home hotspots, consisting of Austin, TX and Phoenix, and some upscale Americans are purchasing villa prior to rates increase.

Interest in 2nd houses initially fell listed below pre-pandemic levels in April 2022, the month the loan-fee boost worked and a number of months after home mortgage rates began leaping.

Approach

The information in this report is from a Redfin analysis of mortgage-rate lock information from property analytics company Optimum Blue It does not consist of money purchases. Redfin developed a seasonally changed index of Optimum Blue’s information to change for common seasonal patterns and enable easy contrasts of second-home need prior to, throughout and after the pandemic. We specify “pre-pandemic” as January and February 2020 and set the index for that duration to 100. We utilized early 2020 as a contrast point due to the fact that it supplies a standard for home mortgage need prior to property buyer activity varied hugely throughout the pandemic. Any information point above 100 represents second-home need that’s above pre-pandemic levels and any information point listed below 100 represents need listed below pre-pandemic levels. This information goes through modification.

A mortgage-rate lock is an arrangement in between a property buyer and a lending institution that enables the property buyer to secure a rate of interest on a home loan for a particular amount of time, using defense versus future interest-rate walkings. Property buyers need to define whether they are using to protect a home loan rate for a main house, a 2nd house or a financial investment residential or commercial property. Approximately 80% of mortgage-rate locks lead to real house purchases.

.