{“page”:0,” year”:2023,” monthnum”:10,” day”:4,” name”:” the-challenge-continues-results-from-the-spiva-latin-america-mid-year-2023-scorecard”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Head of U.S. Equities”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Jim Wiederhold”,”title”:”Director, Commodities and Real Assets”,”image”:”/wp-content/authors/jim.wiederhold-515.jpg”,”url”:”https://www.indexologyblog.com/author/jim-wiederhold/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Factors and Dividends Indices, Product Management and Development”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Head of Factors and Dividends”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities and Real Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”George Valantasis”,”title”:”Associate Director, Strategy Indices”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Michael Mell”,”title”:”Global Head of Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Izzy Wang”,”title”:”Senior Analyst, Factors and Dividends”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Jason Ye”,”title”:”Director, Factors and Thematics Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Daniel Perrone”,”title”:”Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Thematic Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”},{“display”:”Narottama Bowden”,”title”:”Director, Sustainability Indices Product Management”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”}]

The Obstacle Continues: Arise From the SPIVA Latin America Mid-Year 2023 Scorecard

In the history of SPIVA (S&P Indices Versus Active) Scorecards, most active supervisors have actually tended to underperform criteria the majority of the time, particularly over longer durations. The SPIVA Latin America Mid-Year 2023 Scorecard exposed that active supervisors produced blended efficiency throughout the very first half of 2023.

Throughout H1 2023, more than half of active supervisors underperformed in the 5 out of 7 classifications observed, varying from 54% for Brazil Mid-/ Small-Cap funds to 91% for Mexico Equity funds. The only classifications in which less than half of supervisors underperformed were Brazil Corporate Bond and Chile Equity funds, at 30% and 36%, respectively. Over longer time horizons, outperformance was short lived throughout all 7 classifications, with 10-year underperformance rates varying from 82% for Brazil Large-Cap funds to 96% for Brazil Corporate Mutual fund (see Display 1).

Active supervisors looked for outperformance in an usually strong market environment, with the S&P Latin America BMI increasing 21.4% over the very first half of the year and each local standard studied producing favorable efficiency for H1 (see Exhibitions 2 and 3). The start to the year remained in significant contrast to 2022, which ended with 2 criteria, S&P Brazil MidSmallCap and Mexico’s S&P/ BMV IRT, in unfavorable area.

One traditionally typical headwind for active supervisors has actually been the existence of a favorably manipulated circulation of constituent returns. Put more merely, a little number of stocks generally outshines the benchmark return while the bulk lags. This situation was definitely present in Mexico, where just 37% of constituents outshined the S&P/ BMV IRT in H1 2023, maybe a contributing aspect to the incredibly high underperformance rate of Mexico Equity funds. Nevertheless, more than half of benchmark constituents outshined throughout all 4 other equity classifications (see Display 4). This fairly uncommon situation suggested that an arbitrarily picked stock in each of the 4 criteria had more than a 50% opportunity of being an outperformer. Regardless of this absence of favorable alter, couple of supervisors profited from the chance, as the Chile Equity fund classification was the sole classification in which less than half of supervisors underperformed.

Throughout the majority of Latin American equity markets, dispersion levels in H1 2023 fell somewhat from 2022’s raised levels (see Display 5). Greater dispersion, a procedure of cross-sectional volatility revealing distinctions in between stock returns within each index, has actually generally been associated not just with higher benefits from choosing exceeding stocks however likewise with higher charges from choosing underperformers.

For fund selectors, dangers of underperformance are twofold. Initially, results program that the majority of funds underperform their standard in time, making the procedure of discovering a future winner statistically not likely. Second, the charge of choosing an underperforming fund has actually traditionally been more penalizing in regards to typical unfavorable efficiency than the typical advantage created from exceeding funds. More exactly, bottom-quartile funds underperformed their particular criteria to a higher degree than top-quartile funds outshined in 4 out of 7 classifications in H1 2023 (see Display 6).

While the outcomes for the complete year are yet to be seen, for lots of active fund supervisors in Latin America, efficiency obstacles throughout the very first half might have made the climb ahead look much steeper.

The posts on this blog site are viewpoints, not guidance. Please read our Disclaimers

Diversifying Products Increase 16% in Q3 2023 as Equities Drop

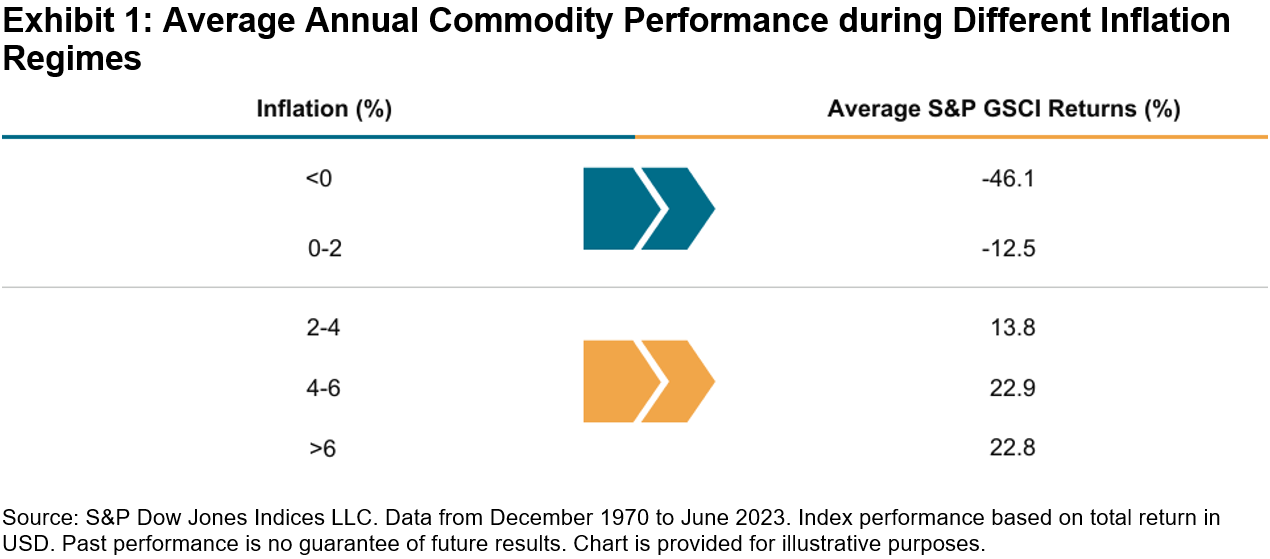

Products, as represented by the S&P GSCI, increased over 4% in September and 16% in Q3 2023. This highlighted the prospective diversity qualities of this possession class, as equities and set earnings both fell throughout the month. Products’ low connections to other possession classes can supply a cushion when other higher-allocated possession classes drop throughout risk-off situations as was seen last month. Including products to a method tends to moisten general portfolio threat and drawdowns in time. Historically, throughout durations of terrific macroeconomic shifts like we are experiencing now, a varied portfolio has actually tended to carry out much better than more extremely focused ones. Throughout durations of high and sticky inflation readings, products have actually supplied a hedge when other possession classes tend to drop from greater input expenses.

The primary factors to the outsized efficiency last month were the energy products. Supply cuts from Saudi Arabia and Russia were the greatest drivers as need continued internationally. The heading S&P GSCI presently has a weight in energy products of over 60% due to its building as a world production-weighted index. Market individuals duplicating it as an inflation hedge saw greater returns just recently in contrast to other equivalent product indices, which tend to be more similarly weighted. Energy products tend to have the greatest inflation beta or level of sensitivity to modifications in inflation in time. Other products utilized in petroleum items such as sugar likewise increased by 5%, with its heavy usage in ethanol in South America.

The S&P GSCI Industrial Metals increased 3.51% in the 3rd quarter, with the 5 metals’ rates continuing to recuperate from hard very first half 2023 efficiencies. Expectations for China’s economy to speed up were never ever fulfilled, however stimulus steps are gradually being presented. China tends to be the greatest factor to metal need and this has the prospective to still hold true throughout the energy shift. The International Energy Firm (IEA) upgraded its Net No Roadmap in September, when it stated electrical power is poised to become the brand-new oil of the worldwide energy system. Metal need will likely get in time due to making use of particular commercial, valuable and unusual earth metals increasing by lot of times more throughout a large period of tidy energy innovations.

The S&P GSCI Farming fell 4.35% and the S&P GSCI Rare-earth Elements fell 3.76% in the 3rd quarter. Both sectors, together with the majority of products, were struck by the headwind of an increasing U.S. dollar. For the farming products, lower soybean use and remarkably bigger wheat production figures were reported in the current USDA quarterly stocks report. Within the rare-earth elements, gold and silver both fell as genuine rates continued to increase. Gold tends to be inversely associated to genuine rates however this hasn’t held true for the majority of 2023. Current heavy reserve bank bullion purchasing might have been the factor for gold’s durability up until now in 2023.

The posts on this blog site are viewpoints, not guidance. Please read our Disclaimers

Tracking Shariah Compliance with Indices

How are indices assisting broaden the variety of Shariah-compliant tools for market individuals? S&P DJI’s John Welling and Chimera Capital’s Sherif Salem sign up with Dubai Financial Markets’ Eric Solomon for an appearance inside how S&P DJI’s Shariah-compliant and Sukuk indices are assisting financiers examine and gain access to regional, local, and worldwide markets while sticking to Islamic law and lining up with customer goals.

The posts on this blog site are viewpoints, not guidance. Please read our Disclaimers

Determining the Worldwide Tidy Energy Chance Set

Environment modification, resource shortage and the shift to a low-carbon economy are producing robust, long-lasting need for worldwide tidy energy services. Look inside the S&P Global Clean Energy Index, an ingenious index constructed on robust datasets that looks for to track pure, liquid and transparent direct exposure to tidy energy.

The posts on this blog site are viewpoints, not guidance. Please read our Disclaimers

Checking Out the Case for Worldwide Diversity in the Middle East

-

Classifications

Equities -

Tags

Active vs. Passive, Chimera Capital, Dubai Financial Markets, Eric Solomon, ESG, ETFs, elements, worldwide diversity, Index developments, index-based techniques, IPOs, John Welling, large-cap equities, Middle East, S&P 500, Sherif Salem, sustainability, thematics, U.S. Equities, UAE

What’s the function of worldwide diversity in the Middle East? S&P DJI’s John Welling and Chimera Capital’s Sherif Salem sign up with Dubai Financial Markets’ Eric Solomon for a more detailed take a look at the growing function of passive investing in the Middle East and how financiers are utilizing indices to notify allotments.

The posts on this blog site are viewpoints, not guidance. Please read our Disclaimers