onurdongel

Analysis Summary

In today’s analysis, I will be covering United States Steel Corp. ( NYSE: X), in the products sector, subsector of steel.

From its profile, this Pittsburgh-headquartered company trades on the NYSE and produces & & offers flat-rolled and tubular steel items mostly in The United States and Canada and Europe.

I offered this stock a hold score, based upon strengths being surpassed by balancing out aspects, nevertheless, insufficient to require a sell score.

Strengths: assessment, efficiency vs. S&P 500, capital & & liquidity.

Balancing out aspects: dividends, income development, earnings & & EPS, share rate vs. moving average.

A danger to my neutral outlook that I determined is unpredictability over the existing takeover quotes going on, in addition to unpredictability over Q3 revenues outcomes.

My score approach is to evaluate the stock holistically throughout the following 7 classifications of equivalent weight, and if it has more strengths than balancing out aspects it gets a buy score:

dividends, assessment, income development, earnings & & EPS, capital & liquidity, share rate vs. moving typical, efficiency vs. S&P 500.(* )Dividends

In this area, I will discuss the dividend yield, dividend development over ten years, and dividend stability of consistent payments. As a dividend-focused expert and financier, I think these are crucial metrics to take a look at.

Though not all financiers are dividend-oriented, I believe it is a chance to create routine

capital from holding a stock longer-term. Initially, let’s take a look at the yield, which is

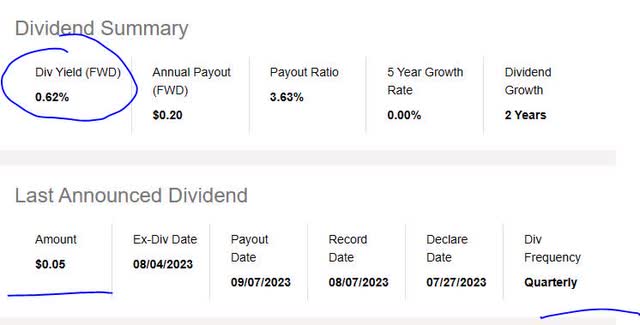

0.62% since this post, in addition to a dividend payment of $ 0.05 on a quarterly basis. United States Steel – div yield

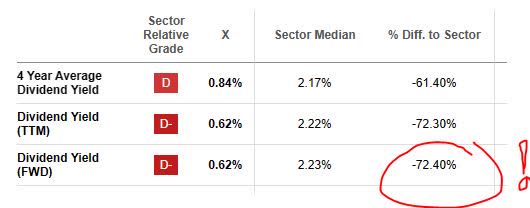

( Looking For Alpha) In contrast to its sector average, this yield is

72.4% listed below the average. I consider this a unfavorable point and I believe a sensible dividend yield would be in between 2% and 4% when thinking about the sector/industry. One element, nevertheless, that I understand might drive a yield down is the share rate escalating upwards, which we will take a look at even more later. In reality, I believe that is the cause. United States Steel – div yield vs. sector (Looking for Alpha)

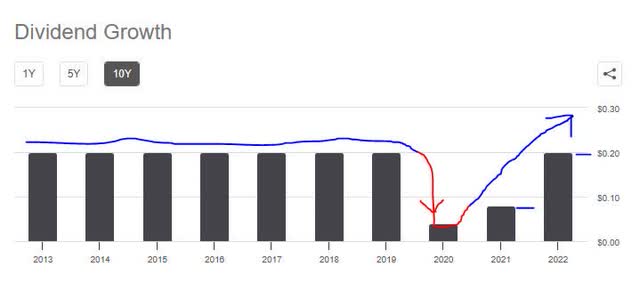

Next, I am taking a look at the 10-year dividend development rate, displayed in the chart below, which reveals a long & & consistent duration without much development at all, followed by a significant dip in 2020, then slowly growing once again however just to recuperate from that dip, which I believe was pandemic-driven considering that it was around that time.

United States Steel – div 10 year development

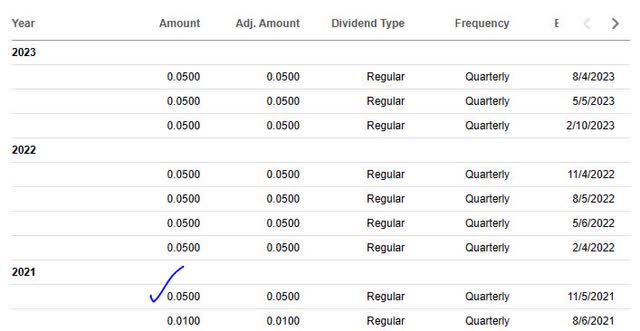

( Looking For Alpha) Lastly, I wish to see dividend payment stability, particularly considering that a lot of my readers depend on the steady dividend earnings that these kinds of stocks use.

In taking a look at the table listed below, you can see steady payments over the last couple of years, with 1 dividend boost in this time. Nevertheless, the payment is what I think about a paltry 5 cents per share, for a business that has actually stayed in business for so long and actually part of the American commercial story.

United States Steel – div history

( Looking For Alpha) Based upon the proof, I think about the classification of dividends an

balancing out element for this stock’s score, on the basis of bad long-lasting dividend development, a yield far below par, and just a little balanced out by the stability of payments. Assessment

To evaluate the assessment, I have actually picked a single metric to take a look at, which is the price-to-earnings ratio (P/E), both the routing and forward P/E, which rapidly informs me a story about where the marketplace is pricing this stock in relation to its revenues.

United States Steel – PE ratio

( Looking For Alpha) Thinking About that the

TTM P/E of 6.25 is 58% listed below the sector average, and the forward P/E of 7.93 is 43% listed below the sector average, I consider this stock significantly underestimated compared to its market. I believe that it is because of the marketplace belief not being positive about revenues, which I will display in a later area have actually been suffering.

In regards to a chance, I believe this assessment metric is a

strength for this stock’s score considering that it provides an undervaluation chance that somebody might snag while it’s still around. Earnings Development

Now, we have actually pertained to a subject lots of experts & & financiers take a look at, which is the top-line income development. The story it informs is how well a company is growing its sales prior to expenditures and taxes enter play.

For this business, we can see from the most current quarterly outcomes that it accomplished a

YoY drop in overall income: United States Steel – income development

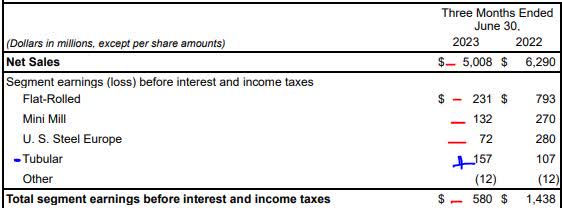

( Looking For Alpha) When segmenting

net sales by service line, according to its Q2 revenues release the company did even worse in the majority of its lines other than for tubular steel. United States Steel – net sales

( business revenues release) For that reason, I believe income YoY development is an

balancing out element for this stock’s score, and am waiting for much better outcomes for Q3. Earnings & & EPS

I wished to separate the fundamental information from top-line income, so earnings & & revenues per share get their own area here to make the analysis much easier to comprehend.

When taking a look at the most current quarter, this company dealt with a

YoY drop in both earnings and EPS: United States Steel – earnings & & EPS

( Looking For Alpha) I believe that this is another

balancing out element for this stock’s score, despite the fact that the company revealed QoQ development in both. From a longer view, it is not at the success level it remained in the very same quarter a year prior. Relying on the business’s

Q2 discussion for some more understanding into headwinds, some “undesirable effects” impacting service consist of lower average recognized costs, greater scrap expenses, greater labor expenses, and greater variable compensation. Capital & & Liquidity

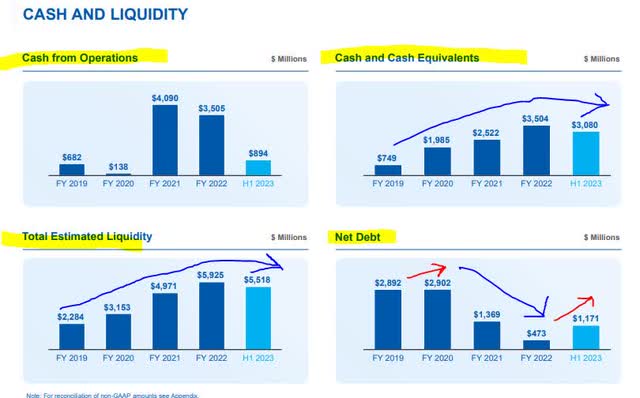

In this area, we wish to concentrate on the principles of whether this business is well-capitalized, has favorable equity, favorable capital, and so on. I believe these are essential aspects to think about and are amongst the really fundamentals of any major service.

Turn your attention to the following graphic. The story it informs is that the company’s money has actually been normally increasing as has total liquidity. Financial obligation went on a great decrease, however then increased back once again, though still at lower net levels than a couple of years earlier. Decrease of business financial obligation is something I search for in efficient management, particularly thinking about the escalating expense of financial obligation in the existing high rate of interest environment.

United States Steel – money & & liquidity

( business quarterly discussion) Other notable products to call out:

balance sheet

: $0.44 per share in favorable complimentary capital. Likewise an excellent indication, I believe. Based upon the proof discovered, I consider this company’s capital & & liquidity scenario a

strength to its total score. Share Rate vs. Moving Typical

In this area, I am trying to find a value-buying chance with this stock based upon my portfolio technique of trading

crossovers listed below the 200-day basic moving average (” SMA”). In my technique, I think about a 5 to 10% drop listed below the 200-day SMA, after a duration of bullishness, a purchasing signal Nevertheless, a cost hovering at or near the SMA might likewise provide a buy chance. This is why I created a really basic trading simulation to check out my thesis.

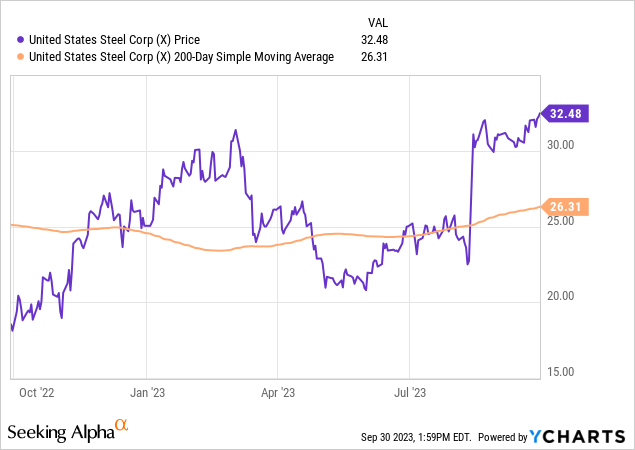

Initially, let’s have a look at the existing rate chart (since the post writing, so live outcomes might differ):

Information by

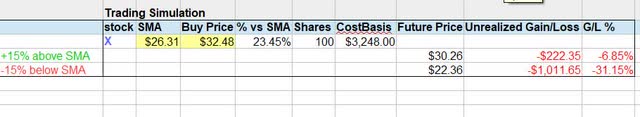

$ 32.48, which is 23.4% above the 200-day SMA of $ 26.31 In the beginning glimpse, it appears overbought and not a worth chance. Nevertheless, we ought to take it for a test drive initially! Utilizing this information, I developed the following trading simulation where I purchase 100 shares at this rate and hold for 1 year, with an objective of accomplishing a latent capital gain at that time within a series of 5% to 20% gain or much better. At the very same time, my optimum loss tolerance is a latent capital loss of 20%.

Note: it is “latent” since no shares are being offered so it is simply paper gains & & losses.

United States Steel – trading simulation

( author analysis) In the above simulation, I am evaluating what gains/losses would happen if the future share rate (in Oct. 2024) increases 15% above the existing 200-day SMA, and if it drops 15% listed below that very same SMA.

The result? I forecast a capital loss of -6.85% in the very first circumstance and an even larger loss of -31.15% in the second circumstance. Both results are

not in line with my portfolio objectives & & loss tolerance. Here is a helpful illustration of what I am discussing. As you can see, the blue arrow reveals the rate at 15% above the SMA and the red arrow reveals the rate at 15% listed below the SMA. The existing share rate is well above my ceiling, so a buy at this rate positions a higher threat of capital losses surpassing my targets.

United States Steel – trading simulation – loss limitation

( author analysis) Consider this a simple example to be utilized as a structure, and might not appropriate for all portfolio objectives, and not a sign of real gains or losses that might happen.

Nevertheless, based upon this simulation, I believe the existing share rate is an

balancing out element in my total score and does not include strength to it. Efficiency vs S&P 500

The following is a contrast of the 1-year rate efficiency of this stock vs. the S&P 500 index. I believe this is an essential index to compare versus considering that it is a market requirement that is frequently tracked.

United States Steel – efficiency vs. S&P 500 (Looking For Alpha)

Obviously, the information reveals the stock

surpassing vs. this index, which I think about a strength In reality, the rate return considering that Sept 2022 has actually been 75% whereas the index has actually seen a cost return of closer to 18%.

Threat to my Outlook

A danger to my

neutral outlook might be both a prospective disadvantage threat and upside threat. Experts and their agreement must be on the mindful side, considering that the company has handled to beat revenues price quotes for 4 quarters directly, and the concern is will another revenues beat for Q3 send out the stock rate even greater?

United States Steel – revenues price quotes

( Looking For Alpha) That kind of circumstance would make a neutral score extremely mindful. In reality, the business in September launched

Q3 revenues assistance showing it anticipates a favorable diluted EPS of $1.10 to $1.15. A revenues miss out on, nevertheless, might send out the share rate toppling a minimum of rather. Likewise, there is the overarching concern of the bidding war amongst a number of gamers in combining with United States Steel, the essential one being

Cleveland-Cliffs ( CLF). The current on that, from a Sept. 28th post in Reuters, is that the 2 business have actually accepted a non-disclosure arrangement (NDA). Even more from the post:

Reuters has actually reported that

ArcelorMittal is among the celebrations that has actually been dealing with a prospective quote for U.S. Steel. Bloomberg News has actually likewise reported that Canadian steelmaker Stelco Holdings ( STLC.TO) is pursuing a quote. So, this takeover concern, which is not a done offer yet, casts a shadow of unpredictability over the future ownership of this business, in my viewpoint.

For This Reason, my

neutral score on this stock represents now, as I do not see validation to be bullish on this equity nor bearish either as it is still a great business and a huge part of both the Fortune 500 in addition to the United States economy returning to the commercial period.