{“web page”:0,”yr”:2023,”monthnum”:5,”day”:1,”identify”:”the-sp-gsci-cooled-in-april-as-inflation-cooled”,”error”:””,”m”:””,”p”:0,”post_parent”:””,”subpost”:””,”subpost_id”:””,”attachment”:””,”attachment_id”:0,”pagename”:””,”page_id”:0,”moment”:””,”minute”:””,”hour”:””,”w”:0,”category_name”:””,”tag”:””,”cat”:””,”tag_id”:””,”creator”:””,”author_name”:””,”feed”:””,”tb”:””,”paged”:0,”meta_key”:””,”meta_value”:””,”preview”:””,”s”:””,”sentence”:””,”identify”:””,”fields”:””,”menu_order”:””,”embed”:””,”category__in”:[],”category__not_in”:[],”category__and”:[],”post__in”:[],”post__not_in”:[],”post_name__in”:[],”tag__in”:[],”tag__not_in”:[],”tag__and”:[],”tag_slug__in”:[],”tag_slug__and”:[],”post_parent__in”:[],”post_parent__not_in”:[],”author__in”:[],”author__not_in”:[],”search_columns”:[],”ignore_sticky_posts”:false,”suppress_filters”:false,”cache_results”:true,”update_post_term_cache”:true,”update_menu_item_cache”:false,”lazy_load_term_meta”:true,”update_post_meta_cache”:true,”post_type”:””,”posts_per_page”:”5″,”nopaging”:false,”comments_per_page”:”50″,”no_found_rows”:false,”order”:”DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Director, U.S. Equity Indices”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Berlinda Liu”,”title”:”Director, Multi-Asset Indices”,”image”:”/wp-content/authors/berlinda_liu-191.jpg”,”url”:”https://www.indexologyblog.com/author/berlinda_liu/”},{“display”:”Jim Wiederhold”,”title”:”Director, Commodities and Real Assets”,”image”:”/wp-content/authors/jim.wiederhold-515.jpg”,”url”:”https://www.indexologyblog.com/author/jim-wiederhold/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Strategy Indices”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Indices Product Management, Latin America”,”image”:”/wp-content/authors/maria_sanchez-243.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-271.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Senior Director, Strategy Indices”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Ben Leale-Green”,”title”:”Associate Director, Research & Design, ESG Indices”,”image”:”/wp-content/authors/ben_leale-green-342.jpg”,”url”:”https://www.indexologyblog.com/author/ben_leale-green/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities and Real Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Michael Mell”,”title”:”Senior Director, Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Izzy Wang”,”title”:”Analyst, Strategy Indices”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”George Valantasis”,”title”:”Associate Director, Strategy Indices”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Jason Ye”,”title”:”Director, Strategy Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Strategy & Volatility Indices”,”image”:”/wp-content/authors/Ari.Rajendra-400.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Daniel Perrone”,”title”:”Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Narottama Bowden”,”title”:”Director, ESG Index Intelligence, Index Governance”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”},{“display”:”Lalit Ponnala”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/lalit.ponnala-388.jpg”,”url”:”https://www.indexologyblog.com/author/lalit-ponnala/”}]

The S&P GSCI Cooled in April as Inflation Cooled

-

Classes

Commodities -

Tags

agriculture, commodities, copper, power, gold, grains, business metals, inflation, S&P GSCI, S&P GSCI Agriculture, S&P GSCI Local weather Conscious, S&P GSCI Copper, S&P GSCI Grains, S&P GSCI Commercial Metals, S&P GSCI Softs, S&P GSCI Sugar, S&P GSCI Zinc, comfortable commodities, sugar, Zinc

The S&P GSCI fell 0.8% in April because the Fedâs most popular measure of inflation, Non-public Intake Expenditures (PCE), fell quite on a year-over-year foundation to 4.6%. Endured increased readings of inflation, albeit cooling, ended in marketplace expectancies that the Fed would hike charges once more in Would possibly to carry inflation again to its 2% goal. Commodities are most often excellent inflation hedges as a result of they generally tend to transport with adjustments in inflation to the upside and, maximum just lately, to the drawback.

Inside the vast S&P GSCI benchmark, a number of commodity sectors declined, with the S&P GSCI Commercial Metals falling probably the most, down 3.0%. The S&P GSCI Copper and the S&P GSCI Zinc dragged down efficiency, as Chinaâs Politburo mentioned their economic system continues to be in a restoration segment, which would require persisted fiscal and financial strengthen because of inadequate home call for. Expectancies for Chinaâs business sector to pick out up at the call for aspect have no longer come to fruition but, and up to date problems with business family members between Australia and China have no longer helped the economic metals area.

The S&P GSCI Agriculture used to be the second-worst-performing sector, down 2.9% in April, with the S&P GSCI Grains the bottom performer, down 6.9%. Corn, soy and wheat had been all dragged decrease owing to robust crop growth and waning call for, because the U.S. Division of Agriculture stated non-public exporters just lately canceled a number of hundred thousand lots of corn. Brazil has an enormous corn crop this yr, and their more economical crop has weighed on U.S. grain costs. The S&P GSCI Softs rose 12.3%, powered through the S&P GSCI Sugar, which rose 22.1% to a brand new 10-year top.

Competing forces had been at play for the S&P GSCI Power, resulting in flat efficiency for the month. This sector constitutes greater than part of the burden within the headline S&P GSCI and has a tendency to have the best inflation beta (or sensitivity to adjustments in inflation) of all commodities. Our just lately introduced S&P GSCI Local weather Conscious is the first-to-market commodities benchmark incorporating environmental issues, and these days has a 3rd of its weight towards power commodities.

The S&P GSCI Gold flirted with a brand new all-time top because the U.S. buck moved decrease and uncertainty throughout markets ended in a safe-haven bid.

The posts in this weblog are critiques, no longer recommendation. Please learn our Disclaimers.

Similarly Weighting inside of Sectors: Affect and Doable Programs

The outperformance of equivalent weight indices is definitely documented, particularly for the S&P 500® Equivalent Weight Indexâs twenty years of reside historical past. Equivalent Weightâs relative returns replicate the have an effect on of a number of vital index traits. As an example, smaller-size publicity and (anti-) momentum results in combination account for round 75% of the ancient variation of its relative returns.

Increased sector dispersion has made sector allocations extra vital in explaining Equivalent Weightâs fresh relative returns. Certainly, the S&P 500 Equivalent Weight Indexâs higher publicity to Power and decrease publicity to Conversation Services and products, Data Era and Shopper Discretionary accounted for round two-thirds of its 7% outperformance in 2022. Those exposures additionally helped to give an explanation for the indexâs underperformance in Q1 2023.

On the similar time, itâs vital to not disregard the have an effect on of equivalent weighting inside of each and every sector. To peer why, we assemble hypothetical âintermediateâ portfolios that constitute steps alongside distinct paths between the S&P 500 and the S&P 500 Equivalent Weight Index. Showcase 1 summarizes those two hypothetical paths.

The hypothetical âSectors Matching EQWâ portfolio adjusts S&P 500 sector weights in order that they fit the ones of the Equivalent Weight Index whilst making sure that businesses inside of the similar sector stay glide market-cap weighted. However, the hypothetical âEQW Inside Sectorsâ portfolio keeps the S&P 500âs sector allocations however weights each identify similarly inside of each and every sector.

Showcase 2 displays that similarly weighting inside of each and every sector mattered extra when explaining the S&P 500 Equivalent Weight Indexâs ancient returns. Certainly, the cumulative overall go back for the hypothetical âEQW Inside Sectorsâ portfolio is graphically indistinguishable from that of the S&P 500 Equivalent Weight Index. Whilst the equivalent weight index will have sporadically benefited from its distinct sector allocations, having extra publicity to the smaller names inside of each and every sector used to be a very powerful motive force of the S&P 500 Equivalent Weight Indexâs returns.

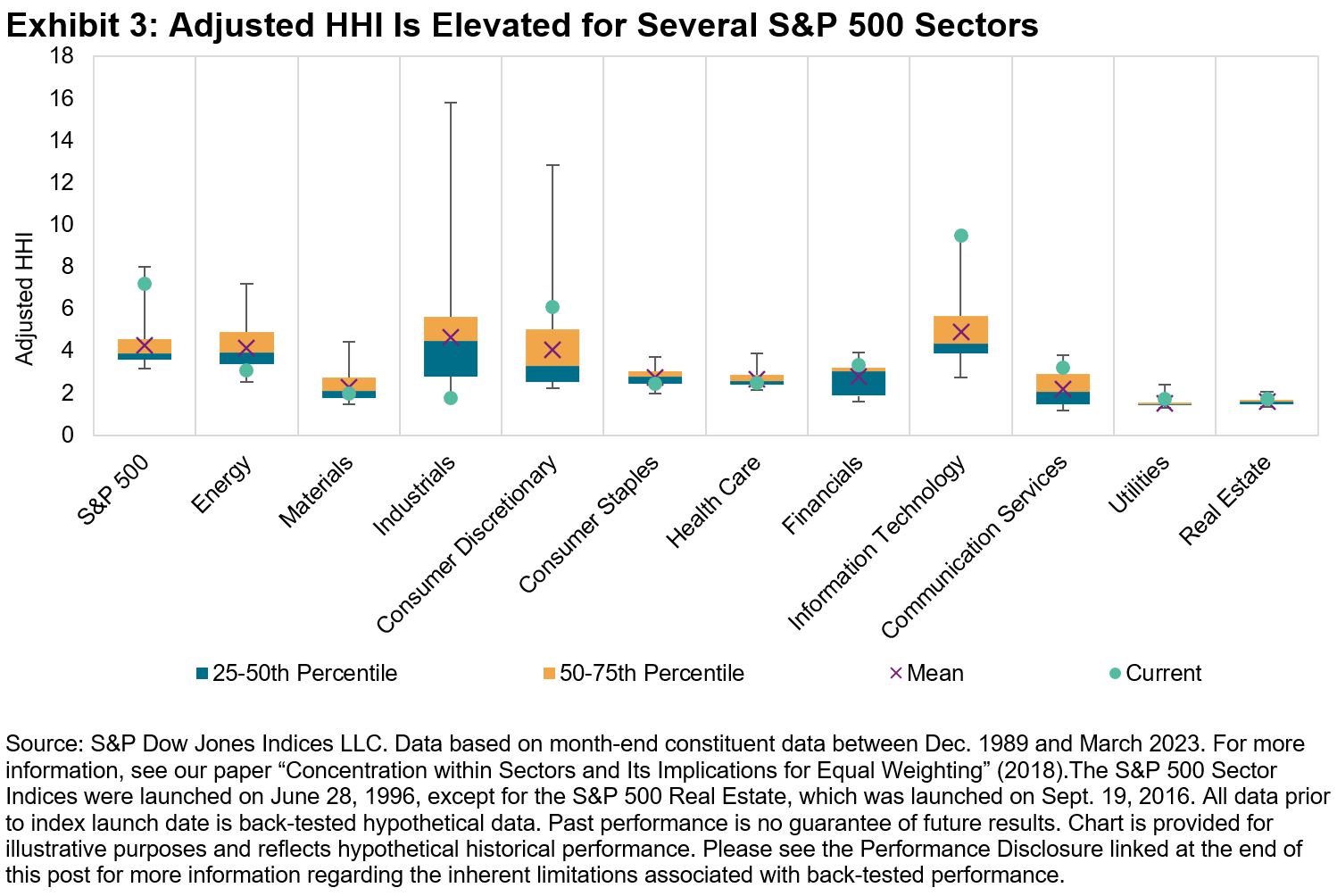

The relative level of focus inside of sectors suggests a possible tactical software. Showcase 3 displays the distribution of adjusted Herfindahl-Hirschman Index (HHI) figures for the S&P 500 and its 11 GICS sectors; the next adjusted HHI determine implies that focus is upper, unbiased of the choice of shares in each and every index. The present focus is increased in numerous sectors, in particular in Data Era.

By way of definition, similarly weighted sector indices have much less publicity to bigger names than do their glide market-cap opposite numbers. All else equivalent, falling focus signifies underperformance from the biggest names, and vice-versa. Therefore, one would be expecting similarly weighted sectors to outperform when focus falls.

Showcase 4 confirms this expectation: the S&P 500 Equivalent Weight Data Era Index in most cases outperformed its glide market-cap counterpart when the sphereâs adjusted HHI declined. Therefore, to the level that present focus ranges decline, marketplace members might want to believe the possible packages of an similarly weighted sector technique.

For more info at the interplay between focus and equivalent weight efficiency, and to rejoice the S&P 500 Equivalent Weight Indexâs 20th birthday, take a look at the replay of our Index Funding Technique name from April 20, 2023.

The posts in this weblog are critiques, no longer recommendation. Please learn our Disclaimers.

Doable Programs of U.S. Equities for Asia-Primarily based Traders

Many buyers have a so-called âhouse bias,â allocating to their home marketplace in higher share than can be anticipated in response to its illustration in international fairness markets. Asia-based buyers are not any exception. Right here we provide our U.S. fairness icons as one doable manner to supply diversification for Asian buyers.

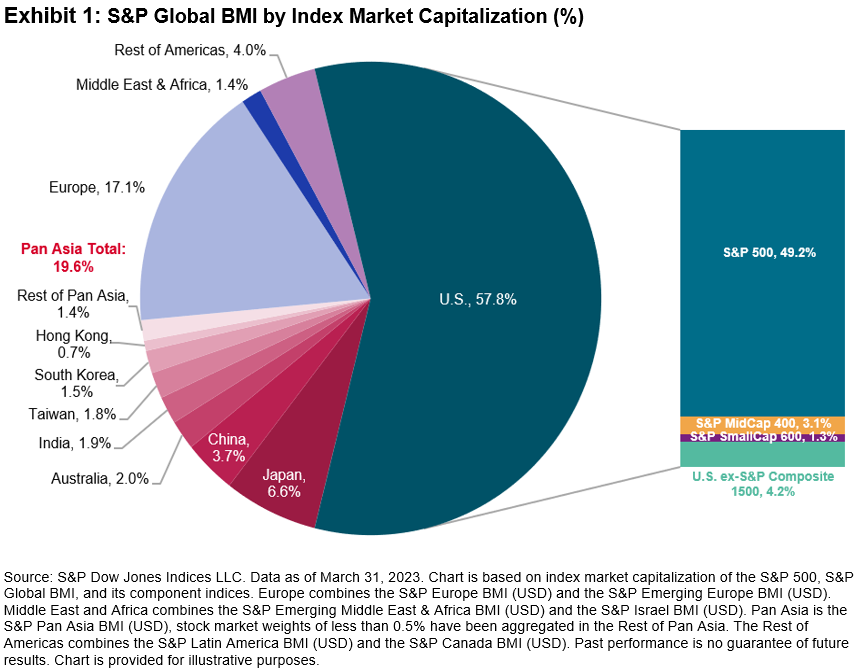

The breadth and intensity of the U.S. fairness marketplace implies that buyers threat overlooking a vital bite of the worldwide fairness alternative set through under-allocating to U.S. equities, which might lead to a big lively proportion in comparison to an international benchmark. As an example, Showcase 1 displays that the U.S. used to be just about 3 times greater than all the investable Asian fairness marketplace, with smaller U.S. fairness segments as huge as complete native inventory markets. The S&P 500® makes up just about part of the pie, with the S&P MidCap 400®  and SmallCap 600® being greater than the Australian and Hong Kong inventory markets, respectively.

Past U.S. equities representing a good portion of the worldwide alternative set, their distinct sector weights might assist buyers to conquer home sector biases. Showcase 2 displays GICS® sector weights of the S&P Pan Asia BMI and the relative weight in comparison to the S&P World BMI and the S&P 500. The S&P Pan Asia BMIâs greatest weights are in Financials (17%) and Data Era (16%), with its smallest weight within the Power sector, at 3%. Some key variations between the S&P Pan Asia BMI and S&P World BMI and S&P 500 are that the worldwide and U.S. benchmarks have a bigger weight in Well being Care and Data Era and decrease weights in Shopper Discretionary, Fabrics and Industrials.

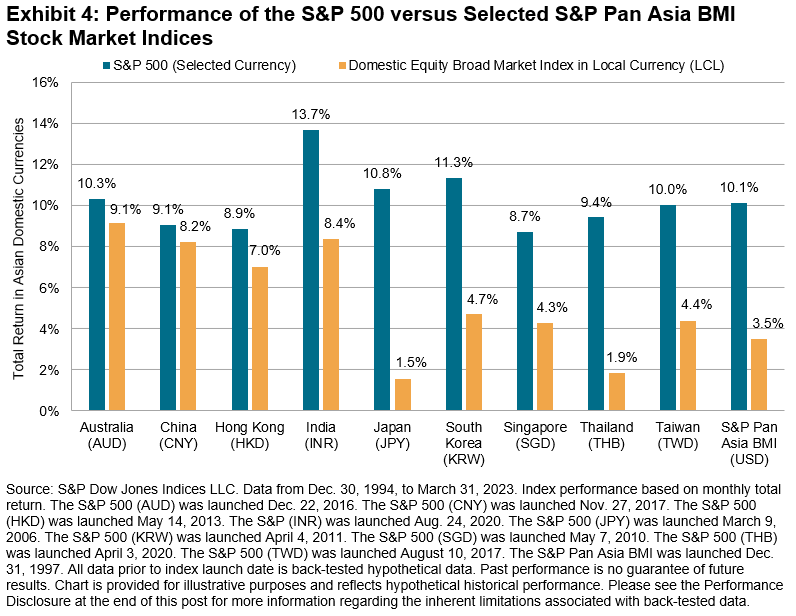

The efficiency of U.S. equities might also inspire some to believe incorporating U.S. equities along home equities. Showcase 3 displays the cumulative efficiency, in USD phrases, of the S&P Pan Asia BMI as opposed to U.S. fairness indices since Dec. 30, 1994. The proper-hand bar chart displays the annualized overall returns of quite a lot of unmarried inventory marketplace indices in opposition to the S&P 500, S&P MidCap 400, S&P SmallCap 600 and DJIA®. Fairly obviously, the U.S. fairness indices outperformed, traditionally.

Showcase 4 displays that the outperformance of U.S. equities used to be no longer pushed through foreign money results. Certainly, the S&P 500 outperformed single-market indices (as represented through the S&P World BMI sub-indices) in native foreign money phrases as neatly.

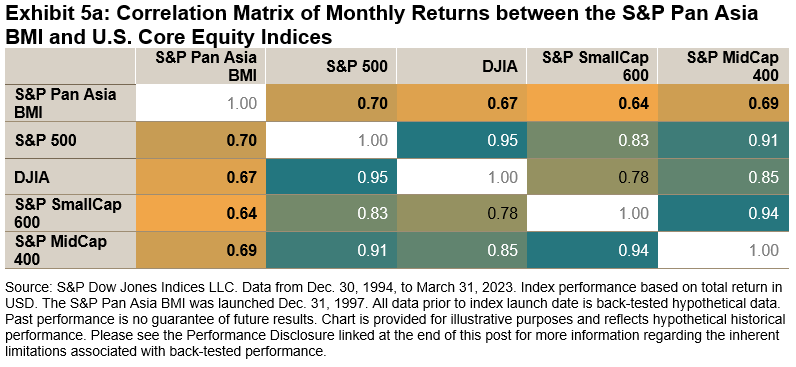

Showcase 5a additionally displays the possible diversification advantage of incorporating U.S. equities: there used to be a non-perfect correlation with Asian equities during the last 28 years. Showcase 5b additionally highlights that a number of single-market indices rank considerably decrease relating to correlation, with China having a nil.4 correlation to the U.S. since Dec. 30, 1994.

Unsurprisingly, most likely, incorporating allocations to the S&P 500 can have advanced risk-adjusted returns. As an example, Showcase 6 displays the annualized returns and volatility for quite a lot of hypothetical mixtures of the S&P 500 and the S&P Pan Asia BMI. Those hypothetical mixtures rebalance again to the objective weights at each and every yr finish.

Portfolios that incorporated some share of the S&P 500 posted upper returns than a 100% allocation to the S&P Pan Asia BMI. The top returns had been additionally completed at a decrease annualized threat.

Take a look at extra analysis and insights at the S&P 500 and DJIA at https://www.spglobal.com/spdji/en/training/article/comparing-iconic-indices-the-sp-500-and-djia/ and https://www.spglobal.com/spdji/en/training/article/regional-relevancy-of-sp-500-and-dow-jones-industrial-average-futures-in-asia.

The posts in this weblog are critiques, no longer recommendation. Please learn our Disclaimers.

Exploring Two A long time of Fastened Source of revenue Innovation

-

Classes

Fastened Source of revenue -

Tags

Energetic vs. Passive, Bond ETFs, bond yields, Brian Luke, credit score threat control, Derivatives, period threat control, fastened source of revenue, Fastened Source of revenue ETFs, fastened source of revenue mutual price range, futures, top yield corporates, iBoxx, source of revenue era, indexing, rate of interest control, funding grade corporates, iTraxx, liquidity, choices, emerging charges, S&P Indices vs. Energetic, SPIVA, overall go back swaps

Take a better take a look at the newest SPIVA effects as S&P DJIâs Brian Luke and BlackRockâs Stephen Laipply speak about how indexing works for fastened source of revenue, the iBoxx liquidity ecosystem, and what a rising vary of passive equipment may just imply for yield seekers as source of revenue returns to fastened source of revenue.

The posts in this weblog are critiques, no longer recommendation. Please learn our Disclaimers.

The Identical, Handiest Other

Within the first quarter of 2023, the most efficient appearing of the 17 issue indices featured in our per 30 days issue dashboard used to be S&P 500® Prime Beta (up 12.5%), whilst the worst performer used to be S&P 500 Momentum (-3.2%). This may occasionally appear peculiar to start with blush, since each indices are, in some sense, efficiency chasersâMomentum in absolute and Prime Beta in relative phrases. This admitted oversimplification ignores variations in rebalancing schedules, lookback classes, and threat changes, but buyers who surprise in regards to the hole between the 2 indicesâ efficiency are asking a cheap query.

Showcase 1 displays the connection between the per 30 days returns of Momentum and Prime Beta. The ancient correlation used to be an excellent 0.73, because the indices generally tend to upward thrust and fall in combination.

This comparability, after all, ignores the have an effect on of the marketplace as a complete at the actions of each elements. Showcase 2 corrects for this oversight through subtracting the go back of the S&P 500 from the ones of each issue indices. The prior robust courting evaporates, because the correlation of per 30 days extra returns is most effective -0.15. Web of the marketplaceâs have an effect on, there may be necessarily no courting between the returns of Momentum and Prime Beta.

Partly, this stems from a subtlety within the development of the 2 indices. Prime Beta seeks to measure the S&P 500âs highest-beta shares. If the marketplace has long gone up, probably the highest-beta shares will likely be a few of the marketplaceâs absolute best performers, and subsequently may also be anticipated to show up in Momentum. If the marketplace has long gone down, on the other hand, probably the highest-beta shares will likely be a few of the marketplaceâs worst performers, main Momentum to tilt towards lower-beta constituents. This is helping provide an explanation for the particular variations seen throughout the 1st quarter of 2023, following the S&P 500âs 18% decline in 2022.

If this rationalization is right kind, it suggests a normal development: when the marketplace has risen, the efficiency of Momentum and Prime Beta may well be an identical; when the marketplace has fallen, their efficiency is more likely to diverge. To check this speculation, we shaped deciles in our ancient database, looked after through the trailing 12-month go back of the S&P 500. For each and every decile, we computed the common next 12-month absolute distinction between the returns of Momentum and Prime Beta.

As Showcase 3 displays, when S&P 500 efficiency used to be in its worst decile (with a mean decline of twenty-two.5%), the adaptation between Momentum and Prime Beta averaged 39.2%. In the second one decile (with the S&P 500 down 2.8% on common), the adaptation falls to 17.6%. Within the different 8 deciles (the place the S&P 500âs efficiency averaged 18.3%), the adaptation between Momentum and Prime Beta used to be a relatively small 10%.

Weâve regularly written in regards to the significance of the marketplace setting in comparing issue index efficiency and in making an allowance for issue mixtures. It may be no much less vital in illuminating issue variations.

The posts in this weblog are critiques, no longer recommendation. Please learn our Disclaimers.