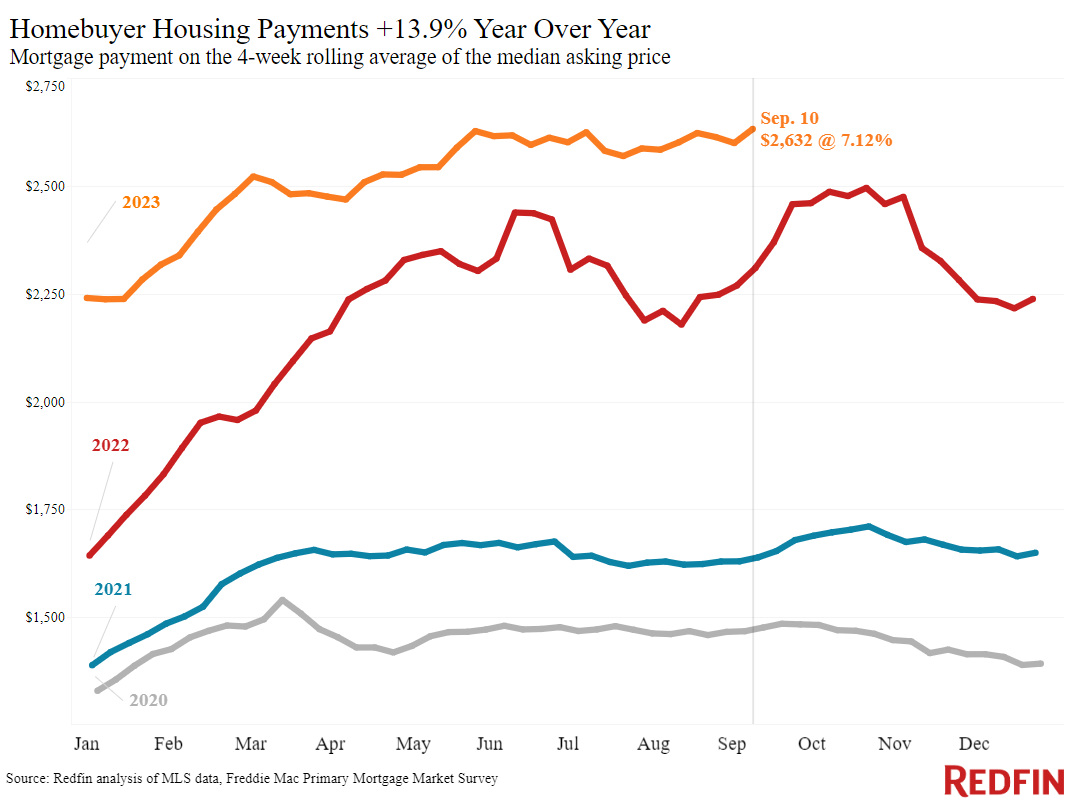

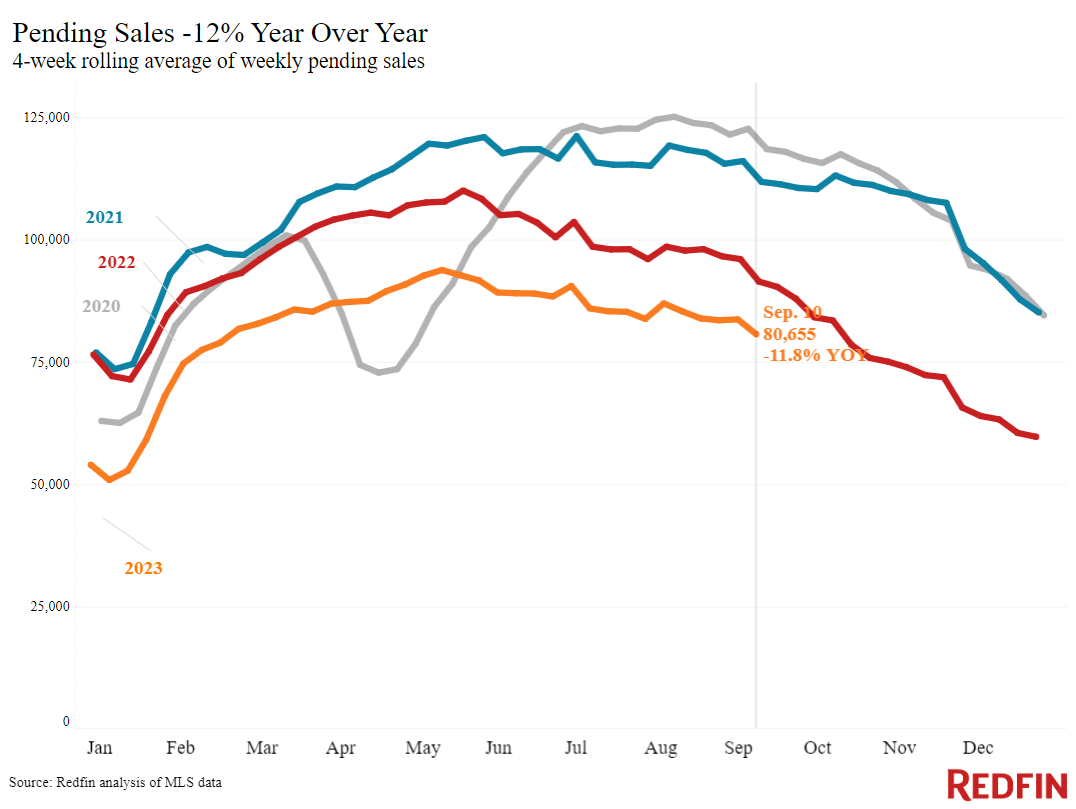

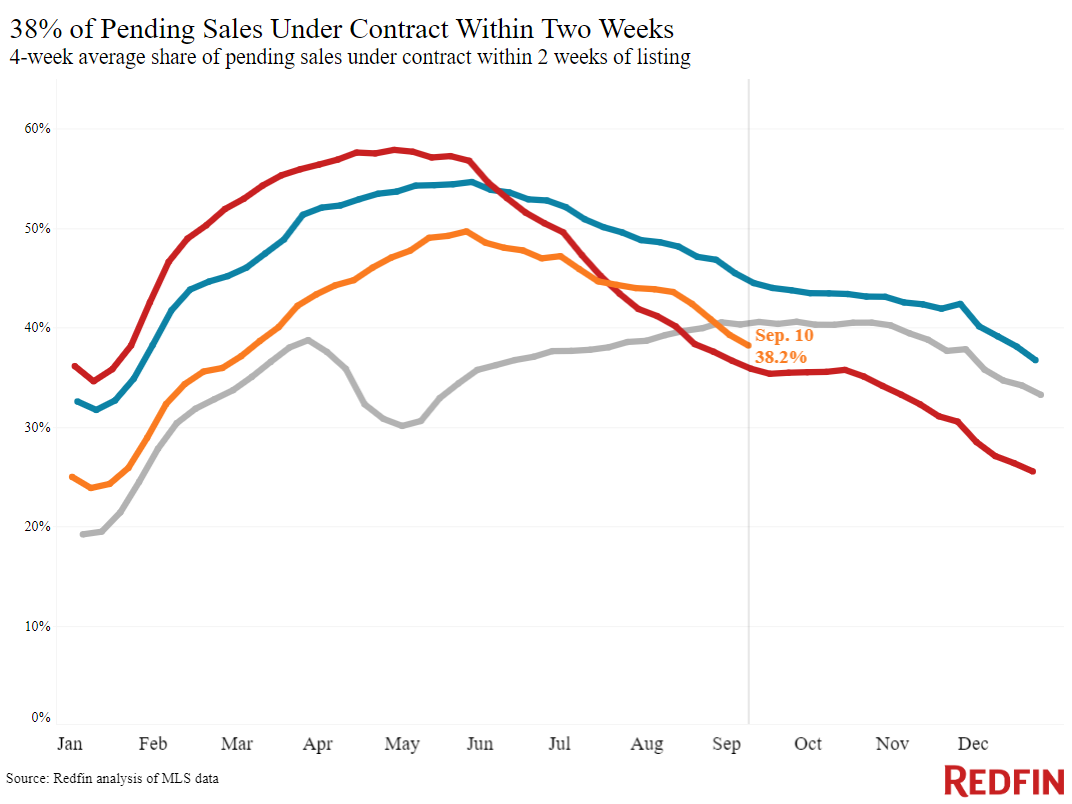

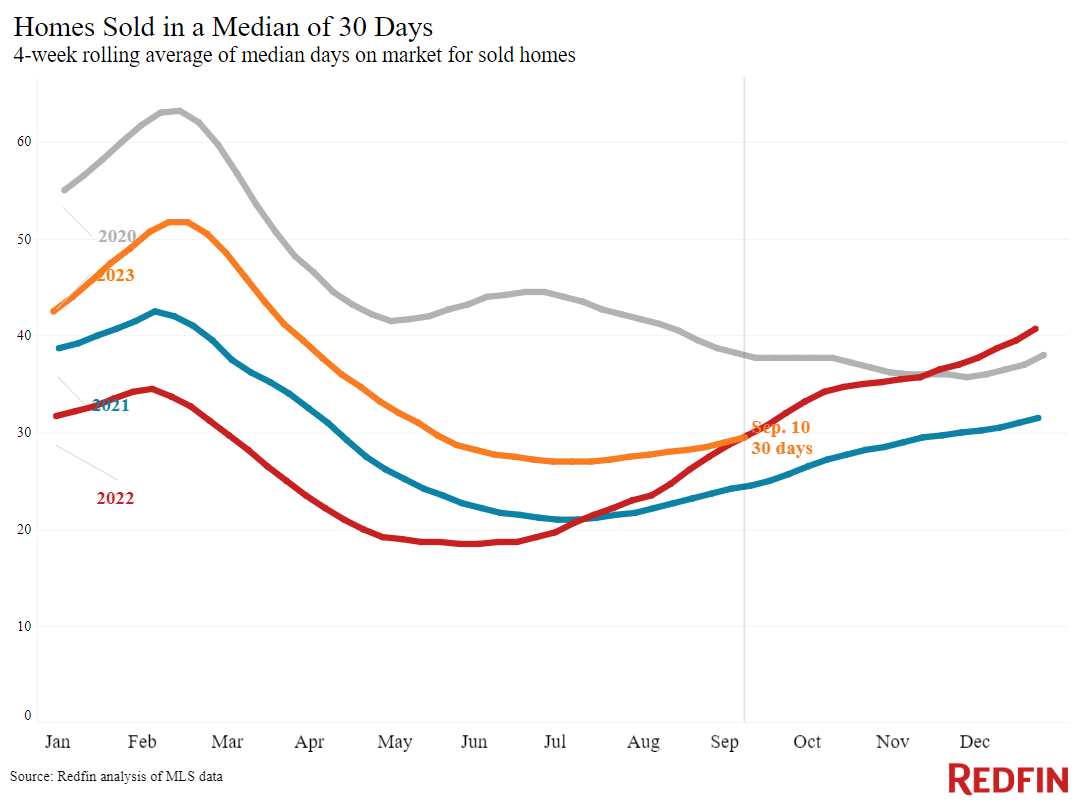

7%- plus home loan rates and increasing house rates have actually pressed the common U.S. regular monthly home loan payment to a record high, and sent out pending house sales down 12% year over year.

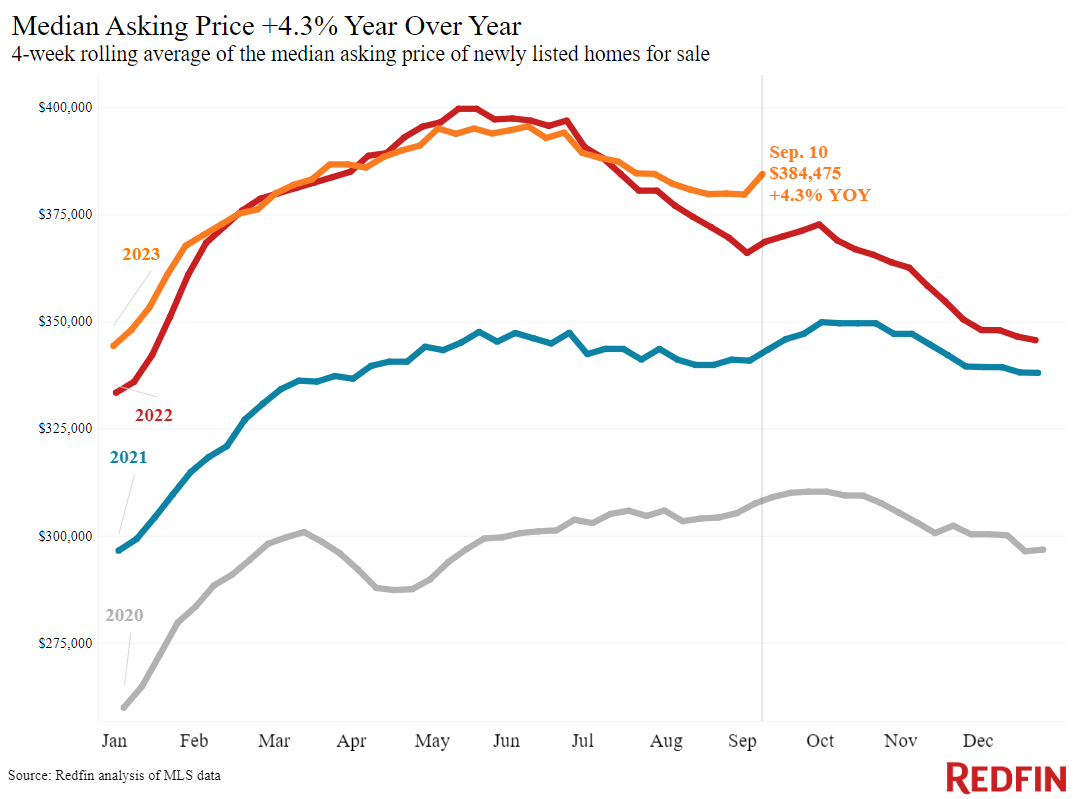

What property buyers require to understand: It’s more costly than ever to purchase a house. The mean regular monthly home loan payment struck an all-time high of $2,632 throughout the 4 weeks ending September 10. Although the weekly typical home loan rate has actually decreased somewhat from August’s two-decade high, it’s still sitting above 7%. Rates are up, too, increasing 4% year over year.

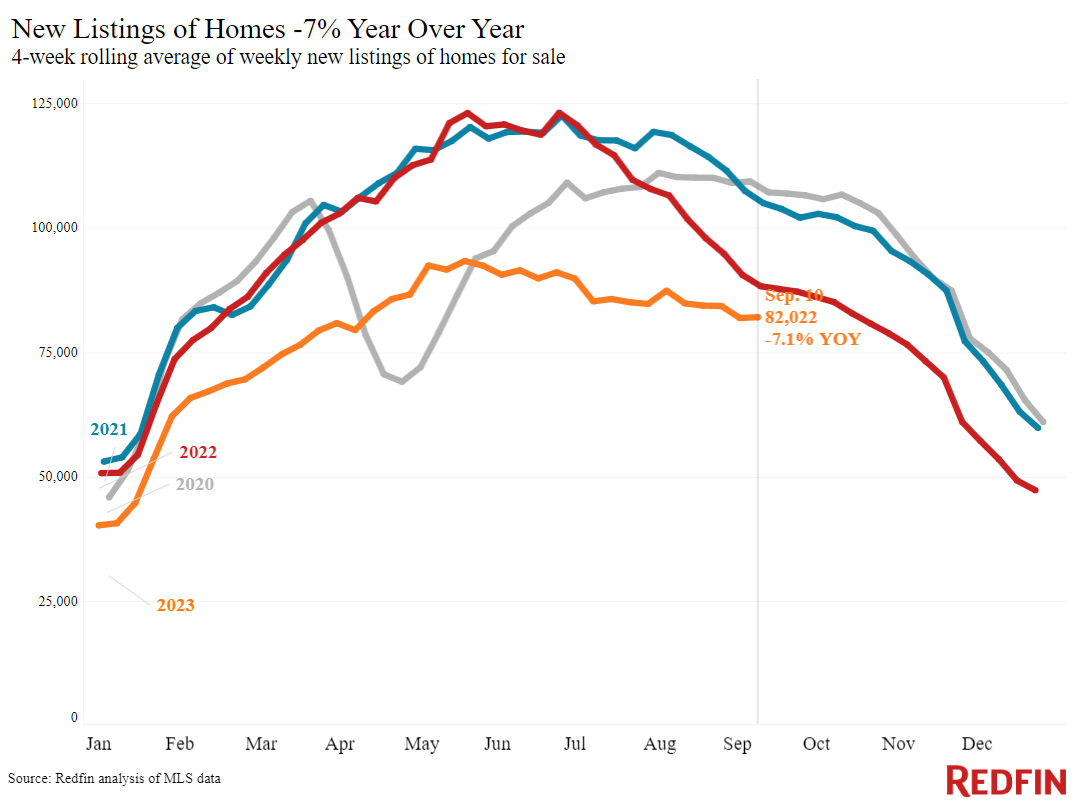

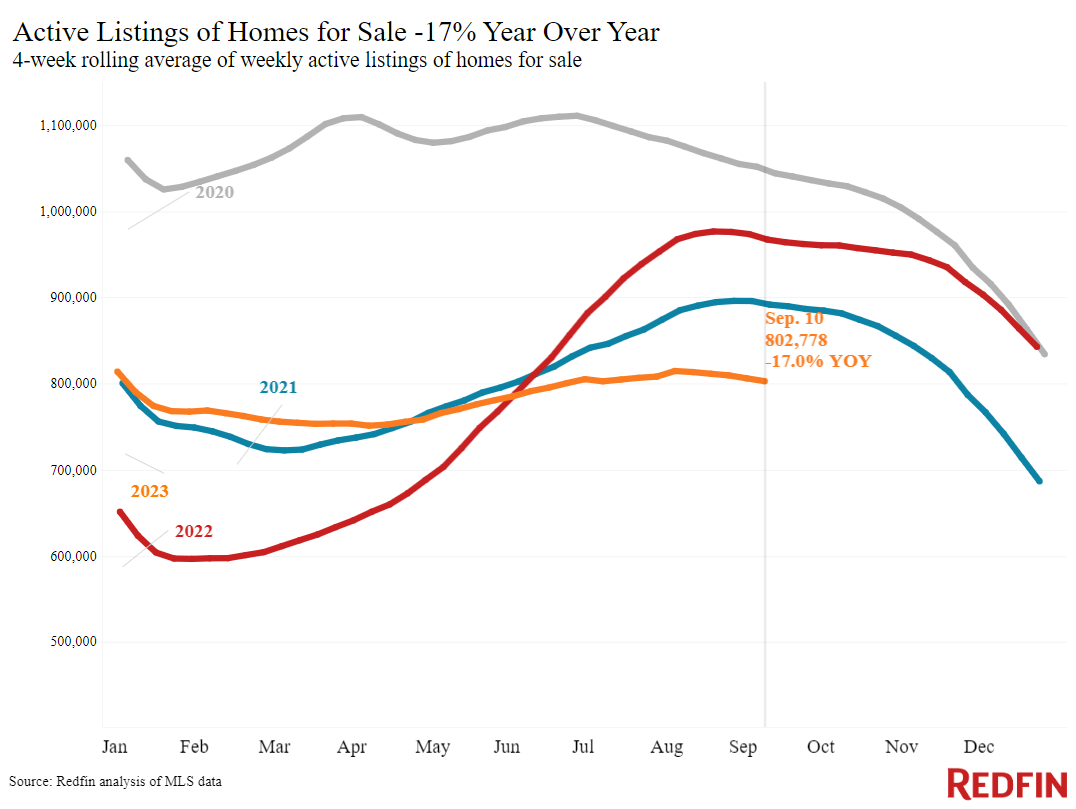

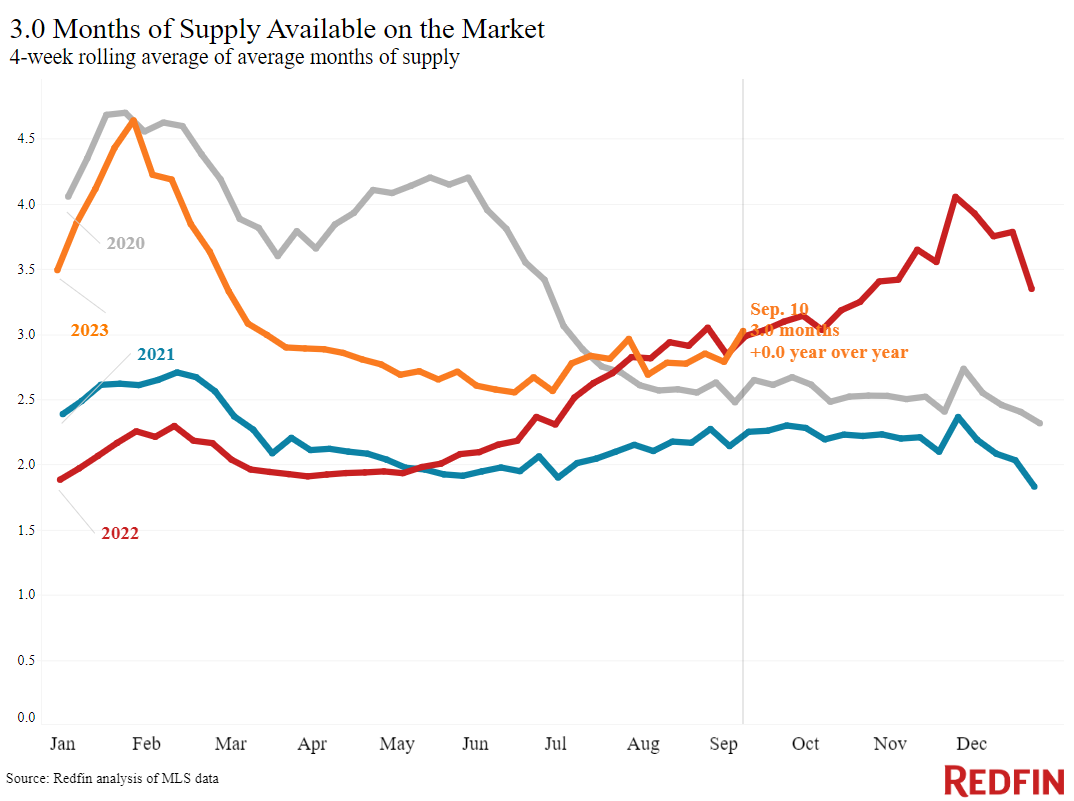

What house sellers require to understand: Rates continue to increase due to the fact that stock is so low, publishing among its greatest decreases in 19 months today. In much of the nation, you’re most likely to get a reasonable cost for your house– it’ll assist if it’s move-in all set and in a preferable area. However bear in mind that high rates, raised rates and the absence of stock is sending out some purchasers to the sidelines; mortgage-purchase applications are hovering near a three-decade low and pending house sales are down 12% year over year.

Looking forward: Today’s CPI report reveals that inflation was available in a touch greater than expected. That does not alter the expectation that the Fed is extremely not likely to trek rate of interest next week, however it does make a rate trek in November or December appear most likely That might imply home loan rates remain high through completion of the year– or rates might boil down if financial information looks appealing over the next couple of months.