andresr/E+ by the use of Getty Photographs

This text analyzes MercadoLibre (NASDAQ:MELI) with a selected center of attention on questions on valuation. How a lot will have to an investor be prepared to pay for hyper-growth? It relies to a big stage on how lengthy that development can be sustained earlier than it starts to vanish. A declining development charge produces a double whammy of slower development blended with a decrease valuation. The present excessive development charge of MELI is indeniable, however a brand new investor’s criterion will have to be at the sustainability of that development. To justify its present PE of 70 it will have to keep growing revenues at one thing no longer a lot under its present 35% development charge. My criterion for this text is that having a look 3 years into the long run its revenues will have to a minimum of double. An organization that may reach that when virtually 20 years of lifestyles is in an excessively elite membership.

Opting for earnings as essentially the most strong development criterion (income and money go with the flow contain a benefit margin variability which can have much less constant reasons), the This fall full-year file is where to start out. Here is what Looking for Alpha’s Quant Issue for Enlargement has to mention about that:

|

Score |

Earnings Enlargement |

Sector Median |

MELI 5Y Avg. |

|||

|---|---|---|---|---|---|---|

|

YOY |

A | 36.72% | 5.43% | 57.54% | ||

|

FWD |

A | 35.29% | 5.45% | 43.42% |

The important thing quantity above is the 35.29% ahead development charge which is missing most effective the This fall earnings quantity which can exchange the This fall 2022 quantity. It is simple to assume that the TTM quantity in Financials is immediately similar to the December 2022 quantity, which means that the earnings development charge as of the tip of 2023 used to be about 25%, however this is obviously no longer the case. Within the Q3 Shape 10-Q, the 9-month charge of build up in revenues used to be 35.52% whilst the three month charge of development used to be on the subject of 40%. The previous determine used to be on the subject of the above 35.29%. With a little bit mathematics, it turns into transparent that the ahead estimate for finish of the yr 2023 revenues is prone to exceed 14,500 which means that MELI’s fading from previous development charges close to 100% is stabilizing and not off course to increase its present speedy earnings development. We will be able to have precise numbers within the Annual Record in February.

In the end, after all, all hyper-growth corporations start to decelerate and MELI will probably be no exception. The minimum expectation going ahead, alternatively, is that MELI will double revenues and build up income at most likely two times that charge over the following 3 years. For this reason, I noticed MELI as undervalued once I bought it on November 14. It’s now up 16% since I purchased it and nonetheless, personally, a Sturdy Purchase. The Looking for Alpha Quant gadget sees it as a Hang even supposing the 2 maximum necessary Components, Enlargement, and Profitability, ranked it A+. I do know that it’s exhausting for a 70 PE to generate anything else however an F score for Valuation. At that altitude, you need to needless to say numerous issues can pass fallacious, however it is similarly necessary to needless to say revenues are prone to double over the following 3 years which calls for a compounding development charge of round 26%. Income are prone to double in two years, which might deliver the valuation down significantly. Previous years have been slightly lumpy as much as 2015 when effects started to stabilize. Summing it up, remarkable execution combines with an enormous possible inhabitants of consumers to make MercadoLibre a hyper-growth corporate value its excessive valuation.

The Greater Context Of Alternative

Many elements come into play, however with MELI the most obvious start line is that it does trade solely in rising marketplace nations. A perfect rising marketplace funding calls for first opting for nations and areas the place in keeping with capita GDP is somewhat low however has the possible to upward push hastily. Latin The usa suits this description as do a couple of different spaces. It is no twist of fate that Mexico used to be in a digital tie with India for the best-performing rising marketplace of 2023 (up 17%). Helped via near-shoring (Mexico) and friend-shoring (India) each are benefitting from US reluctance to do trade with China. One main appeal of Latin The usa is its huge inhabitants, round 665 million as of July 2023 or 1.8 instances the blended 371 million US/Canadian inhabitants of North The usa. Listed here are the six main Latin American nations via inhabitants:

- Brazil 216,423,448

- Mexico 123,485,557

- Colombia 52,085.168

- Argentina 45,773,854

- Peru 39.352,719

- Venezuela 28,838,499

Opting for a particular funding is steadily harder than opting for the rustic or area. With Mexico, as an example, not one of the Mexico ETFs had the specified mixture of rising corporations and industries. Wal-Mart de Mexico (OTCQX:WMMVY), regardless that a tight candidate, did not have the explosive development one would search in an rising marketplace. Moreover, WalMex is a single-country offshoot of its American mother or father and isn’t absolutely consultant of the massive possible of Latin The usa as a complete. What I sought used to be a fast-growing corporate tightly aligned with the long run development in the usual of residing for the entire continent. Considering of it this fashion MercadoLibre used to be the most obvious selection.

Adam Smith And MercadoLibre

MercadoLibre is a corporation acquainted to many traders however with one large benefit which is hidden in undeniable sight. It in reality suits in two classes – rising markets and hyper-growth retail – and each techniques of having a look at MELI are necessary. Based in 1999 via Marcos Galperin, an Argentine simply completing his MBA at Stanford, it connected itself to the way forward for Latin The usa from the beginning. Its Venture Commentary is maximum notable for its brevity and the absence of monetary center of attention throughout the corporate. The unspoken premise is if MELI can elevate the well-being of the Latin American inhabitants, monetary rewards will care for themselves. This is the only sentence objective:

Our venture is to democratize trade and fiscal services and products to turn into the lives of tens of millions of other folks in Latin The usa.”

This temporary Venture Commentary is going the entire as far back as Adam Smith, the highbrow father of capitalism who if truth be told by no means used the phrase capitalism. The actual center of attention of Adam Smith’s paintings used to be no longer at the earnings of companies however at the well-being and advanced way of life of the inhabitants. That is the name and theme of his foundational guide The Wealth of International locations (1776). It isn’t capitalism in keeping with se however its “invisible hand,” and is the reason the best way through which the pursuit of earnings via the wealthy produces desired items successfully and offers them to the inhabitants at an inexpensive fee. The miracle is that this occurs with none central route. Benefit-making companies finally end up doing what a deliberate economic system may aspire to do, however they do it higher. Smith wrote concerning the democracy of the “invisible hand” in those phrases.

They (rich businessmen) ….make just about the similar distribution of the necessaries of existence which might had been made, had the earth been divided into equivalent parts amongst all its population, and thus with out intending it, with out figuring out it, advance the passion of the society, and manage to pay for way to the multiplication of the species…the beggar, who suns himself via the facet of the freeway, possesses that safety which kings are preventing for.”

In this SA article “How Adam Smith May Have Valued Amazon, Netflix, Tesla, and Small Biotechs” (August 10, 2020) I made the argument that the worth a trade supplies to its shoppers is conjoined with the worth of a trade to its self-interested homeowners. Smith understood implicitly that for a trade to flourish, the necessary factor used to be offering worth to its buyer base. It is this reciprocity of consumers and homeowners which makes the size of possible shoppers a useful gizmo in estimating the long-term sustainability of speedy development. That is particularly helpful in inspecting corporations that can not be absolutely evaluated via the usual marketplace metrics of gross sales, margins, income, PE, and discounted money go with the flow. Additionally it is the rationale revenues are essentially the most helpful statistic to believe.

Adam Smith’s considering is thus central to the universe of younger and leading edge corporations like MercadoLibre. The prospective marketplace is all of Latin The usa the place it has the entire benefits of a primary mover. The very extent of the stumbling blocks to doing trade in Latin The usa at the side of its previous failure to meet up with different Western economies quantity to each a problem and an unlimited alternative. To get a complete figuring out of each the problem and the chance it is useful to check out the place Latin The usa is now and the way it were given there.

Massive Demanding situations Come With Huge Alternative

The long-term financial historical past of Latin The usa is dismal. The ultimate time Latin The usa had the next GDP in keeping with capita than North The usa used to be 1492 and the 20 years till the Aztec and Inca empires each collapsed. There’s a huge scholarly literature making an attempt to account for this deficient efficiency however till the piece of analysis cited under, there had by no means been a unmarried authoritative view. All nations in Latin The usa now have populations which can be predominantly Eu in starting place with little distinction in ethnic make-up, tradition, and schooling. Why, then, has South The usa persistently carried out so miserably in comparison to North The usa?

This 2005 NBER Running Paper (#1008) entitled “Latin The usa In The Rearview Replicate” written via prominent students Cole, Ohanian, Riascos, and Schmitz lays out the necessary ancient info. NBER (Nationwide Bureau for Financial Analysis) Circulating Papers are typically essentially the most authoritative resources on necessary topics which might be handed round amongst students and policymakers. This one, regardless that written 25 years in the past, remains to be the gold usual for offering a complete clarification as to why since 1950 Latin The usa as a complete has made 0 growth in catching up with the USA. It supplies the definitive resolution as to why the USA, Europe, and Asia have pulled additional and extra forward with just a few temporary native successes similar to Venezuela in the beginning of the oil increase and Chile, which won a little bit in a length of financial reforms. East Asian nations which had a unique inhabitants and no background in Western economics have been reasonably poorer than Latin The usa in 1950 however have left Latin The usa in the back of and in large part stuck up with the USA since then. This example has endured to the current as has the affect of this paper which has 3 fresh follow-ups printed in 2010, 2020, and 2021.

A couple of information issues from the Cole et al NBER paper lay out the intensity of the issue. (I counsel that bold readers Google the paper, join the loose NBER club, and familiarize themselves with the detailed argument.) In 2000, the extent of LatAm employment used to be 70% of that of the USA whilst in keeping with capita source of revenue used to be most effective 22% as opposed to 69% for all different Western nations. That is the transparent results of an enormous deficit in General Issue Productiveness – productiveness which arises no longer from human failure however from aggressive boundaries. From 1950 to 1998 General Issue Productiveness in Latin The usa if truth be told fell from 33% to 32% whilst Europe as a complete rose from 39% to 79% of that of the USA and East Asia from 15% to 54%. If , this hyperlinks to the Federal Reserve Financial institution of Minneapolis printed model of the paper which accommodates on the backside quite a lot of tables through which the above numbers and rather a couple of others are incorporated.

The above are surprising comparisons that pass some distance towards explaining the intense poverty of the vast majority of Latin Americans accompanied via the deprivation of many items and services and products and such easy fundamentals as to be had banking. The Cole et al paper explains those issues virtually solely relating to General Issue Productiveness, low and static productiveness deriving from the absence of useful establishments (similar to banks), and the decision of small rich elites to deal with their benefits via price lists and different way of constricting pageant. The under are tariff charges on shopper items for a couple of main nations incorporated in a desk on the backside of the NBER paper:

- Argentina 176%

- Brazil 260%

- Chile 328%

- Columbia 247%

- Mexico 114%

The above numbers date from the length when founder Marcos Galperin used to be rounding up monetary make stronger for MELI. The egregious tariff charges display the boundaries he must get previous. Its main competition have been and stay executive entities which can be happy with a establishment that makes items pricey and inefficiently delivered and for which the deficient and dependent will have to pay in money as a result of they’re with out get right of entry to to banks. Not too long ago MELI scored a victory with new August 1 import tax charges exempting the primary $50 of cross-border imports (important to MELI) whilst enacting a normal charge of 17% as mentioned in brief in this SA Information hyperlink. Brazil however stays essentially the most protectionist nation in Latin The usa, and traders wish to stay an in depth eye on all trends involving imports. Then again, MELI’s earnings, as mentioned within the Q3 income name, have been 60% from Mexico and 40% from Brazil. Getting the cross-border import tasks on an inexpensive foundation is easily value some hassle.

The devastating poverty and backwardness of Latin The usa provide an enormous alternative this is to be had to the corporate that is in a position to ship high quality items and services and products affordably at the side of fintech to allow the fewer privileged to shop for successfully. The scale of the distance between Latin The usa and extra evolved Western nations is thus the long-term scale of the chance.

MercadoLibre And Amazon By way of The Numbers: Does Valuation Even Topic?

MercadoLibre and Amazon (AMZN) are very equivalent corporations, such a lot in order that maximum of MELI’s trade gadgets are the an identical of equivalent gadgets of Amazon. It is all the time slightly of a wonder when reminded that Amazon is if truth be told lower than 5 years older. A lot of what Amazon does serves to supply an instruction handbook for MELI as in Amazon Top which served as a type for MELI Royalty. MELI’s Royalty program seems to be a extra complete, reasonably costlier, and winning model. This is applicable similarly effectively in relation to making an allowance for suitable valuation. As with Amazon, the foremost questions are how briskly this corporate can develop and for a way lengthy. The corollary query: how excessive can the PE ratio be and the way lengthy can it stay excessive earlier than earnings and benefit development start to sluggish and motive PE to say no?

MercadoLibre is an amazingly environment friendly and impulsively rising corporate and would indisputably advantage the next PE than extraordinary wholesome and rising corporations. The query is how a lot upper? It is attention-grabbing that the CRSP (Middle for Analysis In Safety Costs, U. of Chicago Sales space College) method used to make a choice development shares for the foremost development indexes has no elements that come with valuation. What this says in impact is that an organization blessed with loopy development numbers and excellent possibilities for the long run does no longer wish to be evaluated via customary worth standards similar to PE, PB, and PS – the P in each and every case being Worth.

Worth, in keeping with CRSP, is not in reality an element value making an allowance for within the early phases of a hyper-growth corporate, so that you will have to simply put out of your mind about Valuation. Being a lifelong worth investor this hasn’t been simple for me to just accept, however it stems from the best-minds analysis at Chicago’s Sales space College and is now used within the biggest development indexes. All you wish to have are quick and estimated long-term development, (produced via Knowledge of Crowds method by the use of 18,000 analysts), three-year ancient income development, three-year ancient development in revenues, a excellent investment-to-assets ratio, and a excellent go back on sources. The entire above are gangbusters for MELI except for the investment-to-assets ratio which is erratic from yr to yr and somewhat low basically as a result of MELI’s trade is so capital-light.

Someday in an organization’s existence, after all, Valuation starts to subject. Specializing in valuation means that the heroic development days are over and the CRSP method starts to allocate a part of its marketplace cap to Price price range because it did with Meta (META) during the last few years. The important query for traders is understanding how a long way someday slowing development will cause that slide towards turning into a Price inventory. A comparability of MELI and Amazon means that Amazon, regardless that nonetheless rising impulsively, is far nearer to the transition the place Valuation starts to subject.

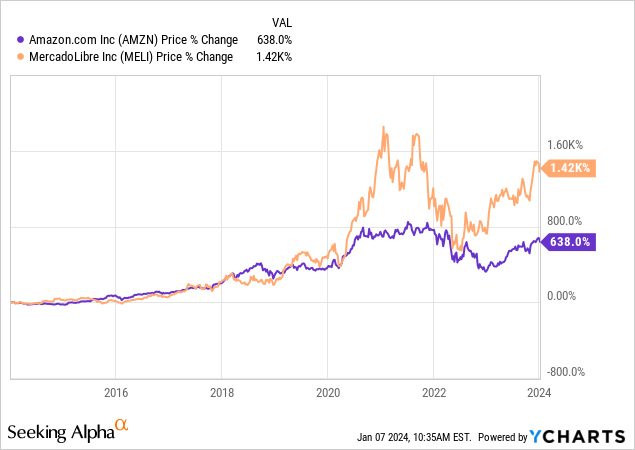

With MercadoLibre, the place effects are inherently slightly lumpy, revenues have not too long ago grown at an annual charge of slightly greater than 35%. That 35% yearly is a little bit beneath seven instances the median earnings development charge for the sphere (numbers being taken from SA Enlargement Issue above). Amazon revenues via comparability develop at a tempo of 10-11% yearly, which means it calls for round seven years to double and grows round two times the median development charge of its sector. The base line income numbers are 27% for Amazon as opposed to 58% for MELI (each from SA Quant Enlargement Issue, 3-5 yr CAGR). Combining those numbers with the chart under, Amazon is starting to seem like a development corporate for which Valuation is starting to subject. MELI continues rising at a charge for revenues, income, and inventory fee which continues to mention, By no means Thoughts Valuation.

The 10-year chart under evaluating the 2 shares displays a extensive correlation of highs and lows suggesting for 2 power growers that fee displays marketplace perspectives on valuation somewhat than working effects. Over all of the ten years MELI inventory fee has grown two times as a lot whilst going up a lot sooner to the 2021 dual peaks and falling a lot sooner to the 2022 backside. Notice that MELI recovered previous and sooner from the ground.

The entire implication from each working numbers and the chart isn’t such a lot that Amazon is a lesser corporate however that it’s a lot additional alongside in its existence cycle from unbelievable development to a extra extraordinary development charge. As development charges fall from the stratosphere, valuation starts to subject, thus the divergence starts to be visual in 2019-2020. The chart development displays in a similar way timed spikes and drops which parallel patterns in all high-growth shares however the principal development steepens in want of MELI.

Why does Amazon seem to be a few years older than its near-contemporary MercadoLibre? The most efficient clarification is that Amazon operates principally in mature markets with significant pageant and the place it has already begun to push limits of gross sales and marketplace percentage.

The important thing benefit for MercadoLibre is that it operates in a far higher marketplace. To this point it has had little pageant from friends. For nations that experience a fragment of the GDP in keeping with capita of the USA, the giant mass of the inhabitants quantities to a contented looking flooring. The primary large leap in way of life is somewhat simple to reach whilst there’s a probability that complicated fintech and strategies of marketing and supply will bounce over conventional banking and slow-motion supply of products. Barring one thing sudden, MELI will have to have years earlier than it reaches where the place Amazon is now. The true query is why MELI’s present price-earnings ratio of 70 is most effective 30% upper than AMZN’s 54.

Checking In With SA Quant Rankings

Quant rankings are in particular useful with comparing MELI and its older peer AMZN despite the fact that it’s important to appear with a magnifying glass at a couple of numbers underneath the skin. The headline is that each MELI and AMZN have general rankings of Hang even supposing each and every class of size excluding Valuation is from A+ to A-. That is reasonably ordinary within the SA Quant gadget which every so often accepts a lesser valuation quantity on speedy development shares which can be stellar in Enlargement and Profitability. My reasonably convoluted interpretation is that it quantities to a caution that if development shares will have to falter MELI specifically may fall rather slightly in a rush despite the fact that working effects have been high quality.

It will have to even be famous that the SA Quant Gadget does no longer pass rather so far as CRSP in relation to ignoring Valuation. The SA Quant gadget every so often bends slightly if the Enlargement and Profitability Components are best, however on this case, valuation simply appears to be an excessive amount of of a subject matter. Oddly, Amazon is a little bit weaker than MercadoLibre on Profitability, an A- as opposed to MELI’s A+, however is however ranked a couple of issues upper and two positions upper within the Broadline Retail Business. In each instances, the foremost exception within the many Valuation classes is in PEG ratio, fee to income development, through which MELI does reasonably higher. This blip is sensible as each corporations do effectively sufficient in Enlargement to push the PEG ratio out of the F score.

The most straightforward manner to take a look at valuation in hyper-growth shares is to estimate long term PEs in response to anticipated development charges a couple of years out. Right here MercadoLibre has a robust case as a result of income development turns out prone to outgrow earnings development via a big sufficient margin {that a} consistent fee would minimally lower PE in part to 34 inside of a few years. One thing like that took place with Meta which saved rising impulsively till fee tagged the only digits, gained a Sturdy Purchase Score within the SA Quant Gadget, and has since rallied strongly. A PE ratio drop like this will not be ultimate, alternatively, as it could suggest that the marketplace sees issues at the horizon. The best can be a PE keeping its flooring or declining reasonably and ceaselessly as working effects proceed to drag the inventory fee up.

Operational Dangers

MercadoLibre has the similar chance as maximum corporations {that a} competitor will come alongside to problem it. It additionally has a moat which is composed of being the primary mover on a big scale, figuring out its shoppers, and figuring out the 2 native languages, Spanish and Brazilian Portuguese.

Govt movements additionally pose a chance. Unfriendly regulation and import taxes cannot be omitted. Any addition of industry boundaries can be destructive.

Inflation is rampant in Latin The usa and accounts for one of the crucial lumpiness of MELI’s monetary information. Whilst the nations of Latin The usa discuss simply two languages, they don’t have a unmarried forex just like the Euro. Main variations in inflation, amongst different issues, make a unmarried forex not going any time quickly, and as vacationers already know forex fluctuations are a headache which generally is a nightmare in relation to trade transactions. MELI has lived in the midst of that briar patch, alternatively, and will have to be capable of maintain it higher than maximum competition.

Conclusion

For me, essentially the most tricky a part of purchasing MELI used to be the mental barrier requiring a lifelong Price investor to forget about Valuation. SA’s Quant gadget does not rather purchase the “Forget about Valuation” argument of the CRSP gadget, and additionally it is no longer simple for me to take action. Then again, the CRSP argument is a robust one, with the structuring of Enlargement Indexes status in the back of it, and despite the fact that hyper-growth shares are probably expensive it used to be a second for my portfolio so as to add a in moderation selected high-growth place.

After making an allowance for the above arguments I purchased a pilot place in MercadoLibre on November 14 at a worth of $1431 in keeping with percentage. When I’ve conviction that my premise is true, I every so often reasonable down despite the fact that I additionally every so often take a tax loss hoping to shop for again and upload in 31 days. I’d do that with MELI. I’d additionally be at liberty to reasonable up as a emerging inventory fee is all the time a excellent Bayesian indicator that my premise is operating. Noticed via the PE quantity on my own MELI appears to be like simply as pricey to me because it does to everybody else however the higher chance perceived to me doing not anything most effective to peer the inventory fee proceed to upward push making it tougher and tougher to start up a place.

From my point of view, an investor in MELI is prone to have long-term luck despite the fact that the preliminary fee is slightly excessive. I aspire to be a long-term holder of the whole lot in my portfolio. This idea has labored effectively through the years (I these days hang no dropping positions) and I’d be expecting it to paintings in particular effectively with a hyper-growth corporate like MELI. To me, this is a Sturdy Purchase.

My advice to readers who have not thought of one of the crucial above arguments is to learn the necessary passages a couple of instances and believe taking a modest pilot place. As all the time stay your losses small and let your winners trip.

Editor’s Notice: This text discusses a number of securities that don’t industry on a big U.S. alternate. Please take note of the dangers related to those shares.