A significant Wall Street bank is cautioning about the threat that inflation expectations might end up being unanchored in a style comparable to the 1970s stagflation period.

Weekend attacks on Israel by Hamas show how geopolitical threats can unexpectedly return– contributing to the surprise shocks of the present years, such as the COVID-19 pandemic and Russia’s intrusion of Ukraine, stated macro strategist Henry Allen and research study expert Cassidy Ainsworth-Grace of Frankfurt-based Deutsche Bank

DB,.

Check Out: Concerns emerge over how Israeli intelligence missed out on Hamas attack

Oil rates settled more than 4% greater on Monday as traders weighed the effect of the war in the Middle East on unrefined materials. The spike in energy rates is contributing to the growing list of resemblances to the 1970s periodРwhich likewise consists of regularly above-target inflation throughout significant economies and duplicated optimism about how rapidly it would fall; strikes by employees; and even increasing opportunities that this winter season will be controlled by the El Ni̱o weather condition pattern, comparable to what occurred in 1971 and which is traditionally connected to greater product rates, according to Deutsche Bank.

Inflation stays above reserve banks’ targets in every G-7 nation– the U.S., Canada, France, Germany, Italy, Japan, and the UK. For how long it will stay high is among the most crucial concerns dealing with monetary markets, and a destabilization of expectations would make it even harder for policy makers to bring back rate stability.

” So offered inflation is still above its pre-pandemic levels, it is essential not to get contented about its course,” Allen and Ainsworth-Grace composed in a note launched on Monday. “After all, if there is another shock and inflation stays above target into a 3rd and even a 4th year, it is progressively challenging to think of that long-lasting expectations will consistently remain lower than real inflation.”

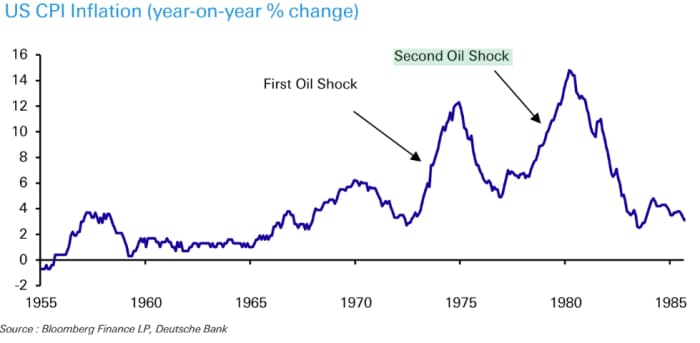

History shows that the last mile of inflation is typically the hardest. Among the crucial lessons of the 1970s was that inflation stopped working to go back to previous levels after the very first oil shock of 1973 and U.S. economic crisis of 1973-1975, and went even greater following a 2nd oil shock in 1979. Now that inflation has actually been above target for the last 2 years, “a fresh inflationary spike might well lead expectations to end up being unanchored,” according to the Deutsche Bank note.

Source: Bloomberg, Deutsche Bank.

In the meantime, the general public’s inflation expectations, as determined by a New york city Fed study of customers in August, stay mostly steady, though still above the Federal Reserve’s 2% target.

The present duration varies from the 1970s period in a variety of methods, the Deutsche Bank group likewise mentions. Long-lasting inflation expectations stay “remarkably” well-anchored, product rates have actually fallen significantly from their peaks over the previous 12 to 18 months, and supply-chain interruptions that emerged throughout the pandemic have actually “broadly recovered.” In addition, the U.S. is less energy extensive than in the previous and less prone to harm from a 1970s-style energy shock.

Nevertheless, “it is critically important to prevent complacency,” Allen and Ainsworth-Grace composed. “Certainly, with the advantage of hindsight, among the errors of the 1970s was that policy was relieved up too early, which added to a revival in inflation.”

Risk-off belief dominated in monetary markets throughout the early part of Monday, before stocks turned higher throughout the New york city afternoon. All 3 significant U.S. stock indexes.

DJIA

COMPENSATION

ended up greater in an unpredictable session. Trading in U.S. government-debt futures showed higher need and gold rallied as a flight to security took hold. The money market for Treasurys was closed for Columbus Day and Indigenous Peoples Day.