{“page”:0,” year”:2023,” monthnum”:9,” day”:5,” name”:” getting-to-know-the-dow-jones-u-s-select-insurance-index”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Head of U.S. Equities”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Jim Wiederhold”,”title”:”Director, Commodities and Real Assets”,”image”:”/wp-content/authors/jim.wiederhold-515.jpg”,”url”:”https://www.indexologyblog.com/author/jim-wiederhold/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Factors and Dividends Indices, Product Management and Development”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Head of Factors and Dividends”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities and Real Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”George Valantasis”,”title”:”Associate Director, Strategy Indices”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Michael Mell”,”title”:”Global Head of Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Izzy Wang”,”title”:”Analyst, Strategy Indices”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Jason Ye”,”title”:”Director, Factors and Thematics Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Daniel Perrone”,”title”:”Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Thematic Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”},{“display”:”Narottama Bowden”,”title”:”Director, Sustainability Indices Product Management”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”}]

Being Familiar With the Dow Jones U.S. Select Insurance Coverage Index

The worldwide insurance coverage market capitalization has actually grown substantially over the previous 3 years, growing from almost USD 350 billion at the end of 1992 to USD 2.7 trillion since H1 2023. This development was accompanied by a shift in worldwide management. For instance, Exhibition 1 reveals that European insurance provider comprised a higher percentage of the insurance coverage market than their U.S. equivalents in the early 1990s. Nowadays, the U.S. represent most of the marketplace capitalization, while Europe’s weight has actually decreased.

The Dow Jones U.S. Select Insurance Coverage Index catches an investable part of the world’s biggest insurance coverage market. Similar to other indices in the Dow Jones U.S. Select Sector Speciality Index Series, the index is created to determine the efficiency of chosen subsectors of the Dow Jones Market Category System (DJICS) Constituents should likewise fulfill liquidity and market capitalization limits. The index utilizes a float-adjusted market capitalization (FMC) weighting plan with some top-level diversity topping guidelines used and is rebalanced quarterly in March, June, September, and December. 1

The Dow Jones U.S. Select Insurance coverage Index consists of stocks from the Dow Jones U.S. Broad Stock Exchange Index that are categorized under DJICS as Complete Line Insurance Coverage, Residential Or Commercial Property & & Casualty Insurance Coverage and Life Insurance Coverage, and omits business whose primary company activities are categorized as Reinsurance and Insurance Coverage Brokers. Exhibition 2 reveals that Residential or commercial property & & Casualty Insurance coverage is the main subsector, comprising 67% of the index since June 30, 2023, followed by Life Insurance coverage at 24% and Complete Line Insurance coverage as the tiniest piece at simply 10%.

Insurer are usually thought about non-cyclical or “protective” considered that the product or services supplied by insurance provider are frequently required no matter the stage of business cycle. The historic efficiency of the Dow Jones U.S. Select Insurance coverage Index appears to show this viewpoint.

Exhibition 3 reveals that, while the Dow Jones U.S. Select Insurance coverage Index published comparable efficiency to the Dow Jones U.S. Broad Market Index because completion of 1991 (an annualized 9.5% vs 9.9%, respectively), the insurance coverage index exceeded in rough environments. For instance, the broad market decreased by 19% in 2022, while the Dow Jones U.S. Select Insurance coverage Index acquired 12%, exceeding by 31%. In H1 2023, the insurance coverage index underperformed, as tech stocks moved the marketplace greater.

The Dow Jones U.S. Select Insurance coverage Index usually had a lower routing 12-month P/E ratio than the Dow Jones U.S. Broad Stock Exchange Index, indicating market individuals usually paid less for every single dollar of incomes got. The index likewise had a reasonably greater recognized dividend yield than the Dow Jones U.S. Broad Market Index, revealing that insurance provider paid more dividends relative to their share rate.

1 For additional information, please see the Dow Jones U.S. Select Sector Speciality Indices Approach

The posts on this blog site are viewpoints, not guidance. Please read our Disclaimers

D-FENCE! Examining Product Efficiency under a Protective Fed

I like this time of year. August holidays are over, the kids are back in school and football season begins in the U.S. The Fed took its August “getaway” at the Jackson Hole Seminar, where Jerome Powell’s remarks singularly concentrated on rate stability. Inflation has actually boiled down however “stays too expensive” and the Fed cautioned it’s “prepared to raise rates even more.” As markets get ready for ongoing limiting financial policy, we returned to school to examine the efficiency of products under a limiting Fed. Because 1970, the S&P GSCI has actually accomplished typical annualized returns of 10.5% compared to simply under 1% throughout durations when the Fed kept a limiting policy position.

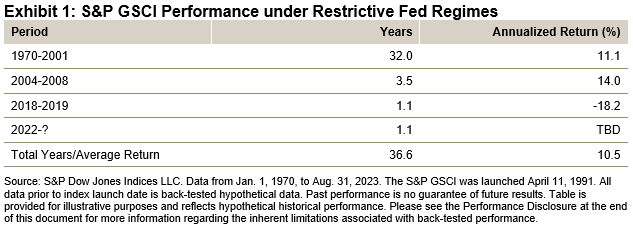

As part of its double required, the Fed sets a target inflation rate of 2%. While that procedure stays approximate, the Fed looks for to attain this through accommodative or limiting financial policy. Utilizing the main tool of the Fed, we compare the efficiency of the S&P GSCI when the Fed funds reliable rate stays above target inflation for a minimum of 12 months. The S&P GSCI is the leading product standard, with back-tested history extending for over 50 years. Taking this renowned standard, we assess index efficiency throughout this time. There have actually each been 3 durations where continual financial policy was either limiting or accommodative, covering 50 of the 53 years because 1970.[1]

In over two-thirds of the sample, typical annualized returns were over 10.5%. This covers the inflationary bouts of the 1970’s, the product very cycle of the 2000’s and one especially brief and abysmal year in 2018/2019. Financiers of product ETFs missed out on these chances, with the development of the product ETF’s happening throughout incredibly loose financial policy routines. Inflation is now the focus of the Fed and product efficiency has actually gotten.

Charting the present Fed funds reliable rate advises me of Mr. Powell’s view of the Grand Tetons. These towering peaks pierce the Wyoming sky, with a rugged shape going for 40 miles. The greatest peak tops 13,775 feet, while the most affordable elevation is well over a mile high. Those peaks rest on leading the 3,000 mile long Rocky Mountains with elevations over one and as much as 3 miles high. Like the Tetons, inflation has actually stuck out up and fell from its current peak however stays raised. This would discuss Mr. Powell’s focus on inflation, mentioning “limiting financial policy will likely play a progressively essential function.”

Taking a look at the history of the S&P GSCI, when the Fed gets protective, products have actually tended to be an excellent offense. In this present duration of limiting financial policy, products have actually produced strong however irregular returns. The S&P GSCI accomplished a 22% return in 2022, exceeding all property classes. Year-to-date, the S&P GSCI has an overall return over 5%. Ought to the Fed stay limiting, historic product returns have actually shown to be a strong protective technique.

[1] The 3 years consist of the present duration and times the reliable rate did not remain above or listed below for a minimum of twelve successive months.

The posts on this blog site are viewpoints, not guidance. Please read our Disclaimers

S&P 500 Low Volatility Index August 2023 Rebalance

The S&P 500 ®(* )carried out well from the last rebalance for the S&P 500 Low Volatility Index on May 19, 2023, through the most current rebalance on Aug. 18, 2023. As Exhibition 1 reveals, the S&P 500 was up 4.7% throughout this duration versus a decrease of 1.5% for the S&P 500 Low Volatility Index. This divergence tends to occur specifically throughout durations of strong efficiency and low volatility for the S&P 500. Remarkably, the annualized day-to-day basic variance over this duration for the S&P 500 was a fairly low 10.7%. As Exhibition 2 programs, routing 1 year volatility reduced for all 11 GICS ® sectors since July 31, 2023, versus April 28, 2023. Determined in outright terms, volatility reduced the most for the Customer Discretionary and Energy sectors, which fell 6.8% and 5.4%, respectively. Since July 31, 2023, Energy, Interaction Solutions, Customer Discretionary, Infotech and Realty were the leading 5 most unstable sectors in the S&P 500, with day-to-day recognized volatilities of roughly 29%, 27%, 26%, 26% and 23%, respectively.

In the middle of the general decline in volatility, the S&P 500 Low Volatility Index’s most current rebalance brought some modifications to sector weights. The most recent rebalance moved an extra 1.5% weight to the Customer Staples sector, which even more strengthened its position as the biggest sector by weight. Energies had the biggest decrease in weight, at roughly 2.9%, dropping it to the third-largest sector by weight. The Customer Staples, Utilities, Healthcare, Financials and Industrials sectors continued to have a combined weight of higher than 90%.

Energy and Products continued having no weight in the S&P 500 Low Volatility Index. The most recent rebalance worked after the marketplace close on Aug. 18, 2023.

The posts on this blog site are viewpoints, not guidance. Please read our

Disclaimers Why Multi-Factor Indices in South Africa?

Elizabeth Bebb

A Random Stroll Down Wall Street, asserted, “The truths recommend that effective market timing is extremely tough to attain.” 1 Multi-factor indices might be a method of guaranteeing you are “in the ideal location at the correct time,” taking part throughout market cycles without jeopardizing timing or returns.

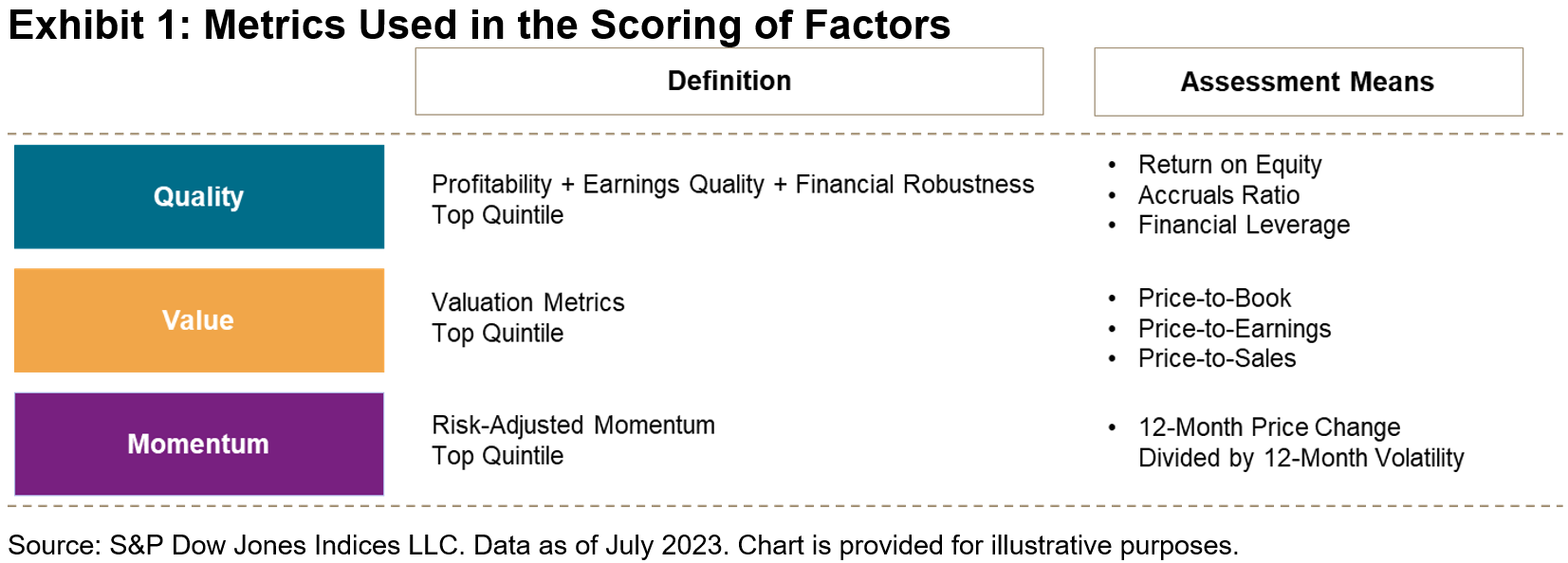

The S&P DJI Multi-Factor Indices are developed on a bottom-up method. This indicates the element ratings are integrated to pick “all-rounders” that score extremely throughout numerous elements. The

S&P South Africa Composite Quality, Worth & & Momentum (QVM) Multi-factor Index uses the Quality, Worth and Momentum elements. The illustration listed below programs the metrics utilized in the scoring for each private element. To be qualified for addition in the S&P South Africa Composite QVM Multi-factor Index, the constituents should be members of the

S&P South Africa Composite and pass a trading liquidity screen. Multi-factor ratings are determined for each business based upon the average for each element. The leading 40 constituents with the greatest element rating are consisted of in the index. All constituents are market capitalization times element rating weighted, to an optimum weight of 10%. The method allows different advantages to be developed into the index. Stocks are chosen within the context of the overall combined portfolio and general direct exposures to the wanted elements might be greater. In addition, back-tested outcomes reveal more powerful risk-adjusted returns than the index of indices technique.

Multi-factor indices have actually traditionally tended to carry out more highly over the longer term on a risk-adjusted basis. This better dynamic is shown by returns being closer to the leading left in Exhibition 2. The S&P South Africa Composite QVM Multi-factor Index is nearer this point than other indices.

We reveal the S&P South Africa Composite QVM Multi-factor Index returns on an annual basis with the private element returns overlaid in Exhibition 3. The S&P South Africa Composite QVM Multi-factor Index line shows how the private element returns are interacting over different years to provide the risk-adjusted return.

The connections throughout excess returns in between elements are low, which enables the possible gain from integrating private elements within the S&P South Africa Composite QVM Multi-factor Index technique.

Exhibition 5 reveals the risk-adjusted returns gradually for each of the elements. The S&P South Africa QVM Multi-factor Index offers excellent returns over the long-lasting with lower tracking mistake versus the S&P South Africa Composite. It likewise gets involved well in increasing markets however prevents a few of the disadvantage in falling markets, showing the advantages of the multi-factor technique.

The S&P South Africa Composite QVM Multi-factor Index offers an intriguing chance to think about for multi-factor indexing in the South African market.

1

Malkiel, Burton. A Random Stroll Down Wall Street W. W. Norton & & Business, Inc. 1973. The posts on this blog site are viewpoints, not guidance. Please read our

Disclaimers Stabilizing Defense with Development: The S&P Quality Indices

Wenli Costs Hao

Senior Lead, Elements and Dividends Indices, Item Management and Advancement

S&P Dow Jones Indices

So far this year, about two-thirds of the

High quality is frequently connected with a business’s

strong success, high incomes quality and robust monetary strength For this reason, the S&P Quality Indices make use of 3 popular metrics to record a business’s quality attributes (see exhibition 2): return-on-equity (ROE), balance sheet accruals ratio (BSA) and monetary utilize ratio (FLR). The choice for the S&P Quality Indices represents the leading 20% of qualified stocks within their particular universe, ranked by their general quality ratings. Index constituents are weighted by the item of their market capitalization and quality ratings, based on restrictions.

1 Efficiency Contrast

Historically, the S&P Quality Indices exceeded their matching standards in the brief and the long term with regard to

overall return and risk-adjusted return ( see Exhibition 3). Year-to-date, the S&P MidCap 400 ® Quality Index and S&P SmallCap 600 ® Quality Index exceeded their standards by 8.55% and 6.46 %, respectively. In addition, these indices have actually tended to display protective qualities, as evidenced by lower volatility, lower beta and smaller sized drawdowns.

YTD Quality Index Efficiency Attribution

So far in 2023, the monetary utilize ratio (FLR) part has substantially exceeded the S&P 500 (see Exhibition 4), recommending that markets might have rewarded lower leveraged business on the back of high rate of interest.

High Benefit Involvement and Protective Qualities

The historic capture ratios in Exhibition 5 reveal that the S&P Quality Indices tend to get involved one for one in up markets

2 while providing substantial outperformance throughout down markets. The protective nature of these indices makes good sense because the quality element tends to track business with long lasting company designs and sustainable competitive benefits. For the

S&P 500 Quality Index, these capture ratios might be partly discussed by the choice of mega-cap development stocks, which tend to have strong financials and underlying company basics. The current constituents consist of 5 (Apple, Microsoft, Nvidia, Alphabet and Meta) of the Splendid 7. Exhibition 6 reveals the leading 15 factors to the S&P 500 Quality Index’s efficiency YTD. Aspect Direct Exposure

Exhibition 7 reveals the element direct exposure distinction in between quality indices and their standards in regards to Axioma Threat Design Aspect Z-scores. The S&P Quality Indices showed a strong

quality tilt versus their particular standards. Particularly, the quality indices had greater direct exposure to success and lower direct exposure to utilize ratio elements. In addition, the indices had comparable evaluation and development direct exposures to their standards. Sector

Structure Exhibition 8 reveals the historical sector direct exposure distinction in between the quality indices and their standards. Historically, the quality indices were obese in Industrials and Innovation, while underweighting Interaction Solutions, Energy, Financials, Realty and Utilities.

1

For additional details about the element meaning, element rating computation and index style, please see the S&P Quality Indices Approach 2

The marketplace is specified as the month-to-month efficiency of the underlying standards from Dec. 31, 1994, to July 31, 2023. The posts on this blog site are viewpoints, not guidance. Please read our