{“page”:0,” year”:2024,” monthnum”:2,” day”:8,” name”:” bond-beginnings-and-beyond”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Head of U.S. Equities”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Wenli Bill Hao”,”title”:”Director, Factors and Dividends Indices, Product Management and Development”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Head of Factors and Dividends”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities, Real & Digital Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”George Valantasis”,”title”:”Associate Director, Factors and Dividends”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Jason Ye”,”title”:”Director, Factors and Thematics Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Michael Mell”,”title”:”Global Head of Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Andrew Innes”,”title”:”Head of Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Izzy Wang”,”title”:”Senior Analyst, Factors and Dividends”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Thematic Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Daniel Perrone”,”title”:”Former Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Elizabeth Bebb”,”title”:”Director, Factor & Dividend Indices”,”image”:”/wp-content/authors/elizabeth_bebb-511.jpg”,”url”:”https://www.indexologyblog.com/author/elizabeth_bebb/”},{“display”:”Margaret Dorn”,”title”:”Senior Director, Head of ESG Indices, North America”,”image”:”/wp-content/authors/margaret.dorn-390.jpg”,”url”:”https://www.indexologyblog.com/author/margaret-dorn/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”}]

Bond Starts and Beyond

American political expert James Carville when commented that he wishes to be reanimated as the bond market because, “ you can daunt everybody” Since July 2023, the international bond market consists of about USD 135 trillion of securities, of which ranked business financial obligation represents USD 23 trillion 1 U.S. business financial obligation comprises approximately half of the international overall, and as Exhibition 1 shows, the 1980s were a turning point in the U.S., as business progressively changed far from looking for bank loans for funding requirements and towards leveraging the growing financial obligation capital markets.

The structure of bond holders has actually likewise developed. Many seemingly, direct retail ownership of corporates and U.S. Treasuries has actually near cut in half, from 20% of impressive issuance in 2010 to 11% since Q2 2023. On the other hand, possessions in U.S. bond shared funds have actually nearly doubled. This has actually become part of a wider pattern of “professionalization” or disintermediation, which saw homes gravitate far from direct security ownership and towards shared funds throughout the booming market of the 1990s

In contrast to the equity markets, where index-based funds have concerned represent nearly half of invested capital, about three-quarters of mutual fund possessions were still actively handled at year-end 2023, as we observe in Exhibition 3. This is partially since set earnings index funds have a much shorter history than their equity cousins: a bond index fund didn’t exist till 1986, and the very first bond ETF wasn’t released till 2002— both lagging their equity equivalents by a years approximately.

Nevertheless, passive investing in the bond markets might capture up. Simply as in equities, it appears challenging for active supervisors to surpass over the long term On the other hand, given that 2010, the percentage of international shared fund and ETF possessions that are passively handled has actually in truth grown much faster in bonds than in equities.

If the transformative trajectory of passive investing in equity markets is any guide for set earnings, the phase might now be set for an exceptional future for passive set earnings management. To evaluate whether (and why) bond markets may continue to capture up, we welcome you to dive into our extensive analysis here

1 Describes the quantity of international and U.S. business financial obligation ranked by S&P Global Rankings since July 2023. For additional information, please see Limbach, Sarah, Gunter, Evan M., and Singh, Vaishali, “ Credit Trends: Global State of Play: Financial Obligation Development Diverging By Credit Quality,” Sept. 6, 2023.

The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

S&P High Yield Dividend Aristocrats Rebalance: Let’s Invite the 18 Newest Members

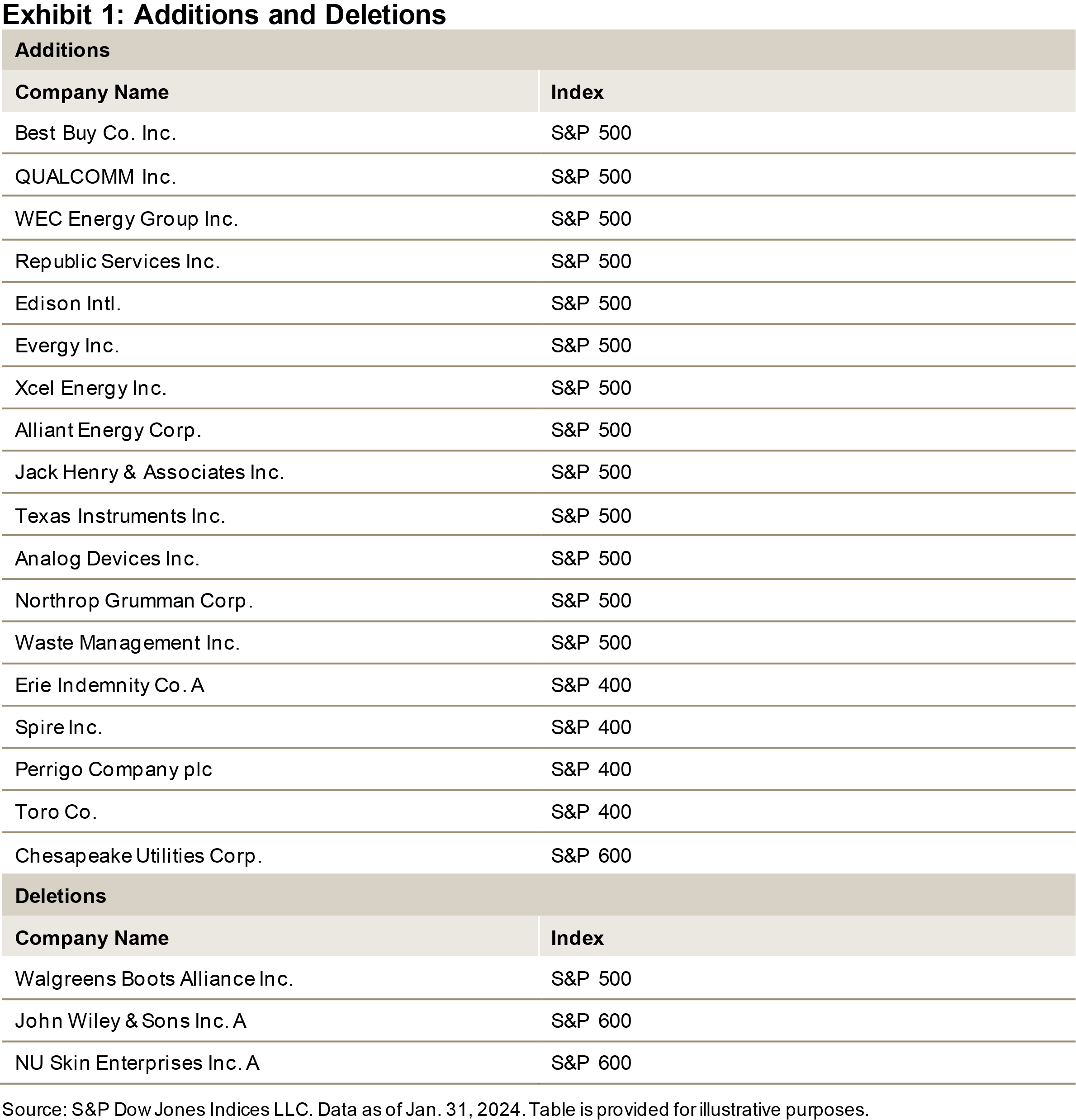

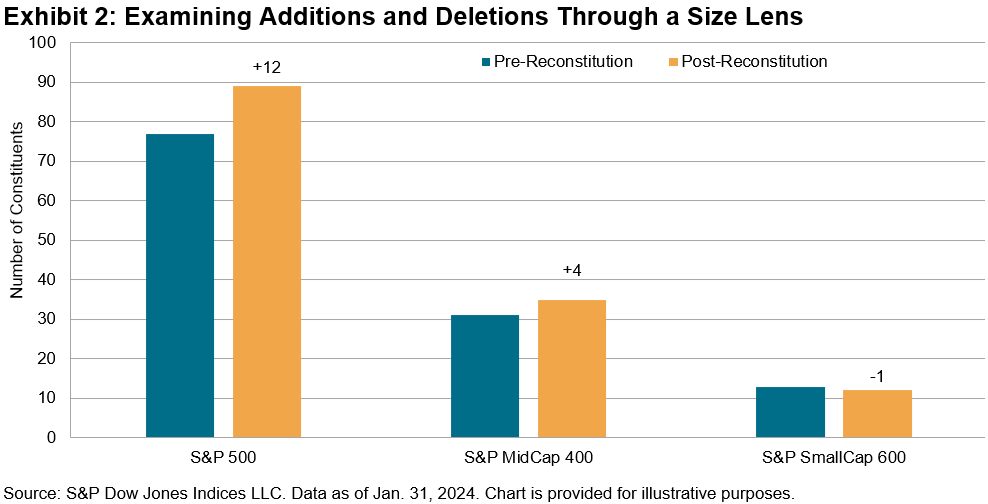

The S&P High Yield Dividend Aristocrats ®(* )consists of big-, mid-, and small-cap business in the U.S. that have actually raised their dividends for a minimum of 20 successive years. The index just recently concluded its yearly reconstitution on Jan. 31, 2024, which brought 18 brand-new members into this accomplished group. Accounting for the 3 removals, the index’s overall count increased from 121 to 136, which boosts its general diversity and liquidity. This blog site will take a look at the additions and removals through a size and sector lens and supply a take a look at the admirable performance history of constituents’ dividend boosts. Exhibition 2 information how the reconstitution impacted the S&P High Yield Dividend Aristocrats from a size viewpoint. Pre-reconstitution, the index had 77, 31 and 13 constituents in the

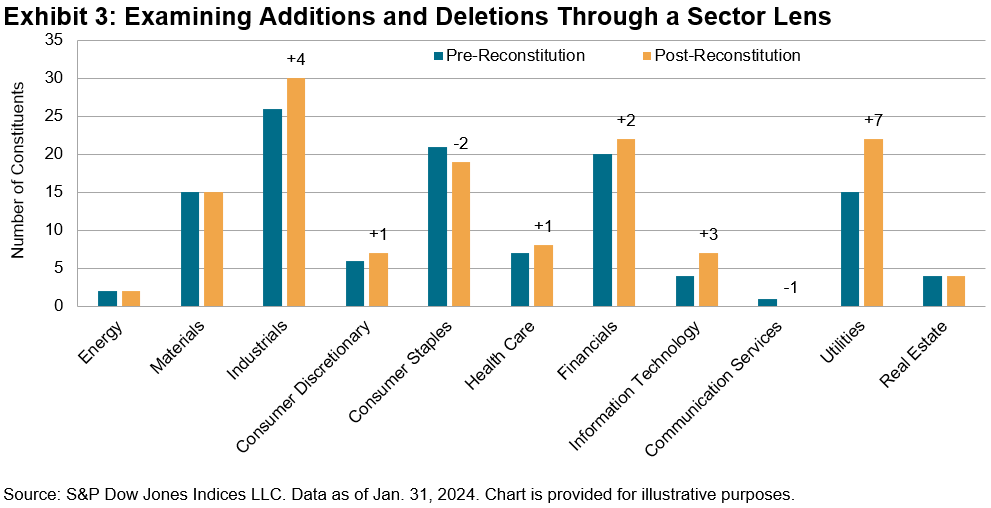

S&P 500 ® ,& S&P MidCap 400 ® and S&P SmallCap 600(* )® , respectively. The 15 net additions consisted of 12 net additions from the S&P 500, 4 additions from the S&P MidCap 400, and 1 net reduction from the S&P SmallCap 600. Post-reconstitution, there are 89, 35 and 12 constituents from the S&P 500, S&P MidCap400 and S&P SmallCap 600, respectively. As Exhibition 3 screens, Energies and Industrials were the greatest recipients of the reconstitution, with their net counts increasing by 7 and 4, respectively. Industrials now consists of 30 constituents, 8 more than the next-highest sectors by count: Financials and Utilities, each with 22. After losing 2 constituents, Customer Staples dropped to the third-highest sector by count, with 19. The only constituent in the Interaction Providers sector, John Wiley & & Sons, was gotten rid of from the index, leading to Interaction Providers being the only GICS ®(* )sector without representation in the index.

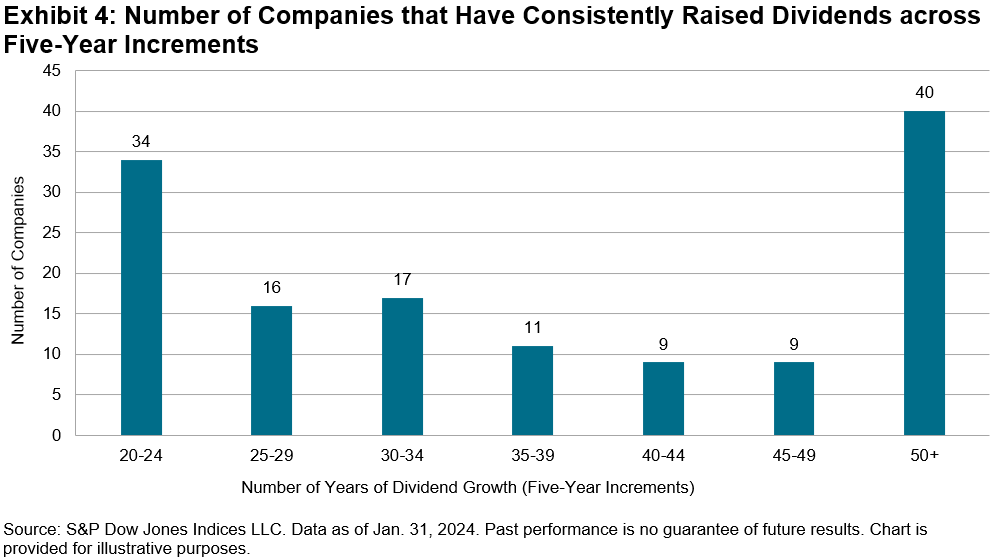

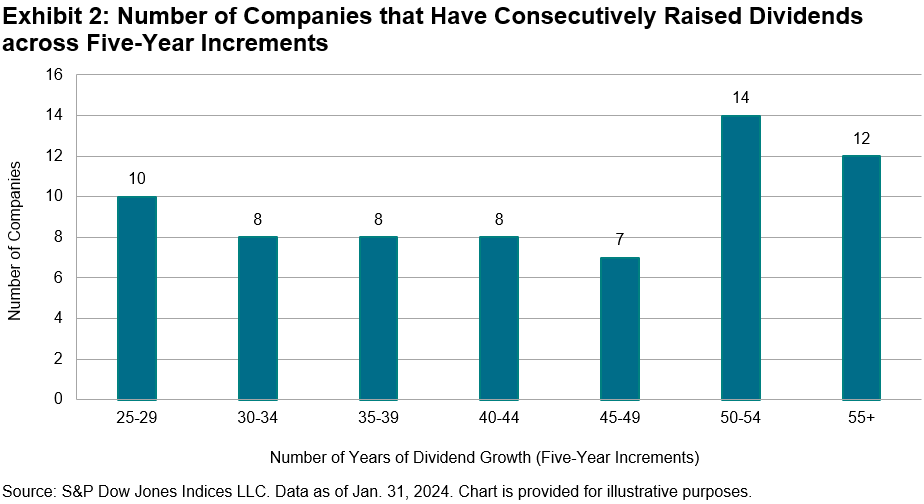

A Long History of Dividend Development Exhibition 4 sums up the variety of constituents that have actually increased their dividends in five-year increments. Especially, over half of constituents have actually increased their dividends for 35 years or longer, and over 36% have actually accomplished this accomplishment for 45 years or longer. These performance history are definitely good and show these business’ traditionally constant capability and determination to return increasing quantities of investor capital throughout several years.

The posts on this blog site are viewpoints, not recommendations. Please read our

Disclaimers

S&P 500 Dividend Aristocrats Rebalance: Fastenal in, Walgreens out

Wenli Costs Hao Director, Elements and Dividends Indices, Item Management and Advancement

S&P Dow Jones Indices

®(* )looks for to track an elite group of business that have actually raised their dividends for a minimum of 25 successive years. This index has actually simply concluded its yearly reconstitution, which worked at the marketplace close on Jan. 31, 2024. Fastenal has actually been included, while Walgreens is out, which keeps the subscription list at 67 stocks. Presenting the Index’s Newest Member: Fastenal Business Fastenal is the current business to be contributed to this prominent index by raising its dividends for 25 successive years. This brand-new S&P 500 Dividend Aristocrat is a commercial supplier that offers products varying from fasteners to tools and has actually developed into a supply chain option business. Since Dec. 31, 2023, Fastenal has a gross margin of 45.7%, 1 a return-on-equity of 34.5% and a low debt-to-equity ratio of 7.8%. Fastenal has a dividend yield of 2.3%, which remains in line with the 2.4% general yield of the S&P 500 Dividend Aristocrats.

A Long-Term Member Is out: Walgreens Boots Alliance, Inc.

Walgreens Boots Alliance was dropped from the index after the drug store chain decreased its quarterly dividends by 48% to 25 cents per share. The relocation comes as the business looks for to

reinforce its long-lasting balance sheet and money position Walgreens had actually been a veteran member of the S&P 500 Dividend Aristocrats, having actually increased its yearly dividends for nearly 50 years. Nevertheless, this index’s rigid approach needs the 25 years to be successive, and guidelines are guidelines.

The S&P 500 Dividend Aristocrats Sector Breakdown

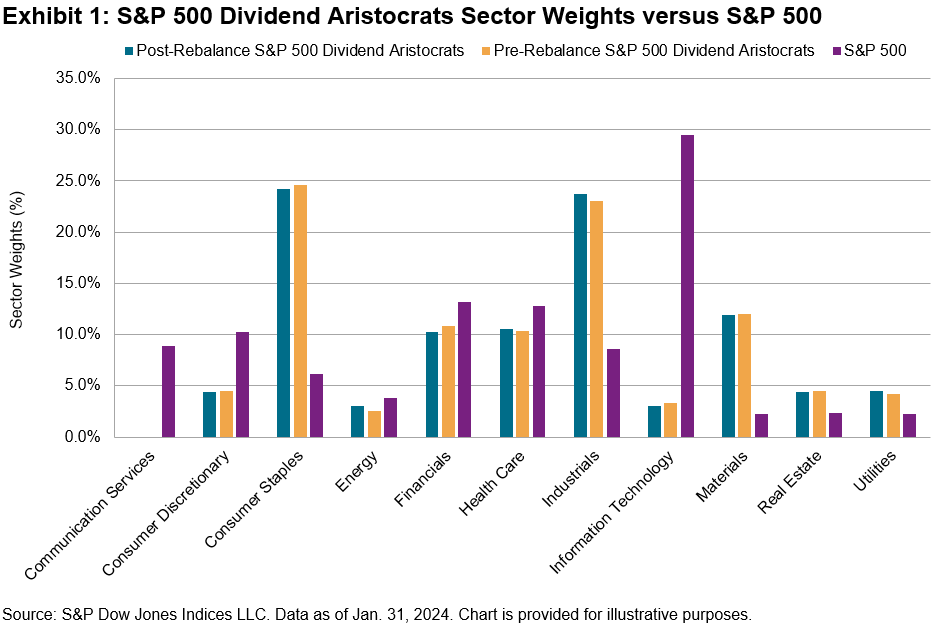

These modifications did not have a product influence on the general sector weights. As Exhibition 1 reveals, the index keeps its fairly big overweights in constant dividend-paying sectors such as Customer Staples and Industrials, with big underweights in IT, Interaction Providers and Customer Discretionary. A Long History of Dividend Development While among the longer-standing members of the index was gotten rid of, Exhibition 2 reveals that over half of the existing constituents in the S&P 500 Dividend Aristocrats have actually grown their dividends for more than 40 years.

1

Taylor Ranta Oborski,

Fastenal Business Reports 2023 Yearly and 4th Quarter Profits

, Jan. 18, 2024.

The posts on this blog site are viewpoints, not recommendations. Please read our

Disclaimers The S&P Dividend Aristocrats Stay Standard Beaters in Pan Asia While the majority of dividend techniques underperformed their particular standards in 2023, the

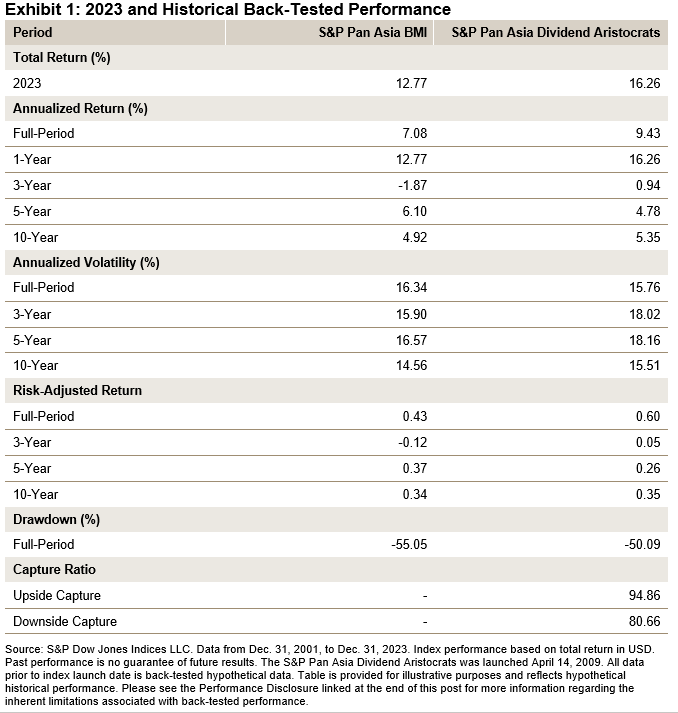

S&P Pan Asia Dividend Aristocrats ® remarkably exceeded the

S&P Pan Asia BMI

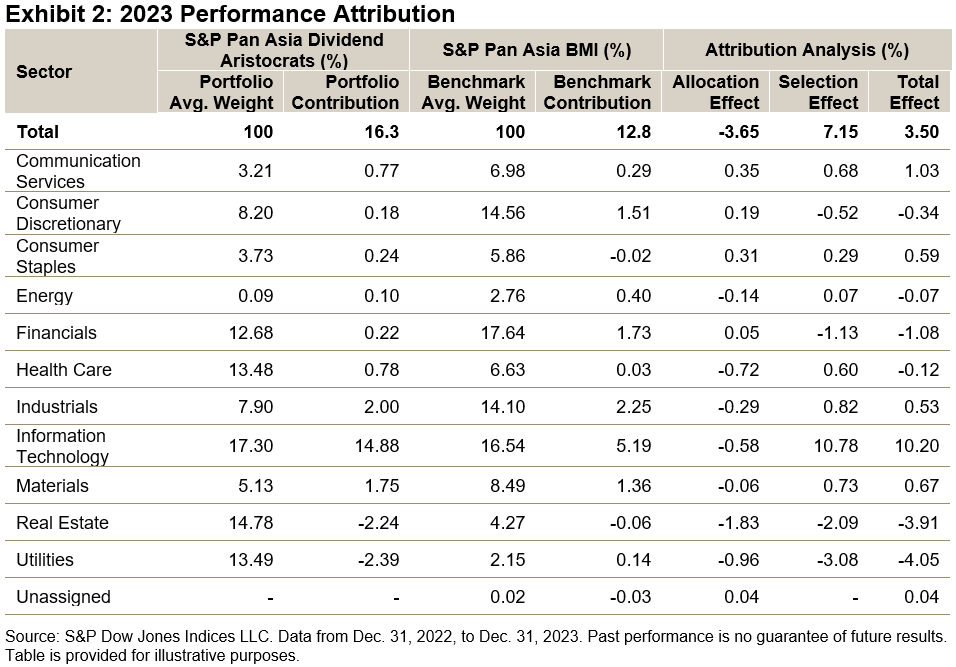

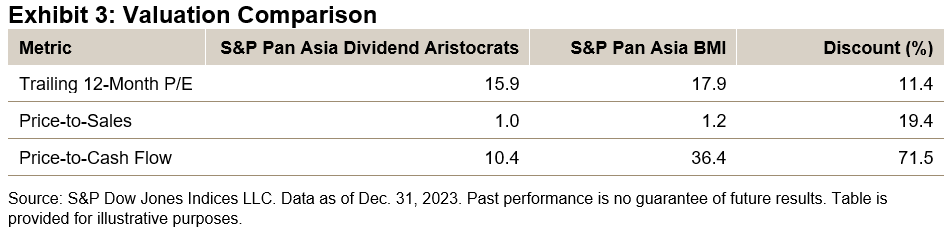

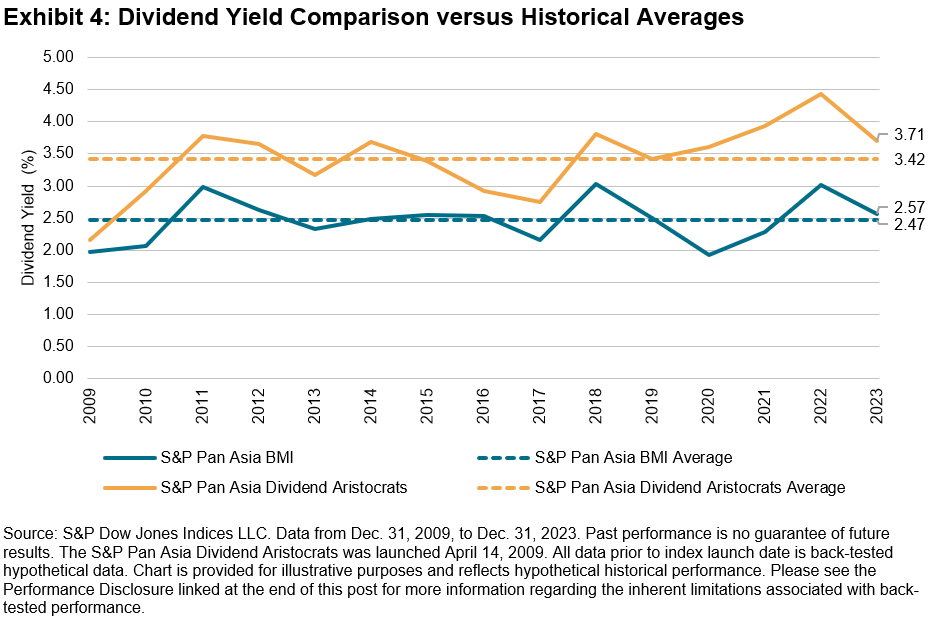

by around 3.50% (see Exhibition 1). In addition, in spite of the outperformance, the S&P Pan Asia Dividend Aristocrats’ evaluations and dividend yield stayed beneficial relative to the criteria (see Displays 3 and 4). This blog site will take a look at these metrics in more information, in addition to supplying an in-depth efficiency attribution for 2023. As Exhibition 1 reveals, the S&P Pan Asia Dividend Aristocrats’ strong 2023 efficiency even more increased its long-lasting outperformance versus the S&P Pan Asia BMI. Returning to Dec. 31, 2001, the S&P Pan Asia Dividend Aristocrats has actually exceeded the S&P Pan Asia BMI usually by 2.35% every year. In addition, this long-lasting outperformance has actually been accomplished while likewise providing a lower full-period volatility, optimum drawdown and disadvantage capture ratio. Exhibition 2 shows the 2023 efficiency attribution for the S&P Pan Asia Dividend Aristocrats and S&P Pan Asia BMI. As displayed in the attribution analysis columns, the overall outperformance amounted to 3.50%, with 7.15% due to the bottom-up stock choice result and -3.65% from the allotment or sector result. Infotech was the biggest positive-contributing sector for the S&P Pan Asia Dividend Aristocrats, at 10.20%, with 10.78% from the choice result and -0.58% due to the allotment result. The crucial differentiator of the S&P Pan Asia Dividend Aristocrats versus its criteria is the requirement that stocks should increase dividends per share for a minimum of 7 successive years. This filter, in addition to the payment and dividend yield filter, might predisposition the index towards choosing greater quality stocks given that the capability to regularly grow dividends over the long term can be an indicator of monetary strength and discipline. Exhibition 3 shows the evaluation contrast and discount rate of the S&P Pan Asia Dividend Aristocrats versus its criteria. The index is more affordable on all 3 metrics revealed, with a typical discount rate over the 3 metrics at around 34%. Disappointed in the table however essential however, is the return-on-equity (ROE) metric, which determines how effectively a business uses investor capital to produce earnings. The S&P Pan Asia Dividend Aristocrats has a 9.9% ROE versus 9.1% for the S&P Pan Asia BMI since Dec. 29, 2023. As Exhibition 4 programs, the index’s dividend yield has actually been greater than the Pan Asia BMI’s dividend yield every year given that 2009. In addition, the typical dividend yield for the S&P Pan Asia Dividend Aristocrats was 3.42% versus 2.47% for the S&P Pan Asia BMI over this duration. Remarkably, the year-end 2023 dividend yield for the S&P Pan Asia Dividend Aristocrats was 3.71%, 8.40% greater than its historic typical versus the S&P Pan Asia BMI’s year-end 2023 dividend yield of 2.57%, just 4% greater than its historic average.

Conclusion

Following a strong year of efficiency in 2023 thanks to its reliable bottom-up stock choice, the S&P Pan Asia Dividend Aristocrats heads into 2024 holding a dividend yield and evaluation benefit over its criteria. For financiers looking for an index with these worth and dividend yield direct exposures, in addition to numerous quality and dividend filters, the S&P Pan Asia Dividend Aristocrats Index is an alternative to think about.

The posts on this blog site are viewpoints, not recommendations. Please read our

Disclaimers

S&P DJI’s International Islamic Equity Criteria Rose Almost 12% in the Last Quarter, Outshining Standard Criteria in 2023

Take Legal Action Against Lee

Director and APAC Head of Index Financial Investment Technique S&P Dow Jones Indices Classifications

Equities,

-

Dow Jones Islamic Indices,

Dow Jones Islamic Market World Index, GCC, international equities, -

Islamic equities,

islamic financing, MENA, S&P Global BMI Shariah, sectors, Shariah, Sue Lee, Sukuk International equities saw a strong Q4 2023 as slowing inflation and the capacity for lower rates of interest enhanced market belief significantly. The S&P Global BMI rallied 11.4% for the quarter, ending up the year with an outstanding 21.9% return. Middle East and North Africa (MENA) equities increased 6.4% in Q4, as determined by the S&P Pan Arab Composite , contributing to a 10.1% overall return for the year. Gulf Cooperation Council (GCC) nations mostly published gains, led by Bahrain (23.4%) and Saudi Arabia (15.0%), while Kuwait was an exception, with a 6.3% loss.

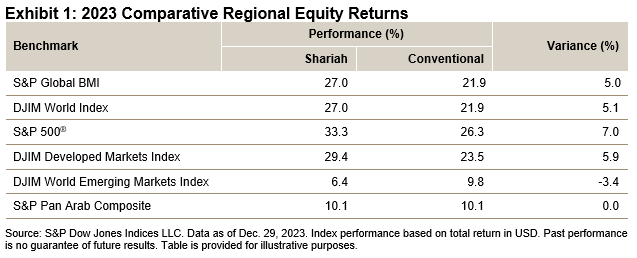

Shariah-compliant standards, consisting of the S&P Global BMI Shariah and Dow Jones Islamic Market (DJIM) World Index, beat their traditional equivalents by about 0.5% throughout the quarter, extending their outperformance to over 5% for the year and 19.7% cumulative over the previous 5 years. Mainly driven by its outperformance in the U.S., the criteria

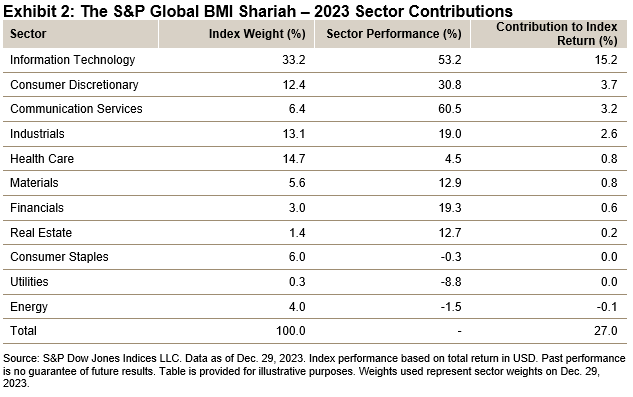

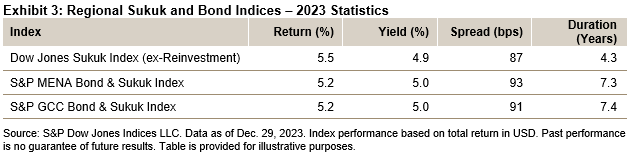

DJIM Established Markets Index stood apart for relative efficiency versus the traditional criteria in 2023. The DJIM World Emerging Markets Index was a laggard, routing behind the traditional criteria along with the industrialized market equivalent (see Exhibition 1). Motorists of Shariah Index Efficiency in 2023 The outperformance of Shariah standards versus their traditional equivalents typically enters into focus through the lens of sectors. Throughout international stock exchange in general, a greater direct exposure to Infotech stocks within Islamic indices, no direct exposure to traditional Financials (consisting of banks) and less direct exposure to extremely indebted business (such as energies) were the significant chauffeurs of the efficiency difference in 2015. The Infotech sector’s 53% gain played a huge part in 2023, adding to over half of the S&P Global BMI Shariah’s overall return. Energy, Utilities and Customer Staples were the only sectors with losses for the year, while their effect was restricted provided their little representation in the index (see Exhibition 2). International Sukuk Reversed in Q4 2023

The international sukuk market likewise had a strong quarter with a gain of 4.5%, as determined by the

Dow Jones Sukuk Index (ex-Reinvestment)

The criteria ended the year with a 5.5% return, falling somewhat except the 5.7% yearly return of the iBoxx USD Overall

, a worldwide USD-denominated financial investment grade bond criteria. The local MENA and GCC Bond & & Sukuk standards got 5.2%.

This post was very first released in IFN Volume 21 Problem 3 outdated Jan. 17, 2024. The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers Tags

Dow Jones Islamic Indices,

Dow Jones Islamic Market World Index, GCC, international equities,