Disclaimer: Your capital is at threat. This is not financial investment suggestions.

Atlas Pulse Gold Report, Concern 86;

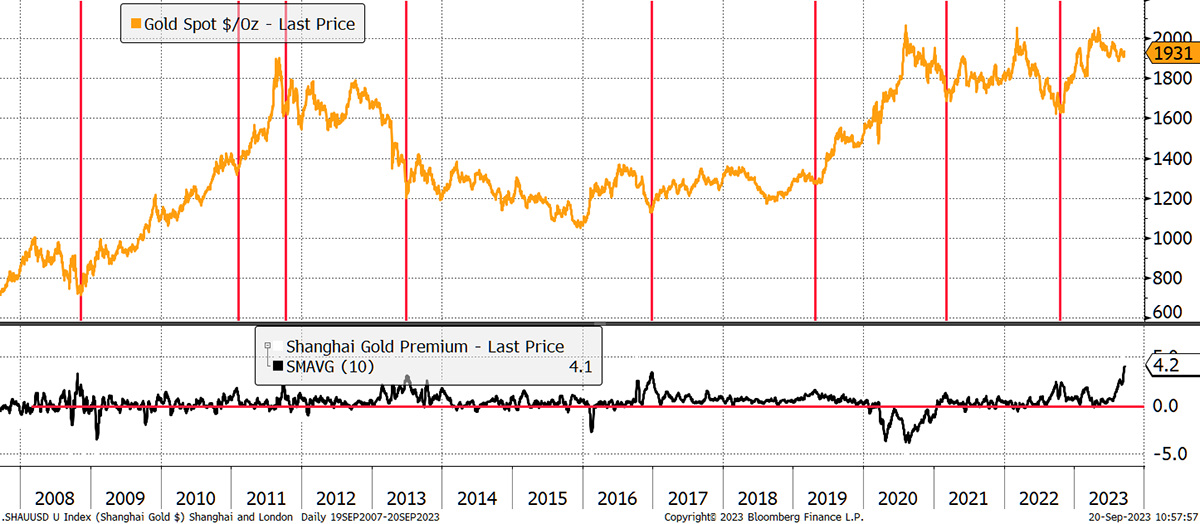

John Reade, primary strategist at the World Gold Council, mentioned recently that the Shanghai Premium was back. That just suggests gold is more costly in China than on the world market. This occurs every other year approximately, however this time, it witnesses the greatest premium ever taped.

Emphasizes

| China | The Shanghai Premium Returns |

| Reserves | Chinese Reserve Development Balances Out ETF Outflows |

| Macro | Development Stalls, Currency Decreases |

| Assessment | Much Better in China |

| Program | Still a Booming Market |

The Shanghai Premium Returns

In August, China continued to construct its reserves, and the Chinese ETFs saw inflows. That contrasts with the remainder of the world’s gold ETFs, which have actually seen substantial outflows. The Shanghai Premium narrowed somewhat on Monday as individuals’s Bank of China raised momentary curbs on gold imports. Yet it has actually expanded once again.

The Chinese development wonder is over, and the currency is falling. Gold is an efficient method to get wealth “out of the nation” while still remaining in the nation That is the charm of liquid alternative possessions.

I have actually followed the Shanghai Premium for numerous years, and it has actually been bullish. The red lines mark premia considering that 2008. A rally in the gold cost tends to follow, basically due to the fact that Chinese need rises and often significant.

A Premium Is Bullish

Notification likewise how discount rates, when gold is Cheaper in China than somewhere else, have actually been both unusual and quick. The essential duration followed COVID-19 roamed out of the laboratory in Wuhan. The discount rate in June marked a peak in the gold cost, which lasted for 3 years. Notification how the existing premium is abnormally high, which has actually resulted in a boost in smuggling.

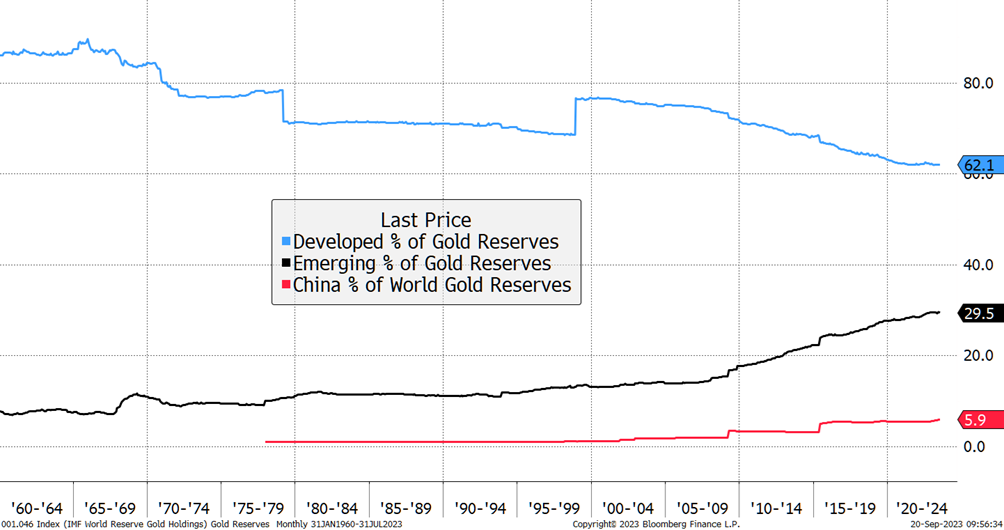

In the last few years, China has actually ended up being progressively essential in the gold market and has more impact on cost. In 2014, they introduced the Shanghai Gold Exchange, and the PBOC has actually been increasing main reserves, which some individuals think are greatly downplayed. That might well hold true due to the fact that China’s main gold reserves, as a share of worldwide gold reserves, are simply 5.9%.

Chinese Reserve Development Balances Out ETF Outflows

5.9% appears low for the world’s second-largest economy. For referral, Europe holds 11.7% of and the U.S.A. 22.8%. Putting all of it together, the industrialized share is falling while the emerging share is growing. Current behaviour by the PBOC recommends that China is eager to capture up.

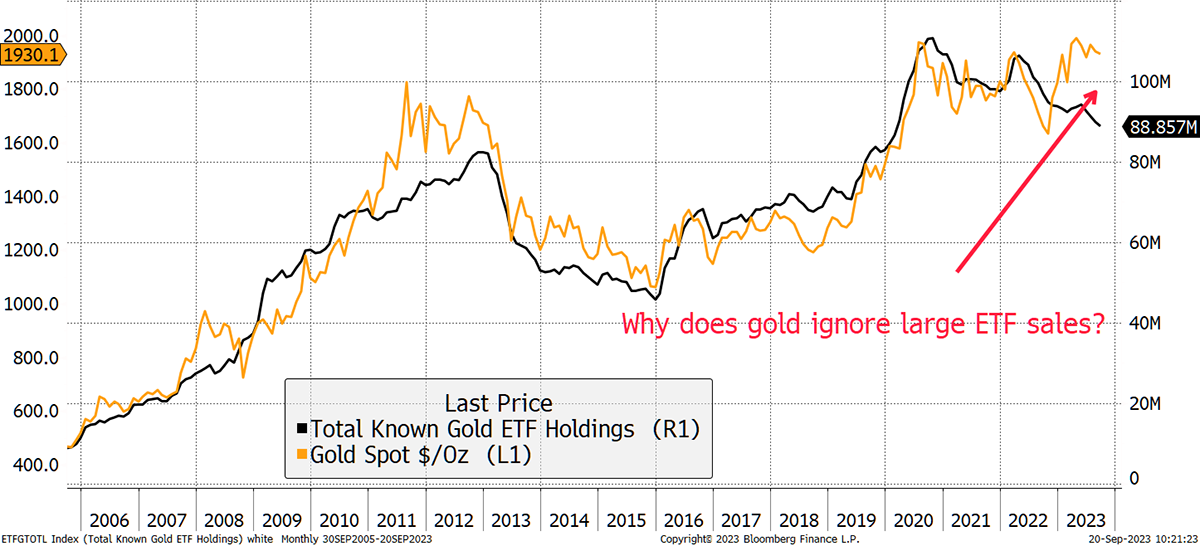

This has actually been extremely essential for the gold cost over the previous year or 2. Gold experts have actually ended up being utilized to the concept that the gold ETFs represent the minimal purchaser, and for that reason are the cost setter. For 15 years, we might carefully associate the gold cost with ETF circulations, however just recently, that relationship has actually broken down.

Gold Holds While ETF Streams Decrease

Considering That 2020, a shocking 21 million ounces of gold have actually left the vaults. The ETFs peaked at $220 billion however today downturn at $171 billion. You may fairly anticipate that to have actually knocked the gold cost to around $1,700 per ounce, however it hasn’t. Maybe it is the development in Chinese Reserves that has actually balanced out the fall in ETF holdings. The chart reveals Chinese reserves and ETF holdings integrated.

Chinese Reserve Development Has Offset ETF Outflows

The bottom line exists is a greater need for gold in China than somewhere else, which originates from individuals looking for a safe house for their cash and the federal government looking for more impact. They state, “all courses result in gold”.

Development Stalls, Currency Decreases

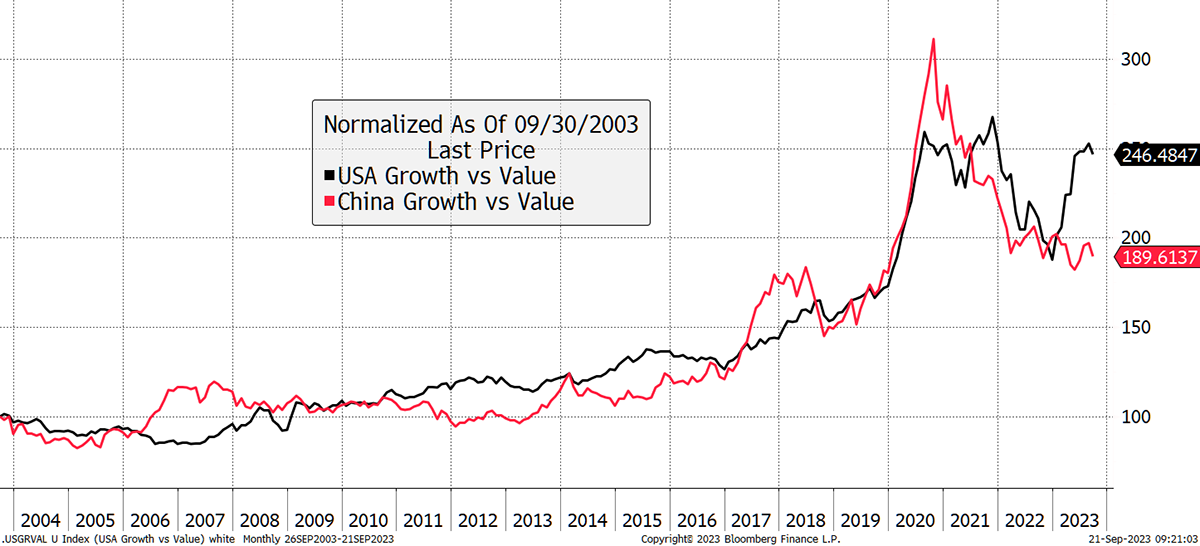

There are lots of methods to reveal financial activity in China, however main GDP stats are best prevented. Considering that 2006, the Development vs Worth trajectory for Chinese and United States stocks has actually been a close match. That is till just recently. The chart is rebased, which highlights both the degree of the development and the fit. Both have actually been extremely comparable for twenty years, yet something has actually altered.

Development vs Worth in China and the United States

This is yet another of the lots of information divergences that appear to have actually surfaced following lockdowns and wars. Things are altering, and the chart above recommends that China is no longer being led by development stocks, which indicates their growth has actually stalled while the U.S.A. continues. Naturally, the United States market might be rolling over too, which appears most likely offered the nosebleed assessments throughout United States development stocks. Still, it has actually been even worse for China.

A decline is normally a great concept throughout a financial downturn due to the fact that it makes the nation more competitive, however do not error it for developing worth. It just cushions the blow by making economic crises somewhat less agonizing.

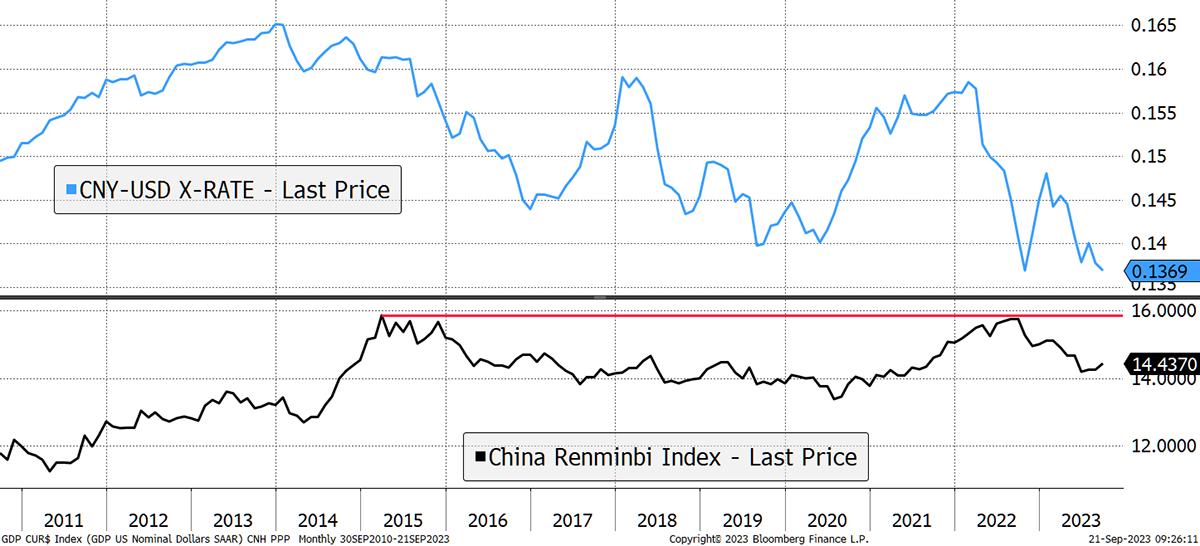

It may appear a decline started in 2014, however it didn’t. That is shown by the lower chart where the Yuan is determined versus a worldwide currency basket ex USD. It has actually held up extremely well and just began to decrease the value of in mid-2022 and has actually just recently bounced off the ten-year low.

Chinese Decline

For all the talk of China’s fantastic decline, in reality, it has actually hardly started. Yet the currency has actually reduced somewhat, which is the result of low rates of interest. In contrast to the United States and Europe, the PBOC has actually been reducing financial policy in an effort to improve development.

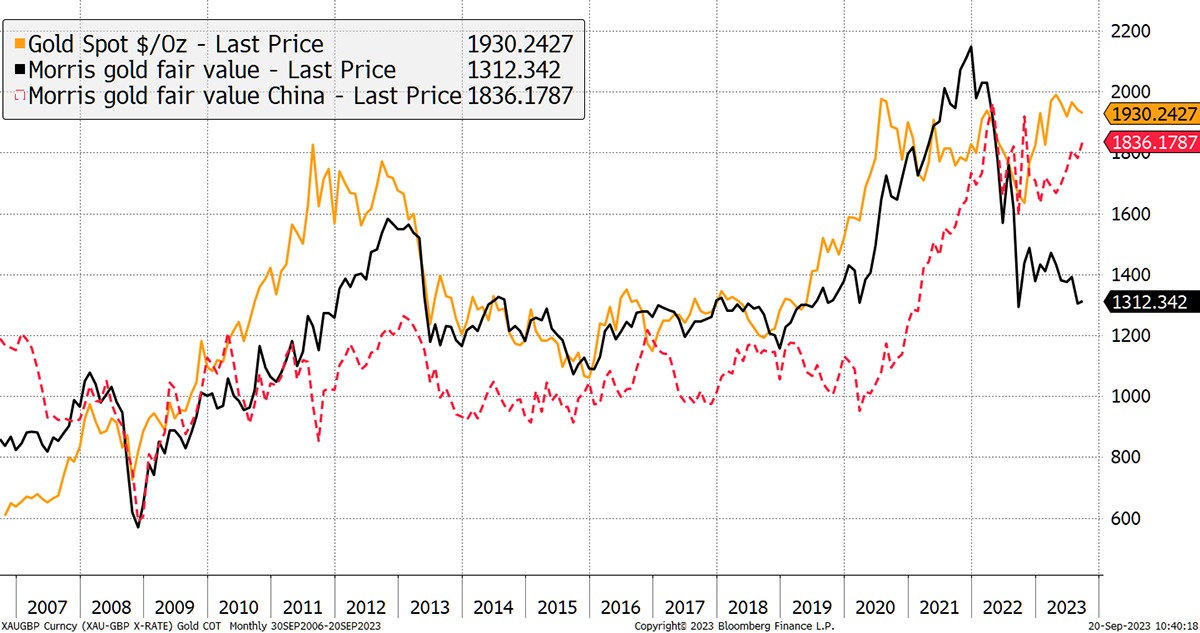

Let us not forget that low rates benefit gold. My gold appraisal design is improved by low rates and high future inflation expectations. The worst situation is high rates and falling inflation, which is basically where we are today. The fantastic wish for gold is that inflation shows durable while rates return down. Utilizing United States rate information, the reasonable worth has actually dropped to $1,312, which is ruthless and shows how tight financial conditions currently are.

Nevertheless, replacing the Chinese long bond for the United States Treasury, the reasonable worth leaps from $1,312 in the U.S.A. to $1,836 in China. Which rate will be more prominent for the gold cost in the future? Definitely, the connection with the latter has actually been growing at the cost of the previous.

Gold Fair Worth Is Much Greater in China

There can be no doubt that China is ending up being a more crucial factor of the gold cost than it has actually remained in the past. Gold is deeply rooted in their culture, and they comprehend the macroeconomic advantages and status of having reputable gold reserves.

Program

Lastly, I will go through my 3 crucial gold routine designs. If 2 or more are bullish, my thesis is that gold remains in a booming market. Spoiler alert: it still is.

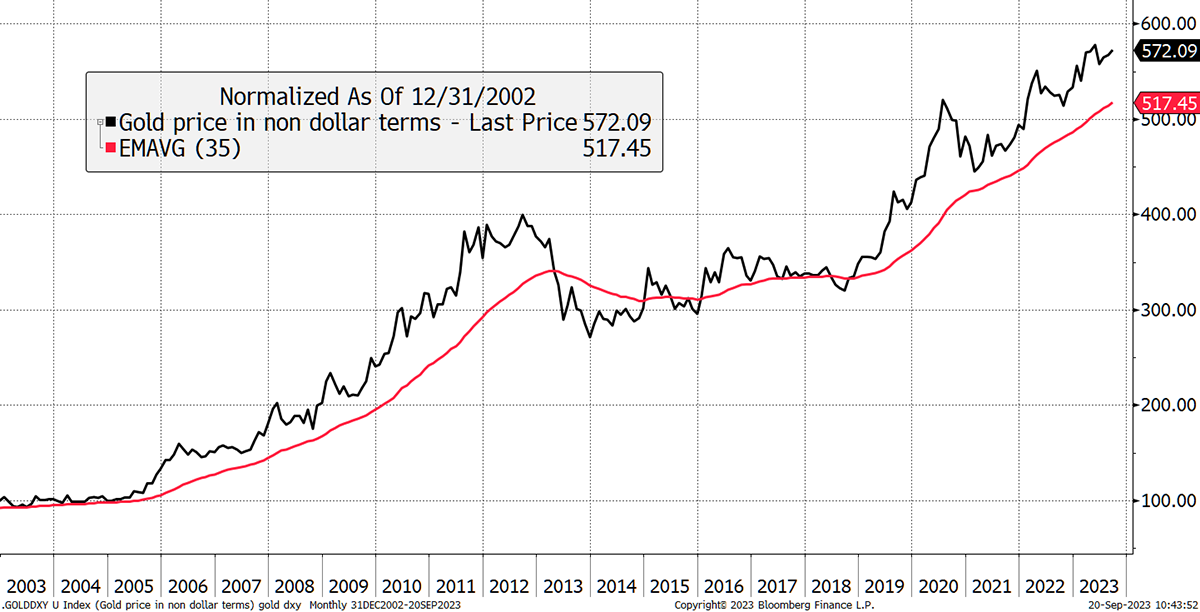

To begin with, gold stays strong in non-dollar terms as the cost is increasing in essentially all currencies. Over the previous year, just the Mexican Peso is ahead.

Gold Cost in non-Dollar Terms Stays Strong

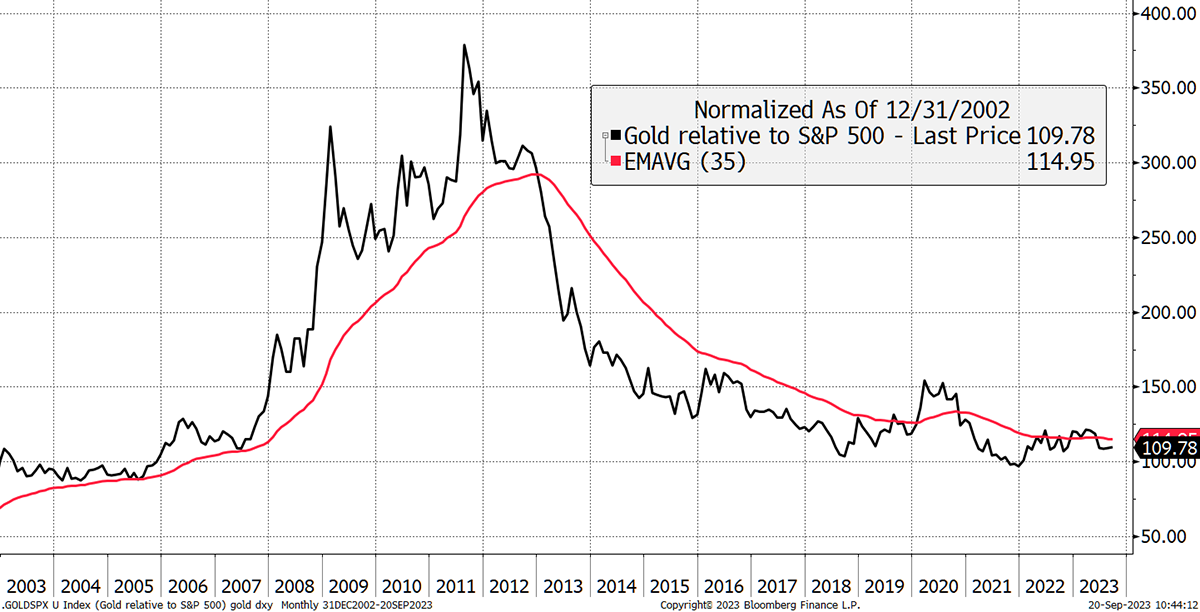

Compared to the stockmarket, gold is likewise succeeding. Undoubtedly, less so versus the S&P 500 (revealed), as tech has actually been so strong this year. However gold leads the remainder of the world stockmarkets and the United States equivalent weight index, which is less exposed to innovation. The bottom line is that gold is doing fine versus equities.

Gold Company vs Equities

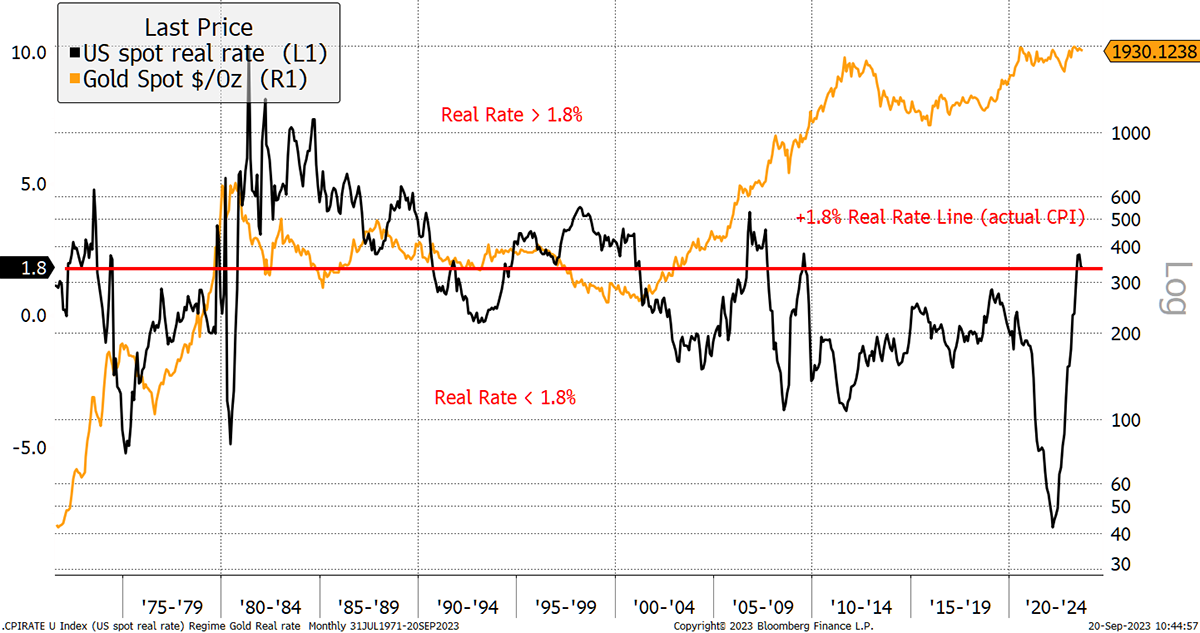

The last test is more uneasy for gold due to the fact that genuine rates of interest (the base rate less inflation) is 1.8%, which is the limit. Historically, when genuine rates have actually been above 1.8%, gold has actually remained in a bearishness.

Genuine Rates Are a Little High

However consider this taken place in 2006, which was great. It’s more a case of understanding that genuine rates can go too expensive, which eliminates gold booming market. The other observation is that continual durations of favorable genuine rates of interest have not been seen in the 21 st century. Numerous think the monetary system, saddled by financial obligation as it is, can not manage it.

I concur, and a few of gold’s appeal is that it is the earliest, and a lot of extensively held, type of sound cash.

VIBRANT

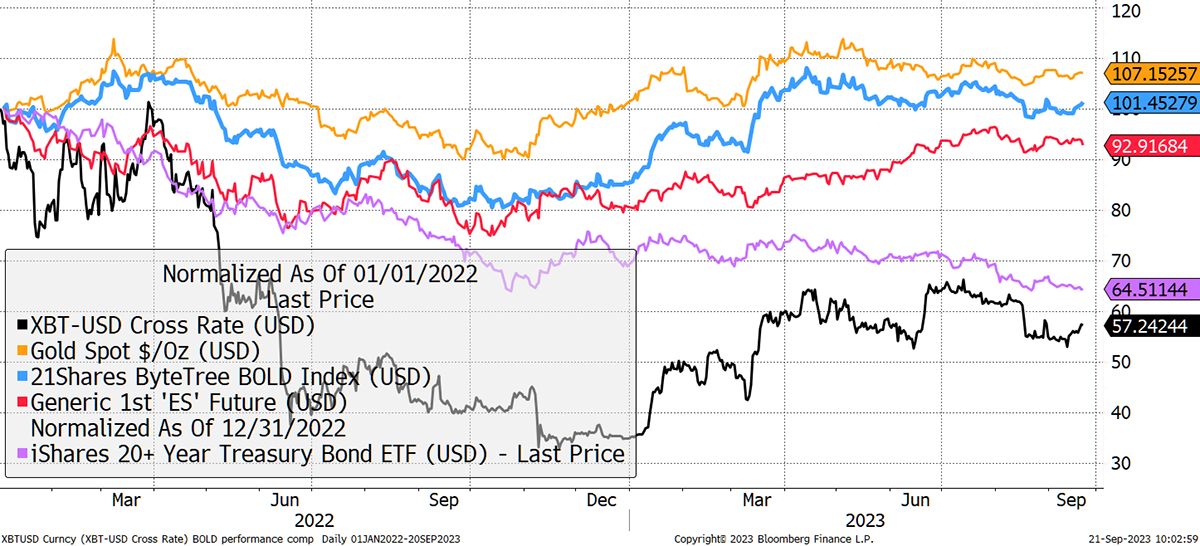

Gold has such a high status as an alternative financial possession that Bitcoin existed as a contemporary option. ByteTree’s BOLD Index integrates Bitcoin and Gold on a risk-weighted basis and rebalances every month.

The current despair in markets started in January 2022. Ever since, United States Treasuries are down 36% and the S&P 500 8%. Gold is up 7%, with Bitcoin down 43%, yet BOLD has actually been amazing under the scenarios.

BOLD Considering That the Bear Began

To find out more about BOLD, read our September rebalancing report, and please register to our subscriber list for month-to-month updates.

Physical Gold and Silver

If you have an interest in purchasing physical silver or gold and want to do so prior to China purchases it all, my suggested bullion dealership is The Pure Gold Business You can take shipment of your metal in the UK, United States, Canada and Europe or leave it in their safe custody. The trading expenses are low, while the quality of service is high, as revealed on Trustpilot For more information on The Pure Gold Business, please visit their site

Summary

Last night, the Federal Reserve stated rates of interest will be greater for longer. It hasn’t decreased well up until now, and gold is down in addition to stocks. However when rates begin to fall, maybe late next year, gold will meaningfully outshine stocks, simply as it performed in dotcom and 2008.

The Gold Dial Stays in Booming Market.