Weekly highlights

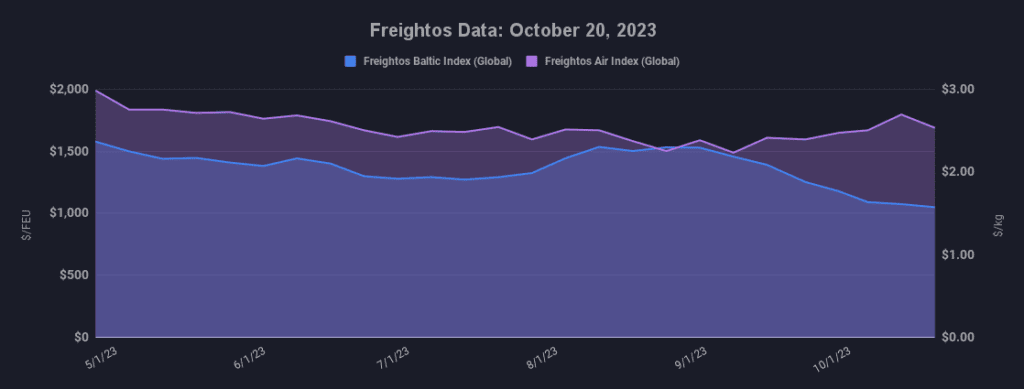

- Asia-US West Coast costs (FBX01 Weekly) reduced 3% to $ 1,499/ FEU

- Asia-US East Coast costs (FBX03 Weekly) fell 4% to $ 2,141/ FEU

- Asia-N. Europe costs (FBX11 Weekly) increased 3% to $ 978/FEU

- Asia-Mediterranean costs (FBX13 Weekly) fell 5% to $ 1,400/ FEU

- China– N. America weekly costs were level at $ 4.80/ kg

- China– N. Europe weekly costs increased 4% to $ 3.86/ kg

- N. Europe– N. America weekly costs increased 1% to $ 1.71/ kg

Dive much deeper into freight information that matters

Remain in the understand in the now with immediate freight information reporting

Analysis

The current information from September revealed continued strength amongst United States customers as retail costs increased.07% compared to August. At the exact same time, there are numerous indications that a downturn might be coming consisting of some costs pull-back amongst lower-income customers, a falling individual conserving rate, and a boost in financial obligation delinquencies.

Reports by lots of significant sellers that stocks are now under control is a favorable indication for the possibility of a restocking cycle after the vacations if costs holds up. However the diminished of those stocks in the last couple of months likewise suggested less importing and a fairly brief and controlled peak season this year.

Need continues to alleviate into the common post-peak season pre-Lunar Brand-new Year lull, however transpacific rates might be leveling off at a brand-new flooring as providers work to minimize capability. Costs to the West Coast fell 3% recently however have to do with even with the early-October level of $1,500/ FEU. Rates to the East Coast reduced 4% and are 5% lower than at the start of the month. In addition to considerable blanked cruisings, THE Alliance likewise revealed today that they will suspend one East Coast service beginning in mid-November till more notification.

Asia– N. Europe rates stayed listed below $1,000/ FEU recently. Significant European ports reported lower Q3 volumes than in 2015, with total Asia– N.Europe volumes falling in August after climbing up the previous 2 months. Some experts job year on year development for the trade lane in Q4, however rates are most likely to be much lower than in 2015 indicating continuous battles with overcapacity.

More providers have actually revealed Asia– N. Europe GRIs prepared for November to attempt and press rates as much as rewarding levels. Like on the transpacific, providers are suspending Asia– N. Europe services together with slow-steaming and blanked cruisings in the hopes of bringing capability in line with need.

However, industry-wide, ships with an overall capability of more than a million TEU are currently idled, and some experts are forecasting that capability development will overtake volume development a minimum of through 2024. These patterns indicate providers will deal with the ongoing difficulty of lining up supply with need, down pressure on rates and possible losses next year and beyond.

Freight news takes a trip faster than freight

Get industry-leading insights in your inbox.