U.S.-listed shares of Arm Holdings PLC rose out of eviction Thursday and closed 25% above their rates after they started trading on the Nasdaq, following a long-awaited going public.

Arm’s American depositary invoices

ARM,.

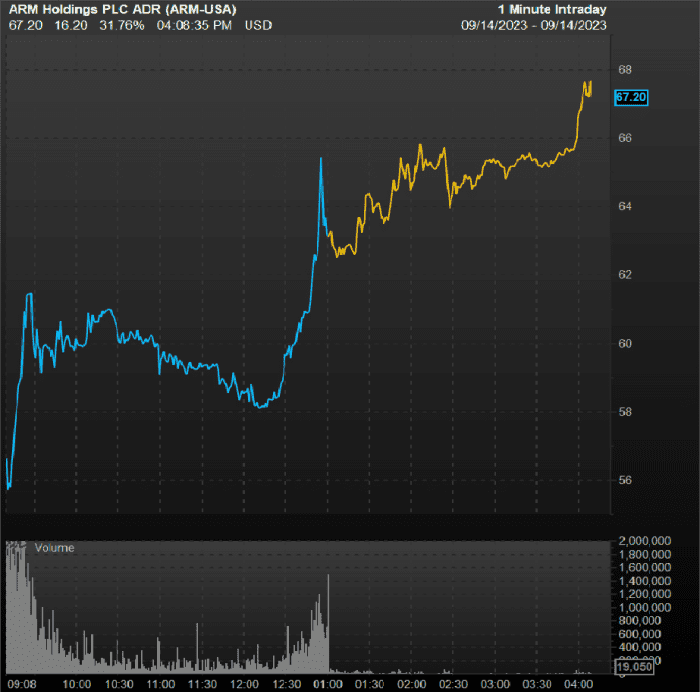

started trading Thursday simply after midday Eastern, opening at $56.10 and rallying as much as 30% above their going public rate of $51. By the end of the day, shares ended up 24.7% at $63.59, according to FactSet, offering Arm a market capitalization of more than $65 billion based upon 1.03 billion shares impressive.

Arm priced those shares at the high-end of its predicted variety Wednesday.

Then, ADRs appeared to get a 2nd wind after the close, increasing more than 5% after hours.

ARM increased after hours following its very first day of trade.

FactSet.

Chief Financial Officer Jason Kid informed MarketWatch on Thursday that Arm’s focus moving forward would be to make the most of the escalating expenses of making smaller sized and smaller sized nanometer-sized transistors for chips. As transistors get smaller sized, the expense for copyright and software application confirmation has actually swollen to use up as much as three-quarters of the style expense, he stated.

Instead of handle that expense themselves, chip makers are beginning to farm that out to Arm, he stated.

” It’s enabling us to do the work, and after that generate income from the work that we do– for IP confirmation, software application confirmation– we do that and offer it to everybody else at a portion of the rate what it would cost for them to do it by themselves,” Kid informed MarketWatch.

” What it does is it enables us to really get greater royalty rates with time since of the expense savings folks are managing utilizing us versus attempting to perhaps do more of the deal with their own,” Kid stated.

The CFO stated this becomes part of why Arm is getting more company creating complete calculate subsystems instead of simply offering direction sets for central-programming systems.

” As an outcome, we’re seeing more clients wishing to take us up on that deal, since it’s conserving them a great deal of time and a great deal of cash,” Kid informed MarketWatch.

While Arm’s IPO was apparently a number of times oversubscribed, it was likewise met stress and anxiety over what seemed a high vulnerability to geopolitical stress must a trade war warm up in between the U.S. and China.

Kid informed MarketWatch that much of the business’s appropriate risk-factor language was at the wish of legal representatives mulling over worst case situations. In the business’s filing, Arm stated its China company “runs separately people,” which exposed the business to “considerable threats.”

” That stated, it’s China,” Kid informed MarketWatch. The CFO stated that having actually managed China operations at 4 various worldwide business, “this is the best of any of my experience with China.”

Check Out: Arm costs IPO at high-end of variety, raising $4.87 billion

” Typically, the entire thing in between China and U.S. exists does not appear to be entirely lined up rewards,” Kid stated, keeping in mind that stress in between the U.S. and China are an issue for the semiconductor market as an entire, and are not Arm particular.

” We are a U.K.-based business, and the majority of our IP is developed beyond the U.S. so we may be a bit various from that viewpoint, however for one of the most part, it’s quite comparable,” Kid informed MarketWatch.

Check Out: Arm IPO: 5 things to learn about the chip designer main to the AI shift

Over 2023, 2022 and 2021, earnings from China-based clients represented about 25%, 18% and 20%, respectively, of Arm’s overall. Income from Taiwan-based clients represented 13.4%, 15.9% and 15.1%, respectively.

That looks relatively basic, as Nvidia Corp.

NVDA,.

obtains 21% of its earnings from China and 25.9% from Taiwan, according to FactSet information. Furthermore, Advanced Micro Gadgets Inc.

AMD,.

gets 21.6% of its earnings from China, and 10% from Taiwan.

With the quarter ending on Sept. 30, Kid stated the business anticipates to provide its very first profits report in November. The business means to publish outcomes “in combination with SoftBank given that they own 90% of the business,” he included.

In financial 2023, which ended March 31, Arm stated R&D expenses totaled up to 41% of earnings, up from 37% in 2022 and 40% in 2021. R&D expenses increased 13.9% to $1.13 billion in 2023, as earnings slipped less than 1% to $2.68 billion, according to Arm.

A group of “foundation financiers” led by Nvidia, AMD, Apple Inc.

AAPL,.

Alphabet Inc.’s.

GOOG,.

GOOGL,.

Google followed through with and purchased about $735 million in American depositary shares at the exact same terms as other buyers, Arm verified.

Prepare For an IPO began after Nvidia President Jensen Huang formally ended on his foundering $ 40 billion deal to purchase Arm straight-out from SoftBank Group Corp.

9984,.

in February 2022, after the FTC signed up with regulators opposing the offer by taking legal action against to obstruct it a couple of months previously. Right after the separation, SoftBank revealed it would take Arm public by March 31, 2024.

In 2016, Arm was bought by SoftBank for $32 billion.

.