{“page”:0,” year”:2023,” monthnum”:10,” day”:4,” name”:” exploring-dividends-down-under”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Head of U.S. Equities”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Jim Wiederhold”,”title”:”Director, Commodities and Real Assets”,”image”:”/wp-content/authors/jim.wiederhold-515.jpg”,”url”:”https://www.indexologyblog.com/author/jim-wiederhold/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Factors and Dividends Indices, Product Management and Development”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Head of Factors and Dividends”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities and Real Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”George Valantasis”,”title”:”Associate Director, Strategy Indices”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Michael Mell”,”title”:”Global Head of Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Izzy Wang”,”title”:”Senior Analyst, Factors and Dividends”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Jason Ye”,”title”:”Director, Factors and Thematics Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Daniel Perrone”,”title”:”Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Thematic Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”},{“display”:”Narottama Bowden”,”title”:”Director, Sustainability Indices Product Management”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”}]

Checking Out Dividends Down Under

-

Classifications

Elements -

Tags

Ausbiz, Australia, Australia FA, buy-write, covered call, Dividend, dividend earnings, dividend chances, high dividend, earnings techniques, Jason Ye, alternatives, S&P/ ASX 200, S&P/ ASX 200 High Dividend Index, S&P/ ASX 300, S&P/ ASX Sustainability Evaluated Dividend Opportunities Index, yield

What’s driving need for index-based access to dividends in Australia? S&P DJI’s Jason Ye surveys the dividend landscape in the Australian market and takes a look at how market individuals are utilizing indices in the look for yield.

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

The Obstacle Continues: Arise From the SPIVA Latin America Mid-Year 2023 Scorecard

In the history of SPIVA (S&P Indices Versus Active) Scorecards, most active supervisors have actually tended to underperform criteria the majority of the time, particularly over longer durations. The SPIVA Latin America Mid-Year 2023 Scorecard exposed that active supervisors produced combined efficiency throughout the very first half of 2023.

Throughout H1 2023, more than half of active supervisors underperformed in the 5 out of 7 classifications observed, varying from 54% for Brazil Mid-/ Small-Cap funds to 91% for Mexico Equity funds. The only classifications in which less than half of supervisors underperformed were Brazil Corporate Bond and Chile Equity funds, at 30% and 36%, respectively. Over longer time horizons, outperformance was short lived throughout all 7 classifications, with 10-year underperformance rates varying from 82% for Brazil Large-Cap funds to 96% for Brazil Corporate Mutual fund (see Exhibition 1).

Active supervisors looked for outperformance in a typically strong market environment, with the S&P Latin America BMI increasing 21.4% over the very first half of the year and each local standard studied creating favorable efficiency for H1 (see Exhibitions 2 and 3). The start to the year remained in significant contrast to 2022, which ended with 2 criteria, S&P Brazil MidSmallCap and Mexico’s S&P/ BMV IRT, in unfavorable area.

One traditionally typical headwind for active supervisors has actually been the existence of a favorably manipulated circulation of constituent returns. Put more merely, a little number of stocks usually surpasses the benchmark return while the bulk lags. This situation was definitely present in Mexico, where just 37% of constituents surpassed the S&P/ BMV IRT in H1 2023, maybe a contributing aspect to the very high underperformance rate of Mexico Equity funds. Nevertheless, more than half of benchmark constituents surpassed throughout all 4 other equity classifications (see Exhibition 4). This fairly uncommon situation suggested that an arbitrarily picked stock in each of the 4 criteria had more than a 50% possibility of being an outperformer. In spite of this absence of favorable alter, couple of supervisors taken advantage of the chance, as the Chile Equity fund classification was the sole classification in which less than half of supervisors underperformed.

Throughout a lot of Latin American equity markets, dispersion levels in H1 2023 fell somewhat from 2022’s raised levels (see Exhibition 5). Greater dispersion, a procedure of cross-sectional volatility revealing distinctions in between stock returns within each index, has actually usually been associated not just with higher benefits from selecting outshining stocks however likewise with higher charges from choosing underperformers.

For fund selectors, dangers of underperformance are twofold. Initially, results program that a lot of funds underperform their standard with time, making the procedure of discovering a future winner statistically not likely. Second, the charge of choosing an underperforming fund has actually traditionally been more penalizing in regards to typical unfavorable efficiency than the typical benefit created from outshining funds. More exactly, bottom-quartile funds underperformed their particular criteria to a higher degree than top-quartile funds surpassed in 4 out of 7 classifications in H1 2023 (see Exhibition 6).

While the outcomes for the complete year are yet to be seen, for lots of active fund supervisors in Latin America, efficiency difficulties throughout the very first half might have made the climb ahead look much steeper.

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

Diversifying Products Increase 16% in Q3 2023 as Equities Drop

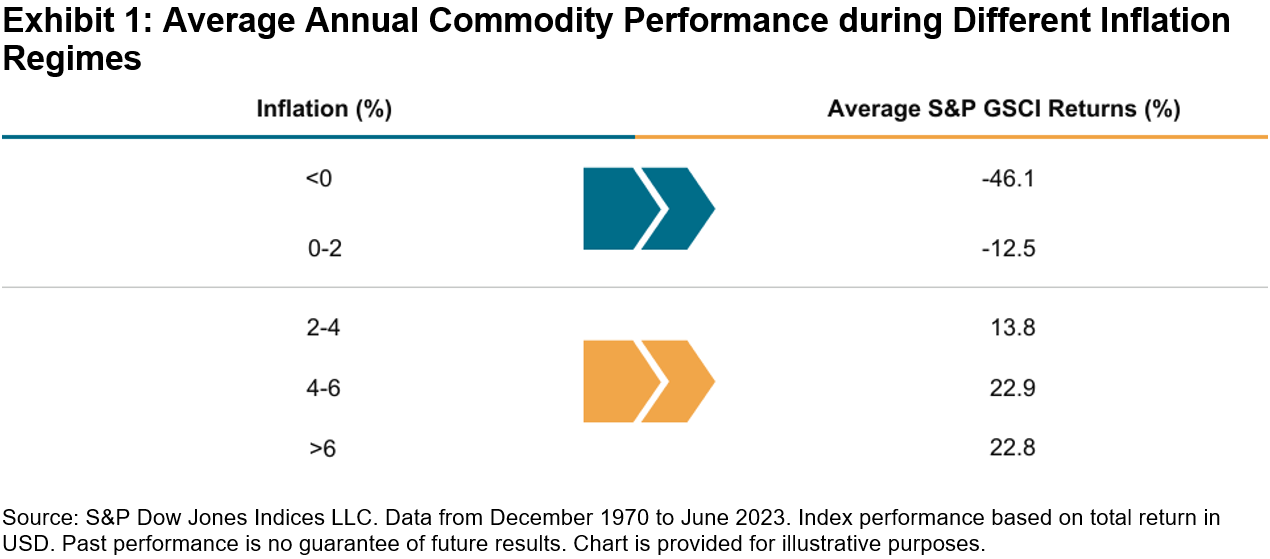

Products, as represented by the S&P GSCI, increased over 4% in September and 16% in Q3 2023. This highlighted the prospective diversity qualities of this property class, as equities and set earnings both fell throughout the month. Products’ low connections to other property classes can supply a cushion when other higher-allocated property classes drop throughout risk-off circumstances as was seen last month. Including products to a method tends to moisten general portfolio threat and drawdowns with time. Historically, throughout durations of fantastic macroeconomic shifts like we are experiencing now, a varied portfolio has actually tended to carry out much better than more extremely focused ones. Throughout durations of high and sticky inflation readings, products have actually offered a hedge when other property classes tend to drop from greater input expenses.

The primary factors to the outsized efficiency last month were the energy products. Supply cuts from Saudi Arabia and Russia were the greatest drivers as need continued worldwide. The heading S&P GSCI presently has a weight in energy products of over 60% due to its building as a world production-weighted index. Market individuals reproducing it as an inflation hedge saw greater returns just recently in contrast to other similar product indices, which tend to be more similarly weighted. Energy products tend to have the greatest inflation beta or level of sensitivity to modifications in inflation with time. Other products utilized in petroleum items such as sugar likewise increased by 5%, with its heavy usage in ethanol in South America.

The S&P GSCI Industrial Metals increased 3.51% in the 3rd quarter, with the 5 metals’ costs continuing to recover from difficult very first half 2023 efficiencies. Expectations for China’s economy to speed up were never ever satisfied, however stimulus steps are gradually being presented. China tends to be the most significant factor to metal need and this has the prospective to still hold true throughout the energy shift. The International Energy Firm (IEA) upgraded its Net No Roadmap in September, when it stated electrical power is poised to become the brand-new oil of the worldwide energy system. Metal need will likely get with time due to making use of specific commercial, valuable and uncommon earth metals increasing by lot of times more throughout a large period of tidy energy innovations.

The S&P GSCI Farming fell 4.35% and the S&P GSCI Rare-earth Elements fell 3.76% in the 3rd quarter. Both sectors, together with a lot of products, were struck by the headwind of an increasing U.S. dollar. For the farming products, lower soybean use and remarkably bigger wheat production figures were reported in the most recent USDA quarterly stocks report. Within the rare-earth elements, gold and silver both fell as genuine rates continued to increase. Gold tends to be inversely associated to genuine rates however this hasn’t held true for the majority of 2023. Current heavy reserve bank bullion purchasing might have been the factor for gold’s strength up until now in 2023.

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

Tracking Shariah Compliance with Indices

How are indices assisting broaden the variety of Shariah-compliant tools for market individuals? S&P DJI’s John Welling and Chimera Capital’s Sherif Salem sign up with Dubai Financial Markets’ Eric Solomon for an appearance inside how S&P DJI’s Shariah-compliant and Sukuk indices are assisting financiers examine and gain access to regional, local, and worldwide markets while sticking to Islamic law and lining up with customer goals.

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

Determining the Worldwide Tidy Energy Chance Set

Environment modification, resource deficiency and the shift to a low-carbon economy are producing robust, long-lasting need for worldwide tidy energy options. Look inside the S&P Global Clean Energy Index, an ingenious index constructed on robust datasets that looks for to track pure, liquid and transparent direct exposure to tidy energy.

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers