Weekly highlights

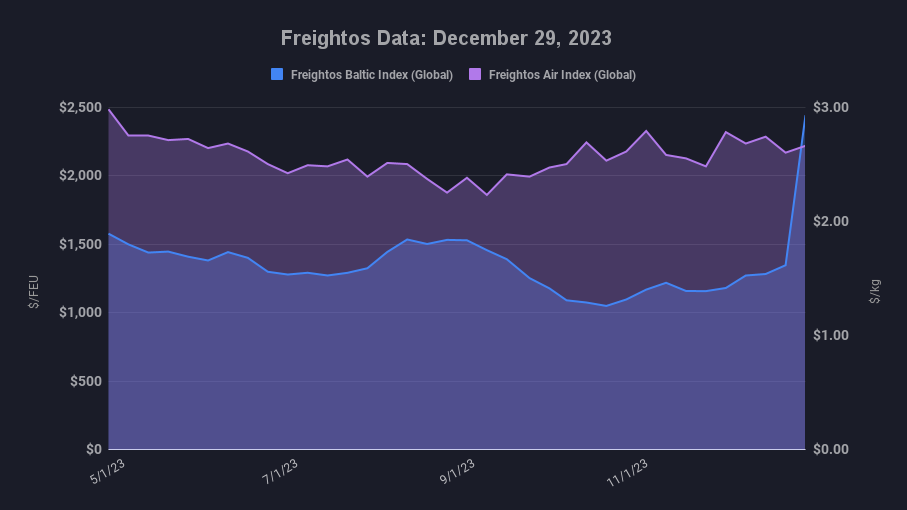

- Asia-US West Coast costs (FBX01) increased 63% to $ 2,713/ FEU

- Asia-US East Coast costs ( FBX03) climbed up 55% to $ 3,900/ FEU

- Asia-N. Europe costs ( FBX11) increased 151% to $ 4,042/ FEU

- Asia-Mediterranean costs ( FBX13) increased 108% to $ 5,175/ FEU

- China– N. America weekly costs remained level at $ 5.85/ kg

- China– N. Europe weekly costs fell 25% to $ 2.98/ kg

- N. Europe– N. America weekly costs fell 13% to $ 1.82/ kg

Dive much deeper into freight information that matters

Remain in the understand in the now with immediate freight information reporting

Analysis

Even with the US-led global marine job force in location, Houthi attacks on industrial vessels continued recently consisting of a rocket attack and tried hijacking of a Maersk container ship on Saturday

Saturday’s tried hijacking– considerable since Maersk was among 2 providers to just recently reveal it would reroute back through the Suez Canal– marked an escalation. The United States action sunk 3 Houthi boats approaching the Maersk ship, supposedly eliminating 10. International stress are increasing as the UK is thinking about targeting Houthi positions in Yemen and Iran moved a warship to the Red Sea on Sunday, mentioning that Iranian marine vessels have actually regularly remained in the Red Sea “” to protect shipping lanes, fend off pirates, to name a few functions because 2009.” Houthi rocket attacks have continued into the New Year even after United States and UK reactions.

A lot of container providers are continuing to divert their vessels far from the Red Sea even with the force patrolling. Maersk and CMA CGM had actually resumed some Red Sea cruisings since late recently, and revealed that they would slowly return completely when possible. However following the attack on Saturday, Maersk suspended all its Red Sea transits till additional notification.

The longer trips for diverted services suggest longer preparation for importers and some risk of port blockage if upgraded schedules can’t be kept and numerous vessels come to as soon as, though up until now there have actually not been reports of stockpiles. The excess capability that providers were competing with before the Red Sea disturbances will now be triggered to utilize more ships than normal per service to attempt and stay up to date with departure schedules and keep containers moving.

Some providers are reducing the “leisure time” N. American import containers are enabled to sit at location ports in efforts to accelerate the return of empty containers and prevent devices lacks at Asian origin ports, as empty containers will now take longer to return to export centers.

The diversions are likewise triggering ocean rates to surge.

Asia– N. Europe rates have actually increased 173% compared to right before the diversion statements, to more than $4,000/ FEU. Asia– Mediterranean costs have actually doubled to more than $5,000/ FEU. These rates are more than double costs in January 2019. CMA CGM revealed Asia– Mediterranean rates will increase to more than $6,000/ FEU on January 15th. Providers have actually likewise revealed additional charges varying from $500 to as much as $2,700 per container which might press the all-in costs paid by carriers even greater.

Rates to N. America’s East Coast have actually climbed up 52% to $3,900/ FEU, 30% greater than in 2019. Some providers have actually included considerable additional charges for India– N. America containers, and $500/FEU additional charges for all Asia– N. America deliveries beginning in mid-January, though additional charge statements for N. America have actually not been prevalent up until now. Costs to the West Coast have actually likewise increased greatly, climbing up more than $1,000 per container to $2,713/ FEU, perhaps showing some awaited shift in need to the West Coast to prevent the increased transit time to the East Coast.

With additional charges, if all-in costs reach the $5k– $8k per container variety for these significant ex-Asia tradelanes, those rate levels would be 2.5 to 4 times above regular levels for this time of year.

However compared to the pandemic years, providers have the readily available capability to attend to diversions and longer trips. The extra expenses and capability used up by the longer transits are pressing rates up substantially, however even at $5,000– $8,000/ FEU, Asia– N. Europe and Mediterranean costs would be 45%– 65% lower than their $14k/FEU pandemic peak in late 2021, and 65%– 75% lower compared to the Asia– N. America East Coast peak of $22k/FEU.

In air freight, some experts are anticipating the hold-ups in ocean freight to cause some shift of more immediate volumes to sea-air services or air freight options. Up until now there have actually not been reports of any considerable air freight bump, however. Freightos Air Index rates for Asia– N. America have actually stayed level, while Asia– N. Europe costs reduced recently, to their least expensive level because August of in 2015 at about $3.00/ kg.

Freight news takes a trip faster than freight

Get industry-leading insights in your inbox.