In an international the place surprises can shatter monetary steadiness in a single day, we are facing a tricky selection: Is chasing momentary beneficial properties truly value risking the whole lot? With the nationwide debt pushing thru $33 trillion and your buying energy actually vanishing, time isn’t on our aspect.

You must questioningâwhen the debt bubble pops, will there be time to react? Sign up for me these days as we discover treasury yields, debt bubbles, and the Fedâs strikes, and uncover how the 1% are making ready. The clock is ticking. Arising.

CHAPTERS:

0:00 Good points or Regrets

2:19 10-Yr Treasury Be aware Yield

11:14 Federal Reserve

13:14 $33 Trillion Debt

19:40 Buying Energy

22:10 Good Transfer via Central Bankers

25:44 Gold & Silver

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

In an international the place surprises can shatter monetary steadiness, growth, in a single day we are facing a tricky selection. Is chasing momentary beneficial properties truly value risking the whole lot? With the nationwide debt pushing thru 33 trillion and also youâre buying energy actually vanishing. Frankly, time isn’t on our aspect. You must marvel, when the debt bubble pops, will there be time to react? Sign up for me these days as we discover treasury yields debt bubbles and the fedâs strikes and uncover how the 1% are making ready. The clock is tick, tick, ticking. Arising.

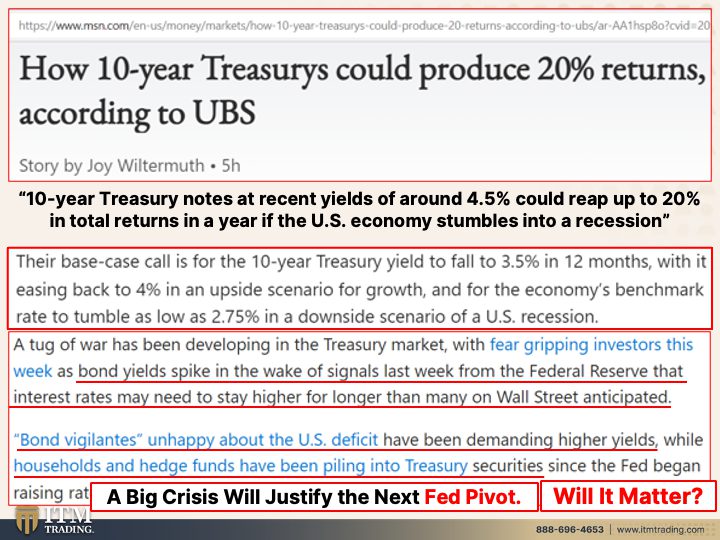

I’m Lynette Zang, Leader Marketplace Analyst right here at ITM Buying and selling a complete carrier bodily gold and silver broker, however truly focusing on customized methods. And you realize, itâs at all times such a lot higher while you in reality have a plan. You in reality have a method with the intention toât be distracted via the opposite manipulations which might be taking place. And you realize, itâs a truly attention-grabbing factor thatâs taking place at the moment, which our persons are flying to the perceived protection of treasuries. And so theyâre listening to headlines like this as a result of reasonably truthfully, the patrons of treasuries, the Federal Reserve, overseas governments thatâs been declining, they want the general public to begin to select up and purchase the ones treasuries. âreason Theyâre issuing a ton of them. And I imply, thereâs such a lot of attention-grabbing issues. Let me simply pass on.

And so that youâre gonna pay attention headlines like this, how 10 yr treasuries may just produce 20% returns in line with U B s or in line with this or that financial institution. And I ponder whether that isnât like nudging you to shop for treasuries, which is out of the frying pan into the hearth. Weâve been speaking concerning the loss of liquidity in that marketplace since 2015. And itâs handiest gotten worse since 2020. However the treasury yield, the treasury notes Iâm sorry, 10 yr treasury notes at a up to date yield of round 4 level part p.c may just reap as much as 20% in overall returns in a yr if america financial system stumbles into recession. As a result of they truly need us to assume, oh, alright, neatly, comfortable touchdown, or Hello, perhaps weâve already had the recession and we donât are aware of it. And so what theyâre truly speaking about, be mindful this, rates of interest, foremost worth when issued, worth when issued. So treasury bond comes out, or any bond it doesnât, or any debt software can be a loan, might be any debt software comes out with a said rates of interest when out there, the rates of interest pass up, the price of that theory declines. The marketplace worth of that theory declined rates of interest pass down, the marketplace worth of that theory is going up. K? Now in fact you’re assuming that what you’ll convert it into known as Federal Reserve notes anyplace they’re. Right hereâs an outdated one, k? Youâre reckoning on that maintaining some degree of worth of buying energy worth. But if theyâre speaking about those 20% returns, thatâs what theâre regarding their base case name is for the ten yr treasury yield to fall to a few.5%. So a share level in one year with it easing again to 4% in an upside situation for quote unquote development. And for the financial systemâs benchmark price to tumble as little as two and 3 quarters in a downsize situation, blah, blah blah. So what theyâre truly announcing is, k, rates of interest at 4 level a part p.c when rates of interest pass down to a few level a part p.c.

The marketplace worth of that theory of that word is going up and thatâs the way you get your 20%. Smartly, is that an opportunity? Anything else is conceivable, proper? However theyâre searching for a calamity for the Federal Reserve to do a pivot and drop charges. So let, let me display you. A tug of warfare has been growing within the treasury marketplace with worry gripping buyers as bond yields spike, proper? As bond yields spike within the wake of alerts final week from the tip this week too, frankly, it, the spiking continues from the Federal Reserve that rates of interest would possibly wish to keep upper for longer than many on Wall Side road expected bond vigilantes. Now, bond vigilante is a bond dealer that doesn’t neatly, itâs a bond dealer. Now those bond vigilantes are unsatisfied about america deficit and feature been not easy upper yields. In order that theyâve been promoting bonds, which has been pushing the ones yields up. And the foremost worth down. Now everyone, banks, central banks, anyone that purchased bonds since 2009 when yields have been driven to 0, they’ve an incredible quantity of loss. Super, proper? For this very explanation why. Thatâs why I at all times hammer that house. So you know the way bonds paintings, however bond yields spike within the wake of final weekâs sign bond vigilantes, unsatisfied about america deficit were not easy upper yields. In order that theyâve been promoting bonds whilst families and hedge finances, nevertheless itâs that family piece which have been piling into treasuries since that is what they look ahead to A disaster ensues. The fed lowers the charges and pushes the nominal worth or the marketplace worth of the ones bonds up. So bond vigilantes, bond investors are promoting and families are purchasing. Perhaps theyâre purchasing immediately as a result of in spite of everything, theyâre seeing this yield at 4 level part p.c. And so they pass, gee, theyâre, and what their stockbrokers telling âem is, it is a secure yield, however why, why is it a secure yield?

Since the executive can tackle debt and print from not anything from that debt, the cash to pay off you. After all once they do this, thatâs what theyâre doing. And that still signifies that the price of all of that debt or the cash that theyâre growing is going down and thatâs what youâre gonna convert into. So simply to recap, a large disaster, thatâs what theyâre reckoning on right here, will justify the following fed pivot, although the central financial institution is popping out and announcing, no, no, no. So the que that theyâre now not is that this upper rates of interest for longer. So the query is that it’s a must to ask your self, alright, letâs say that this occurs a large sufficient disaster. Yeah, completely may just make the, the Fed pivot and push rates of interest down in an try to encourage borrowing and spending. However will it subject? Will it truly subject? As a result of if this has completely 0 worth, itâs now not gonna subject. And thatâs what Iâm truly hoping to get you to look. As a result of all through an evident disaster, there’s a flight to perceived protection, therefore the treasury bonds. However whatâs the true protection? Bodily gold, bodily silver to your ownership? Thatâs actual protection. The opposite is solely perceived.

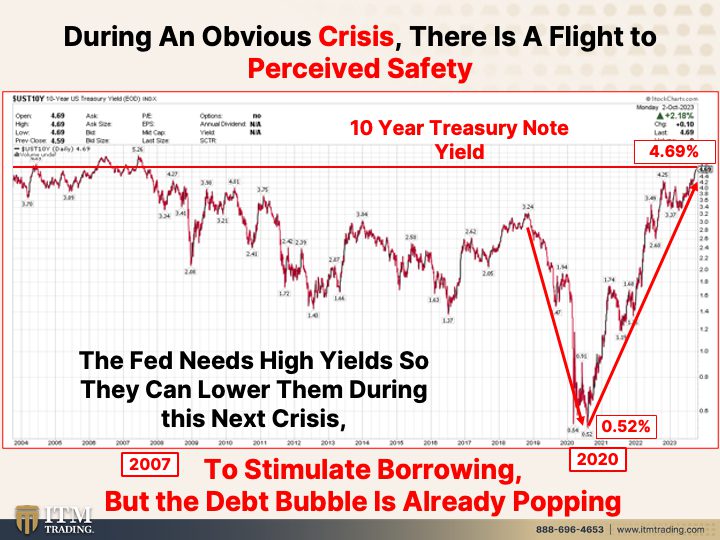

And letâs have a look. Now I do know yields went up these days, however this is going thru this is going thru the previous day. If truth be told perceive that is the yield at the treasury word. The one distinction between a invoice, a bond and a word is the period to adulthood. Shorter our expenses. 10 yr is word, 30 yr is a bond. Itâs the one distinction both anyway, they’re all debt tools. So the large communicate is truly across the treasury yield and what sort of that has spiked. You’ll be able to see how temporarily it dropped. That is what theyâre counting directly to get you the ones returns.

However, they usually went all of the method right down to 0.52%. Now they’re at 4 69. 4 4.69% didnât take very lengthy to make that occur. K? And I imagine they went up, I donât know the place they closed the day. However that implies that each one of the ones banks and all, and anyone that used to be keeping treasury bonds that locked in those charges down right here, they’re hurting. They’re hurting. We noticed SVB, we noticed the regional banks pass out. They would like you to assume that that downside is mounted. It ainât mounted. Itâs such a lot larger than simply the ones regional banks they usually know that theyâre doing it. So between the feds are between a rock and a troublesome position as a result of via elevating charges, theyâre jeopardizing the, the financial system. And via decreasing charges, theyâre looking to battle inflation. Both method, theyâre hurting everyone both method. We’ve got a disaster brewing, surely about that. However simply take note the Fed wishes upper charges so they may be able to they may be able to decrease them into the following disaster. In so doing, they did pop the debt bubble. It isn’t one thing Iâm looking ahead to to occur. Itâs one thing thatâs sitting right here and taking place as we talk. We simply canât see it.

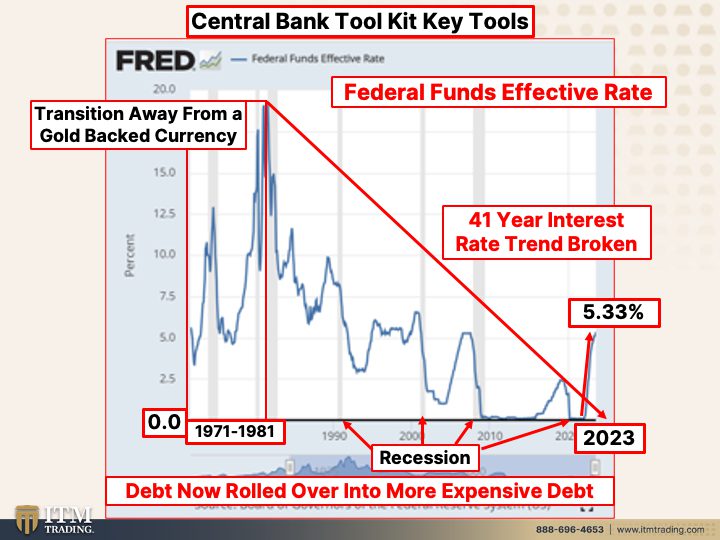

And I wanna indicate that the Fed is out of equipment. I would like you to check out the place we have been, proper? Transition clear of the gold subsidized foreign money as a result of weâre getting close to there. Once more, have a look at how temporarily rates of interest may just spike. And each time they lift the charges, which you’ll see right here, and you’ll see right here, you’ll see it right here. You’ll be able to see it right here. It brought about a recession. This subsequent one isnât gonna be simply a typical recession. Itâs now not gonna be a comfortable touchdown. Itâs now not gonna be a no touchdown. That is gonna be giant as a result of what theyâve truly finished is they’ve damaged a 41 yr development cycle. And the ones don’t pass out quietly. And and not using a whimper, they will need you to assume so as a result of in that method then you definitelyâll fly to the perceived protection. Youâll fly to fiat cash property, this rubbish youâll fly. I shouldnât name it rubbish. You’ll fly to the perceived protection of money and different issues. However the truth is you need protection. Itâs this, as a result of that is the one monetary asset that runs no counterparty menace. All of that, together with treasury bonds. This is all counterparty menace. And despite the fact that you get your theory again, what you’ll do with that theory, reasonably truthfully could be very questionable. And all of this debt, whether or not itâs executive, company or folks, bet what? All of it both must be paid, serviced, or rolled over. And the hobby that itâs gotta be rolled over into is far, a lot upper. I donât even know what bank card debt is, however boy, in case you are sporting bank card debt, you’re in deep, doo-doo as a result of the ones charges are in the course of the roof.

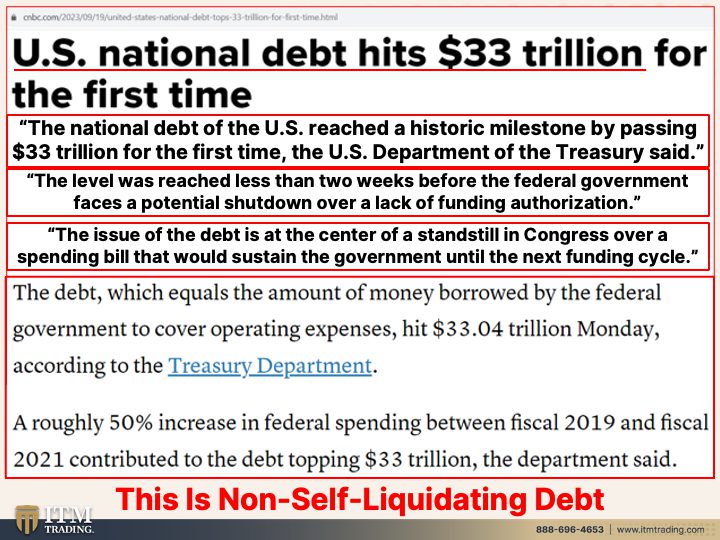

And now not handiest that, however sure certainly america nationwide debt hits 33 trillion for the primary time in 2009 after I did a find out about on, gee, if weâre handiest working trillion buck deficits, why on the earth are we servicing 13 trillion in debt? That wasnât that way back. That used to be all through the final nice monetary disaster. Weâve were given some other one coming for the reason that resolution has at all times been develop extra debt, develop extra debt. I imply, what can I say? 33 trillion. Do you assume it would, is there any likelihood in Hades that that may be a payable debt? That will be, no, it’s not a payable debt. The nationwide debt of america reached ancient milestones via passing 33 youngsters trillion for the primary time. Hmm, the extent used to be reached not up to two weeks prior to the government faces a possible shutdown over a loss of investment authorization, gotta stay spending that cash, gotta stay taking over an increasing number of and extra debt. And whilst they pulled it out on the tenth hour, so there wasnât in reality a central authority shutdown, all they did used to be put off it until prior to Thanksgiving. You recognize, we’re so divided, itâs ridiculous. The problem of the debt is on the heart of a standstill in Congress over a spending invoice that will maintain the federal government till the following investment cycle. Hmm, letâs have a look at that slightly nearer. The debt, which equals the amount of cash borrowed via the government to hide running bills, hit $33.04 trillion Monday, a more or less 50% building up in federal spending between fiscal 2019 and financial 2021 contributed to the debt topping $33 trillion. However that is what you wish to have to grasp about this debt. It’s non-self liquidating debt. Smartly, what the heck is that? Proper? Thereâs two types of debt, self-liquidating debt and non self-liquidating debt. Self-Liquidating debt can be, you personal a trade and also you amplify, you borrow cash to amplify this trade. And now you succeed in extra consumers. And so since youâre getting extra consumers and making extra earnings, you repay that debt.

This is self-liquidating debt. However what do they are saying right here? The debt, which equals the amount of cash borrowed via the government to hide running bills. Running bills. So thereâs no likelihood in Hades that that debt can also be paid off. It simply calls for extra taxes, extra depreciation in order that this cra this, those bucks have much less and no more and no more worth they usually pay off that debt with bucks that in the end haven’t any worth.

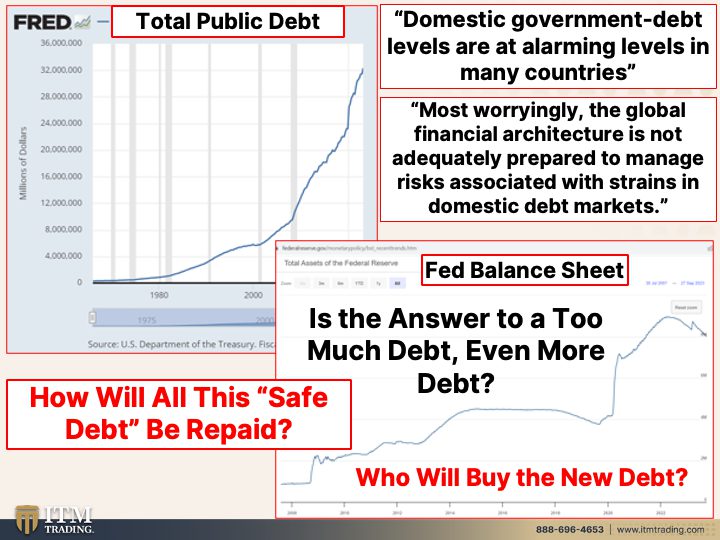

So what youâre having a look at is the entire public debt right here. And are you able to see it ever even making an attempt to be paid off? And are you able to additionally see that each time it hits a grey bar, the rate at which that debt grows sooner and sooner and sooner. I imply 2020, thatâs nearly directly up. Beautiful with regards to directly up. And oh, via the way in which, the entity thatâs been purchasing a large number of that debt, the Federal Reserve, and they’ve been since 2000, the Federal Reserve is making an attempt to normalize their steadiness sheet. All of this debt that they collected is underwater. It all. It began out prior to 2008 at 800 billion. Now itâs nonetheless at 8 trillion. Did you get that? $800 billion. $8 trillion. And so theyâre looking to liquidate it to only win a bond. Win a bond or word or invoice that theyâre keeping, matures now not rolling it over. So weâve misplaced large patrons on this debt. And what do they suspect the solution is? K? I imply, take into consideration this logically. Is the solution to an excessive amount of debt? Much more debt? As a result of thatâs at all times been their resolution. You’ll be able to see it proper right here. Thatâs at all times been the solution. âreason Thatâs how cash is created within the machine. Home executive debt ranges are at alarming ranges in many nations. This isnât only a US factor, it is a international factor. Maximum worryingly, the worldwide monetary structure isn’t adequately ready to control dangers related to lines within the home debt markets. Smartly, if the fedâs been purchasing our debt, thatâs the home marketplace. And what theyâre announcing here’s itâs exhausting to, itâs exhausting to roll that debt over if there arenât patrons. And what concerning the folks, proper? In order thatâs why they want the general public to step in. Smartly you may well be sitting there and announcing, neatly, I havenât purchased any of that. However when you have a pension or any roughly retirement plan, sure mutual finances, sure ETFs, the ones are institutional patrons which might be purchasing for your behalf. When you have a 401K and you’ve got a goal date funding, thatâs debt, thatâs bonds, it’s a must to ask your self, are you gonna be the one patrons on this debt in order that when this, when this recreation of musical chairs forestall, you’re the one whoâs left keeping the recent potato. As a result of my resolution to this is sure. My resolution to this is it’s going to be the general public that can pay. âreason Itâs at all times the general public that can pay. So is that this truly secure debt? Youâll get your foremost again âreason they may be able to create the cash. I imply thatâs, thatâs not anything. They certain know the way to do this.

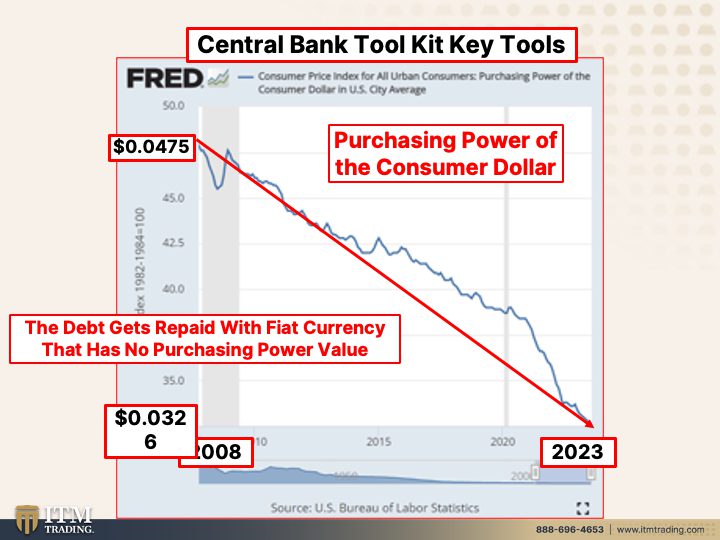

However what are you able to do with this? This was once, it is a hundred bucks invoice used so that you can in reality purchase one thing with it. As of late, how a lot are you able to purchase with it? You recognize that Thatâs the reality. You recognize, your own revel in with these items as itâs all about devaluation. That is the shopper worth index. So the buying energy of the shopper buck since 2008, because the disaster become obvious to everyone, what used to be the solution to make it seem like issues have been standard? Your buying energy loss. And you’ll see the way itâs been dashing up. What do you assume? I imply, severely, what do you assume? It handiest is going in a single course. That buying energy isn’t coming again. It by no means does. It by no means ever does as itâs been spent away. And oh, via the way in which, for those who gained the buck up right here and also you attempted to put it aside, have a look at that loss in buying energy. Theyâve been robbing you because the day you have been born. Are they gonna forestall now? Why would they? They donât have any selection. Theyâre handiest choice is to pay off that debt with bucks or fiat cash any place on the earth. This is nearly nugatory, nugatory, nugatory. Itâs that nominal confusion. When you had a $20 invoice over right here and you were given a $20 invoice over right here, itâs nonetheless a $20 invoice. However what that you must purchase with it then and what you’ll purchase with it these days is massively other. This may be a $20 coin. Hmm. Did this pass down in worth? No it didn’t. It went up relating to fiat cash. It held your buying energy in tact, which in my view is the only maximum vital factor that cash is meant to do. Grasp your buying energy intact.

The machine isn’t for your aspect. And Ray Dalio, who anticipates a revolution and so do I, he additionally says america goes to have a debt disaster thatâs bobbing up. Can I let you know that itâs gonna be Thursday morning at at 3? No, nevertheless it might be. The time to get ready is now he even says how briskly it transpires, I believe goes to be a serve as of that provide call for factor. Thatâs the provision and insist of these things. So Iâm looking at that very, very cautious intently. So Iâm looking at that very intently. Yeah, me too. As a result of a failure to achieve an settlement may just imply a central authority close down and lift the perceived menace of the rusticâs debt. However itâs already a menace. This isn’t risk-free. Your theory could also be risk-free as a result of they may be able to pass forward and simply create extra money and provides it again to you. However itâs now not risk-free as a result of you’llât do anything else with it if you get it, when all self assurance is misplaced. Thatâs it. Now, I did put this in combination prior to Sunday, which is once they went forward and handed the forestall hole invoice not to close down the federal government. However you realize, itâs gonna rear its unpleasant head time and again and time and again and once more as a result of we’ve any such divided and dysfunctional executive. And are they truly running to your highest part or in particular hobby highest part? Take into consideration that.

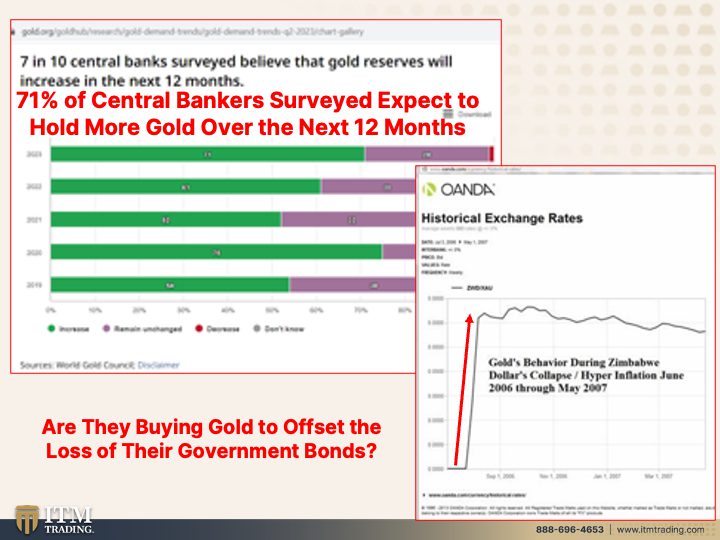

As a result of what we all know is seven in 10 central banks surveyed imagine that gold reserves will building up within the subsequent one year. Hmm. Yeah. Letâs see if this used to be such an outdated relic, why do you assume that 71% of central bankers surveyed be expecting to carry extra gold over the following one year, proper After they’ve purchased extra gold within the first part of this yr than ever in recorded historical past? Hmm. What do you assume they know and what must you realize? They know the way gold behaves all through in a single day resets as a result of they take this, that has no intrinsic worth. Itâs utilized in one position they usually reset it by contrast, which is all intrinsic worth as a result of it’s utilized in each unmarried sector of the worldwide financial system. After which bet what? That is how gold behaves once they do the ones in a single day revaluations, that also lies forward. However make no mistake about it, itâs coming. And that, I imagine, is why they’re purchasing such a lot gold to offset the losses that theyâre already in via keeping all that executive debt and now at 0% and now ratcheting the ones rates of interest up. However most commonly as a result of they wish to retain their possible choices. They wish to retain their energy and their freedoms. And Iâm considering, so do you. I do know thatâs what I wanna do.

So for those who havenât already began your gold and silver technique, click on that Calendly hyperlink underneath and get it finished. Have a dialog with one among our gold and silver professionals so they may be able to lend a hand put in combination a portfolio of gold and silver that will give you barter skill, wealth preservation, and alternative positioning. Thatâs what weâve gotta have. Thatâs why, I imply, wealth by no means disappears. It simply shifts location. Why now not have the wealth shift your method? Why now not retain your freedoms and your possible choices? As a result of they do wanna take us right into a complete surveillance financial system, a complete surveillance society. How are you able to say no? That is how you’ll do it. Together with ensuring that you’ve got Meals, Water, Power, Safety, Barterability, Wealth Preservation, Group and Safe haven. As a result of then you’re sturdy and we’re all sturdy in combination. âreason weâre all on this in combination. We willât do it on my own. I willât battle the fed alone. Who am I? Iâm not anything. However for those who sign up for me now rapidly weâre all an entire lot extra tough and we will do that. We will truly do that. We need to do that now not for ourselves such a lot. We need to do it for our kids and our grandchildren and those who are bobbing up the road as a result of theyâre going to make use of each software they may be able to recall to mind to suck us within the machine with out us understanding it. Thatâs now not k with me.

So you realize, we’ve, for those who havenât visited but, pass to Past Gold and Silver the place we discuss techniques to control all of the remainder of the chant items. And we attempt and meet you the place you’re. So if that is emblem new to you, hello weâre there for you. When youâre knowledgeable at any of those spaces, sign up for us. Lend a hand train others, make our neighborhood extra supportive and extra tough. You no doubt must be looking at my fresh deep dive on dominated via the IMF the place Iâm speaking a couple of one global foreign money. I imply run via unelected officers. I imply you all haven’t any say and weâve, weâve watched this over time. They do it slowly. They do it in order that you assume the whole lot is standard and the similar and itâs truly now not. And likewise Taylor Kenney did an excellent activity on recession alerts. I believe she does fabulous breaking it down in truly easy phrases in an overly quick time frame. So no doubt take a look at her out. Sheâs nice. I really like her. Iâm more than pleased that sheâs joined our neighborhood at ITM Buying and selling âreason I think like she brings a large number of worth to the desk. And for those who havenât subscribed right here, please click on on that hyperlink underneath and subscribe. Hit the bell. Weâll help you know once weâre going reside. Go away us a remark, give us a thumbs up. And maximum vital, percentage, percentage, percentage. As a result of monetary shields, that is what theyâre fabricated from, now not paper and guarantees that they have got no goal of retaining. Actual exhausting, tangible wealth. And till subsequent we meet. Please be secure available in the market. Bye-Bye.

SOURCES:

How 10-year Treasurys may just produce 20% returns, in line with UBS (http://msn.com )

https://stockcharts.com/h-sc/ui

https://www.cnbc.com/2023/09/19/united-states-national-debt-tops-33-trillion-for-first-time.html

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

https://www.cnbc.com/2023/09/28/ray-dalio-says-the-us-is-going-to-have-a-debt-crisis.html