zhengzaishuru

Dear readers/subscribers,

There’s a really slim benefit for specific niche business like the North European Oil Royalty Trust ( NYSE: NRT). The business has a working and appealing organization design, a minimum of in theory. I have actually currently covered it in many previous short articles, the previous one being discovered here.

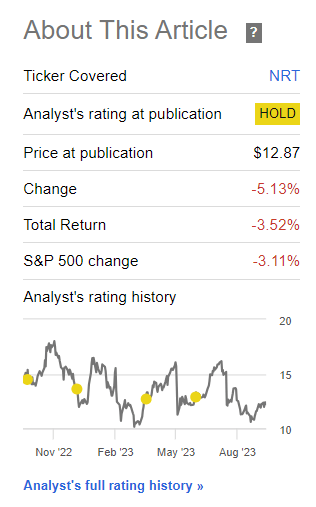

My thesis for this business has actually constantly been one finest referred to as “thinking twice”. The business provides an unquestionably appealing yield, however in spite of this yield, the North European Oil Royalty Trust has actually stopped working to carry out with favorable returns for a minimum of as long as I have actually covered it. The existing efficiency stands as follows, which may not be much of an unfavorable compared to some financial investments and their bad efficiency, however it’s an underperformance however, even inclusive of the business’s generous dividends.

Looking For Alpha NRT RoR (Looking For Alpha NRT RoR)

As you can see, even from my really first short article back in 2022, the business has still underperformed, in spite of some severe dips and ups throughout that time. I’m going to benefit from this time and supply you with an upgrade for both bearish and bullish theses on business – due to the fact that there’s space for both here.

North European Oil Royalty Trust – The up and the disadvantage, however the disadvantage rules here.

The bullish thesis for a gamer like this is reasonably basic. It’s a simple take a look at the general circulation development rate, the dividend/distribution protection ratio, and reasonably strong basic KPIs such as the complimentary capital yield, the simpleness of its organization design, its position in the European energy worth chain now that Russia has, to big degree compared to where it formerly was, gone bye-bye, and the hope that the business can basically out-navigate the common ups and downs of the market and the energy sector.

The issue with this bullish position – and I understand a few of you, dear readers, do follow and purchase this business, is that it holds really little water when seen in the context of the much bigger or longer timeframe.

A minimum of, seeing it with such simpleness does not work. NRT is, as I see it, not even near to having the ability to outnavigate basic ups and declines in the energy sector. I would argue it even follows these patterns more slavishly than other organizations do.

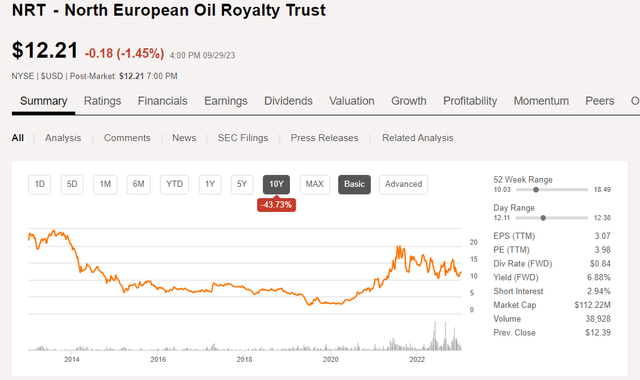

Have a look at what has actually taken place to financiers in the business for the previous ten years.

Looking For Alpha NRT (Looking For Alpha)

What you see, is as the chart states, a 10-year post-GFC RoR of unfavorable 43%, even with the current bump. You’ll likewise discover that that bump corresponds really carefully with the beginning of the Ukraine crisis and the oil rate increases/energy rate boosts that follow.

If you take a look at the business on a 2, 5, or perhaps 7-year basis, you can think that yes, NRT does undoubtedly surpass its peer group. The issue is that this isn’t a big sufficient contrast, as I see it.

NRT is a really little business. We’re talking less than $120M in market cap. The business is, in reality, a NYSE-listed follower of the North European Oil Corporation and Oil Business, and those shares have actually been around on the marketplace for around 40 years at this moment.

However it’s incredibly little. Like, administered-by-five-trustees sort of little. The function of the Trust is to gather, hold, and validate royalties paid into the Trust by the operating business, German subsidiaries of the Exxon Mobil Corporation ( XOM), and the Royal Dutch/Shell Group of Business ( SHEL). Which is undoubtedly what the business does, then paying those royalties on a quarterly basis to investors.

On the favorable side, there is no financial obligation – and the trust is not allowed, in reality, to handle any sort of financial obligation if you check out the filings of the trust arrangement. So that’s a good information.

However in the end, the profits and the dividends you’re getting originated from the sale of fossil resources, in the type of nagas, oil, sulfur, and condensates from sources of those products within the trust operating location – in this case, those are discovered in Northern Germany in the type of concessions and leases – and just northern Germany. The trust has never ever, nor does it strategy to according to filings, own properties or land beyond these locations.

That restricts its appeal.

Why?

Since, as you might discover, up until the beginning of these macro problems, NRT traded really in a different way from where it trades today. It traded at around $2-$ 4/share.

Why is that?

Since, if worldwide trade “works”, and nations like Russia with low-cost producing properties belong to the network, then sourcing products from Germany is neither effective nor low-cost in contrast. In order for the business to make an excellent revenue, the oil price/commodity prices levels require to be high. That’s why the business has a present yield of near to 7%, which’s why this stock has actually been trading so expensively for the previous couple of years.

This brings me to another issue, and it’s a huge one, as I see it. The dividend/distribution.

The basic reality is that a 6.88% yield in a world where you can get 7-8% yield from BBB+ ranked financial investments or equivalents simply isn’t really appealing. Why in the world would you invest capital into a not-rated $100M microcap business when you could have more yield and much better upside with real investment-grade credit ranking and without the relatively dangerous product direct exposure?

There exists a detach here, as I see it, in between where this business “must” trade and where it presently does trade. The general appraisal pattern considering that the business peaked in mid-2022 has actually gone down.

In spite of relatively favorable existing patterns, I do not see this altering.

However wait, there are more threats and negatives.

The business’s minimal operating location features tested reserve threats. Unlike much bigger upstream gamers, the business has really minimal schedule of brand-new sources of item. If you actually wish to purchase the business, I highly motivate you to have a look at the previous short articles I have actually composed that enter into more information on the sources offered to NRT, based upon the Oldenburg concession. To be clear, NRT isn’t as much oil as it is gas (specifically since late with gas rate patterns), however it’s my view and the marketplace’s view that the worst in the Natgas sector is in fact previous.

When I initially discussed NRT, their dividend yield was 33%. It’s now less than 7%. The normalization in dividend yield and payment that I anticipated in my really first short article has actually now emerged practically completely, and I do not anticipate it to stop there. Even if there might be a temporary drop in the decrease in product prices, I anticipate costs for the business to integrate with inflation and put more pressure on distributable profits.

That does not even enter into the political threats here. Germany and energy production is not a safe endeavor. The German federal government has actually at times entered into and cut production and growth of whatever from lignite, coal, and other sources for both ecological and other factors. This business, with its property concentration and size, has really little option when its sources begin to decrease in regards to life expectancy.

For all of these factors discussed, I do not think about the most recent report and upgrade to its circulation to be of product effect for a favorable thesis. I in reality view this as a gamer piano that’s presently playing the tune precisely as I anticipated it, in regards to instructions, to end up.

I would motivate any would-be-investors in NRT to actually take a look at whether this is something they wish to own long-lasting due to the fact that I securely do think that from an essential perspective, the unfavorable threats significantly exceed the favorable prospective gain here.

Let’s take a look at appraisal.

Northern European Oil Royalty Trust

In my previous short article, I offered the business a conservative share rate of $10/share. The business has not, ever since, not when dropped listed below or really near to that rate.

Since this short article, I’m reducing it due to the wear and tear of the circulation both existing and what I see most likely moving forward. I’m sufficing to $8/share, at which point the business would presently yield around 10.5%. At that yield, I can possibly see some attract somebody investing in this for earnings.

However at the very same time, I would personally rather purchase a 7-8% yielding BBB-graded pref stock than I would this business even at that level. In order for it to be something I would personally think about for my portfolio long-lasting, I would most likely require a share rate of $5-$ 6/share, which’s reasonably impractical in the existing macro.

The problem is that if you do invest now, and the directional pattern of the business maintains, which I think it will, there appears to be a non-trivial possibility that you’re going to have a tough time triumphing with this financial investment.

The continued (mainly) exception of Russian-sourced crude is an advantage for the business, and I do not see the dispute there easing off even in 2024. However this is inadequate, as I see it, to validate a greater share rate here.

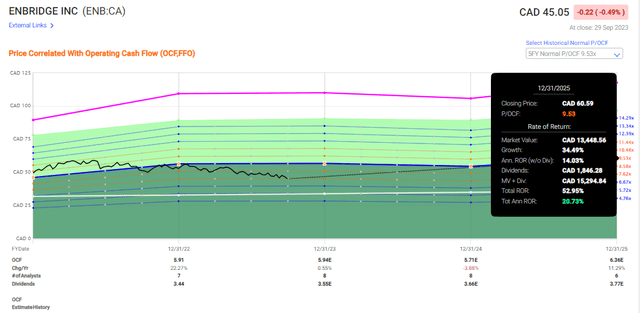

Not when you can actually “PURCHASE” Enbridge ( ENB) today, at a 7.89% yield with a considerable conservative benefit.

Enbridge Benefit (F.A.S.T charts)

I reveal this to you due to the fact that this is in fact an energy business that I just recently purchased. NRT is not. I continue to think that the business, at this rate, in no chance validates what upside and yield there is. The reality that we’re now down to less yield than a BBB+ ranked gamer like Enbridge with a $CAD90B market cap, ought to offer you some sign of simply how far this has actually gone.

It’s for that reason really simple for me to state that I have no interest, at this time, in purchasing this company/this trust.

I’ll wait on a huge drop which substantial benefit I at some time hope exists.

Thesis

My thesis for NRT is as follows:

- The business is a fascinating play on a particular EU gas/Oil/sulfur property in Germany. It’s not without its basic appeal, however I would state that there’s excessive threat to fish here, in spite of some enhancement in rate.

- Since October, I’m stating that the business is still too miscalculated to make it an appealing “BUY”, however I am providing it a continued, clear target.

- I would upgrade my PT to represent a lower prospective disadvantage, and relocate to $8/share, making this a really dangerous play offered the connection to energy rates.

- I think about NRT a “HOLD” here and would wait.

Keep In Mind, I’m everything about:

- Purchasing underestimated – even if that undervaluation is minor and not mind-numbingly enormous – business at a discount rate, enabling them to stabilize in time and harvesting capital gains and dividends in the meantime.

- If the business works out beyond normalization and enters into overvaluation, I collect gains and turn my position into other underestimated stocks, duplicating # 1.

- If the business does not enter into overvaluation however hovers within a reasonable worth, or returns down to undervaluation, I purchase more as time enables.

- I reinvest profits from dividends, cost savings from work, or other money inflows as defined in # 1.

Here are my requirements and how the business satisfies them ( italicized).

- This business is general qualitative.

- This business is essentially safe/conservative & & well-run.

- This business pays a well-covered dividend.

- This business is presently low-cost.

- This business has a practical benefit that is high enough, based upon profits development or numerous expansion/reversion.

The business satisfies just one of my requirements at this time in October of 2023 and I call it a “HOLD”.