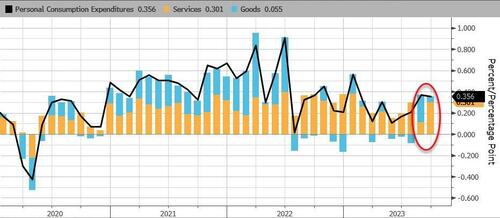

Among The Fed’s preferred inflation indications – Core PCE Deflator – slowed to 3.7% YoY in September (its most affordable given that May 2021). Heading PCE was flat at 3.4% YoY. Both remained in line with expectations …

Source: Bloomberg

Nevertheless, while the YoY information slowed, Core PCE increased by 0.3% MOTHER – the greatest mother dive in 4 months.

Providers inflation leaving out real estate and energy sped up to 0.4%, from 0.1% in the previous month.

The total PCE cost index, on the other hand, increased 0.4%, strengthened by greater energy costs.

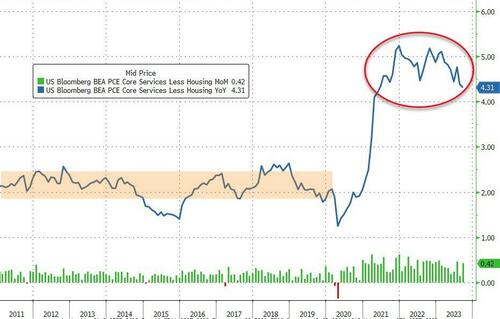

Much more concentrated, is the Fed’s view on Provider inflation ex-Shelter, and the PCE-equivalent programs that it is slowing/trending lower however quite still stuck at high levels (and increased a big 0.4% MOTHER) …

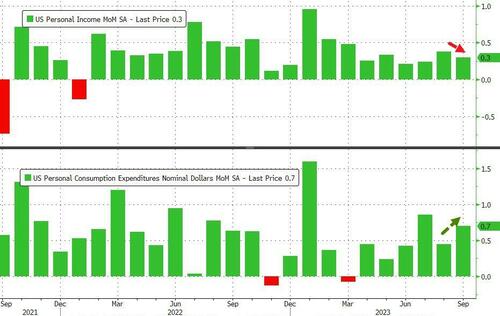

Individual Intake skyrocketed 0.7% mother while earnings grew at just 0.3% MOTHER …

Source: Bloomberg

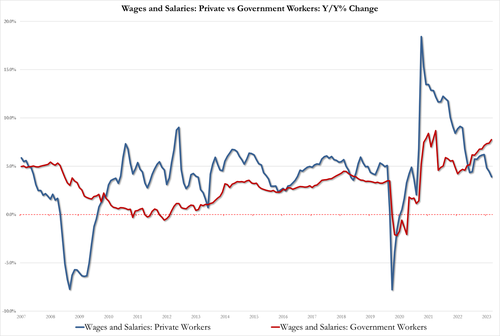

Concentrating on the earnings side alone, personal employees earnings plunged to 3.9%, below 4.5% and the most affordable given that Feb 2021.

So where is the balanced out to hot earnings you might ask? Why federal government employees: earnings of govt employees are up 7.8% YoY vs 7.4% in August and approaching the record high of 8.7% in Oct 2021

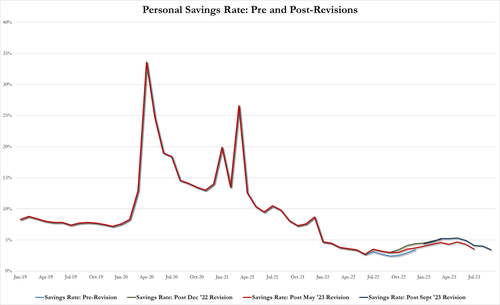

All of which implies the individual cost savings rate collapsed even further, from 4.0% to 3.4% of DPI …

Source: Bloomberg

The cost savings rate is down 4 straight months, back near record lows … AND this is after synthetic modifications that synthetically improved the cost savings rate 3 times in the previous year ( see above chart)

Bidenomics, hard at work.

Filling …