Today, gold and silver went their different methods, with gold increasing and silver falling, with today’s Gaza headings pressing gold significantly greater …

With area gold topping $2,000 for the very first time considering that Might …

And, as Bloomberg’s Nour Al Ali mentions, this current velocity might move the rare-earth element to a fresh record high.

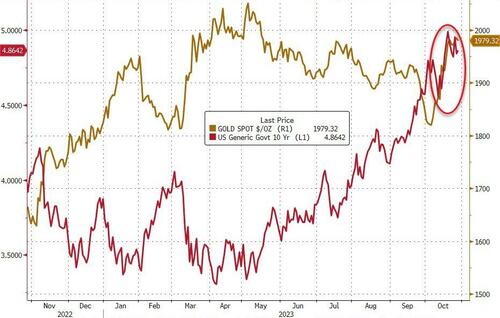

Gold has actually rallied nearly 10% this month in spite of rising United States yields and a resistant dollar, mainly driven by its appeal as a safe-haven property in the middle of geopolitical stress in the Middle East.

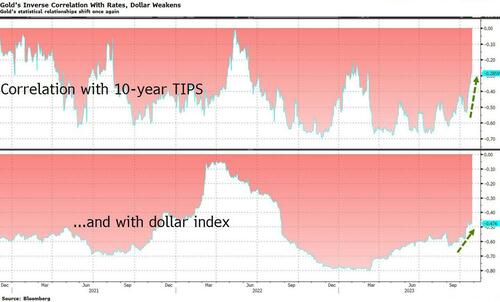

Its historic inverted connection with genuine yields and the dollar, typically trustworthy and strong, has actually just recently subsided, based upon the distinction in between the possessions determined daily on a 40-day duration.

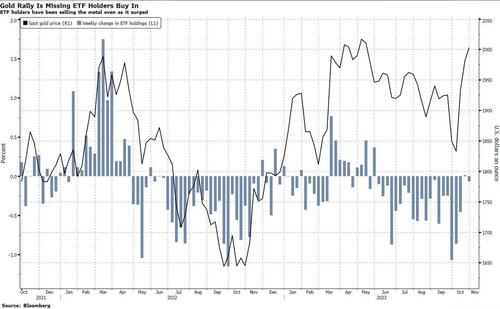

Its outstanding resurgence has actually seen the rare-earth element leading $2,000 per ounce limit, recovering from an October low of ~$ 1,810. Speculators, triggered by geopolitical stress and purchasing pressure from funds moving from brief to net long positions, have actually sustained this renewal. Yet, overall holdings in bullion-backed ETFs have actually continued to decrease as property supervisors stay concentrated on United States financial strength, increasing bond yields, and the expense of holding non-interest-bearing rare-earth elements.

Their loss.

As the marketplace’s attention now turns to Middle East advancements, gold’s present cost action, within a high rising channel, suggests both its rally’s strength and the requirement for combination, as kept in mind by Saxo Bank’s Ole Hansen, who concludes, “a close above $2,000 can press gold beyond the previous record highs it saw around $2,050 in May this year, and March 2022.”

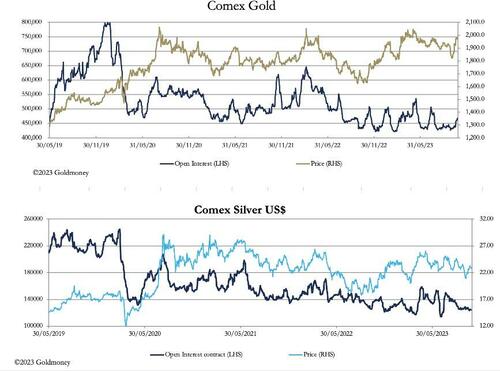

Certainly, as GoldMoney’s Alasdair Macleod describes listed below, all the action remains in gold, with Comex Open Interest continuing to increase as our next chart programs, while that of silver is still controlled.

This month, the relationship has actually driven the gold/silver ratio greater, presently at 87. However it is not as if the hedge funds have actually been aggressive purchasers of gold agreements. While in these markets the Dedication of Traders figures for 17 October are stagnant (upgrade for 24 October due tonight), they exposed that the Managed Cash classification was just net long 15,103 agreements.

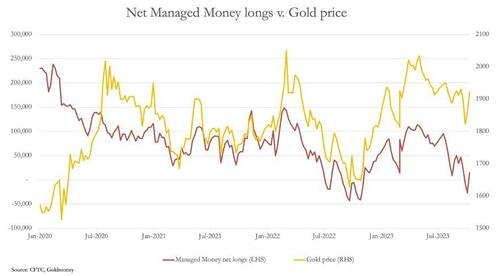

he next chart reveals the position relative to the gold cost.

The broadening space in between the cost and net longs is bullish. It suggests the gold cost has actually held up well in spite of hedge funds not purchasing. With Open Interest having actually increased by under 30,000 agreements considering that the COT figures, hedge funds are not likely to be more than 35,000– 40,000 agreements net long today versus a neutral position of over 100,000 agreements. To put it simply, after an increase of $175 in this month alone, gold still looks oversold.

The minor caution is that in the next couple of days, there is the month end agreement expiration, when the Swaps and market makers might make a collective effort to get rates down so that as lots of call choices as possible end useless.

There are 2 factors for this modification in behaviour: geopolitics, and a growing awareness of the alarming state of the United States Federal government’s financial resources.

The Israeli-Hamas scenario is the most immediate. The other day, American jets assaulted Hamas-related positions in Syria. At the very same time, President Putin has actually welcomed senior Hamas and Iranian leaders to Moscow for talks, most likely to America’s inconvenience.

With the western alliance unquestionably backing Israel and Russia with an eye on her Muslim interests, the dispute in Gaza is threatening to expand.

For dealerships in gold, it appears that we are early in a weakening scenario.

The worry should be that the western alliance presses the limits as far as it can to safeguard the Israelis.

The larger photo is to not provide anymore ground to the Asian hegemons over impact in the Middle East. The Saudis are type in this, no longer kowtowing to the United States, dealing with Russia and Iran to manage oil rates.

This is the brand-new truth. If the United States has a pop at Iran, Iran will most likely strike back by closing Hormuz and driving oil rates substantially greater. And unlike in the past, led by the Saudis the Arab world will most likely unify behind Iran.

One last word on America’s degrading financial resources: gold is now increasing together with United States Treasury yields …

… suggesting that the dollar is ending up being destabilised by Bidenomics, and a financial obligation trap is being sprung on United States Federal government financial resources.

By Zerohedge.com

.