{“page”:0,” year”:2023,” monthnum”:10,” day”:2,” name”:” diversifying-commodities-rise-16-in-q3-2023-as-equities-drop”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Head of U.S. Equities”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Jim Wiederhold”,”title”:”Director, Commodities and Real Assets”,”image”:”/wp-content/authors/jim.wiederhold-515.jpg”,”url”:”https://www.indexologyblog.com/author/jim-wiederhold/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Factors and Dividends Indices, Product Management and Development”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Head of Factors and Dividends”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities and Real Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”George Valantasis”,”title”:”Associate Director, Strategy Indices”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Michael Mell”,”title”:”Global Head of Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Izzy Wang”,”title”:”Senior Analyst, Factors and Dividends”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Jason Ye”,”title”:”Director, Factors and Thematics Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Daniel Perrone”,”title”:”Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Thematic Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”},{“display”:”Narottama Bowden”,”title”:”Director, Sustainability Indices Product Management”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”}]

Diversifying Products Increase 16% in Q3 2023 as Equities Drop

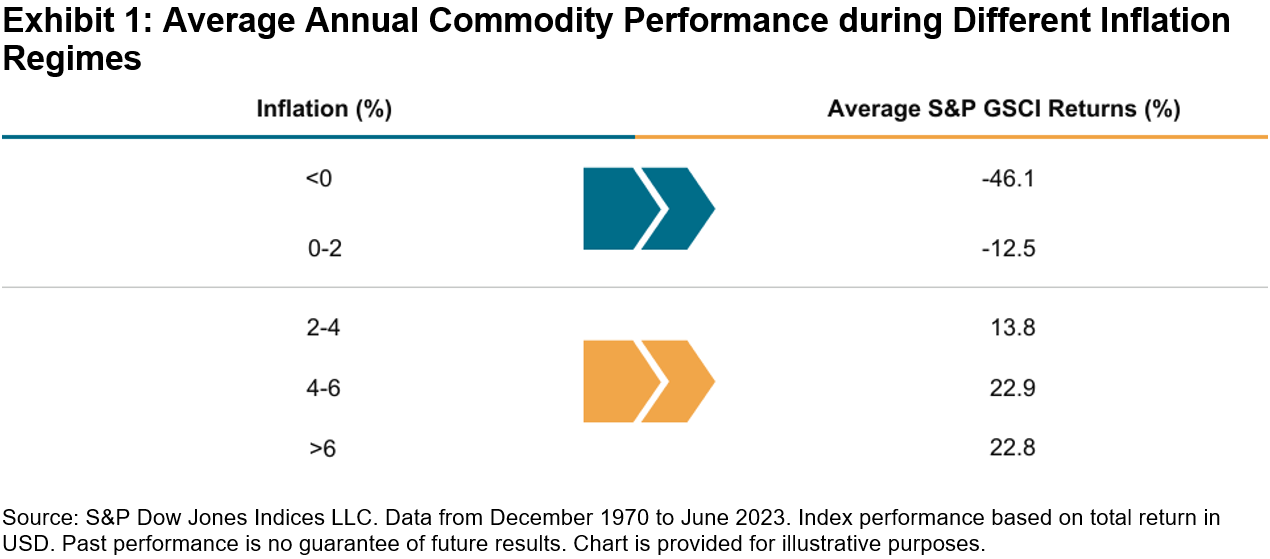

Products, as represented by the S&P GSCI, increased over 4% in September and 16% in Q3 2023. This highlighted the possible diversity qualities of this possession class, as equities and set earnings both fell throughout the month. Products’ low connections to other possession classes can supply a cushion when other higher-allocated possession classes drop throughout risk-off situations as was seen last month. Including products to a method tends to moisten total portfolio threat and drawdowns in time. Historically, throughout durations of fantastic macroeconomic shifts like we are experiencing now, a varied portfolio has actually tended to carry out much better than more extremely focused ones. Throughout durations of high and sticky inflation readings, products have actually offered a hedge when other possession classes tend to drop from greater input expenses.

The primary factors to the outsized efficiency last month were the energy products. Supply cuts from Saudi Arabia and Russia were the greatest drivers as need continued internationally. The heading S&P GSCI presently has a weight in energy products of over 60% due to its building as a world production-weighted index. Market individuals duplicating it as an inflation hedge experienced greater returns just recently in contrast to other equivalent product indices, which tend to be more similarly weighted. Energy products tend to have the greatest inflation beta or level of sensitivity to modifications in inflation in time. Other products utilized in petroleum items such as sugar likewise increased by 5%, with its heavy usage in ethanol in South America.

The S&P GSCI Industrial Metals increased 3.51% in the 3rd quarter, with the 5 metals’ costs continuing to get better from hard very first half 2023 efficiencies. Expectations for China’s economy to speed up were never ever satisfied, however stimulus steps are gradually being presented. China tends to be the greatest factor to metal need and this has the possible to still hold true throughout the energy shift. The International Energy Firm (IEA) upgraded its Net No Roadmap in September, when it stated electrical energy is poised to become the brand-new oil of the worldwide energy system. Metal need will likely get in time due to making use of particular commercial, valuable and unusual earth metals increasing by lot of times more throughout a broad period of tidy energy innovations.

The S&P GSCI Farming fell 4.35% and the S&P GSCI Rare-earth Elements fell 3.76% in the 3rd quarter. Both sectors, in addition to the majority of products, were struck by the headwind of an increasing U.S. dollar. For the farming products, lower soybean use and remarkably bigger wheat production figures were reported in the most recent USDA quarterly stocks report. Within the rare-earth elements, gold and silver both fell as genuine rates continued to increase. Gold tends to be inversely associated to genuine rates however this hasn’t held true for the majority of 2023. Current heavy reserve bank bullion purchasing might have been the factor for gold’s strength up until now in 2023.

The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

Tracking Shariah Compliance with Indices

How are indices assisting broaden the variety of Shariah-compliant tools for market individuals? S&P DJI’s John Welling and Chimera Capital’s Sherif Salem sign up with Dubai Financial Markets’ Eric Solomon for an appearance inside how S&P DJI’s Shariah-compliant and Sukuk indices are assisting financiers assess and gain access to regional, local, and worldwide markets while sticking to Islamic law and lining up with customer goals.

The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

Determining the Worldwide Tidy Energy Chance Set

Environment modification, resource shortage and the shift to a low-carbon economy are producing robust, long-lasting need for worldwide tidy energy options. Look inside the S&P Global Clean Energy Index, an ingenious index constructed on robust datasets that looks for to track pure, liquid and transparent direct exposure to tidy energy.

The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

Checking Out the Case for Worldwide Diversity in the Middle East

-

Classifications

Equities -

Tags

Active vs. Passive, Chimera Capital, Dubai Financial Markets, Eric Solomon, ESG, ETFs, aspects, worldwide diversity, Index developments, index-based techniques, IPOs, John Welling, large-cap equities, Middle East, S&P 500, Sherif Salem, sustainability, thematics, U.S. Equities, UAE

What’s the function of worldwide diversity in the Middle East? S&P DJI’s John Welling and Chimera Capital’s Sherif Salem sign up with Dubai Financial Markets’ Eric Solomon for a better take a look at the growing function of passive investing in the Middle East and how financiers are utilizing indices to notify allotments.

The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

Presenting the Dispersion Index (DSPX)

At 9:45 am Eastern Time on Sept. 27, 2023, a brand-new index started releasing under the ticker DSPX SM, with a preliminary live worth of 26.81. This index, the Cboe S&P 500 ®(* )Dispersion Index (the Dispersion Index to its good friends), may be loosely referred to as a “ VIX ®(* )for dispersion.” However what is it? Why is it called that? And what is it great for? A brief intro remains in order. Determining Market Chance Dispersion is a

basic procedure of threat and chance

in the stock exchange; it determines how in a different way stocks are carrying out, or are anticipated to carry out. Dispersion is a complementary procedure to market volatility; the latter steps total variations in stock averages like the S&P 500, while dispersion steps variations in stocks relative to each other. We determine dispersion traditionally

by the observed spread of stock returns (as in S&P DJI’s routine month-to-month dispersion control panel). Individually, we can obtain an expectation for future dispersion from noted choices. The Dispersion Index is based upon such expectations for dispersion over the next 30 calendar days. The Dispersion Index is released as an annualized figure, so that the preliminary DSPX level of 26.81 suggests a market expectation that the spread of annualized S&P 500 stock returns will have a basic variance of 26.81% over the next month. Display 1 reveals the historic theoretical levels of the index over the duration for which information are readily available. A Market Requirement for Tradeable U.S. Equity Dispersion

The Dispersion Index was released in cooperation in between Cboe and S&P Dow Jones Indices, utilizing the Cboe Volatility Index

®

(VIX) and the S&P 500 universe as core foundation. The VIX method is used to both S&P 500 index choices and choices on picked S&P 500 constituents, with maturities either side of the next thirty days. The distinction in between the alternative costs for the S&P 500’s single-stock constituents and costs for choices on the index informs us just how much more motion the marketplace expects in stocks. This is, in essence, an expectation for future dispersion. Complete information of the estimation are readily available in the method What DSPX Informs United States: The Chance Index The Dispersion Index’s stablemate, VIX, is understood for using a leading gauge of market belief– for this reason its name as “The Worry Index,” along with being referred to as a frequently incorrect however

however helpful predictor

for future volatility. The details encoded in the Dispersion Index relates, however various: by determining how in a different way stocks are anticipated to carry out, dispersion examines the magnitude of the possible benefits (or possible humiliation) from active stock choice. In this sense, DSPX may be more properly monikered as “The Chance Index.” Showing its possible qualifications as a “predictor” of future stock-picking chances, Display 2 compares the index level to the

real

S&P 500 dispersion determined over the subsequent 30 calendar days. Like its stablemate, DSPX would have been a frequently incorrect however however useful sign. Making use of the S&P 500 as the beginning equity universe and the combination of the VIX method links the Dispersion Index to a broad environment of tradeable equity and volatility items

and suggests that DSPX might in the future ended up being “tradeable” itself. Till such time, by teaming up to develop the Dispersion Index, Cboe and S&P Dow Jones Indices are supplying market individuals with a real-time, thorough sign for near-term dispersion worldwide’s biggest equity market. The posts on this blog site are viewpoints, not recommendations. Please read our

Disclaimers