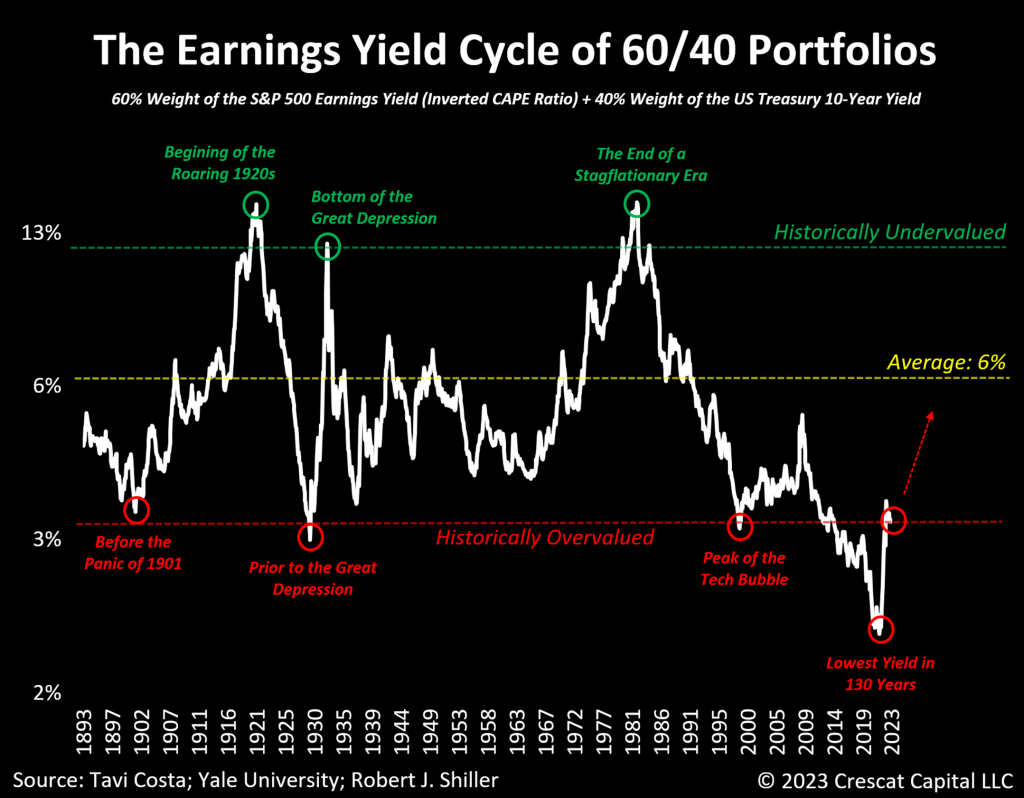

We imagine typical funding methods are poised to go through an important restructuring, putting a distinguished emphasis on investments in exhausting property. As illustrated within the accompanying chart, the valuation historical past of 60/40 portfolios unfolds via prolonged cycles, and we’re recently experiencing some other essential juncture on this dynamic.

In August 2021, the blended valuation of general equities and US Treasuries had reached its most costly degree in 130 years. To place the present valuation imbalance into standpoint, its contemporary top was once a staggering 61% larger than its earlier top within the early 2000s. Even supposing costs have corrected rather, specifically within the Treasury marketplace, as of lateâs increased multiples nonetheless undergo resemblance to sessions that preceded important financial downturns, such because the Nice Despair of 1929 and the Tech Bust of 2001.

The upward push in recognition and the luck of those conventional funding methods in contemporary many years will also be credited to a length characterised by way of disinflation, fostering one of the speculative environments within the historical past of economic markets. It’s extremely not likely that equities and bonds, given their present inflated costs, will in combination yield really extensive returns over the following decade. That is specifically the case in an international the place structural inflationary forces proceed to conform within the machine, whilst the price of capital is predicted to exceed historic norms.

Â

Â

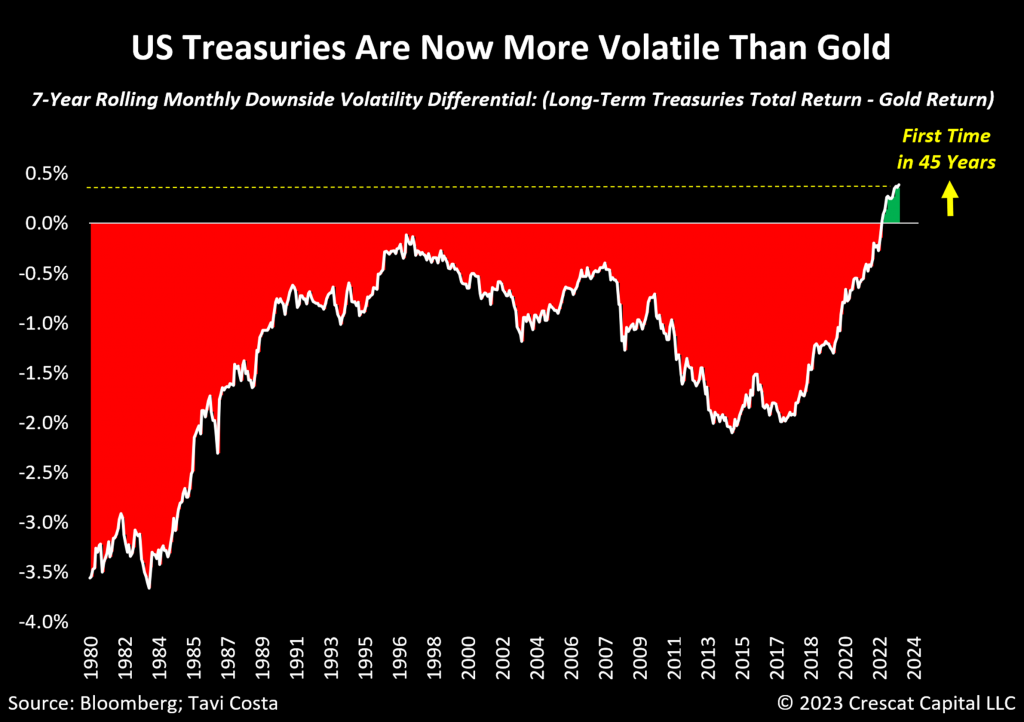

Treasuries: No Longer the Most secure Selection

The transferring dynamics of capital shifting clear of crowded fairness and fixed-income holdings, as buyers search new funding alternatives, may have profound implications in monetary markets. That is the place gold and general commodities are poised to play an important function all the way through this transitional section.

As is widely known, the 40% phase of those typical portfolios, principally made from fixed-income property, has been dealing with really extensive demanding situations. This has resulted in basic questions in regards to the doable want to restructure those allocations. The principle reason buyers come with this portion of their portfolios is essentially as a result of they’re searching for safe-haven property with minimum problem volatility, particularly the ones that have a tendency to accomplish smartly all the way through financial downturns. Nonetheless, establishments will have to deeply mirror upon this the most important research:

For the primary time in 45 years, US Treasuries have exhibited larger problem volatility than gold.

Itâs noteworthy that world central banks have already begun to acquire gold for their very own causes. This effort is very important with a view to carry the usual of high quality for his or her world reserves after enduring a longer length of imprudent financial coverage selections. Fairly than loading their steadiness sheets with debt tools from some other financial system this is already careworn by way of a historical past of indebtedness, it’s crucial for world central banks to carry a impartial selection with centuries of confirmed credibility as a difficult asset to change into the cornerstone in their financial techniques.

We await that those coverage adjustments will exert important affect on different main establishments, which can be prone to step by step undertake gold as a haven selection through the years.

Â

Â

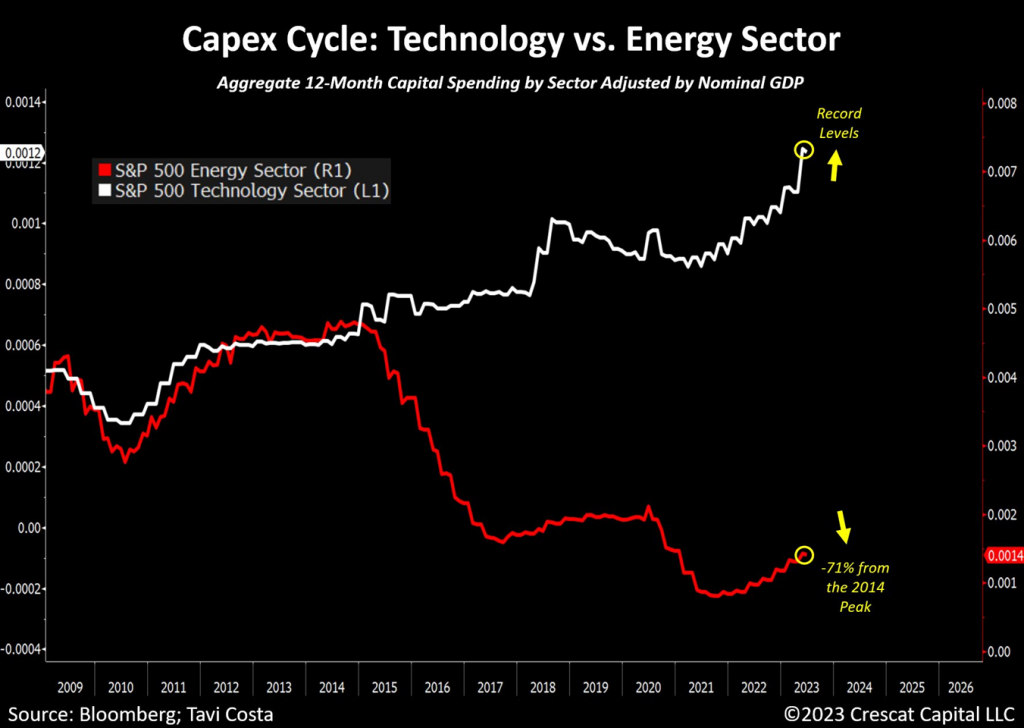

The Ignored Very important A part of Our Financial system

One more reason why inflationary forces persist so prominently as of late will also be attributed to the hanging disparity in capital allocation between generation and useful resource industries, an issue that continues to be traditionally notable. That is certainly a relating to subject, emphasizing the existing investor focus on one sector of the marketplace, frequently on the expense of companies that stay basic to our financial system as of late.

Itâs the most important to keep in mind that useful resource industries necessitate sustained, really extensive capital funding to ramp up manufacturing forward of a length of rising call for. However capital markets are frequently now not in sync. That is why we have now trade cycles and the main reason commodity bull markets generally tend to start with sharp charge will increase because of provide shocks. Additionally, when a sector-wide loss of funding has passed off over an extended time frame, commodity bull cycles also are prone to play out over prolonged tendencies.

The upward push of deglobalization and demanding situations in housing affordability are prone to additional power the will for infrastructure construction, in the end growing upward drive at the call for for fabrics and herbal assets to fulfill those evolving necessities.

Â

Â

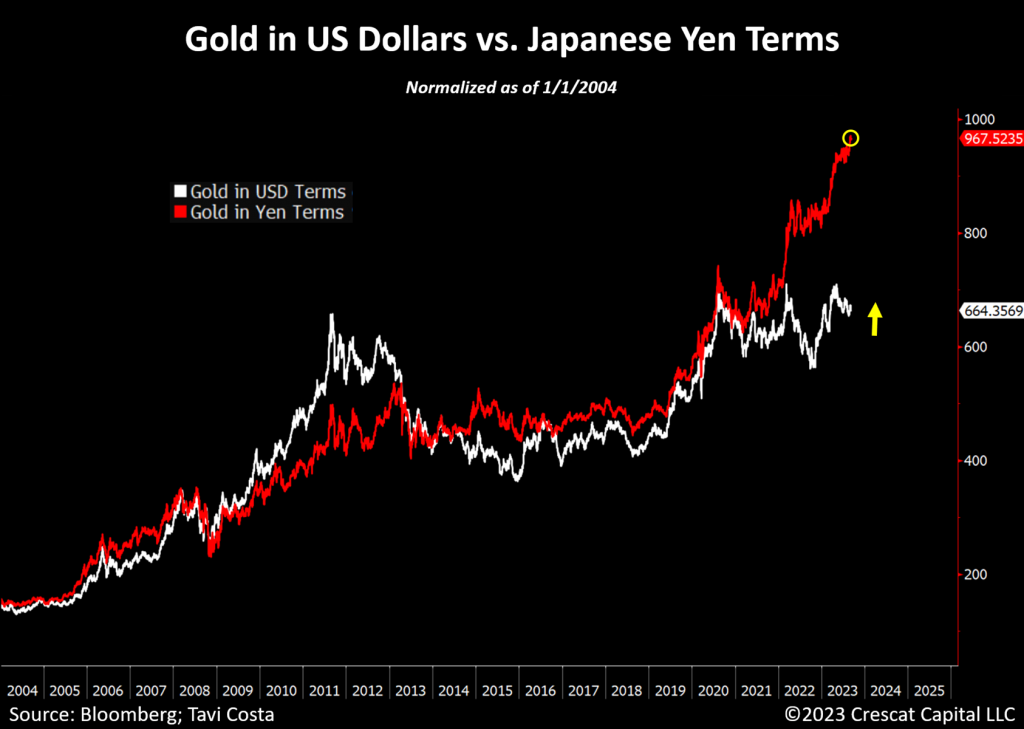

Japan: A Compelling Case Find out about

It may be difficult for the general public to take hold of the theory of exhausting property changing into a competent selection to standard portfolios, particularly when taking a look at their underperformance all the way through the International Monetary Disaster against this to the robust efficiency of US Treasuries. To totally comprehend this idea, one wishes a deeper working out of historic patterns, acknowledging that other asset correlations emerge all the way through inflationary sessions.

Advanced economies are recently dealing with a prolonged debt disaster, with deeply entrenched inflationary pressures propelled by way of escalating deglobalization, reckless fiscal spending, worsening inequality, and restricted get admission to to very important herbal assets.

The Jap financial system is a compelling case learn about of a rustic that has suffered from a protracted length of economic and financial indiscipline. The truth that the Financial institution of Japan has made repeated makes an attempt to relieve the mounting charge of debt, even with 10-year rates of interest at an insignificant 0.7%, arguably stands as one of the important macro occasions lately and is a roadmap for the wider world financial system. Their financial systemâs reliance on steady govt intervention vividly underscores the magnitude of the current debt disaster. It isn’t surprising that gold costs in Jap Yen phrases consistently succeed in document ranges.

Make no mistake; this example isn’t unique to Japan. The Fed, the Eu Central Financial institution, the Financial institution of England, the Other peopleâs Financial institution of China, and others are on the point of confronting the exact same quandary.

In an international careworn by way of historic ranges of debt, itâs essential to keep in mind that through the years, all paper currencies will have to lose price towards exhausting property. In our robust view, the yen is solely an early mover.

Â

Â

Introducing Laborious Belongings to 60/40 Portfolios

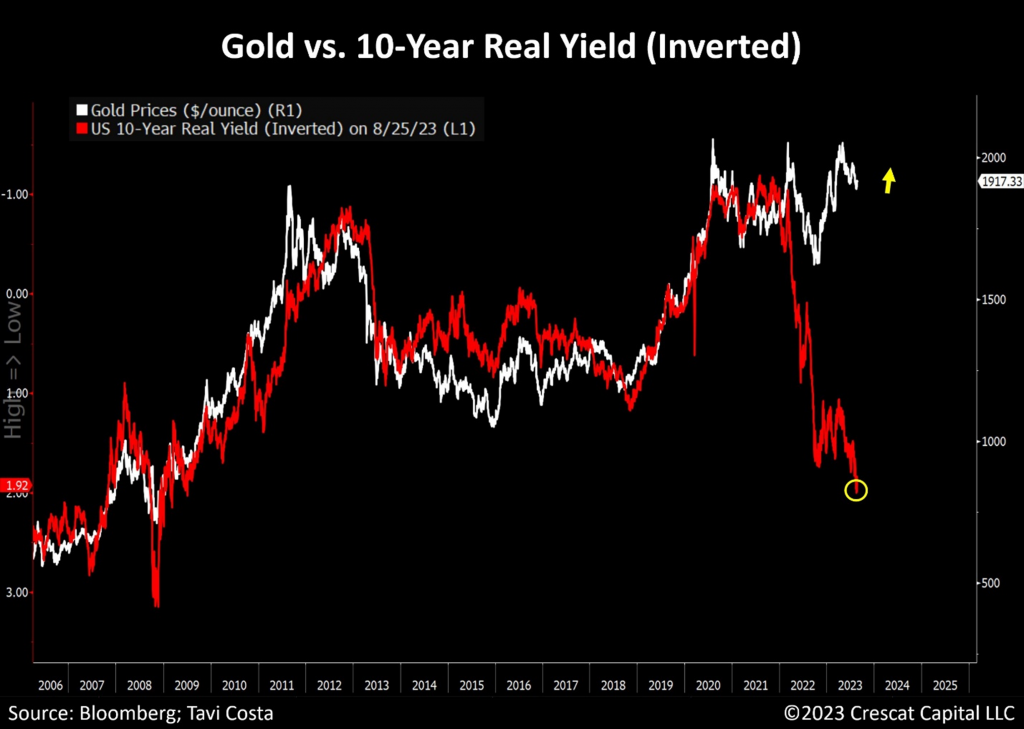

Any other common argument towards the theory of making an investment in tangible property in as of lateâs financial setting, specifically gold, is the problem posed by way of emerging rates of interest, as it’ll appear much less sexy to carry an asset that doesnât yield anything else. Then again, historic examples contradict this perception. Gold delivered a few of its most powerful performances all the way through the Seventies, regardless of the backdrop of accelerating rates of interest.

This pattern isnât restricted to that particular decade; you’ll be able to in finding identical cases within the 1910s and Forties. Whilst gold costs won’t were freely floating all the way through the ones sessions, different tangible property, reminiscent of commodities, demonstrated exceptional efficiency.

There’s a transparent and compelling reason the present charge of gold stays impressively resilient regardless of the drive from actual charges. The weakening of the correlation between inflation-adjusted yields and valuable metals is changing into extra obvious. With inflation operating warmer than historic requirements, gold is extremely prone to decouple from Treasury costs, a lot love it did all the way through the Seventies.

Who would have concept that during such an intricate macro setting, there could be such a lot of skeptics about proudly owning exhausting property?

Â

Â

Additional Debt Enlargement Most likely Forward

If we believe Japanâs govt debt imbalance as a number one indicator, it means that different world economies would possibly now not have totally learned the level in their leverage problems. Whilst the USA federal debt recently stands at over 120% of nominal GDP, Japanâs determine is greater than double that quantity, now at 255%!

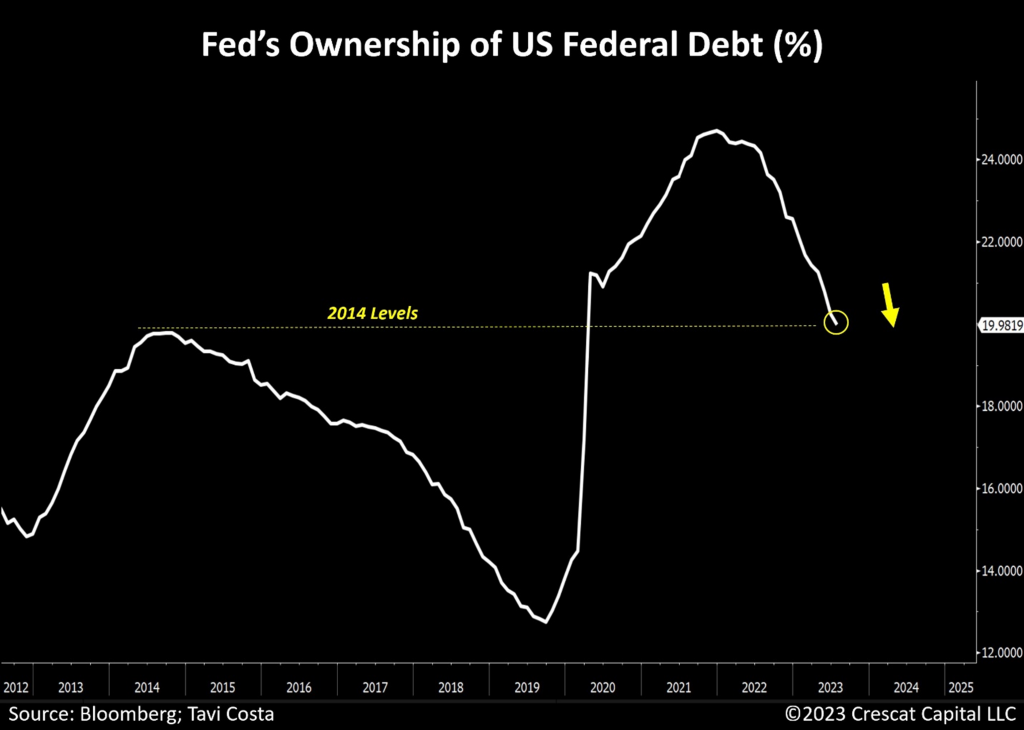

Very similar to the stairs taken by way of the Financial institution of Japan, even within the face of prevailing inflationary pressures, central banks in closely indebted economies inevitably in finding themselves forced to change into the main clients of their very own govt debt.

The present financial coverage in the USA is starkly misaligned with the surge in Treasury issuances and the existing ranges of fiscal irresponsibility.

Itâs essential to notice that the Fedâs possession of US federal debt has not too long ago plunged to 2014 ranges. Inevitably, this pattern must be reversed.

Â

Â

These daysâs Fiscal Spending Is Certainly Extremely Inflationary

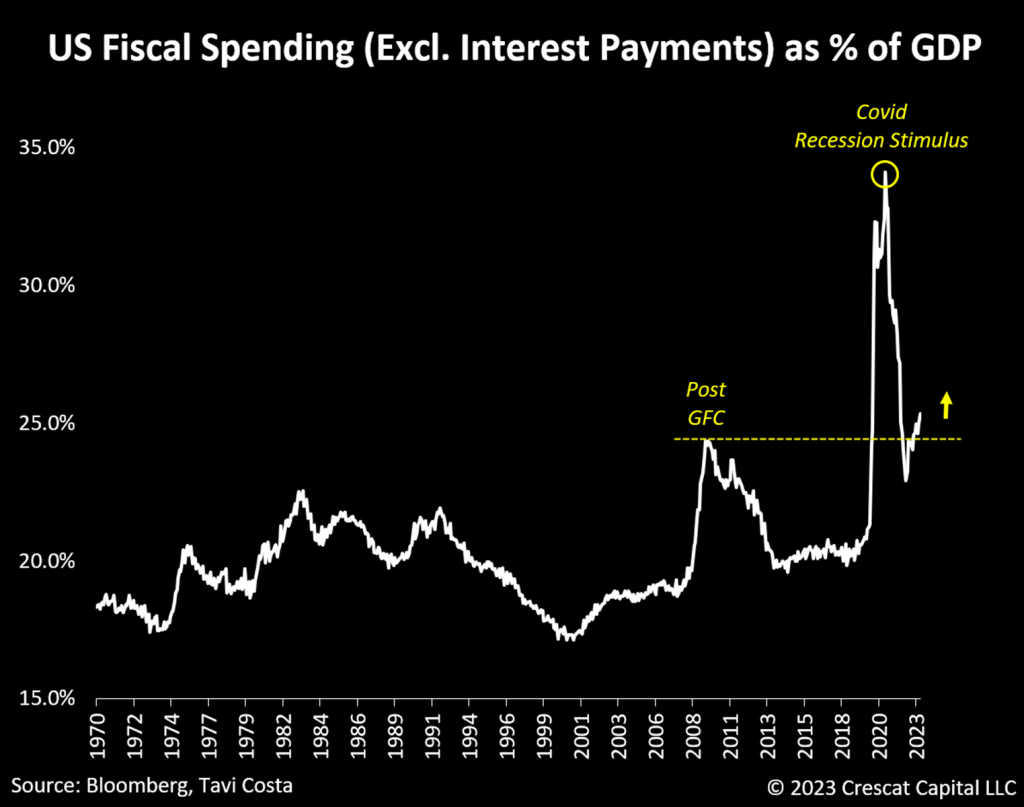

Many contemporary articles have advised that the present fiscal spending will not be stimulative within the conventional sense, as a considerable portion of it’s pushed by way of the pointy upward push in passion bills. Then again, itâs essential to notice that this standpoint isn’t totally correct.

Even with out factoring in the price of servicing the debt, fiscal spending by myself represents over 25% of GDP in the USA. These daysâs govt expenditure has already surpassed the degrees noticed after the International Monetary Disaster. The notable difference is that we havenât skilled an financial downturn but.

Whatâs much more essential, aside from the Covid recession, we have now now not witnessed this kind of really extensive scale of presidency stimulus previously half-century. The loss of fiscal self-discipline is prone to persist as a distinguished motive force of inflation.

Â

Â

The Resurgence of Exertions Marketplace Participation

The previous member of the Federal Reserve Board of Governors Lael Brainard, who now serves because the director of the Nationwide Financial Council, not too long ago had an interview on CNBC the place she shared her overview of the new upward push in hard work drive participation. She expressed optimism in regards to the expanding numbers, attributing them to a powerful financial system and the supply of what she known as âactually terrificâ activity alternatives.

Our overview, alternatively, takes an absolutely other standpoint.

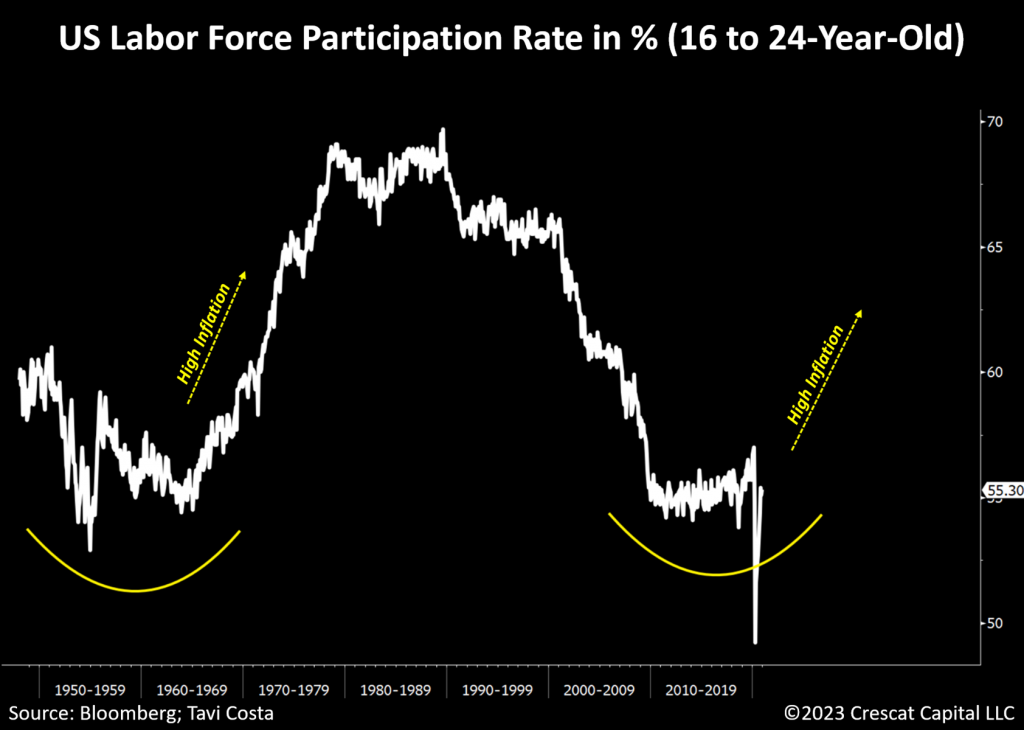

Once we read about historic tendencies, the resurgence of work marketplace participation is but some other indicator of doable inflationary issues within the machine. A identical development passed off again within the Seventies when emerging dwelling prices forced families to rejoin the hard work marketplace. The time period âThe Nice Resignation,â steadily highlighted by way of the media, is basically rooted in taking a look on the previous.

We imagine the hard work drive participation fee is most likely within the technique of bottoming. Whilst some policymakers might interpret this as a good construction, we see it as additional proof that we may well be getting into a length characterised by way of stagflation.

This pattern is clear throughout all age teams, however it’s specifically noticeable amongst people elderly 16 to 24. More youthful people have considerably lowered their participation within the hard work marketplace because the top of inflation within the early Nineteen Eighties. So long as inflation stays larger than historic norms, this demographic, at the side of others, is prone to change into a considerable addition to the activity marketplace.

Â

Â

Wealth Hole Problems Result in Additional Govt Spending

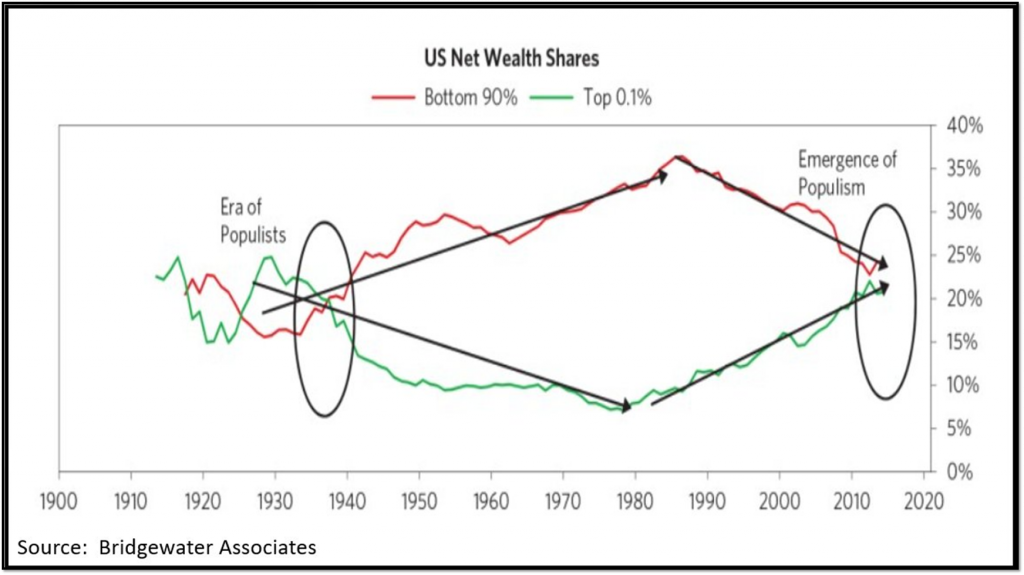

A notable distinction to the inflationary length of the Seventies is the prominence of as of lateâs inequality downside.

Other from the huge wage-price spiral skilled again then, the convergence of the present wealth hole disparity and a considerably increased charge of dwelling is ready to pay attention rising salary drive a few of the huge inhabitants within the decrease and middle-income teams.

This example mirrors what’s frequently witnessed in rising markets. To confront those demanding situations, governments generally tend to prioritize in depth fiscal stimulus measures aimed at once at addressing populist social welfare problems, thereby exacerbating of the inflationary downside.

Advanced economies are beginning to undertake identical social insurance policies, even though those tendencies are nonetheless of their early levels. That is anticipated to give a contribution considerably to larger govt spending as time progresses.

Â

Â

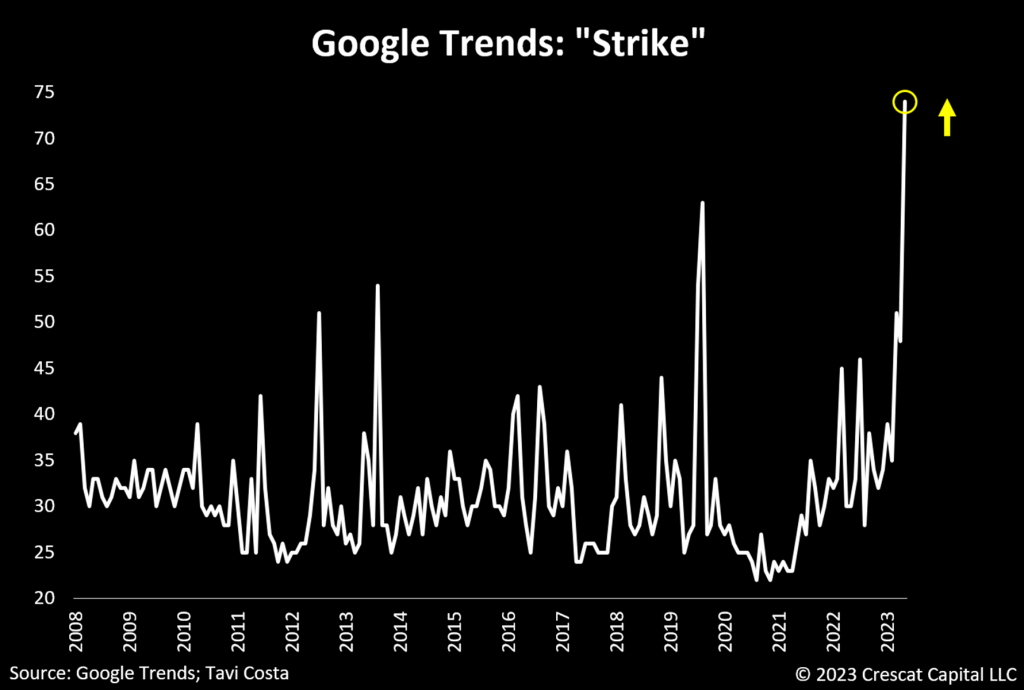

The Proliferation of Exertions Moves

The rising salary drive is changing into extra obvious, resulting in a extra widespread incidence of work moves in society. This example is harking back to historic sessions when client costs additionally exceeded historic norms, serving as unmistakable indicators of an inflationary atmosphere.

This is an engaging chart appearing that Google tendencies for the phrase âstrikeâ not too long ago surged to document ranges. This spike implies a rising drive amongst employees to safe progressed repayment offers with their employers.

Â

Â

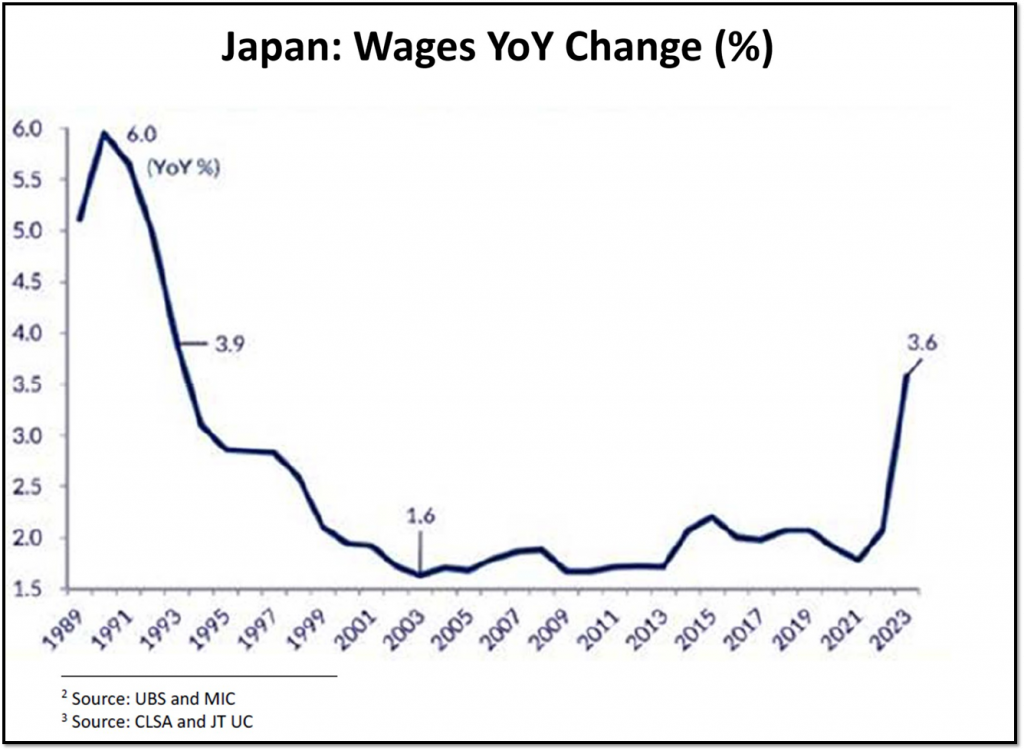

Salary Drive on a International Scale

Then again, as of lateâs wage-price spiral seems to be a world phenomenon. Advanced economies have now not handled a majority of these structural inflationary forces for lots of many years, and in consequence, there is still a prevalent factor of over the top govt spending. This displays the ignorance amongst policymakers about how fiscal stimulus has a tendency to have extremely inflationary results.

To attract from the instance of Japan as soon as once more, its financial system is recently present process a basic shift at its core. Following a length of greater than 30 years with muted salary enlargement, Jap employees have in spite of everything began not easy larger salaries.

The chart underneath is courtesy of our pals at Donald Smith & Co.

Â

Â

Diverging Towards the Consensus Narrative

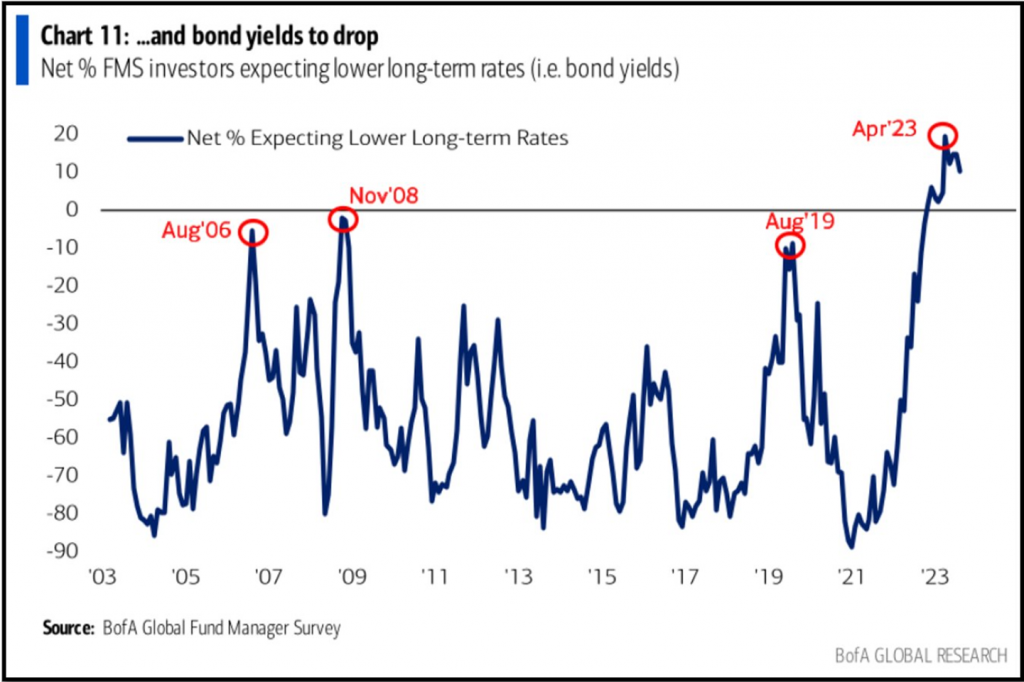

In the meantime, buyers anticipating world inflation to slow down is probably the most consensus view within the historical past of the information, even less than all the way through the International Monetary Disaster.

That is in line with how marketplace individuals are probably the most bullish on long-term Treasuries they have got ever been, as indicated by way of the BofA International Fund Supervisor Survey. Crowded marketplace perspectives are frequently improper, the present inflationary forces seem to have an important underlying structural basis.

Â

Â

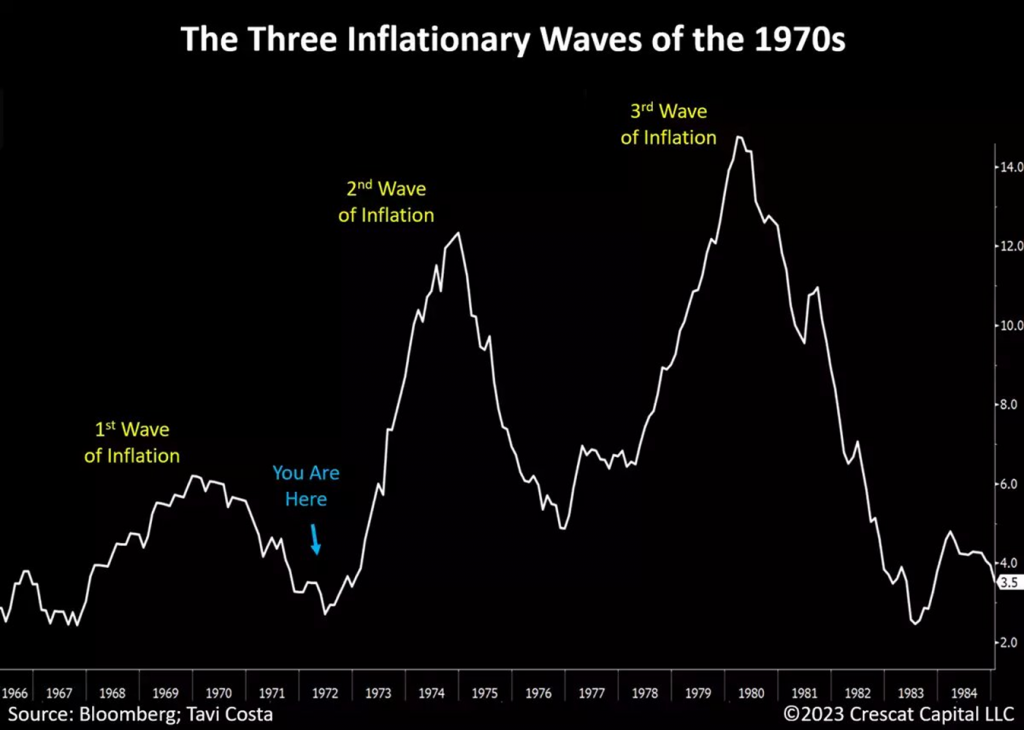

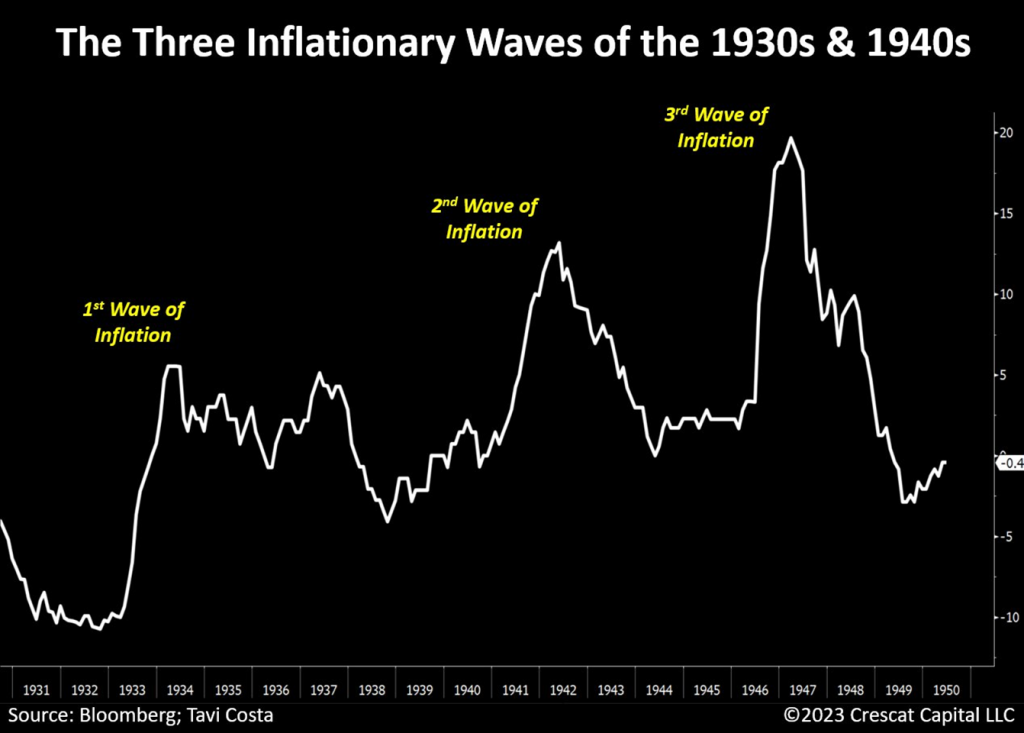

Inflation Develops Via Waves

Marketplace individuals and the Federal Reserve appear to be committing an important oversight by way of neglecting previous studies and patterns.

Whilst the macro setting as of late differs from that of the Seventies or Forties, a lesson from historical past stays: inflation has a tendency to broaden via waves.

Regardless of the entire debate in regards to the Forties and Seventies:

Inflation grew to become out to be structural in nature and manifested itself via waves all the way through each sessions.

Consider of that during standpoint of what’s unfolding as of late. Inflation is most likely in a bottoming procedure, and the new tendencies in commodity costs and breakeven charges are including to that case.

This isn’t a cyclical factor; as an alternative, the primary drivers of as of lateâs inflationary regime are:

- Deglobalization,

- Irresponsible ranges of presidency spending,

- Ongoing commodity provide constraints,

- Salary-price spiral, particularly amongst lower-income employees.

Â

Â

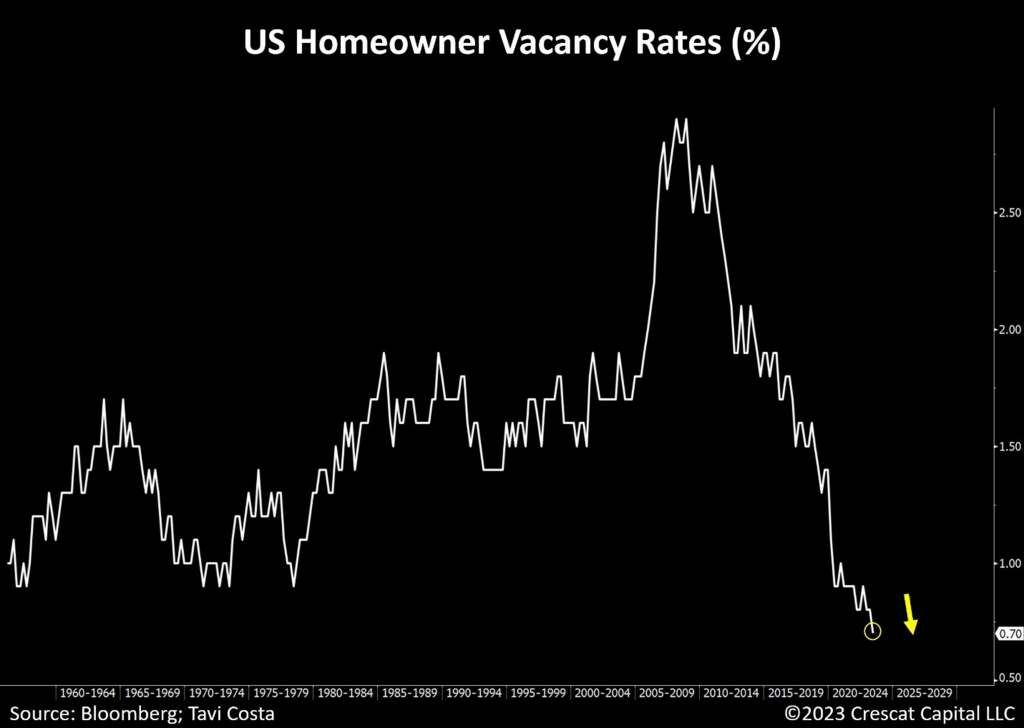

Unpopular Opinion: This Is No longer 2008

The housing marketplace is gradually rising as a extra important contributor to the inflation factor.

America now has the bottom emptiness charges in virtually 70 years. Opposite to what maximum imagine, the present state of affairs does now not seem to be a repeat of the housing bubble. There’s no oversupply of residential actual property stock.

Even supposing there may well be some wholesome temporary charge changes because of larger loan charges, the housing marketplace will have to proceed to give a contribution to the inflationary drive over the long run.

The strategy to this downside is to construct extra houses. There’s a explanation why for Warren Buffettâs really extensive build up in investments amongst US homebuilders.

Nonetheless, allow us to now not put out of your mind that increasing the whole space provide includes an important call for for fabrics and more than a few commodities as smartly. Right here we come complete circle for some other essential explanation why to possess exhausting property on this setting.

Â

Â

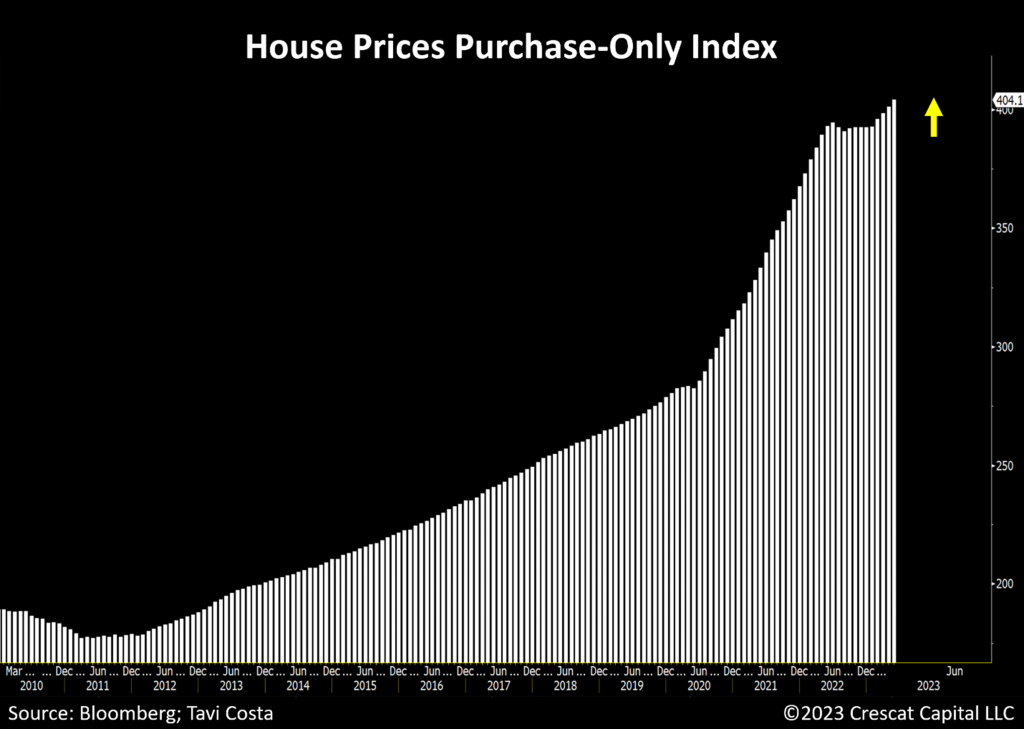

Housing Costs Making New Highs

Having a look on the contemporary gross sales transactions, space costs have speeded up considerably within the closing 4 months to document ranges, now rising at virtually a ten% annualized fee.

Â

Â

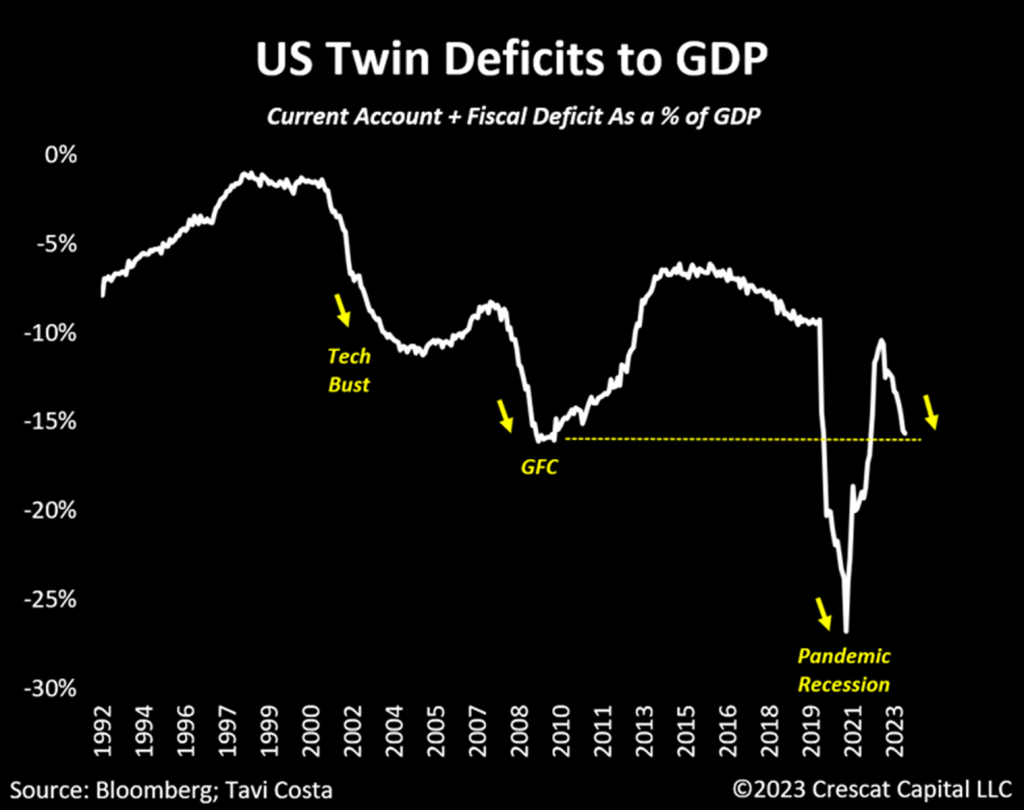

Dual Deficits Progressively Worsening

To additional emphasize the significance of proudly owning commodities in as of lateâs setting. America is now operating dual deficits which are as critical as the ones skilled all the way through the worst portions of the International Monetary Disaster. This issue has contributed to the new weak point in the USA buck.

Of even better fear is the indication that this represents an ongoing structural factor this is nonetheless within the technique of evolving. Be aware that with each and every prior recession, this dimension has reached new lows.

Â

Â

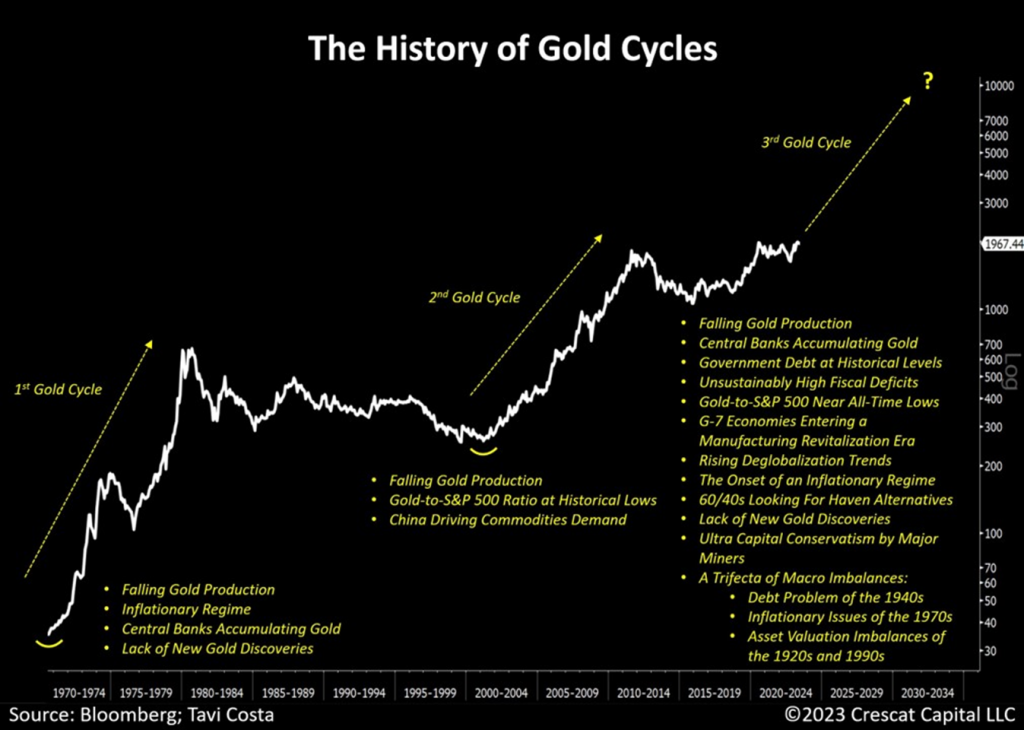

A New Gold Cycle

The multitude of macro drivers supporting the onset of some other gold cycle is really exceptional. Amplified by way of the existing skepticism surrounding the steel, we’re arguably experiencing a very powerful time in goldâs historical past.

The celebs are aligning, and apparently to be just a subject of time till we see a big breakout from the new triple-top formation.

Â

Â

Silver: Poised for an Explosive Transfer

The chart underneath is perhaps a very powerful technical chart for valuable metals buyers as of late. Silver is amazingly just about a big breakout from a 12-year resistance. Following a longer length of consolidation, the steel is poised for a energetic rally to revisit its highs from 2011. At its present charge, silver seems to be exceptionally sexy and is prone to take the lead on this long-term cycle.

Â

Â

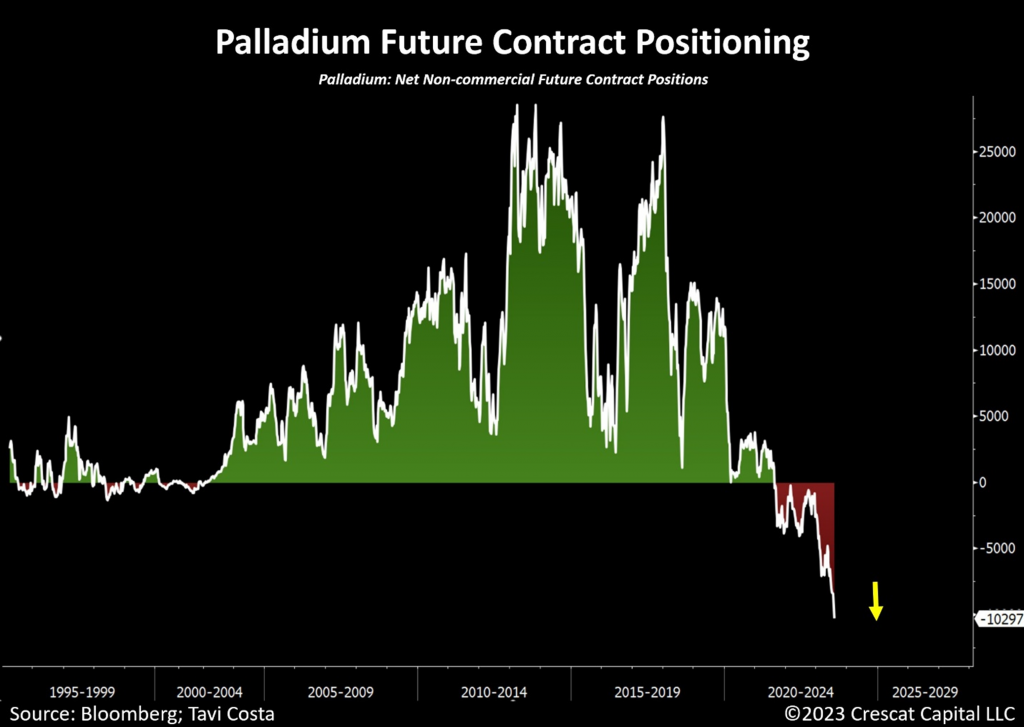

Mountain climbing A Wall of Fear

Palladium futures now have the most important web speculative brief place on document. General valuable metals glance extremely sexy after the surge in costs from oversold ranges.

Amidst the existing overwhelmingly adverse sentiment, gold seems to be gearing up for a historic breakout from a triple-top technical formation. Primary capital allocators are simplest beginning to notice that conventional 60/40 portfolios are not the optimum positioning for navigating as of lateâs inflationary regime.

Â

Â

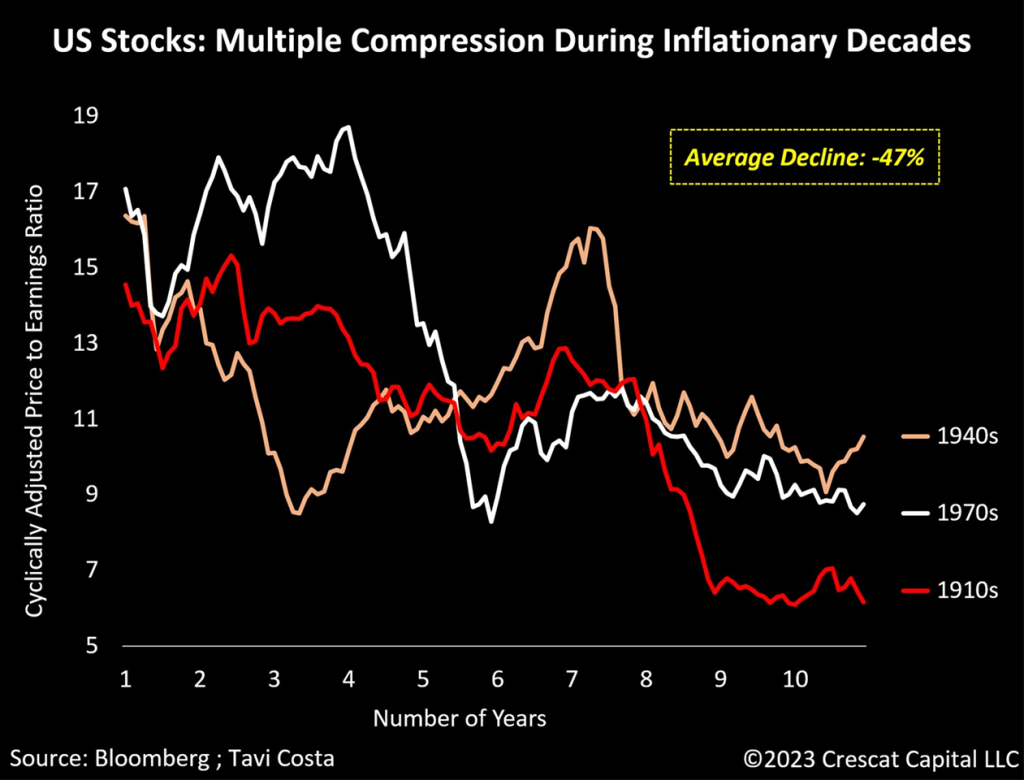

More than one Compression All over Inflationary Many years

Inflation is certainly a essential piece of the present macro puzzle. When client costs revel in upward drive, it triggers a cascade of results:

Rate of interest dangers build up, the price of capital spikes, the chance of defaults by way of companies and governments rises, the price of dwelling turns into dearer, employees call for larger wages, trade benefit margins are squeezed, and in the end, company profits contract in consequence.

This dynamic is what reasons stagflation.

In the meantime, buyers were conditioned to worth monetary property as though they have been about to revel in some other disinflationary decade with top enlargement.

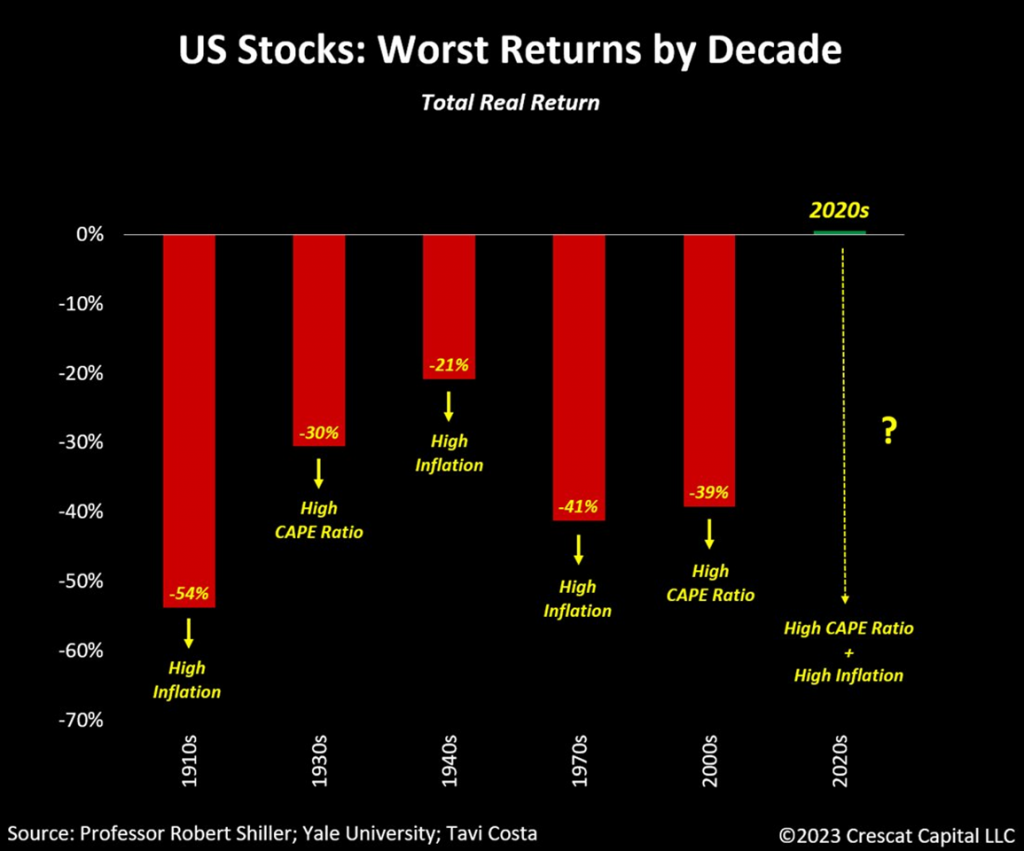

As proven within the closing chart, the closing time we had an extended length of higher-than-average charge of capital was once within the 1910s, Forties, and Seventies. Whilst each and every had its personal distinctive cases, basic multiples for shares considerably reduced in size over all the ones many years. To be particular, the common decline was once just about 50%.

Extra importantly, notice that CAPE ratios have been at unmarried digits on the finish of 2 sessions, and round 10.5x for the â40s.

What if as of lateâs multiples have been to succeed in identical ranges by way of the tip of this decade?

Â

Â

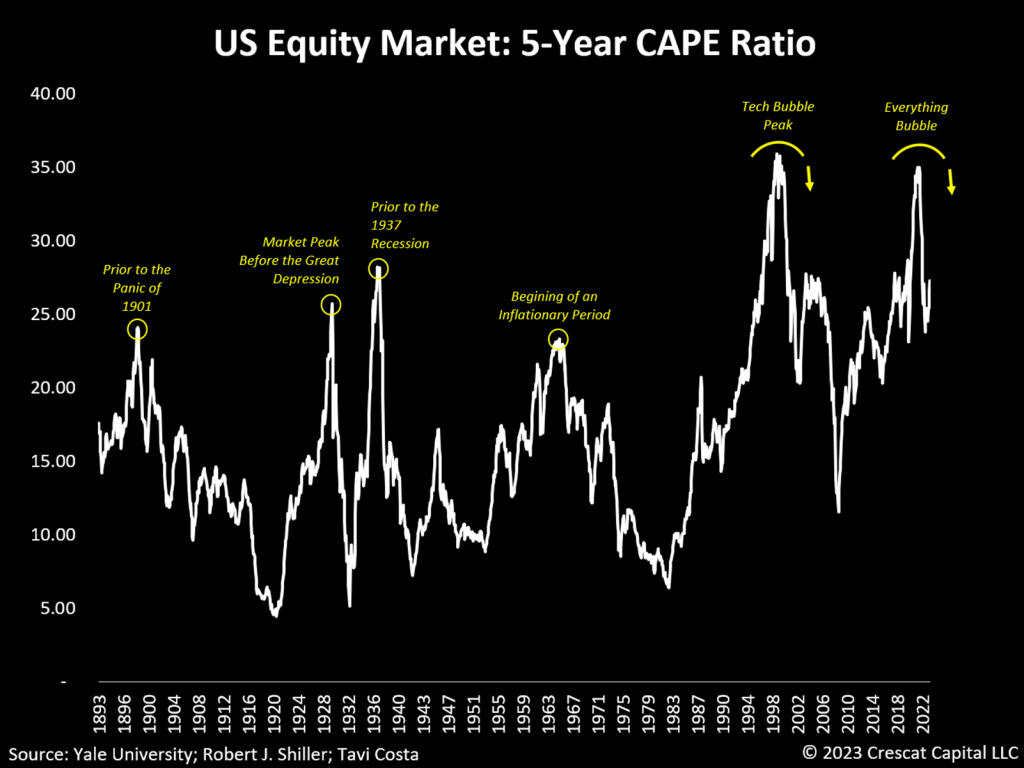

These daysâs Inflated Multiples Echo October 1929

The total fairness marketplace valuations stay at an awfully top degree. After re-testing the height tech bubble ranges on a 5-year cyclically adjusted P/E ratio foundation, shares are nonetheless extra hyped up than they have been sooner than the Nice Despair in October 1929.

The price of debt is on the upward thrust, and justifying as of lateâs basic multiples is changing into an increasing number of difficult.

On a separate notice, itâs astonishing to listen to folks draw comparisons between the present financial setting and the filthy rich length of the Nineteen Twenties. Again then, the 5-year CAPE ratio was once lower than 5, or the bottom degree in historical past. These daysâs scenario is markedly other.

Â

Â

Each Problems at As soon as: Inflation & Valuation

Allow us to now not put out of your mind that since 1900, there were 5 many years that the whole go back for shares was once adverse. Returns all the way through each and every of those sessions have been in truth deeply adverse. 3 of them took place all the way through the inflationary eras. The opposite two passed off when fairness valuations have been at historic ranges. These days, like by no means sooner than, we have now each setups on the similar time.

Â

Â

The Heightening Chance of a Laborious Touchdown

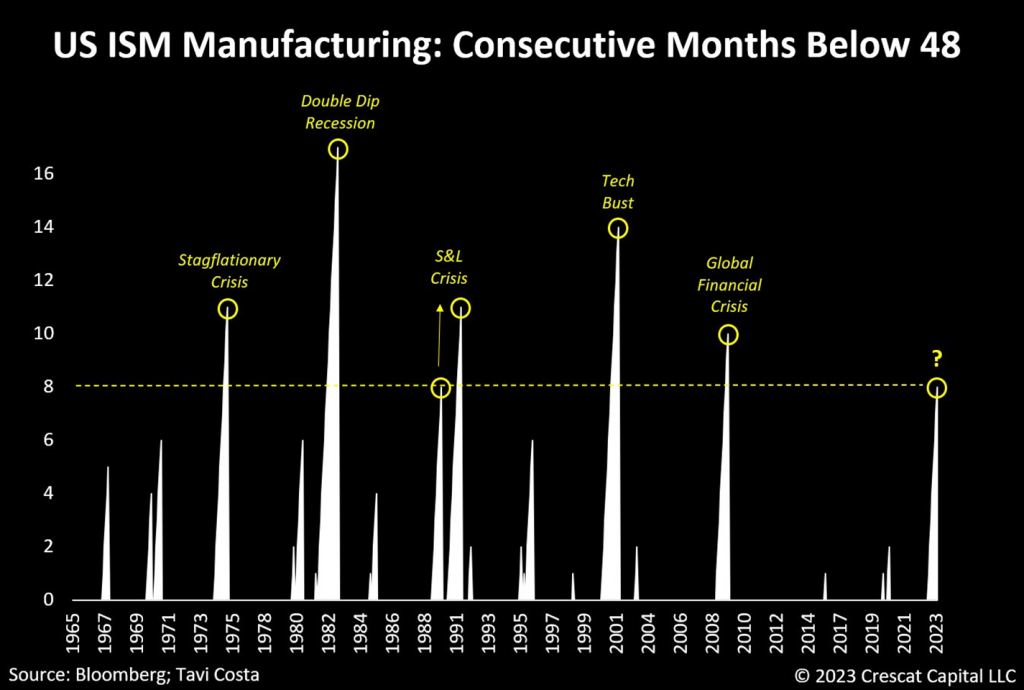

The ISM production index has been underneath the 48 degree for 8 consecutive months, a development that has simplest passed off all the way through all earlier exhausting landings within the closing 55 years. Whilst buyers frequently have brief recollections, there may be really extensive proof pointing in opposition to a conceivable repetition of this pattern:

- Critical yield curve inversions,

- The prospective lagging impact of the steepest financial tightening in many years,

- The slender management within the inventory marketplace,

- A vital upward push in the price of debt,

- Oil costs nearing $90 according to barrel,

- Contracting company basics.

Within the period in-between, monetary markets stay excessively complacent, with credit score spreads at traditionally low ranges and exorbitantly top valuations within the general inventory marketplace.

Â

Â

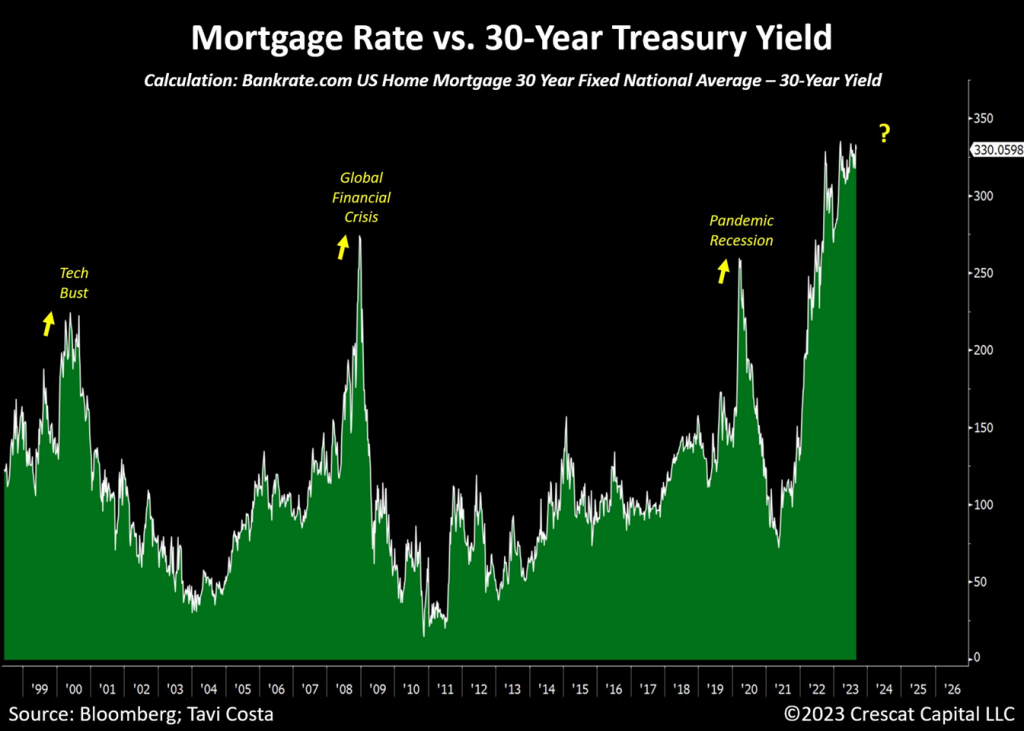

Indicators of Credit score Tightness

We are actually seeing the widest unfold between loan charges and 30-year risk-free charges in historical past. The closing occasions we skilled cyclically huge spreads have been forward of the tech bust, in the course of the worldwide monetary disaster, and all the way through the pandemic recession. This indicator presentations that credit score has already tightened considerably within the housing sector although credit score spreads have not begun to observe similarly within the company debt marketplace and thus the financial system isn’t in recession simply but. Nevertheless, the document spike in loan spreads seems to be an excellent more potent caution shot than the only forward of the tech bust and 2001 recession.

Â

Â

The Monetary Pinch on Shoppers

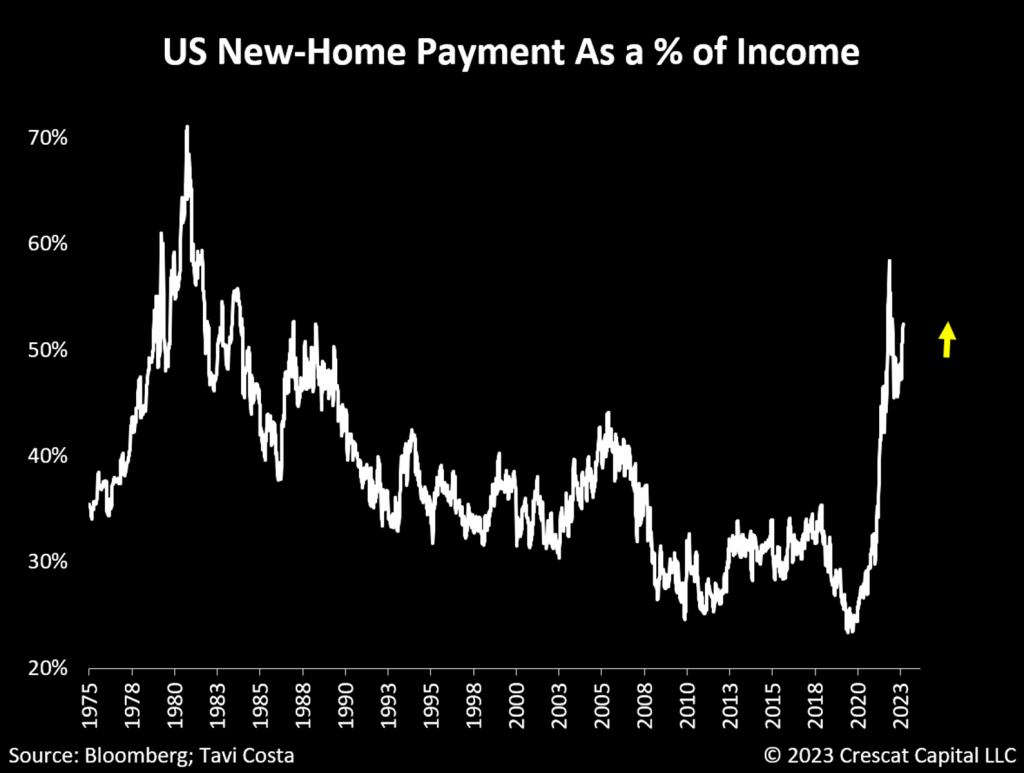

The tightening of economic prerequisites is easily illustrated on this chart. US housing fee for brand spanking new houses is now as top as 51% of the median family revenue. That’s the very best degree because the Nineteen Eighties.

Â

Â

An Vital Marketplace Divergence

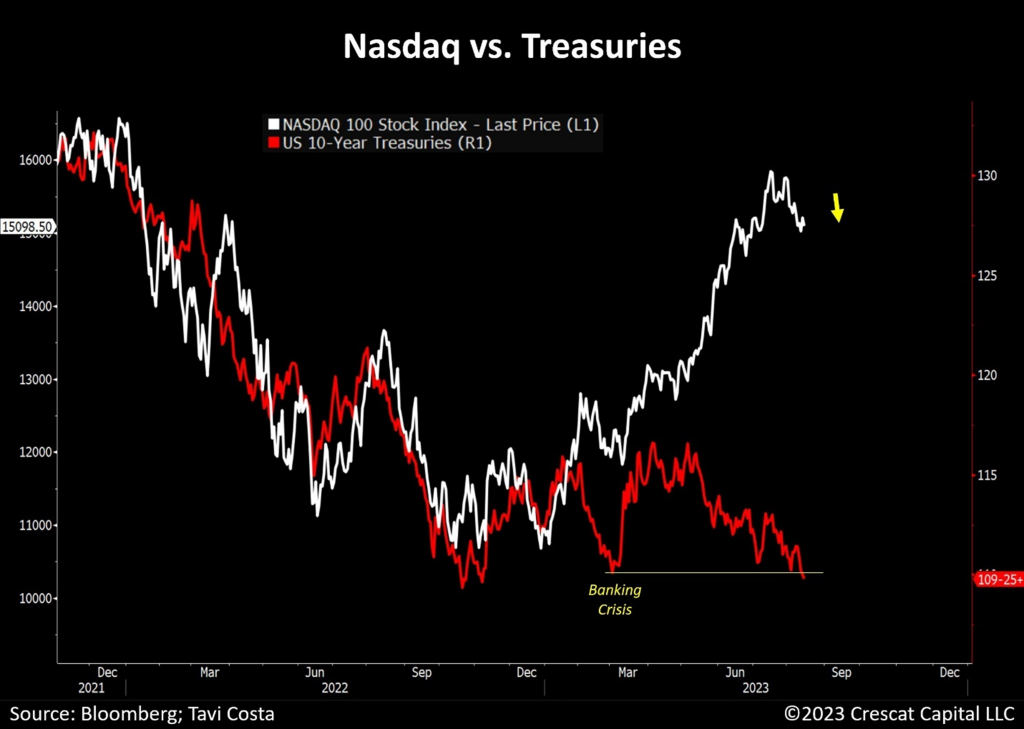

10-year Treasury costs are decisively breaking underneath the degrees that brought about the new banking problems. The inflated valuation of economic property hinges on a low cost-of-capital setting, a circumstance that not holds true as of late.

Buyers are beginning to take hold of the importance of structurally increased cut price charges however there’s a lengthy strategy to rectify those deeply ingrained valuation imbalances.

Â

Â

The First Dominos to Fall

Maximum fund managers were anticipating long-term rates of interest to fall, however the 10-year yield is now surpassing its earlier top from closing yr, achieving its very best level in 16 years.

The Treasury and loan markets were to be the primary dominos to fall given this dynamic. It’s exhausting to imagine the tension in those markets receivedât cause additional issues within the banking sector that result in emerging company credit score spreads and general marketplace volatility, either one of which stay traditionally suppressed.

Be aware the resurgence of the expansion to worth rotation unfolding once more as of late. On the similar time, cracks within the junk bond marketplace are simply beginning to seem with additional problem most likely forward.

Â

Â

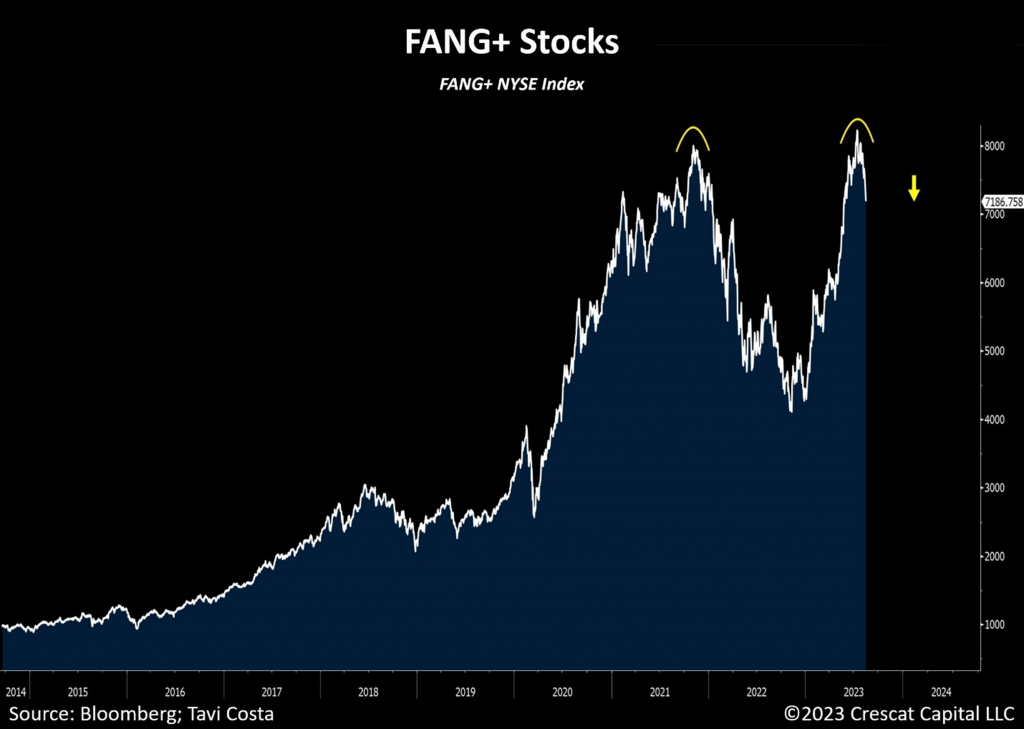

Stairs Up, Elevator Down

The double-top formation at the FANG+ index has change into extra glaring. As of as of late, the combination P/E for those corporations is roughly 45x, or 29x the estimated profits for subsequent yr. Very similar to how mega-cap tech shares drove the marketplace larger, those shares are actually the primary ones to return below drive.

In the long run, basics subject, specifically at a time when the price of capital is larger than historic requirements.

Â

Â

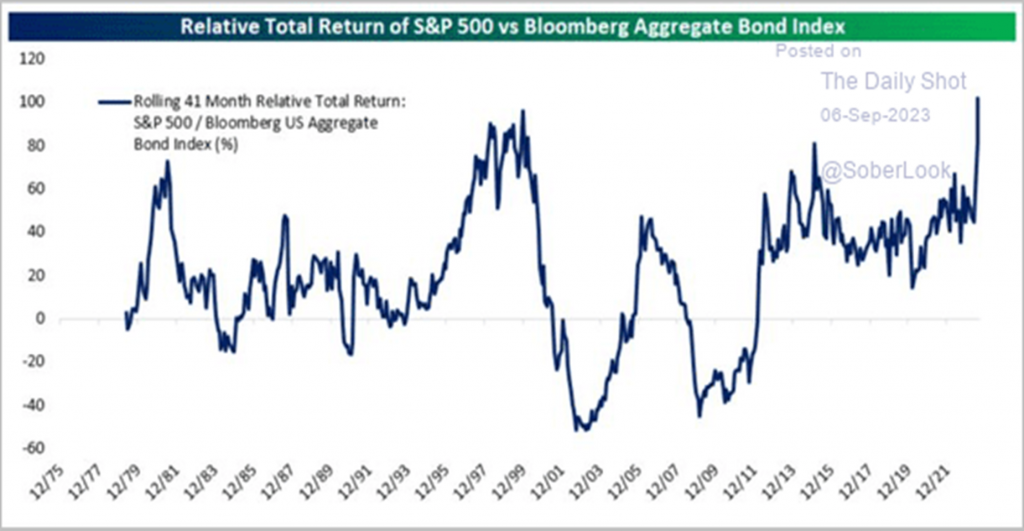

Speculative Bubbles Abound

Fairness markets seem to be stretched, even if in comparison to the bond marketplace, which is dealing with its personal set of issues. The relative efficiency of the S&P 500 as opposed to US Treasuries is as excessive because it was once all the way through the height of the tech bubble.

Overvaluation in each shares and bonds is on the core of the problems surrounding the overly common 60/40 portfolios, contributing to the inflated-price imbalance of those property.

Over the following couple of years, we think typical funding portfolios to go through a notable shift in opposition to better steadiness, with a brand new emphasis on allocating to commodities.

Â

Â

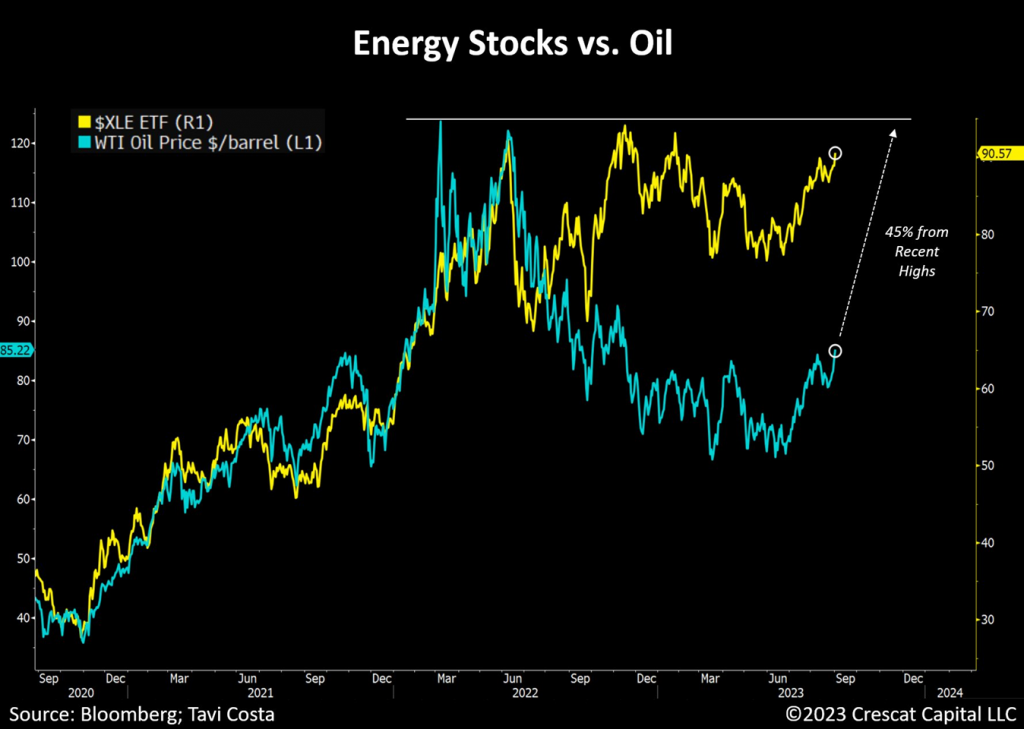

All the way through historical past, the relentless surge in power costs has persistently performed a pivotal function in triggering financial downturns. One may argue that the present structural and political components are much more compelling than the ones noticed in previous cycles.

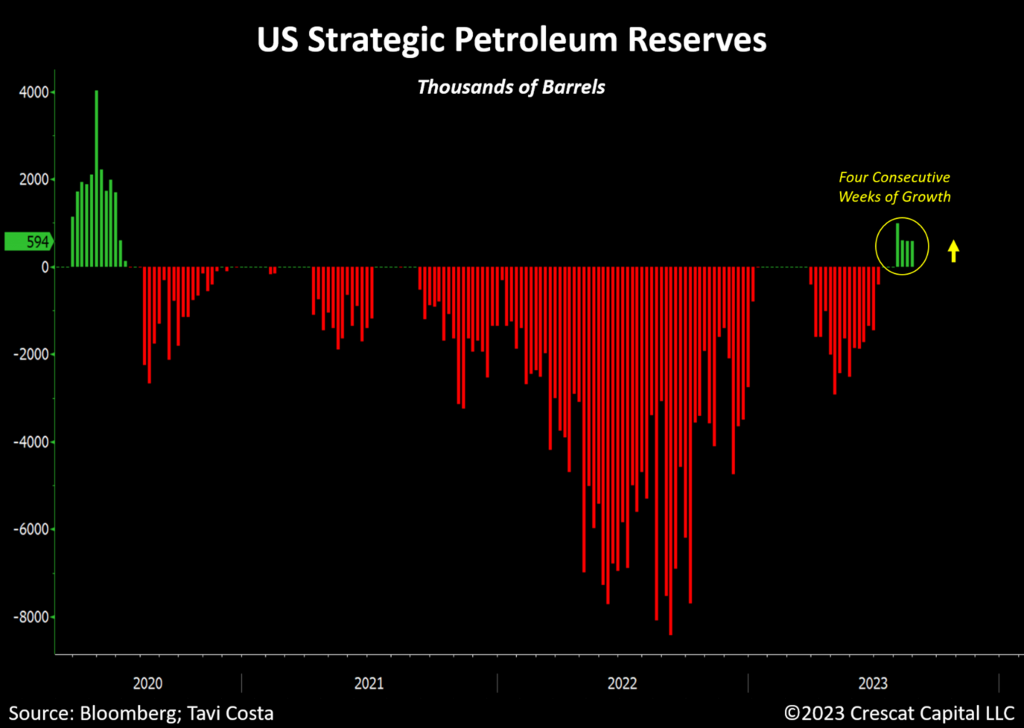

The hot surge in oil costs above $85 according to barrel coincided with 4 consecutive weeks of enlargement in the USA Strategic Petroleum Reserves. That is the most important collection of weekly will increase because the pandemic recession. Power costs were frequently emerging with implied call for for oil close to all-time highs whilst fuel costs are on the very best degree in virtually a yr.

Moreover, US oil manufacturing has now not but returned to pre-pandemic ranges, and combination capital spending for power corporations stays 52% underneath the 2014 top.

Inflationary forces stay entrenched within the financial system and the federal government is now having to stroll again its erratic coverage of depleting its Strategic Petroleum Reserves at an especially delicate juncture.

Â

Â

Oil costs are prone to face additional upward drive because of consistently tight provide prerequisites. In consequence, power equities are already drawing near new contemporary highs. If that serves as a roadmap, WTI costs have a forty five% appreciation doable forward to get again to their very own contemporary highs.

A endured resurgence in the cost of crude and its delicate merchandise is a the most important facet of the present macro puzzle as a result of it might result in an drawing close 2nd wave of emerging inflation. If that’s the case, plenty of buyers recently reveling within the disinflationary cushy touchdown thesis would most likely be stuck off-guard.

Â

Â

Â

We strongly inspire you to succeed in out to us if you have an interest in studying extra about our methods. You’ll e-mail or name Marek the use of the touch data underneath.

Â

Kevin C. Smith, CFA

Founding Member & Leader Funding Officer

Â

Tavi Costa

Member & Macro Strategist

Â

For more info together with make investments, please touch:

Â

Marek Iwahashi

Investor Members of the family Coordinator

(720) 323-2995

Â

Linda Carleu Smith, CPA

Co-Founding Member & Leader Running Officer

(303) 228-7371

Â

Â

© 2023 Crescat Capital LLC

Â

Vital Disclosures

Efficiency knowledge represents previous efficiency, and previous efficiency does now not ensure long term effects. A person investorâs effects might range because of the timing of capital transactions. Efficiency for all methods is expressed in U.S. bucks. Money returns are incorporated within the general account and aren’t detailed one after the other. Funding effects proven are for taxable and tax-exempt shoppers and come with the reinvestment of dividends, passion, capital features, and different profits. Any conceivable tax liabilities incurred by way of the taxable accounts have now not been mirrored within the web efficiency. Efficiency is in comparison to an index, alternatively, the volatility of an index varies very much and investments can’t be made at once in an index. Marketplace prerequisites range from yr to yr and may end up in a decline in marketplace price because of subject matter marketplace or financial prerequisites. There will have to be no expectation that any technique will likely be successful or supply a specified go back. Case research are incorporated for informational functions simplest and are supplied as a common review of our common funding procedure, and now not as indicative of any funding revel in. There’s no make it possible for the case research mentioned listed here are totally consultant of our methods or of the whole thing of our investments, and we reserve the correct to make use of or alter some or the entire methodologies discussed herein.

This presentation isn’t an be offering to promote securities of any funding fund or a solicitation of provides to shop for this kind of securities. Securities of a fund controlled by way of Crescat is also presented to chose certified buyers simplest by the use of a whole providing memorandum and similar subscription fabrics which include important further details about the phrases of an funding within the Fund and which supersedes data herein in its entirety. Any resolution to speculate will have to be based totally only upon the guidelines set forth within the Providing Paperwork, irrespective of any data buyers will have been in a different way furnished, and will have to be made after reviewing such Providing Paperwork, undertaking such investigations because the investor deems important and consulting the investorâs personal funding, felony, accounting and tax advisors with a view to make an unbiased decision of the suitability and penalties of an funding within the Fund.

Dangers of Funding Securities: Range in holdings is crucial facet of threat control, and CPM works to deal with numerous subject matters and fairness varieties to capitalize on tendencies and impede threat. CPM invests in a variety of securities relying on its methods, as described above, together with however now not restricted to lengthy equities, brief equities, mutual price range, ETFs, commodities, commodity futures contracts, foreign money futures contracts, constant revenue futures contracts, non-public placements, valuable metals, and choices on equities, bonds and futures contracts. The funding portfolios informed or sub-advised by way of CPM aren’t assured by way of any company or program of the U.S. or any international govt or by way of every other particular person or entity. The kinds of securities CPM buys and sells for shoppers may lose cash over any time-frame. CPMâs funding methods are supposed essentially for long-term buyers who cling their investments for really extensive sessions of time. Potential shoppers and buyers will have to believe their funding objectives, time horizon, and threat tolerance sooner than making an investment in CPMâs methods and will have to now not depend on CPMâs methods as a whole funding program for all in their investable property. Of notice, in instances the place CPM pursues an activist funding technique by the use of keep an eye on or possession, there is also further restrictions on resale together with, as an example, quantity barriers on stocks offered. When CPMâs non-public funding price range or SMA methods spend money on the valuable metals mining trade, there are certain dangers associated with adjustments in the cost of gold, silver and platinum staff metals. As well as, converting inflation expectancies, foreign money fluctuations, hypothesis, and business, govt and world client call for; disruptions within the provide chain; emerging product and regulatory compliance prices; hostile results from govt and environmental legislation; international occasions and financial prerequisites; marketplace, financial and political dangers of the nations the place valuable metals corporations are situated or do trade; skinny capitalization and restricted product strains, markets, monetary assets or workforce; and the conceivable illiquidity of positive of the securities; each and every might adversely impact corporations engaged in valuable metals mining similar companies. Relying on marketplace prerequisites, valuable metals mining corporations might dramatically outperform or underperform extra conventional fairness investments. As well as, as lots of CPMâs positions within the valuable metals mining trade are made via offshore non-public placements in reliance on exemption from SEC registration, there is also U.S. and international resale restrictions appropriate to such securities, together with however now not restricted to, minimal protecting sessions, which can lead to reductions being implemented to the valuation of such securities. As well as, the truthful price of CPMâs positions in non-public placements can not at all times be made up our minds the use of readily observable inputs reminiscent of marketplace costs, and due to this fact might require using unobservable inputs which is able to pose distinctive valuation dangers. Moreover, CPMâs non-public funding price range and SMA methods might spend money on shares of businesses with smaller marketplace capitalizations. Small- and medium-capitalization corporations is also of a much less seasoned nature or have securities that can be traded within the over the counter marketplace. Those âsecondaryâ securities 12 frequently contain considerably better dangers than the securities of bigger, better-known corporations. Along with being topic to the overall marketplace threat that inventory costs might decline over brief and even prolonged sessions, such corporations will not be well known to the making an investment public, won’t have important institutional possession and will have cyclical, static or simplest average enlargement potentialities. Moreover, shares of such corporations is also extra unstable in charge and feature decrease buying and selling volumes than greater capitalized corporations, which ends up in better sensitivity of the marketplace charge to particular person transactions. CPM has huge discretion to vary any of the SMA or non-public funding fundâs funding methods with out prior approval by way of, or understand to, CPM shoppers or fund buyers, supplied such adjustments aren’t subject matter.

Â

Benchmarks

HFRX GLOBAL HEDGE FUND INDEX. The HFRX International Hedge Fund Index represents a huge universe of hedge price range with the potential to industry a variety of asset categories and funding methods around the world securities markets. The index is weighted in response to the distribution of property within the world hedge fund trade. This can be a tradeable index of tangible hedge price range. This can be a appropriate benchmark for the Crescat International Macro non-public fund which has additionally traded in more than one asset categories and implemented a multi-disciplinary funding procedure since inception.

HFRX EQUITY HEDGE INDEX. The HFRX Fairness Hedge Index represents an investable index of hedge price range that industry each lengthy and brief in world fairness securities. Managers of price range within the index make use of all kinds of funding processes. They is also widely assorted or narrowly interested by particular sectors and will vary widely on the subject of ranges of web publicity, leverage hired, protecting sessions, concentrations of marketplace capitalizations and valuation levels of standard portfolios. This can be a appropriate benchmark for the Crescat Lengthy/Brief non-public fund, which has additionally been predominantly composed of lengthy and brief world equities since inception.

PHILADELPHIA STOCK EXCHANGE GOLD AND SILVER INDEX. The Philadelphia Inventory Change Gold and Silver Index is the longest operating index of worldwide valuable metals mining shares. This can be a assorted, capitalization-weighted index of the main corporations keen on gold and silver mining. This can be a appropriate benchmark for the Crescat Treasured Metals non-public fund and the Crescat Treasured Metals SMA technique, that have additionally been predominately composed of valuable metals mining corporations keen on gold and silver mining since inception.

RUSSELL 1000 INDEX. The Russell 1000 Index is a market-cap weighted index of the 1,000 greatest corporations in US fairness markets. It represents a huge scope of businesses throughout all sectors of the financial system. This can be a frequently adopted index amongst establishments. This index accommodates most of the similar securities because the S&P 500 however is broader and comprises some mid-cap corporations. This can be a appropriate benchmark for the Crescat Huge Cap SMA technique, which has predominantly held and traded identical securities since inception.

S&P 500 INDEX. The S&P 500 Index is most likely probably the most adopted inventory marketplace index. It is thought of as consultant of the U.S. inventory marketplace at huge. This can be a marketplace cap-weighted index of the five hundred greatest and maximum liquid corporations indexed at the NYSE and NASDAQ exchanges. Whilst the firms are U.S. based totally, maximum of them have huge world operations. Subsequently, the index is consultant of the huge world financial system. This can be a appropriate benchmark for the Crescat International Macro and Crescat Lengthy/Brief non-public price range, and the Huge Cap and Treasured Metals SMA methods, that have additionally traded broadly in huge, extremely liquid world equities via U.S.-listed securities, and in corporations Crescat believes are heading in the right direction to succeed in that standing. The S&P 500 Index could also be used as a supplemental benchmark for the Crescat Treasured Metals non-public fund and Treasured Metals SMA technique as a result of probably the most long-term objectives of the valuable metals technique is low correlation to the S&P 500.

References to indices, benchmarks or different measures of relative marketplace efficiency over a specified time frame are supplied on your data simplest. Connection with an index does now not indicate that the fund or one after the other controlled account will reach returns, volatility or different effects very similar to that index. The composition of an index won’t mirror the style by which a portfolio is built when it comes to anticipated or accomplished returns, portfolio tips, restrictions, sectors, correlations, concentrations, volatility or monitoring.

One by one Controlled Account (SMA) disclosures: The Crescat Huge Cap Composite and Crescat Treasured Metals Composite come with all accounts which are controlled consistent with the ones respective methods over which the chief has complete discretion. SMA composite efficiency effects are time-weighted web of all funding control charges and buying and selling prices together with commissions and non-recoverable withholding taxes. Funding control charges are described in Crescatâs Shape ADV 2A. The chief for the Crescat Huge Cap technique invests predominantly in equities of the highest 1,000 U.S. indexed shares weighted by way of marketplace capitalization. Â The chief for the Crescat Treasured Metals technique invests predominantly in a world all-cap universe of valuable metals mining shares.

Â

Â

Bloomberg Information Disclosure: Bloomberg variety standards is in response to returns. The Bloomberg go back desk was once compiled from folks acquainted, investor letters and different Bloomberg Information reporting. The record is written by way of editor Erin Fuchs of Bloomberg Information to recognize returns for month and yr so far. Crescat Capital didn’t publish fee, outdoor of our workersâ Bloomberg subscriptions, for attention or placement in those ratings. Our score will not be consultant of anyone shopperâs revel in because it displays the returns of a hypothetical, complete fee-paying investor who has invested since inception. Score isn’t indicative of long term efficiency. The displayed desk is in response to US submissions simplest and the collection of submissions varies on a week-by-week foundation. Crescat studies efficiency estimates and finalized numbers to Bloomberg as they’re launched and shows each favorable and destructive months on the discretion of the Bloomberg Information crew. Crescat Capital isn’t affiliated with Bloomberg Information.

Hedge Fund disclosures: Best permitted buyers and certified shoppers will likely be admitted as restricted companions to a Crescat hedge fund. For herbal individuals, buyers will have to meet SEC necessities together with minimal annual revenue or web price thresholds. Crescatâs hedge price range are being presented in reliance on an exemption from the registration necessities of the Securities Act of 1933 and aren’t required to agree to particular disclosure necessities that follow to registration below the Securities Act. The SEC has now not handed upon the deserves of or given its approval to Crescatâs hedge price range, the phrases of the providing, or the accuracy or completeness of any providing fabrics. A registration remark has now not been filed for any Crescat hedge fund with the SEC. Restricted spouse pursuits within the Crescat hedge price range are topic to felony restrictions on switch and resale. Buyers will have to now not suppose they’re going to be capable of resell their securities. Making an investment in securities comes to threat. Buyers will have to be capable of undergo the lack of their funding. Investments in Crescatâs hedge price range aren’t topic to the protections of the Funding Corporate Act of 1940. Efficiency knowledge is topic to revision following each and every per month reconciliation and annual audit. Present efficiency is also decrease or larger than the efficiency knowledge introduced. The efficiency of Crescatâs hedge price range will not be at once related to the efficiency of alternative non-public or registered price range. Hedge price range might contain complicated tax methods and there is also delays in distribution tax data to buyers.

Buyers might download probably the most present efficiency knowledge, non-public providing memoranda for Crescatâs hedge price range, and knowledge on Crescatâs SMA methods, together with Shape ADV Phase II, by way of contacting Linda Smith at (303) 271-9997 or by way of sending a request by means of e-mail to [email protected]. See the personal providing memorandum for each and every Crescat hedge fund for entire data and threat components.

Â

Â

Â

© 2023 Crescat Capital LLC

Â

Â

Vital Disclosures

Efficiency knowledge represents previous efficiency, and previous efficiency does now not ensure long term effects. A person investorâs effects might range because of the timing of capital transactions. Efficiency for all methods is expressed in U.S. bucks. Money returns are incorporated within the general account and aren’t detailed one after the other. Funding effects proven are for taxable and tax-exempt shoppers and come with the reinvestment of dividends, passion, capital features, and different profits. Any conceivable tax liabilities incurred by way of the taxable accounts have now not been mirrored within the web efficiency. Efficiency is in comparison to an index, alternatively, the volatility of an index varies very much and investments can’t be made at once in an index. Marketplace prerequisites range from yr to yr and may end up in a decline in marketplace price because of subject matter marketplace or financial prerequisites. There will have to be no expectation that any technique will likely be successful or supply a specified go back. Case research are incorporated for informational functions simplest and are supplied as a common review of our common funding procedure, and now not as indicative of any funding revel in. There’s no make it possible for the case research mentioned listed here are totally consultant of our methods or of the whole thing of our investments, and we reserve the correct to make use of or alter some or the entire methodologies discussed herein.

This presentation isn’t an be offering to promote securities of any funding fund or a solicitation of provides to shop for this kind of securities. Securities of a fund controlled by way of Crescat is also presented to chose certified buyers simplest by the use of a whole providing memorandum and similar subscription fabrics which include important further details about the phrases of an funding within the Fund and which supersedes data herein in its entirety. Any resolution to speculate will have to be based totally only upon the guidelines set forth within the Providing Paperwork, irrespective of any data buyers will have been in a different way furnished, and will have to be made after reviewing such Providing Paperwork, undertaking such investigations because the investor deems important and consulting the investorâs personal funding, felony, accounting and tax advisors with a view to make an unbiased decision of the suitability and penalties of an funding within the Fund.

Dangers of Funding Securities: Range in holdings is crucial facet of threat control, and CPM works to deal with numerous subject matters and fairness varieties to capitalize on tendencies and impede threat. CPM invests in a variety of securities relying on its methods, as described above, together with however now not restricted to lengthy equities, brief equities, mutual price range, ETFs, commodities, commodity futures contracts, foreign money futures contracts, constant revenue futures contracts, non-public placements, valuable metals, and choices on equities, bonds and futures contracts. The funding portfolios informed or sub-advised by way of CPM aren’t assured by way of any company or program of the U.S. or any international govt or by way of every other particular person or entity. The kinds of securities CPM buys and sells for shoppers may lose cash over any time-frame. CPMâs funding methods are supposed essentially for long-term buyers who cling their investments for really extensive sessions of time. Potential shoppers and buyers will have to believe their funding objectives, time horizon, and threat tolerance sooner than making an investment in CPMâs methods and will have to now not depend on CPMâs methods as a whole funding program for all in their investable property. Of notice, in instances the place CPM pursues an activist funding technique by the use of keep an eye on or possession, there is also further restrictions on resale together with, as an example, quantity barriers on stocks offered. When CPMâs non-public funding price range or SMA methods spend money on the valuable metals mining trade, there are certain dangers associated with adjustments in the cost of gold, silver and platinum staff metals. As well as, converting inflation expectancies, foreign money fluctuations, hypothesis, and business, govt and world client call for; disruptions within the provide chain; emerging product and regulatory compliance prices; hostile results from govt and environmental legislation; international occasions and financial prerequisites; marketplace, financial and political dangers of the nations the place valuable metals corporations are situated or do trade; skinny capitalization and restricted product strains, markets, monetary assets or workforce; and the conceivable illiquidity of positive of the securities; each and every might adversely impact corporations engaged in valuable metals mining similar companies. Relying on marketplace prerequisites, valuable metals mining corporations might dramatically outperform or underperform extra conventional fairness investments. As well as, as lots of CPMâs positions within the valuable metals mining trade are made via offshore non-public placements in reliance on exemption from SEC registration, there is also U.S. and international resale restrictions appropriate to such securities, together with however now not restricted to, minimal protecting sessions, which can lead to reductions being implemented to the valuation of such securities. As well as, the truthful price of CPMâs positions in non-public placements can not at all times be made up our minds the use of readily observable inputs reminiscent of marketplace costs, and due to this fact might require using unobservable inputs which is able to pose distinctive valuation dangers. Moreover, CPMâs non-public funding price range and SMA methods might spend money on shares of businesses with smaller marketplace capitalizations. Small- and medium-capitalization corporations is also of a much less seasoned nature or have securities that can be traded within the over the counter marketplace. Those âsecondaryâ securities 12 frequently contain considerably better dangers than the securities of bigger, better-known corporations. Along with being topic to the overall marketplace threat that inventory costs might decline over brief and even prolonged sessions, such corporations will not be well known to the making an investment public, won’t have important institutional possession and will have cyclical, static or simplest average enlargement potentialities. Moreover, shares of such corporations is also extra unstable in charge and feature decrease buying and selling volumes than greater capitalized corporations, which ends up in better sensitivity of the marketplace charge to particular person transactions. CPM has huge discretion to vary any of the SMA or non-public funding fundâs funding methods with out prior approval by way of, or understand to, CPM shoppers or fund buyers, supplied such adjustments aren’t subject matter.

Benchmarks

HFRX GLOBAL HEDGE FUND INDEX. The HFRX International Hedge Fund Index represents a huge universe of hedge price range with the potential to industry a variety of asset categories and funding methods around the world securities markets. The index is weighted in response to the distribution of property within the world hedge fund trade. This can be a tradeable index of tangible hedge price range. This can be a appropriate benchmark for the Crescat International Macro non-public fund which has additionally traded in more than one asset categories and implemented a multi-disciplinary funding procedure since inception.

HFRX EQUITY HEDGE INDEX. The HFRX Fairness Hedge Index represents an investable index of hedge price range that industry each lengthy and brief in world fairness securities. Managers of price range within the index make use of all kinds of funding processes. They is also widely assorted or narrowly interested by particular sectors and will vary widely on the subject of ranges of web publicity, leverage hired, protecting sessions, concentrations of marketplace capitalizations and valuation levels of standard portfolios. This can be a appropriate benchmark for the Crescat Lengthy/Brief non-public fund, which has additionally been predominantly composed of lengthy and brief world equities since inception.

PHILADELPHIA STOCK EXCHANGE GOLD AND SILVER INDEX. The Philadelphia Inventory Change Gold and Silver Index is the longest operating index of worldwide valuable metals mining shares. This can be a assorted, capitalization-weighted index of the main corporations keen on gold and silver mining. This can be a appropriate benchmark for the Crescat Treasured Metals non-public fund and the Crescat Treasured Metals SMA technique, that have additionally been predominately composed of valuable metals mining corporations keen on gold and silver mining since inception.

RUSSELL 1000 INDEX. The Russell 1000 Index is a market-cap weighted index of the 1,000 greatest corporations in US fairness markets. It represents a huge scope of businesses throughout all sectors of the financial system. This can be a frequently adopted index amongst establishments. This index accommodates most of the similar securities because the S&P 500 however is broader and comprises some mid-cap corporations. This can be a appropriate benchmark for the Crescat Huge Cap SMA technique, which has predominantly held and traded identical securities since inception.

S&P 500 INDEX. The S&P 500 Index is most likely probably the most adopted inventory marketplace index. It is thought of as consultant of the U.S. inventory marketplace at huge. This can be a marketplace cap-weighted index of the five hundred greatest and maximum liquid corporations indexed at the NYSE and NASDAQ exchanges. Whilst the firms are U.S. based totally, maximum of them have huge world operations. Subsequently, the index is consultant of the huge world financial system. This can be a appropriate benchmark for the Crescat International Macro and Crescat Lengthy/Brief non-public price range, and the Huge Cap and Treasured Metals SMA methods, that have additionally traded broadly in huge, extremely liquid world equities via U.S.-listed securities, and in corporations Crescat believes are heading in the right direction to succeed in that standing. The S&P 500 Index could also be used as a supplemental benchmark for the Crescat Treasured Metals non-public fund and Treasured Metals SMA technique as a result of probably the most long-term objectives of the valuable metals technique is low correlation to the S&P 500.

References to indices, benchmarks or different measures of relative marketplace efficiency over a specified time frame are supplied on your data simplest. Connection with an index does now not indicate that the fund or one after the other controlled account will reach returns, volatility or different effects very similar to that index. The composition of an index won’t mirror the style by which a portfolio is built when it comes to anticipated or accomplished returns, portfolio tips, restrictions, sectors, correlations, concentrations, volatility or monitoring.

One by one Controlled Account (SMA) disclosures: The Crescat Huge Cap Composite and Crescat Treasured Metals Composite come with all accounts which are controlled consistent with the ones respective methods over which the chief has complete discretion. SMA composite efficiency effects are time-weighted web of all funding control charges and buying and selling prices together with commissions and non-recoverable withholding taxes. Funding control charges are described in Crescatâs Shape ADV 2A. The chief for the Crescat Huge Cap technique invests predominantly in equities of the highest 1,000 U.S. indexed shares weighted by way of marketplace capitalization. Â The chief for the Crescat Treasured Metals technique invests predominantly in a world all-cap universe of valuable metals mining shares.

Hedge Fund disclosures: Best permitted buyers and certified shoppers will likely be admitted as restricted companions to a Crescat hedge fund. For herbal individuals, buyers will have to meet SEC necessities together with minimal annual revenue or web price thresholds. Crescatâs hedge price range are being presented in reliance on an exemption from the registration necessities of the Securities Act of 1933 and aren’t required to agree to particular disclosure necessities that follow to registration below the Securities Act. The SEC has now not handed upon the deserves of or given its approval to Crescatâs hedge price range, the phrases of the providing, or the accuracy or completeness of any providing fabrics. A registration remark has now not been filed for any Crescat hedge fund with the SEC. Restricted spouse pursuits within the Crescat hedge price range are topic to felony restrictions on switch and resale. Buyers will have to now not suppose they’re going to be capable of resell their securities. Making an investment in securities comes to threat. Buyers will have to be capable of undergo the lack of their funding. Investments in Crescatâs hedge price range aren’t topic to the protections of the Funding Corporate Act of 1940. Efficiency knowledge is topic to revision following each and every per month reconciliation and annual audit. Present efficiency is also decrease or larger than the efficiency knowledge introduced. The efficiency of Crescatâs hedge price range will not be at once related to the efficiency of alternative non-public or registered price range. Hedge price range might contain complicated tax methods and there is also delays in distribution tax data to buyers.

Buyers might download probably the most present efficiency knowledge, non-public providing memoranda for Crescatâs hedge price range, and knowledge on Crescatâs SMA methods, together with Shape ADV Phase II, by way of contacting Linda Smith at (303) 271-9997 or by way of sending a request by means of e-mail to [email protected]. See the personal providing memorandum for each and every Crescat hedge fund for entire data and threat components.

Â