Tl; dr: Rates the same (in target series of 5.25% -5.5%, a 22-year high) however hawkish-er than anticipated projection for rates … however at the very same time indicated a ‘ soft landing’ with greater development projections.

-

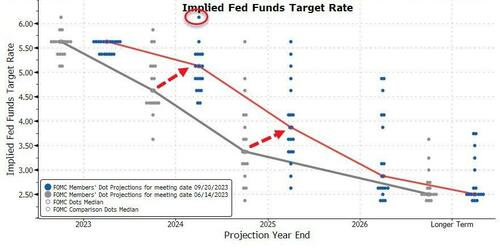

Dot plot’ of rate forecasts reveals policymakers still anticipate another walking this year, however 2024 and 2025 rate forecasts each increased by a half-percentage point, a signal the Fed anticipates rates to remain greater for longer

-

Twelve of 19 policymakers on the FOMC anticipate another rate trek this year to be proper; the staying 7 favor holding rates consistent

-

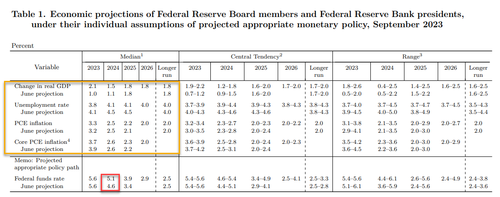

Average forecast for financial development in 2023 dives to 2.1% from 1% in June; authorities substantially minimize joblessness projections and now anticipate unemployed rate to peak at 4.1%, instead of 4.5%

-

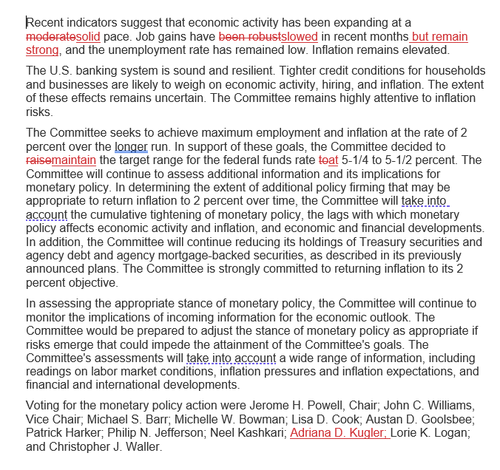

Declaration repeats previous language stating authorities are thinking about “the level of extra policy firming that might be proper”; Fed acknowledges task gains have “slowed” however states they “stay strong”

Dots:

- 2023: 5.625% versus 5.625% previous and 5.625% anticipated

- 2024: 5.125% versus 4.625% previous and 4.875% anticipated

- 2025: 3.875% versus 3.375% previous and something like 3.875% anticipated

- 2026: 2.875%

- Long-run: 2.50% versus 2.50% previous and 2.625% anticipated

SEP projections: Development projections were increased rather significantly this year and next. Heading inflation was changed a little greater in 2023 and 2025, with core marked lower this year however up a bit in 2025.

Something that seems missing out on for their analysis …

Fed approximates that r * stays at 0.5%, and yet rates in 2026, when United States financial obligation might strike $50 trillion will be 3%.

This indicates that mixed interest on United States financial obligation will be ~$ 2 trillion, double where it is now.

Video Game over

— zerohedge (@zerohedge) September 20, 2023

* * *

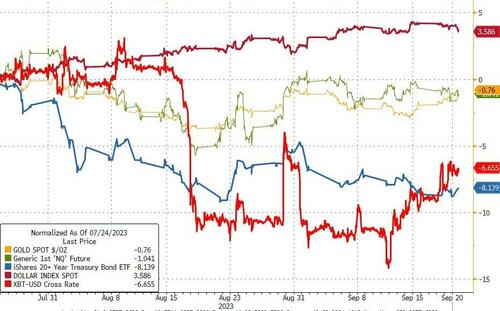

Because the last FOMC declaration and interview (on July 26th), the dollar has actually skyrocketed however bitcoin and bonds have actually been damaged lower in rate (with gold and stocks essentially unch) …

Source: Bloomberg

Remarkably, area gold is precisely back up to the spike-lows of the July FOMC day.

Source: Bloomberg

In Addition, The Fed’s jawboning of “greater for longer” is progressively being accepted by the rates market as the SOFR spreads for Dec 2023-2024 and 2023-2025 have actually risen because the last FOMC …

Source: Bloomberg

In reality the genuine shift began in September (as 2023 rate-hike exp faded and 2024 rate-cut exp were lowered) …

Source: Bloomberg

Of some note, we have actually seen monetary conditions tighten up substantially because the last FOMC (while at the very same time, macro surprise information has actually dissatisfied) …

Source: Bloomberg

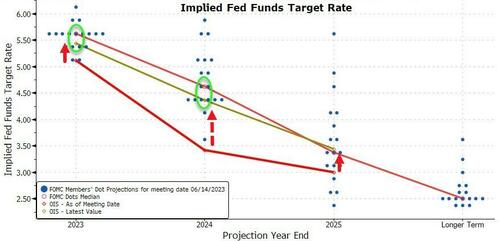

Therefore, while the world makes sure that The Fed will stay on ‘time out’ today, all eyes are on the Dot-Plot for signals of simply how ‘greater for longer’ they will be and for Powell’s tone throughout the presser with agreement anticipating the FOMC will repeat its ‘date-dependence’ however keeping a tightening up predisposition while getting rid of one rate-cut from 2024’s dots.

For context, because the last FOMC, the marketplace has moved hawkishly (red arrows) up towards The Fed’s previous Dot-Plot, however stays more dovish (green ovals) than The Fed …

Source: Bloomberg

Therefore, what did we get?

The fed left rates the same – as anticipated – however the dots were substantially more hawkish, slashing 2 cuts from 2024 dot-plot:

-

* FED: 12 AUTHORITIES SEE ANOTHER WALKING THIS YEAR, 7 SEE ON HOLD

-

* FED ’23 TYPICAL RATE PROJECTION REMAINS AT 5.6%; ’24 INCREASES TO 5.1%

One Fed member is predicting a 6.125% End 2024 rate …

Dots:

-

2023: 5.625% versus 5.625% previous and 5.625% anticipated

-

2024: 5.125% versus 4.625% previous and 4.875% anticipated

-

2025: 3.875% versus 3.375% previous and something like 3.875% anticipated

-

2026: 2.875%

-

Long-run: 2.50% versus 2.50% previous and 2.625% anticipated

SEP projections:

The Fed updated its typical forecast for development in 2023 to 2.1% from 1% in June. They likewise reduced their joblessness projection.

That is big however it’s likewise playing catch-up and shows how the financial outlook has actually altered because June, when economic crisis calls were still live.

Heading inflation was changed a little greater in 2023 and 2025, with core marked lower this year however up a bit in 2025.

There were practically no modifications to the declaration:

Over to you Mr.Powell …

Filling …