When China experiences financial turbulence, it typically works as a precursor of worldwide financial difficulties. This concept encompasses different elements such as their reserve bank digital currency efforts, real estate markets, and more. This highlights the significance of reserve banks and federal governments intervening in the gold market to affect its area cost. A rising gold cost tends to draw in higher attention and can signify underlying problems within a fiat currency’s stability. In essence, when China deals with financial difficulties, it has a causal sequence on the remainder of the world.

CHAPTERS:

0:00 What’s Occurring In China

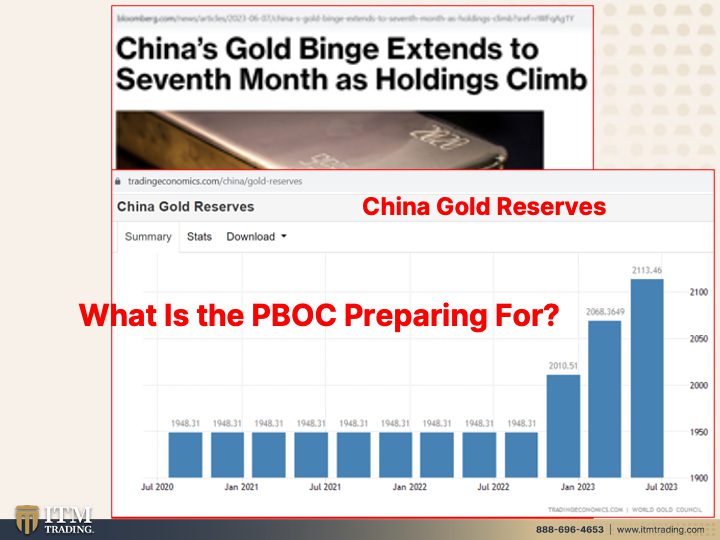

1:58 Gold Binge

2:32 World Concerns China

3:56 China Fading

5:13 House Rates

9:02 China Residential Or Commercial Property Market

10:16 Clouding Scrap Bond

13:16 Area Gold

SLIDES FROM VIDEO:

RECORDS FROM VIDEO:

When China sneezes, the entire world gets the influenza. What’s taking place in China is actually a precursor to what’s taking place all over else. That holds true with their CBDCs, their real estate markets, whatever. That’s why it is so crucial for reserve banks and federal governments to control the area cost of gold. An increasing gold cost is gon na get more eyes on it, which is certainly an indicator of a stopping working fiat currency. And if you wan na understand the real worth of gold, an area cost is not where to look. The worldwide economy counts on China, however China, what was expected to manifest is simply not taking place. So I’m going to reveal you what’s taking place there today and how all of this informs a clear story of our instant future, turning up.

I’m Lynette Zang, Chief Market Expert here at ITM Trading a complete physical, gold and silver dealership concentrating on methods. And you much better have one due to the fact that I’m taking a look at things breaking down actually rapidly. And I believe it’s actually intriguing. I seem like I do not precisely seem like we remain in the eye of the storm due to the fact that there’s a lot of unfavorable things that are taking place, however individuals have actually put their blinders on and, and it resembles they’re 2 years of ages. Oh, you can’t see me due to the fact that I have my hands in front of my eyes. I imply, that does not make any sense. So take a look at plainly what is taking place due to the fact that this is an international economy and eventually they wished to get back at more worldwide, more under a one world management system. That’s another story for another day. However we need to understand what’s taking place in China due to the fact that it’s taking place all over else too.

China’s gold binge encompasses seventh month. Really that was back in June. It is now encompassed 10 months. So China is demolishing gold as rapidly as they can. Hmm. Why do you believe they might do that? What is it that they are getting ready for? And when I state China, I’m actually speaking about the federal government there. What are they getting ready for? Due to the fact that it wasn’t all that long earlier when the world pertains to China. I stated at the time that I didn’t believe that this was a great concept. That in my viewpoint, and I still, it is still my viewpoint that that by the MSCI providing an ETF connected to the Chinese markets, it had to do with moneying the Chinese markets and providing cash. Which occurred back on May 31st in 2018. And they’re going to consist of that, whoopy do. And they’re including it at a 5% preliminary weight might cause roughly United States dollars 22 billion of capital inflows into these stocks. Well, that advantages someone, however I’m uncertain who that actually does advantage. A leading company of worldwide equity indexes, which these things can be produced at impulse. And all they have is, you understand, like trash. They’re comprised of trash. They’re not comprised of anything that’s genuine. However they revealed starting June, 2018, it will consist of China A-shares in the MSCI emerging markets index and the MSCI ACWI index all that alphabet soup. ‘.

So what was the outcome of that? Well, this chart begins in 2017. Oops, let me get my laser guideline. And the outcome of that was a flood of cash into the Chinese markets, which is now reversing or has actually started to reverse. However rather truthfully, it is still at nosebleed levels. Do you believe any of this is a mishap? And by the method, who do you believe owns this things? Hmm, let’s consider this. Hmm? Perhaps retirement funds. Perhaps pension. I would state that a great deal of, a great deal of entities that are investing your cash into 401Ks any place, they’re the ones that are actually supporting this more than anything else. Take a look at the level of equity ownership in all of these various locations of the MSCI. Right? Still at nosebleed levels. So for that reason, considering that you might not understand that you own it, I believe that you require to be mindful and check and see if you do not. Undoubtedly. Due to the fact that what increases should boil down. And when you do stimulus right, all of this financial obligation development and cash printing free of charge. And it does not matter where that occurs on the planet, it makes things appear like development is terrific. Oh, take a look at the development engine in China. Take a look at the development engine in the United States. So handling brand-new financial obligation and developing inexpensive cash can make things appear to increase. However top, whenever they do that, the worth of the cash that’s currently out there decreases. And second, it’s not sustainable.

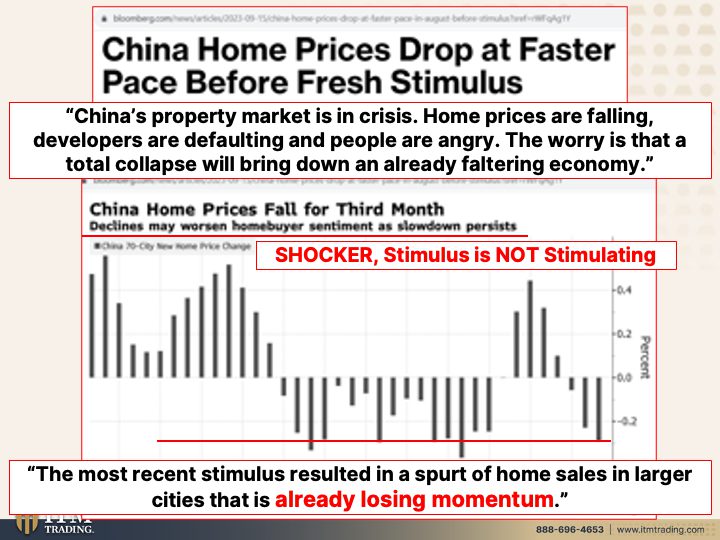

So here you go. China’s house rates drop at fastest speed prior to fresh stimulus. Oh wow. However residential or commercial property financial investment in sales stay weak last month. Oh my gosh. And expert doubt, most current reducing procedures will end the real estate slub. Oh no. So what occurs is the more stimulus they provide, it resembles pressing on a string. And I do not care whether you remain in China or you remain in the United States, the more stimulus they produce, the less effect it has. Now let’s take a look at Chinese residential or commercial property market due to the fact that you may be sitting there going, oh, however in the United States there are still pockets where rates are increasing. Does that mean that they remain in good condition? No, it does not. China’s residential or commercial property market remains in crisis. House rates are falling, designers are defaulting, and individuals are upset. The concern is that an overall collapse will reduce a currently failing economy. So why wasn’t all that cash printing go throughout the turning world? Why didn’t that repair things if it’s so promoting? For goodness sake, you can even look that the house rates succumb to the 3rd month. Well take a look at propping up house rates. Makes individuals feel abundant. And when they feel abundant, then they’ll invest cash, they’ll handle more financial obligation. And in China, well look, it holds true in the United States we constantly point fingers, however we got ta appearance in the mirror. I imply, that’s where you see the fact. Individuals have actually been trained to consider homes as short-term financial investments. It utilized to be someone would purchase a home, they would have the top of the Newell post emp detachable due to the fact that the Newell post would be empty when they settled their home loan, they had a celebration, they buried the home loan pay files inside that Newell post and glued that brand-new post on, glued it on. And after that that residential or commercial property was given from generation to generation. What’s incorrect with that? Picture what it would be not to have a home mortgage payment, right? However they desire you to believe short-term decreases might intensify house purchaser belief as decrease continues. Well, yes, it ends up being a doom loop, right? So rates are decreasing so for that reason you understand what’s taking place to my cash, for that reason I’m not gon na invest it. And keep in mind, China’s been transitioning into a customer driven economy, however the most current stimulus led to a spur of house sales in big cities. Which is currently a losing momentum. So can you see this entire thing actually breaking down? And the truth is stimulus is not promoting just for a couple of, and not for you and me. ’cause We’re not because club.

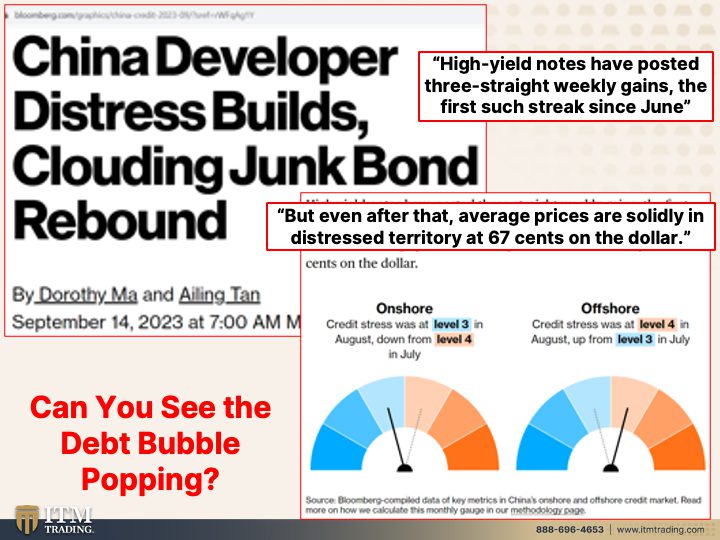

China’s residential or commercial property crisis market crisis is problem for the entire world. Yes, undoubtedly it is. Due to the fact that the function of realty started to alter due to the fact that house rates had actually constantly increased. Individuals started to think they constantly would. Whatever has a life process. Whatever consisting of currencies that caused a growing number of Chinese purchasing houses as a method of investing their cost savings instead of to reside in. And the exact same thing has actually taken place here. Please open your eyes, search in the mirror due to the fact that what’s taking place in China is going to occur here. And madness is doing the exact same thing over and over and anticipating various outcomes. The outcomes are not going to be various. We are at completion of the worldwide fiat cash experiment. China’s been blazing a trail in how you manage your population with CBDCs. You have options at this moment. Do not misuse the time. China designer distress constructs clouding scrap bond rebound. We’re having problems in the bond market on an international basis due to the fact that rates of interest have actually increased a lot and they, and these corporations have actually handled a lot financial obligation.

High yield, that’s scrap area. High yield notes have actually published 3 straight weekly gains, the very first such streak considering that June. Whoopty doo. See the water’s fine, let’s go swim with those sharks. Not for me, not for me. However even after that, typical rates are sturdily in distressed area at 67 cents on the dollar. So keep in mind, alright, keep in mind rates of interest, primary worth of bonds. So they rates of interest increased, the primary worth decreased. They may have increased 3 weeks in a row due to the fact that to promote, they’re decreasing the rates of interest a bit, however they’re still 67 cents on the dollar. So if you paid a dollar for something and it’s just worth 67 cents, are you hurrying out to handle more financial obligation and purchase things? I do not believe so. The financial obligation bubble is popping. It’s popping all over the world. Can you see this? ’cause you require to. You require to see what’s taking place so that you can make informed options that puts your benefit. Initially, what a principle do you believe these reserve banks or federal governments are keeping an eye out for your benefit?

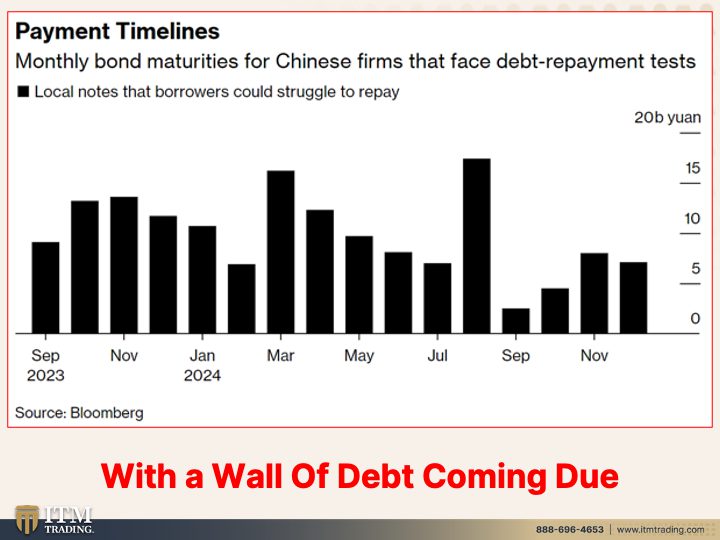

Take a look at this regular monthly bond maturities for Chinese companies that deal with financial obligation payment tests. Simply put, they can’t repay this financial obligation and they’re having problem rolling it over. Does not that noise familiar? Numerous individuals disregard what’s taking place in China, however you disregard it at your own threat due to the fact that there is a wall of financial obligation that is coming due in this greater rates of interest environment all over the world. That suggests we are having a growing number of defaults. A growing number of insolvencies, a growing number of layoffs. The Fed might in fact get what they desire, which is they do not desire the general public, the employees to have that much say in their pay. After all. Cost stability is not that. That cost of that gallon of milk stays the exact same. It’s that you do not request greater salaries that to the reserve banks is cost stability. So all of these insolvencies, these corporations going outta service, Hmm. What do you believe is going to occur to staff members?

The writing is on the wall. Please take note. This is Area gold agreement versus the Fiat yuan, the Chinese currency. And it simply returns ten years to 2013. However you saw just how much gold the Chinese federal government is purchasing. And I imply, we have actually been seeing that seriously considering that 2010 when it went net favorable in Reserve bank Gold purchases. However obviously it’s simple to control the cost. Really, extremely simple. However we are near a breakout. Can you see that? And we’re gon na get it. We’re gon na get it there. We’re gon na get it here. However this is what I actually wished to reveal you due to the fact that I have actually revealed it to you a lot in the United States typical premium in August. So that’s the cost that they pay above area increased to a record. Hmm, isn’t that intriguing? And have not we seen that too with the extremely rarities in the gold collectible coins? Oh yes, we have a record high. The Shanghai London gold cost spread balanced United States dollars 40 an ounce in August. A fresh record high. Hmm. And United States dollars 23 an ounce greater month over month. What’s that inform you? That informs you that the Chinese population can see their entire system breaking down. If you’re simply taking a look at this chart, can you see that? No. There’s a cup development. So there’s a build-up pattern, however it’s not breaking out. However think what’s taking place in the physical market? Breaking out. Boom, done. You inform me which market exposes the fact.

So if you have actually refrained from doing so currently, ensure that you subscribe and strike that bell listed below so we can let you understand when we provide a brand-new video. Then we do that extremely prolifically. And if you have not done this currently, please, please, please click that Calendly link listed below. Get your gold and silver method began. Having the ideal gold and silver for your objectives and your goals is definitely important. There’s gold, there’s silver, and after that there’s various sort of gold and silver and they carry out various functions. So you wan na ensure that that is definitely in location to support your objectives. Put your objectives initially. And if you have not taken a look at this yet, you have actually got ta take a look at the deep dive on run-away inflation alert due to the fact that we are this close. And I’m not joking you, we likewise Taylor it a fantastic video on the plot to topple the United States dollar. And if you remain in the United States we are gon na feel this a lot more. So you require to focus on that video. She does a fantastic task of breaking all of it down actually, actually rapidly. And on Monday, bartering on BGS, Beyond Gold and Silver, bartering for survival. And keep in mind, wealth guards are made from physical gold and silver, not paper or pledges and not lies. And till next we fulfill. Please be safe out there. Bye-Bye.

SOURCES:

https://tradingeconomics.com/china/gold-reserves

https://www.msci.com/www/blog-posts/the-world-comes-to-china/01002067599

https://www.bloomberg.com/graphics/china-credit-2023-09/?sref=rWFqAg1Y