United States Business Bankruptcies simply went beyond the overall for all of in 2015. We remain in a debt-based system, and the effect of raising rate of interest is now beginning to be felt in a huge method.

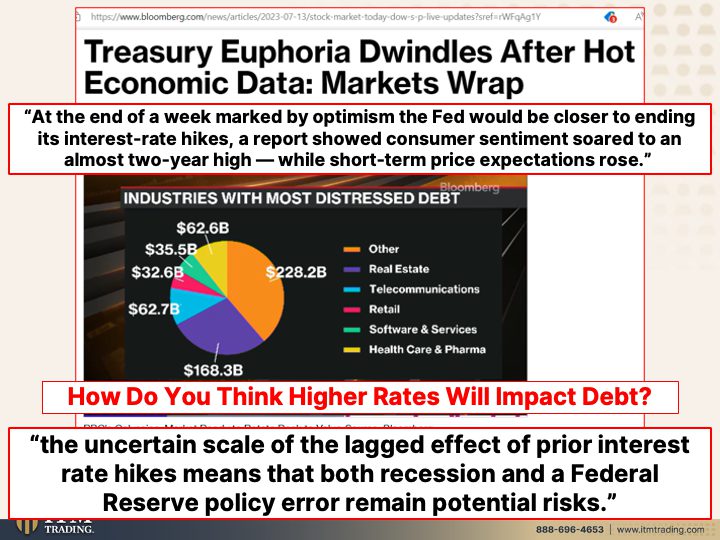

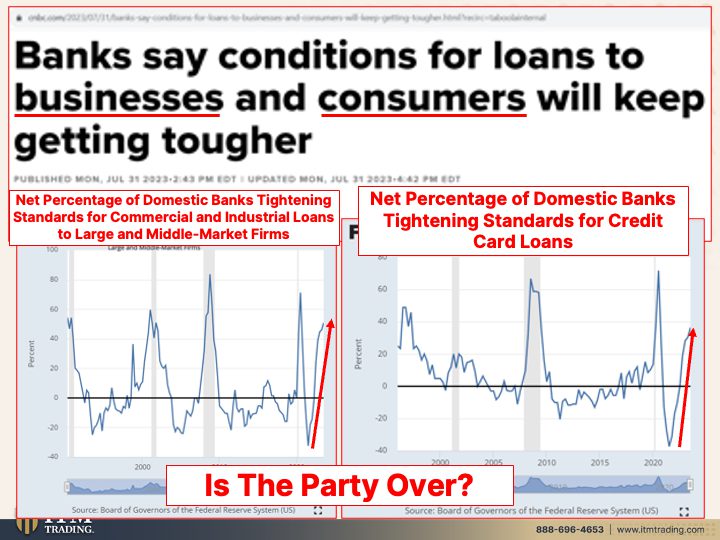

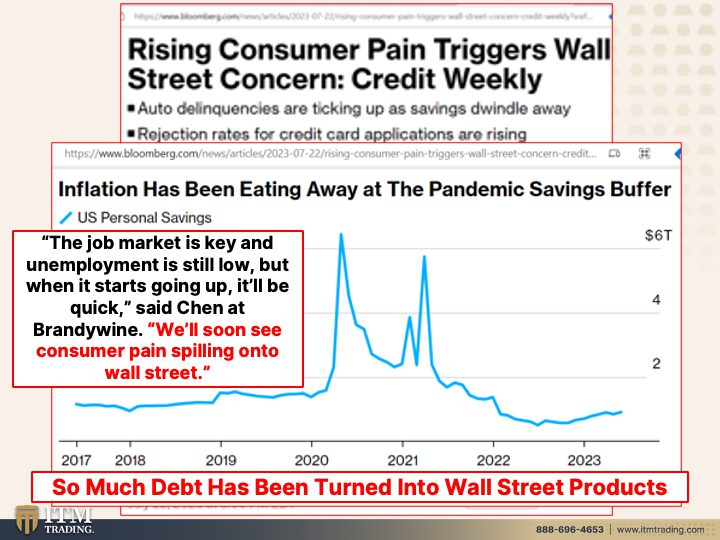

The boost in the expense of loaning and the expense of servicing financial obligation for both companies and people is causing defaults. Corporations and business realty companies are not able to re-finance due to credit tightening up and they’re being pushed into personal bankruptcy. This is causing task losses and reduced customer costs which will affect other companies and set off a down spiral of occasions.

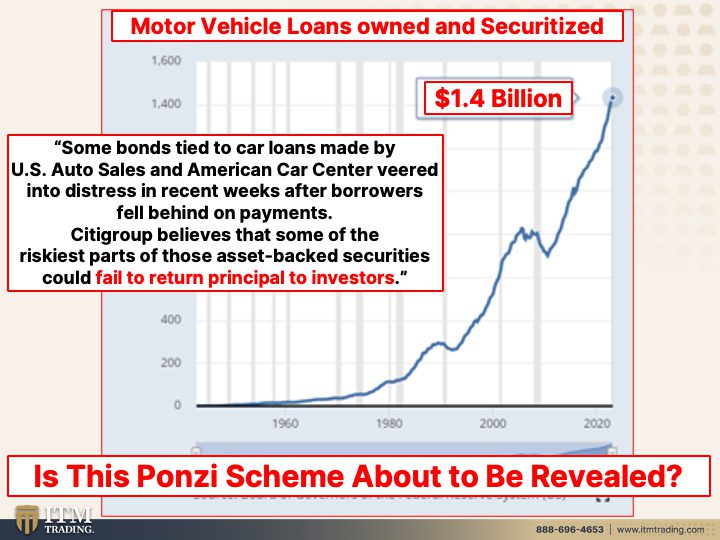

This economy is driven by the unsustainable compounding of financial obligation and derivatives that are now being offered as all the wall street items your monetary consultant suggests to you. Well think what, the ponzi plan gets exposed today … showing up!

CHAPTERS:

0:00 Business Personal Bankruptcies

2:00 Distressed Financial Obligation

4:32 Domestic Banks Tighten Up

5:55 New Zombies

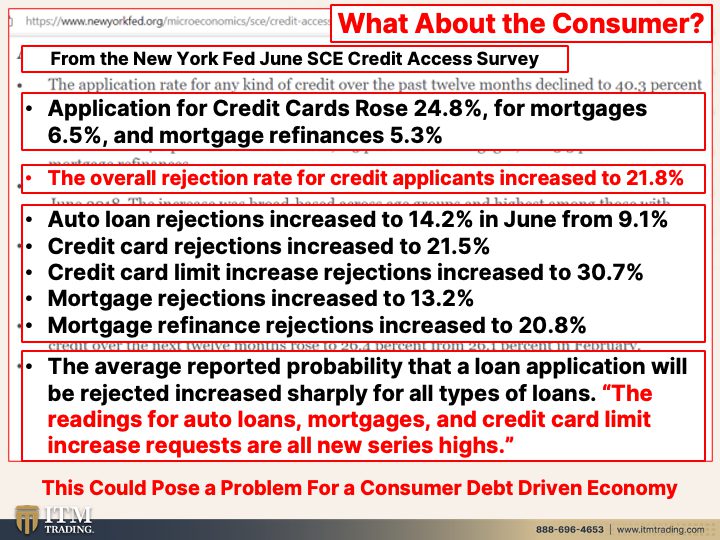

9:18 What About The Customer

13:59 Trainee Loan Time Out Ends

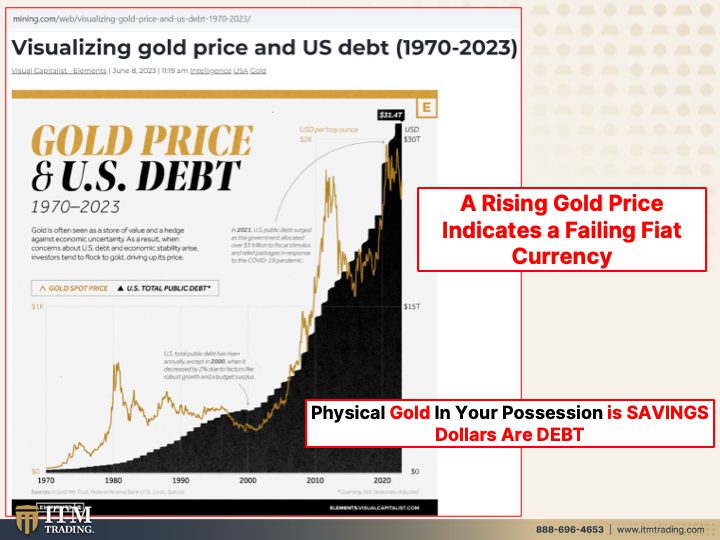

15:36 Gold Rate & & United States Financial Obligation

SLIDES FROM VIDEO:

SOURCES:

Stock Exchange Today: Dow, S&P Live Updates for July 14– Bloomberg

https://fred.stlouisfed.org/series/DRTSCLCCcc

https://fred.stlouisfed.org/series/DRTSCILM

https://fred.stlouisfed.org/series/SUBLPDRCSN

https://www.msci.com/www/quick-take/cmbs-dominates-first-wave-of/03740236548

SCE Credit Gain Access To Study– FEDERAL RESERVE BANK of New York City (newyorkfed.org)

Increasing Customer Discomfort Activates Wall Street Issue: Credit Weekly– Bloomberg

https://fred.stlouisfed.org/series/MVLOAS

Trainee Loan Time Out Ends With Turmoil Looming for 28 Million United States Debtors– Bloomberg

https://fred.stlouisfed.org/series/SLOAS

https://www.mining.com/web/visualizing-gold-price-and-us-debt-1970-2023/