Contributions leapt 11.8% (more individuals working, huge pay boosts). Outgo leapt 12.0% (more individuals at retirement age and the 8.7% SODA POP).

By Wolf Richter for WOLF STREET

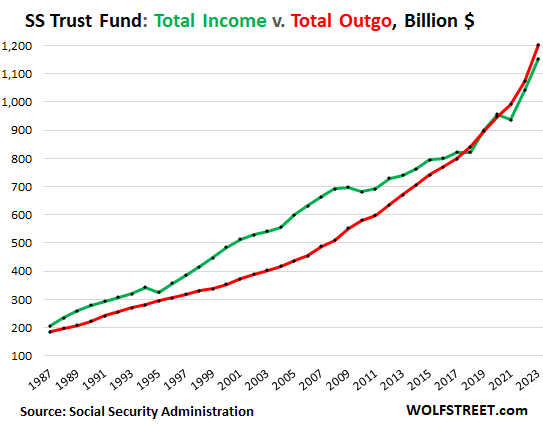

Overall earnings from all sources leapt by $111 billion from the previous year, or by 10.7%, to a record $1.15 trillion in the United States federal government ended September 30, according to the Social Security Administration (SSA) today (green line in the chart listed below). By classification of earnings:

- Contributions leapt by $110 billion, or by 11.8%, to $1.04 trillion due to work development and huge pay boosts in 2022 and 2023.

- Interest earnings from the securities in the Trust Fund dipped by $2 billion to $63 billion.

- Tax of advantages increased by $3 billion to $50 billion.

Overall outgo increased by $129 billion, or by 12.0%, to a record $1.20 trillion (red line), on the 8.7% Expense of Living Modification, the greatest given that 1981, and more individuals at retirement age and drawing Social Security advantages. Advantages paid represented 99.2% of the outgo; the staying 0.8% were comprised of transfers to Railway Retirement programs ($ 5.6 billion) and administrative expenses ($ 4.3 billion).

When the green line (overall earnings) was above the red line (overall outgo), the Trust Fund collected properties. When the green line fell listed below the red line, the Trust Fund diminished.

The space in between earnings and outgo was $50 billion, up from a deficit of $32 billion in 2022, however below the $55 billion deficit in 2021, after surpluses in 2020 and 2019.

The very first deficit in the information returning to 1987 took place in 2018 ($ 19 billion). Till then, the yearly surpluses had actually produced the $2.8 trillion in the Trust Fund at the time.

The low 3.2% soda for next year will slow the development of the outgo. With the release of the CPI information 2 weeks earlier, the CPI-W was likewise launched. It’s the procedure that the soda estimations are based upon, and they were quite thin: In 2024, the soda of 3.2% will be bad for retired people, however it will slow the deficit, or might even produce a surplus if work and pay continue to grow at the existing speed.

The Social Security Trust Fund.

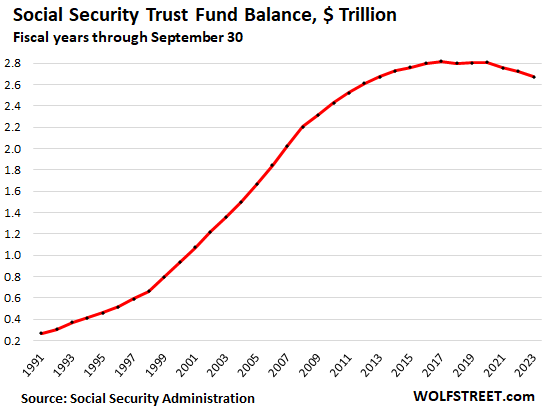

Technically referred to as “Old-Age and Survivors Insurance Coverage (OASI) Trust Fund,” it decreased by $50 billion, or by 1.8%, throughout the , to $2.67 trillion, according to SSA information.

These figures to not consist of the Special needs Insurance coverage Trust Fund, which by law is a different entity from the OASI Trust Fund, and is not part of this conversation here.

How the Trust Fund invests the $2.67 trillion

The OASI Trust Fund buys interest-bearing Treasury securities and short-term money management securities. These securities are not sold the secondary market, comparable to the popular I-bonds that lots of people, consisting of a variety of WOLF STREET commenters here, are holding at TreasuryDirect.

It’s an advantage that the securities in the Trust Fund are exempt to the impulses and periodic turmoil of the secondary market: The worth of these holdings– comparable to the worth of our accounts at TreasuryDirect– does not vary with the costs in the secondary market. The Trust Fund holds Treasury securities up until they grow and after that makes money stated value for them. Everyday rate variations are unimportant for the Trust Fund.

At the end of the , the Trust Fund held $2.47 trillion in interest-bearing special-issue Treasury securities and $202 billion in short-term cash-management securities (” certificates of insolvency”).

Buying Treasury securities when they’re provided and holding them up until they grow is a low-risk conservative technique that basically removes credit danger.

This technique permits the SSA to run the system with ultra-low administrative expenditures, totaling up to simply 0.16% of the properties under management.

The Fed’s rate of interest repression produced the deficit.

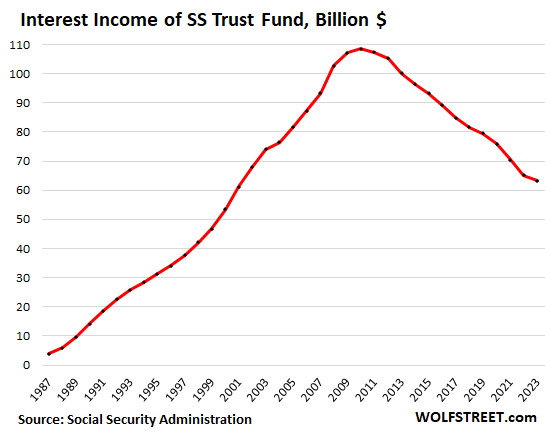

The Trust Fund made $63 billion in interest on its Treasury holdings in the , down by 42% from the peak in 2010, the year of peak interest, though the Trust Fund balance was smaller sized in 2010 than today.

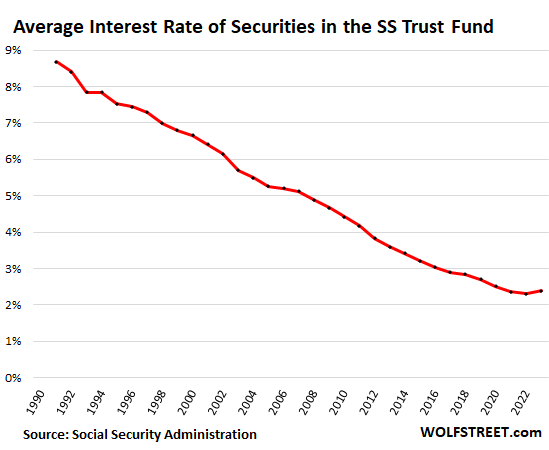

The typical weighted rate of interest that the Trust Fund made ticked as much as 2.4% this , from 2.3% in 2015, as greater yielding securities started changing some lower yielding securities in the Fund– however it’s still simply a small enhancement.

As an outcome of the Fed’s rate of interest repression beginning in 2007, the rate of interest that the Trust Fund made was cut by over half, from 5.1% in 2007, to 2.4% this year.

Since the Fund buys long-lasting securities and since rate of interest of securities do not alter up until the securities grow and are changed with brand-new securities, there is a lag before modifications in long-lasting yields filter into the “typical rate of interest” and into the interest-income stream.

The typical variety of years to maturity utilized to be around 7 to 7.5 years. However in 2020 it started to drop, and in the through September, it decreased to 5.67 years, the quickest on record. Simply put, the existing crop of higher-yielding securities is going to make their method into the Fund a bit quicker.

Today’s rate of interest would get rid of the deficit.

If the Trust Fund had actually made a typical 5% on its balance of $2.67 trillion this year, it would have made $133 billion in interest earnings, rather of $63 billion, and the Fund would have had a surplus of $20 billion!

Undoubtedly, what the Trust Fund experienced– that the Fed damaged its capital by means of rate of interest repression in between 2007 and 2022– is exactly what all yield financiers, consisting of retired people, experienced on their fixed-income financial investments.

If longer-term Treasury yields stabilize in the 4% to 8% variety, as held true in between 1990 and 2007 (they were even greater in the previous twenty years), the Fund’s earnings and outgo would be back in balance. However it would take a couple of years before the low-yielding securities would be changed by greater yielding securities.

Fairly little modifications would get rid of the deficit.

The existing space is not big– $50 billion this year, or 4% of overall earnings, in spite of the big 8.7% SODA POP. The Trust Fund still has $2.67 trillion in collected surplus. At a yearly deficit of $50 billion, it’s going to take several years before the fund lacks cash. You can do the mathematics. At that out-of-money point, if no other modifications are made, advantages would require to be cut by some portion to match earnings.

The deficit will likely be smaller sized next year, based upon the 3.2% SODA POP. And besides greater rate of interest, a mix of fairly little modifications to the strategy would bring it back into balance for years to come.

Numerous propositions have actually been drifted in Congress throughout the years. And prohibiting the Fed to take part in QE (repression of long-lasting rate of interest) must belong to the service, and would do some heavy lifting.

It’ll exist, however it will not suffice.

Social Security was never ever meant to be the sole income source in retirement. It was created as a base layer of earnings to keep individuals out of abject hardship or even worse when they can no longer work. Social Security will exist when individuals retire, the spousal advantages will exist, and the survivor advantages will exist. However they will not suffice.

And the Soda pops throughout the years will not suffice either to totally offset the loss of the acquiring power of the senior citizen’s dollar.

Social Security was created to be supplemented by other incomes, such as from properties or cost savings that individuals put aside throughout their working lives.

In addition, working for as long as possible, even part-time, is extremely advantageous in all elements. Our political leaders have actually figured that out too. They’re working well past their complete Social Security retirement age– a few of them years past their complete retirement age– and they’re undoubtedly having a blast doing it.

Enjoy reading WOLF STREET and wish to support it? You can contribute. I value it exceptionally. Click the beer and iced-tea mug to discover how:

Would you like to be alerted by means of e-mail when WOLF STREET releases a brand-new short article? Register here

![]()