{“page”:0,” year”:2024,” monthnum”:2,” day”:9,” name”:” sp-dji-kensho-goes-global”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Head of U.S. Equities”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Wenli Bill Hao”,”title”:”Director, Factors and Dividends Indices, Product Management and Development”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Head of Factors and Dividends”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities, Real & Digital Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”George Valantasis”,”title”:”Associate Director, Factors and Dividends”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Jason Ye”,”title”:”Director, Factors and Thematics Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Michael Mell”,”title”:”Global Head of Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Andrew Innes”,”title”:”Head of Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Izzy Wang”,”title”:”Senior Analyst, Factors and Dividends”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Thematic Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Daniel Perrone”,”title”:”Former Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Elizabeth Bebb”,”title”:”Director, Factor & Dividend Indices”,”image”:”/wp-content/authors/elizabeth_bebb-511.jpg”,”url”:”https://www.indexologyblog.com/author/elizabeth_bebb/”},{“display”:”Margaret Dorn”,”title”:”Senior Director, Head of ESG Indices, North America”,”image”:”/wp-content/authors/margaret.dorn-390.jpg”,”url”:”https://www.indexologyblog.com/author/margaret-dorn/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”}]

S&P DJI Kensho Goes International

The development of language designs and generative AI has actually revamped the procedure of creating actionable structured information from disorganized text files and improved our capability to obtain and classify details from formerly hard-to-access sources. As we see increasing need for brand-new methods to slice the marketplace based upon maker learning-based insights, S&P Dow Jones Indices (S&P DJI) is presenting S&P DJI Global Kensho Index Solutions.

What’s New?

S&P DJI Global Kensho Index Solutions utilize natural language processing (NLP) methods 1 and business regulative filings in the stock choice procedure to build thematic indices. When concentrated on U.S indices specifically, this freshly improved ability makes it possible to develop international thematic indices. Secret functions consist of:

- Access to best-in-class internal business filings database S&P Global Market Intelligence’s database of international filings provides an one-upmanship, covering both English-source and English translations of filings from business noted throughout almost 100 exchanges.

- Improved NLP designs No longer dedicated to files sticking to recommended filing design templates from the SEC, S&P DJI Global Kensho Index Solutions can now parse text files in a wide array of formats. Business are not just tagged effectively to styles, however likewise classified based upon their significance to these styles.

The primary actions in the S&P DJI Kensho index building and construction procedure, from market modeling to private stock choice, stay essentially the same Nevertheless, put simply, the procedure now includes an international set of yearly files, which improves an index’s capability to track a style throughout the international market.

Effectively Showing Styles with Long-Term Effect

Our transparent thematic indices integrate sophisticated innovation and access to special datasets to track long-lasting, market-altering styles with accuracy. There are 2 broad difficulties related to creating an investable index for an offered long-lasting style.

The very first difficulty is specifying a style. Take electrical cars for instance. Electric cars and trucks and trucks appear like an uncomplicated option for addition. Nevertheless, possibly consisting of electrical trains, electrical ships or electrical drones opens the style as much as subjective choices on what innovations fall within the meaning of electrical cars. For that reason, specifying a market design that shows the essence of a style is crucial.

The 2nd difficulty is choosing business that offer an item and/or a service pertinent to the style. Curating these organizations needs reading business’ numerous public files in information and comprehending their existing service focus locations, in addition to their prepare for future development. In the past, we mainly count on human effort and market specialists to achieve this. Nevertheless, current updates to the NLP toolkit have structured these efforts, while increasing replicability of outcomes.

Conclusion

As interest in thematic investing grows internationally, financiers are seeking to access a growing series of progressively intricate styles. S&P DJI Global Kensho Index Solutions enable S&P DJI to establish index methods and preserve indices in accordance with those methods to fulfill this increasing need. The ability integrates inputs from best-in-class information sources with sophisticated information processing methods to provide ingenious index options throughout international markets.

1 Mayor, Tracy. “ Why financing is releasing natural language processing” MIT Sloan School of Management. Nov. 30, 2020.

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

S&P 500 Highs Keep Coming

The S&P 500 ®(* )closed at another record high today, marking the ninth all-time high closing cost level up until now this year. Although all-time highs are not unmatched– 2024 is the 41 st year considering that 1957 to host a brand-new high– a couple of observations stick out when taking a look at this year’s records. Initially,

January 2024 saw completion of the seventh longest space in between S&P 500 all-time highs, ever More than 2 years– or 513 trading days– apart Jan. 19, 2024’s then record close and its previous record high, published on Jan. 3, 2022. This wait ended 27 trading days earlier than the 540-trading day space in the 1950s, and it ended substantially quicker than other waits in between all-time highs going back to the 1920s (see Exhibition 2). January likewise hosted among the longest successive all-time high streaks, ever

Amidst financiers’ favorable responses to macroeconomic information and better-than-expected business revenues, the S&P 500 closed at record highs for 5 successive sessions in between Jan. 19, 2024, and Jan. 25, 2024. The streak ended some method except the 11-day records (published in the 1920s and the 1960s), yet the 5-day run ranked as the joint 29 th longest streak for the index and the longest run considering that the standard increased for 8 successive sessions around completion of October 2021. So what might these observations imply for the S&P 500 in 2024? We will need to wait and see if the S&P 500 continues to publish record highs this year: anticipating the future is hard, and the last couple of years have actually functioned as a pointer that there are a lot of stories (some telegraphed beforehand, some not) that can drive the marketplace’s instructions. However with the S&P 500 up around 5% YTD on a cost efficiency basis, history provides more than a twinkle of expect the optimists.

In Between 1957 and 2023, in the 40 years when the S&P 500 published an all-time high, the U.S. equity standard tape-recorded approximately 29 all-time highs each year. The typical cost efficiency throughout these years (13%) was much better than the average for the twenty years when no all-time highs were observed (1.8%), and in turn greater than the typical efficiency throughout all years considering that 1957 (8.5%).

Comparable outcomes were observed when taking a look at the 16 years in between 1957 and 2023 when all-time highs were tape-recorded in both January and February. These years were related to approximately 42 highs, and a typical yearly cost gain of 15%.

The posts on this blog site are viewpoints, not suggestions. Please read our

Disclaimers The S&P 500 ESG Index Turns 5!

Margaret Dorn

Senior Director, Head of ESG Indices, The United States And Canada

S&P Dow Jones Indices

The S&P 500

®(* )ESG Index commemorated its 5th birthday on Jan. 28, 2024. Over the previous 5 years, the index has actually ended up being a crucial piece of the sustainable indexing puzzle for financiers seeking to utilize the strength of the S&P 500 while integrating significant and quantifiable sustainability-focused improvements. Generally, five-year events are marked by gifting something made from wood. As a sign, wood represents strength, stability and the capability to hold up against difficulties. It embodies the vigor required to get rid of challenges and adjust to altering situations. In numerous methods, this is proper importance for an index that has actually been created to assist financiers resolve the difficulties and altering situations in a developing world. Let’s commemorate this turning point with a glimpse back at the previous 5 years of the S&P 500 ESG Index.

From the Start

The launch of the S&P 500 ESG Index on Jan. 28, 2019, indicated an advancement in sustainable investing. The index filled a crucial space for financiers looking for to integrate ESG worths while preserving comparable general attributes to the extensively understood and used

S&P 500

( see Exhibition 1). Developing Sustainability Landscape Adjusting to the ever-changing landscape of sustainable indexing has actually been necessary over the life-span of the S&P 500 ESG Index. Numerous improvements have actually been made to the index approach to show the progressing beliefs of a sustainability-minded financier. These views have actually been voiced in the outcomes of a number of market assessments that resulted in a modified and broadened list of exemptions based upon a business’s participation in specific service activities (see Exhibition 2). The assessments likewise attended to a number of other pertinent updates, consisting of more regular eligibility look for service participation activities

3

and UNGC exemptions. 4 Most just recently, S&P Dow Jones Indices spoken with the marketplace on 2 crucial sustainability improvements, which resulted in the modification from the Sustainalytics Item Participation to the S&P Global Service Participation Screens and the modification from the S&P DJI ESG Ratings to the S&P Global ESG Ratings. 5 With these improvements, the S&P 500 ESG Index has actually maintained its primary goal, which is to preserve comparable general market group weights to the S&P 500, while improving the general sustainability profile of the index with a typical ESG Rating enhancement of 7.65% over its five-year life-span. 7

Five-Year Efficiency As seen in Exhibition 3, the S&P 500 ESG Index has actually exceeded the S&P 500 not just over its 5 years of live history, however over the shorter-term 1 year and three-year durations too. One may presume that this outperformance has actually come at the cost of an increased danger profile for the index, however as we can see in Exhibition 4 that is not the case. The risk/performance profile of the S&P 500 ESG index was substantially much better than the S&P 500 over both the 3- and five-year timeframes.

Efficiency Point Of View

Among the primary criticisms around sustainability financial investment techniques is that the over (or under) efficiency is just an outcome of over (or under) weights to specific sectors. In Exhibition 5, it is clear that it is not real for the S&P 500 ESG Index, which has actually kept comparable sector direct exposure to the S&P 500 considering that its launch. This is additional evidenced by taking a look at the efficiency attribution of the S&P 500 ESG Index. Exhibition 6 highlights that the excess returns have actually been mainly driven by stock choice instead of distinctions in sector direct exposure. This is by style, as the approach provides itself to a broadly sector-neutral result. Therefore, the outperformance was not all always due to considerable too much exposure to Infotech and underexposure to Energy, as some may presume.

Conclusion

The 5 years of live history for the S&P 500 ESG Index is undoubtedly something to commemorate, and we anticipate viewing our sustainable indexing star continue to shine.

1

Illustration shows the existing usage of the S&P DJI ESG Ratings in the index approach. On Jan. 23, 2024, S&P Dow Jones Indices revealed the outcomes of an assessment which revealed the transitioning of the S&P DJI ESG Ratings to the S&P Global ESG Ratings. The modifications will be carried out since the marketplace open on May 1, 2024. For additional information on the S&P Global ESG Ratings, please describe the

S&P Global ESG Ratings Method 2 In cases where threats exist, S&P Global launches a Media and Stakeholder Analysis (MSA) that includes a series of concerns such as financial criminal activity and corruption, scams, unlawful industrial practices, human rights concerns, labor conflicts, office security, devastating mishaps and ecological catastrophes. The Index Committee examines constituents flagged by S&P Global’s MSA to examine the prospective effect of questionable business activities on the structure of the indices. If the Index Committee chooses to get rid of a business, that business is disqualified for re-entry for a minimum of one complete fiscal year, starting with the subsequent rebalancing.

3 Index constituents are evaluated on a quarterly basis for continuous eligibility under business Activities exemption requirements. Business figured out to be disqualified are eliminated from the index, efficient after the close of the last service day of July, October and January. The referral date for this evaluation is the last service day of the previous month. No constituent will be contributed to the index as an outcome of any removal that might occur. Modifications to Sustainalytics protection are ruled out as part of this evaluation.

4 As an outcome of market assessment that was completed Jan. 23, 2024, S&P DJI is modifying the Quarterly Eligibility Evaluation procedure in pertinent indices, so UNGC eligibility is constantly evaluated in March, June, September and December, in line with the schedule of the International Standards Evaluating dataset. This will make sure a prompt elimination of those business categorized as Non-Compliant with UNGC eligibility requirements no matter the rebalancing schedule of the particular index. For additional information on the outcomes of this assessment, please go to

UNGC Quarterly Eligibility Evaluation Method Updates 5 Both improvements will be carried out to line up with the yearly rebalance of the S&P 500 ESG index which works after the close of the last service day of April. For additional information, please referral

Transitioning S&P Sustainability Indices to S&P Global ESG Ratings and Service Participation Screens (spglobal.com) 6 For additional information on the marketplace assessments that led to these modifications, please go to

Historic Statements– Customer Resource Center|S&P Dow Jones Indices (spglobal.com) 7 The index has actually accomplished a typical S&P DJI ESG Rating enhancement of 7.65% (at the index level) from Jan. 27, 2020-Jan. 29, 2024, representing approximately 21.47% of the general ESG enhancement capacity, provided the sustainability attributes of the beginning universe.

The posts on this blog site are viewpoints, not suggestions. Please read our

Disclaimers

Bond Starts and Beyond

Anu Ganti

Senior Director, Index Financial Investment Technique

S&P Dow Jones Indices

American political specialist James Carville when commented that he wishes to be reanimated as the bond market because, “

you can frighten everybody

” Since July 2023, the international bond market makes up about USD 135 trillion of securities, of which ranked business financial obligation represents USD 23 trillion 1 U.S. business financial obligation comprises approximately half of the international overall, and as Exhibition 1 shows, the 1980s were a turning point in the U.S., as business progressively changed far from looking for bank loans for funding requirements and towards leveraging the growing financial obligation capital markets. The structure of bond holders

has actually likewise developed. The majority of obviously, direct retail ownership of corporates and U.S. Treasuries has actually near cut in half, from 20% of exceptional issuance in 2010 to 11% since Q2 2023. On the other hand, possessions in U.S. bond shared funds have actually nearly doubled. This has actually belonged to a more comprehensive pattern of “professionalization” or disintermediation, which saw families gravitate far from direct security ownership and towards shared funds throughout the booming market of the 1990s In contrast to the equity markets, where index-based funds have concerned represent nearly half of invested capital

, about three-quarters of mutual fund possessions were still actively handled at year-end 2023, as we observe in Exhibition 3. This is partially due to the fact that set earnings index funds have a much shorter history than their equity cousins: a bond index fund didn’t exist till 1986, and the very first bond ETF wasn’t introduced till 2002— both lagging their equity equivalents by a years approximately. Nevertheless, passive investing in the bond markets might capture up. Simply as in equities, it appears hard for active supervisors to surpass over the long term

On the other hand, considering that 2010, the percentage of international shared fund and ETF possessions that are passively handled has actually in reality grown much faster in bonds than in equities. If the transformative trajectory of passive investing in equity markets is any guide for set earnings, the phase might now be set for an amazing future for passive set earnings management. To evaluate whether (and why) bond markets may continue to capture up, we welcome you to dive into our extensive analysis here

1 Describes the quantity of international and U.S. business financial obligation ranked by S&P Global Rankings since July 2023. For additional information, please see Limbach, Sarah, Gunter, Evan M., and Singh, Vaishali, “

Credit Trends: Global State of Play: Financial Obligation Development Diverging By Credit Quality,” Sept. 6, 2023. The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

S&P High Yield Dividend Aristocrats Rebalance: Let’s Invite the 18 Newest Members The

S&P High Yield Dividend Aristocrats

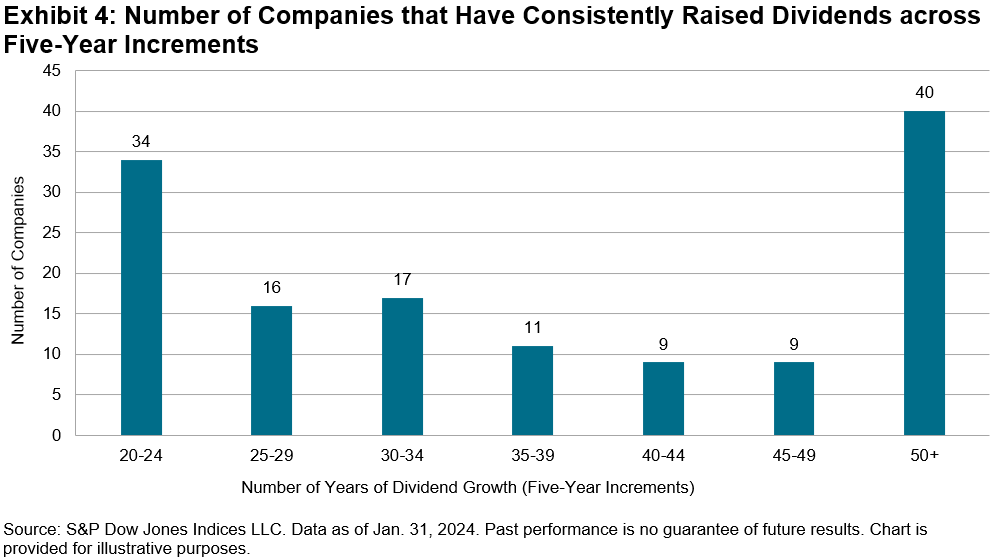

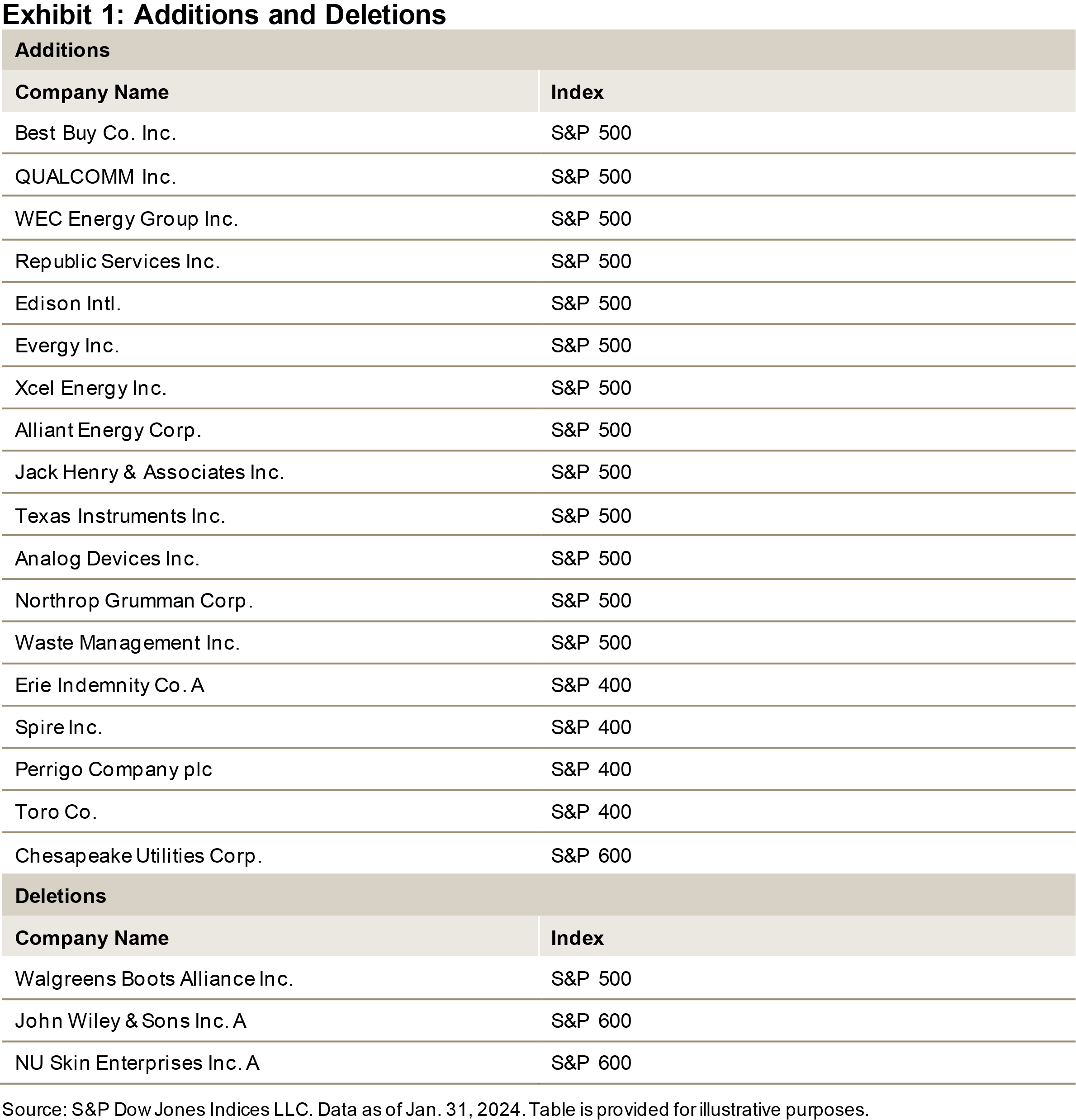

®(* )consists of big-, mid-, and small-cap business in the U.S. that have actually raised their dividends for a minimum of 20 successive years. The index just recently concluded its yearly reconstitution on Jan. 31, 2024, which brought 18 brand-new members into this accomplished group. Accounting for the 3 removals, the index’s overall count increased from 121 to 136, which improves its general diversity and liquidity. This blog site will take a look at the additions and removals through a size and sector lens and offer a take a look at the admirable performance history of constituents’ dividend boosts. Exhibition 2 information how the reconstitution impacted the S&P High Yield Dividend Aristocrats from a size viewpoint. Pre-reconstitution, the index had 77, 31 and 13 constituents in the S&P 500 ®

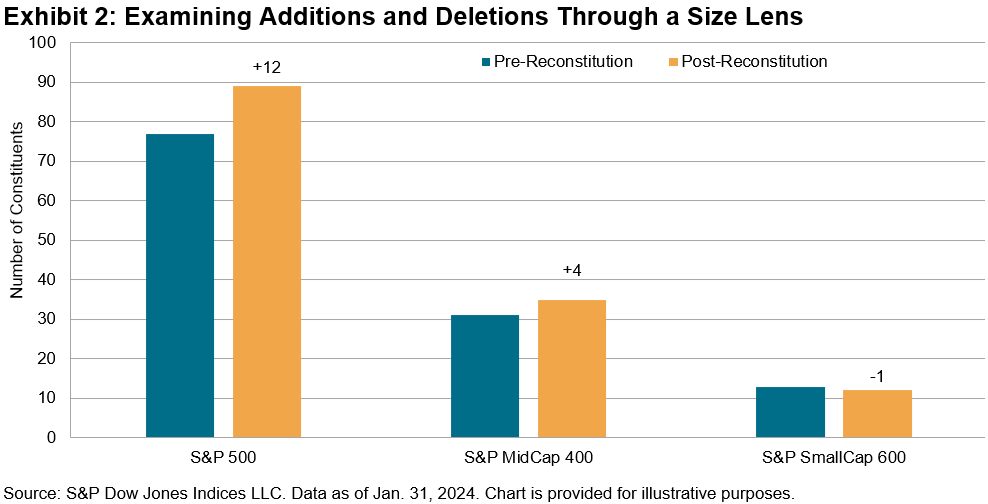

,& S&P MidCap 400 ® and S&P SmallCap 600(* )® , respectively. The 15 net additions consisted of 12 net additions from the S&P 500, 4 additions from the S&P MidCap 400, and 1 net reduction from the S&P SmallCap 600. Post-reconstitution, there are 89, 35 and 12 constituents from the S&P 500, S&P MidCap400 and S&P SmallCap 600, respectively. As Exhibition 3 display screens, Energies and Industrials were the greatest recipients of the reconstitution, with their net counts increasing by 7 and 4, respectively. Industrials now makes up 30 constituents, 8 more than the next-highest sectors by count: Financials and Utilities, each with 22. After losing 2 constituents, Customer Staples dropped to the third-highest sector by count, with 19. The only constituent in the Interaction Solutions sector, John Wiley & & Sons, was eliminated from the index, leading to Interaction Solutions being the only GICS ® sector without representation in the index. A Long History of Dividend Development

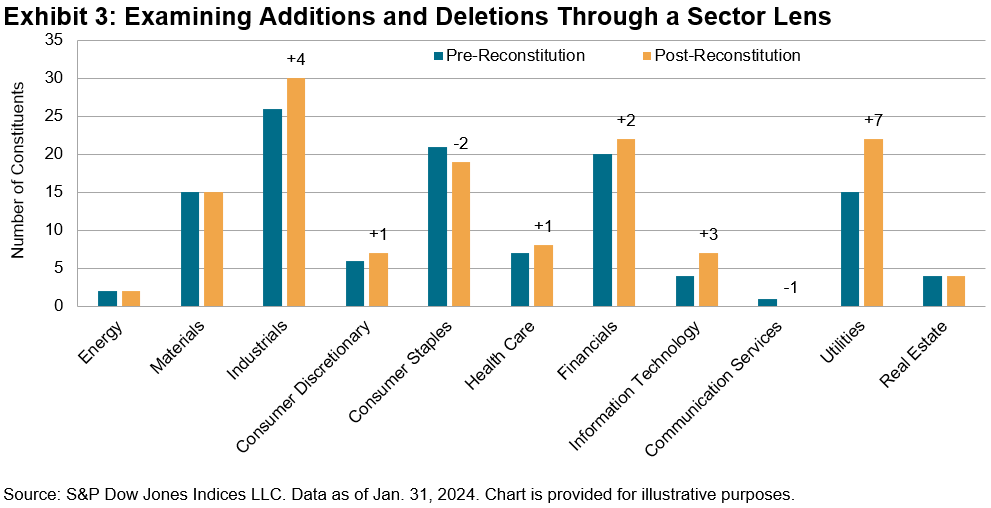

Exhibition 4 sums up the variety of constituents that have actually increased their dividends in five-year increments. Especially, over half of constituents have actually increased their dividends for 35 years or longer, and over 36% have actually accomplished this accomplishment for 45 years or longer. These performance history are definitely good and show these business’ traditionally constant capability and determination to return increasing quantities of investor capital throughout numerous years. The posts on this blog site are viewpoints, not suggestions. Please read our

Disclaimers